Happening Now

The White House continues to roll out new global trade policies across key trade partners. This page provides an up-to-date recap of the latest announcements and their potential impact on global trade.

As of November 20th

The President Trump has released an Executive Order on “Modifying the Scope of Tariffs on the Government of Brazil”. Below are the key points from the Executive Order.

Key Points:

-

- The Executive Order (EO) is issued under presidential authority derived from the International Emergency Economic Powers Act (IEEPA), the National Emergencies Act, Section 604 of the Trade Act of 1974, and Section 301 of Title 3 of the U.S. Code.

- It builds on a prior EO — Executive Order 14323 (Addressing Threats to the United States by the Government of Brazil), dated July 30, 2025 — which declared a national emergency and imposed an additional ad valorem duty of 40% on certain Brazilian-origin goods.

- After bilateral discussions with Brazil (including a call with President Luiz Inácio Lula da Silva) and further review, the US government determined that certain agricultural products originating in Brazil should no longer be subject to the additional duty originally imposed under EO 14323.

- Accordingly, the EO modifies the scope of the additional tariff by updating Annex I of EO 14323 and implementing Annex II to this order which adjusts the Harmonized Tariff Schedule (HTS) of the United States. These modifications apply to goods entered for consumption or withdrawn from warehouse for consumption on or after 12:01 a.m. EST on November 13, 2025.

- The EO instructs US government agencies (State, Commerce, Treasury, DHS, USTR, ITC) to coordinate implementation and monitor the situation with Brazil; and it authorizes the President under IEEPA to take further actions as necessary.

- If duties already collected need to be refunded in light of the modification, the EO directs refunds to be processed through the standard procedures of US Customs and Border Protection (CBP).

- The EO contains a severability clause and states that it is not intended to create any legal right enforceable by private parties against the United States.

Affected Product Categories (Summary)

Products in the HTS lines listed under Annex I are now EXCLUDED from the additional 40% duty. Key categories include:

- Beef & Bovine Products

- Fresh, Frozen & Dried Vegetables

- Coconuts, Nuts & Edible Seeds

- Fresh & Dried Fruits (e.g., mango, papaya, avocado)

- Fruit Juices & Concentrates (incl. orange juice)

- Prepared Fruits & Vegetables

- Coffee & Tea

- Spices (pepper, cinnamon, ginger, etc.)

- Cereal Grains & Specialty Grains

- Flours, Meals & Starches (e.g., cassava, banana flour)

- Vegetable Oils & Waxes

- Fertilizers (agricultural inputs)

- Cocoa Beans, Paste, Butter & Powder

- Beverage Ingredients & Extracts

Only products classified under the HTSUS numbers listed in Annex I are eligible for removal from the additional duty.

Potential Duty Refunds

Entries of Brazil-origin agricultural products subject to the 40% duty on or after November 13, 2025 may qualify for refund through:

- Post-Summary Correction (PSC)

- Protest (if liquidation is near)

- Other CBP refund mechanisms

As of November 14th

President Trump has released an Executive Order on “Modifying the Scope of the Reciprocal Tariff with respect to certain Agricultural Products”. Below are the key points from the Executive Order.

Key Points:

-

- The Order amends Executive Order 14257 (April 2, 2025) which imposed reciprocal tariffs on goods from trading partners with large U.S. trade deficits, under the national-emergency powers.

- The Order further amends earlier modifications (such as Executive Order 14346 of September 5, 2025) and introduces updated annexes to specify items that are exempt or subject to the reciprocal tariffs.

- Effective Date: The modifications apply to goods entered for consumption or withdrawn from warehouse on or after 12:01 a.m. Eastern Standard Time on November 13, 2025.

- The Order exempts certain agricultural products from the reciprocal tariffs. These include, for example:

- coffee and tea

- tropical fruits and fruit juices

- cocoa and spices

- bananas, oranges, tomatoes

- beef

- certain fertilizers and other agricultural categories.

- The Order directs the U.S. Trade Representative, the Secretary of Commerce and the Secretary of Homeland Security to monitor and implement further adjustments, including rulemaking, regulation, and guidance to effectuate the changes.

- For products that are now added to the exempt list (Annex II), the Harmonized Tariff Schedule of the United States (HTSUS) will be modified accordingly, and importers may seek refunds of duties collected under the earlier tariff regime, through the established U.S. Customs procedures.

- The Order emphasizes that the U.S. may further reduce or eliminate reciprocal tariffs (and certain Section 232 tariffs) for imports from trading partners that conclude final trade and security agreements with the U.S., and that the “exempt product” list may be updated further in the future.

Key HTS/Compliance Highlights:

- The order adds 237 agricultural HTSUS classifications, plus 11 additional categories, to the list of products exempt from the reciprocal tariffs under Executive Order 14257.

- For goods entered for consumption or withdrawn from warehouse for consumption on or after 12:01 a.m. EST on November 13, 2025, the updated HTS list applies.

- Importers should now use subheading 9903.01.32 to declare goods exempt from reciprocal tariffs if they fall under the 237 classifications. If they fall under the “11 additional categories” described in U.S. note 2(v)(iii)(b) to subchapter III of chapter 99 HTSUS, then use subheading 9903.02.78.

- For HTS entries already filed (entered/withdrawn) under sub-headings 9903.01.25 or 9903.02.02-9903.02.73 that include the newly exempted agricultural products listed above and entered on or after the effective date, importers should take corrective action: file a Post Summary Correction (PSC) if unliquidated, or file a protest if liquidated, to claim the duty refund.

- The Harmonized Tariff Schedule of the United States (HTSUS) will be modified as provided in the order’s Annex I (which lists affected HTS subheadings) to reflect the changes.

As of November 13th

The White House has released a fact Sheet outlining its trade deal with Republic of Korea (ROK) on November 13, 2025. Below are the key points from the Fact Sheet.

-

- The U.S.-ROK Alliance is described as entering a “new chapter” in light of the state visit and shared democratic values.

- The two leaders reaffirmed their commitment to rebuilding and expanding critical industries, including shipbuilding, energy, semiconductors, pharmaceuticals, critical minerals, AI / quantum computing.

- Under the recent agreement:

- $150 billion in Korean investment in U.S. shipbuilding has been approved.

- $200 billion in additional Korean strategic investments are expected via a separate MoU.

Tariff and trade framework updates:

- The U.S. will apply the higher of U.S.-Korea Free Trade Agreement (KORUS FTA) or U.S. Most Favored Nation (MFN) rate, or a 15 % tariff on originating goods from Korea under EO 14257.

- The U.S. will reduce Section 232 tariffs on ROK-origin autos, auto parts, timber, lumber, and wood derivatives to 15%, and impose no additional 232 duty if the FTA or MFN rate is ≥15%.

- For ROK pharmaceuticals and semiconductors, the U.S. commits to applying 232 rates no greater than 15 % and ensuring Korea’s terms are no less favorable than future partner terms.

Financial/macro-policy commitment

The ROK agrees to ensure foreign exchange market stability and commits to not fund an aggregate U.S. dollar amount greater than $20 billion annually under the MoU.

Commercial ties:

- Announcement of ROK FDI in the U.S. of approximately $150 billion.

- A major Korean purchase order for U.S. commercial aircraft (≈$36 billion) was welcomed.

Reciprocal trade commitments:

- Elimination of the 50,000-unit cap on U.S.-origin vehicles entering Korea under FMVSS compliance.

- Korea and U.S. to work together on non-tariff barriers (food/agriculture, digital services, data flow, IP, forced labor, environmental issues).

Security and defense:

- U.S. reaffirmed defense commitment to ROK and full spectrum extended deterrence.

- ROK commits to spend 3.5 % of GDP on defense and purchase $25 billion in U.S. military equipment by 2030; ROK to support U.S. Forces Korea with ~$33 billion.

- Joint U.S.-ROK cooperation in space, cyber, AI, shipbuilding, and nuclear power is also part of the agenda.

Korea-Peninsula & Indo-Pacific commitments

The two nations reiterated full support for denuclearization of the DPRK, upholding maritime law, and trilateral ties (e.g., with Japan).

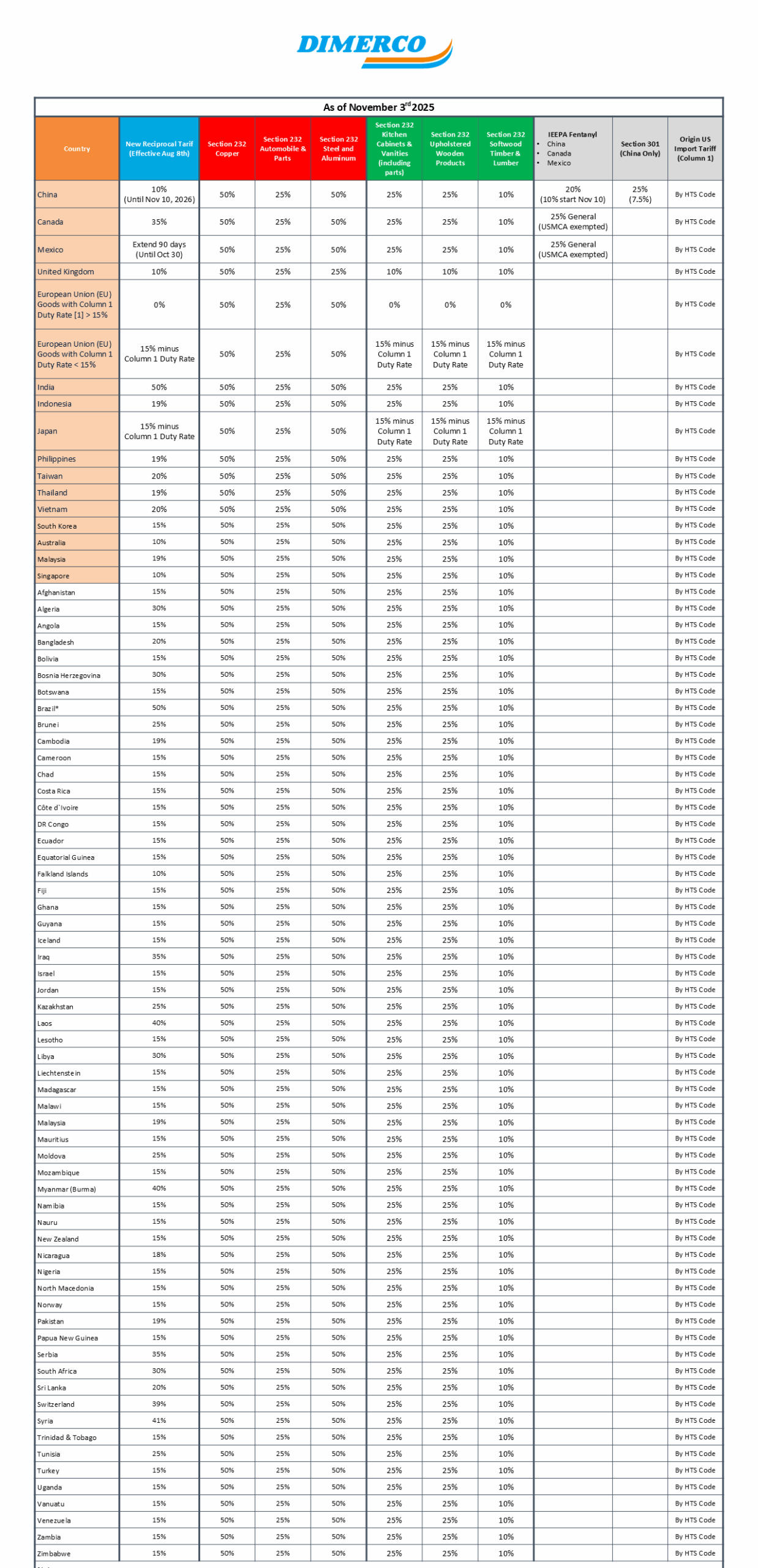

As of November 3rd

The White House has released a fact Sheet outlining its trade deal with China. Below are the key points from the Fact Sheet:

- The 10% reduction of the 20% IEEPA Fentanyl tariff on China will go into effect on November 10, 2025, and will remain in effect until November 10, 2026.

- The current 10% IEEPA Reciprocal Tariff and all other tariffs on China will remain in effect during this period.

- “Certain” Section 301 tariff exclusions due to expire on November 29 will be extended until November 10, 2026. (Although we don’t know for sure if this includes all current exclusions, the language seems to indicate that all those currently in effect will be extended).

- The USTR 301 China Ships fees are suspended for one year starting on November 10, 2025.

- China has also suspended its Ships Fees and export controls on rare earth minerals; suspended its retaliatory tariffs on US goods; removed certain companies from its “unreliable entities list”; resumed purchases of US soybeans; will ensure the resumption of trade from Nexperia’s facilities in China; and will take various other steps outlined in the Fact Sheet.

On Trade with Brazil and Canada

With bipartisan support, the Senate voted yesterday on a measure that would end both the Brazil 40% tariff and tariffs on Canada. The Senate has now also approved a measure that would end the President’s global reciprocal tariffs. It is unlikely the measures will be taken up or would pass in the House. While the measures may have no immediate tariff impact, they will certainly impact the Administration’s future trade negotiations and the timing of the votes so near the November 5 Supreme Court oral arguments on the legality of the IEEPA tariffs adds an interesting twist to those deliberations.

Current Trade Developments with Southeast Asia

-

- Vietnam: during this trip to Asia, the Administration signed a framework for an agreement that would keep Vietnam’s reciprocal rate at 20% but potentially place 0% duty on some articles contained in Annex III of its September 5 EO.

- Malaysia: the Administration has also signed a framework agreement that maintains their reciprocal rate at 19% and that will extend a 0% duty to many articles contained in Annex III of the September 5 EO (“Potential Tariff Adjustments for Aligned Partners”)

- Thailand: the Administration has signed a framework agreement that maintains their reciprocal rate at 19% and that will extend a 0% duty to some articles contained in Annex III of the September 5 EO (“Potential Tariff Adjustments for Aligned Partners”)

- Cambodia: the Administration has also signed a framework agreement that maintains their reciprocal rate at 19% and that will extend a 0% duty to many articles contained in Annex III of the September 5 EO (“Potential Tariff Adjustments for Aligned Partners”)

- India: India advises negotiations are going well and a trade agreement to lower the current 50% tariff rate may come “soon”; rumors of a tariff rate between 15 and 16% have been published in the media.

NOTE: Keep in mind all of these “Joint Statements” and “Frameworks” are non-binding, and the details have yet to be finalized in either country.

Definition of Transshipment

Transshipment: most of the framework agreements continue to contain language that prohibits “transshipment” and reiterates that the deals for each country are solely for the benefit of goods that qualify under US rules of origin as products of those countries; there are rumors that more stringent transshipment/origin determination rules could soon be coming from CBP that could shift country of origin rules to include language around the ownership of factories in Southeast Asian countries by Chinese entities.

As of September 29th

President Trump issued a proclamation adjusting the imports of timber, lumber, and their derivative products into the United States.

Keypoints

Effective on or after 12:01 AM EDT on October 14, 2025 for goods entered for consumption or withdrawn from a warehouse for consumption:

- Softwood timber & lumber: +10% tariff (rising to 30% on January 1, 2026).

- Certain Upholstered wooden products: +25% tariff (rising to 50% on January 1, 2026).

- Kitchen cabinets & vanities (including parts): +25% tariff.

- United Kingdom imports: capped at 10% duty.

- Europe & Japan imports: capped at 15% duty above normal Column 1 rates

- Duties under this proclamation are eligible for drawback.

The Secretary shall provide the President, not later than October 1, 2026, with an update on hardwood lumber and timber imports, their markets, and the domestic industry so that the President may determine whether additional duties on hardwood lumber or timber imports are warranted.

As of September 24th

On September 24th, 2025, the U.S. Department of Commerce announced two new Section 232 national security investigations:

Section 232 – Imports of Robotics and Industrial Machinery

- Initiated: September 2nd, 2025 (statutory completion within 270 days)

- Industrial robots and programmable computer-controlled mechanical systems

- Machine tools for cutting, welding, and handling workpiece

- Autoclaves and industrial ovens

- Stamping/pressing machines, jigs/fixtures, automatic tool changers

- Laser and water-jet cutting tools and machinery

Section 232- Imports of Personal Protective Equipment (PPE), Medical Consumables, and Medical Equipment (including Devices)

- Initiated: September 2nd, 2025 (statutory completion within 270 days)

- PPE & consumables: surgical masks/N95s, gloves, gowns, face masks, IV bags, gauze/bandages, sutures

- Medical equipment/devices: syringes, infusion pumps, wheelchairs, crutches, hospital beds

- Advanced devices: pacemakers, insulin pumps, coronary stents, heart valves, hearing aids, prosthetics, blood-glucose monitors, orthopedic appliances, CT scanners, MRI machines

The Secretary of Commerce must submit a report to President Donald Trump within 270 days of initiation, detailing findings and recommended actions to mitigate any national security risks.

Additional Announcements from Trumps Social Media

President Trump also posted on his social media that he is planning to impose the following Section 232 tariffs effective October 1, 2025. (Not yet confirmed by any official notice/government agencies)

- Heavy trucks: +25%

- Kitchen cabinets & Bathroom vanities (and related): +50%

- Upholstered furniture: +30%

- Pharmaceuticals (branded/patented): up to 100%; exemption if the manufacturer is currently building in the U.S. (NOTE: “Is Building” mean either breaking ground and/or under construction, then there will be no tariff on these pharmaceutical products)

Status: No Presidential Proclamation, Federal Register Notice, or CBP CSMS guidance yet. Treat as preliminary until official instruments are issued.

These tariffs that President Trump is planning to place on key sectors are separate from tariffs that he levied on countries using his executive authority under the 1977 IEEPA (International Emergency Economic Powers Act).

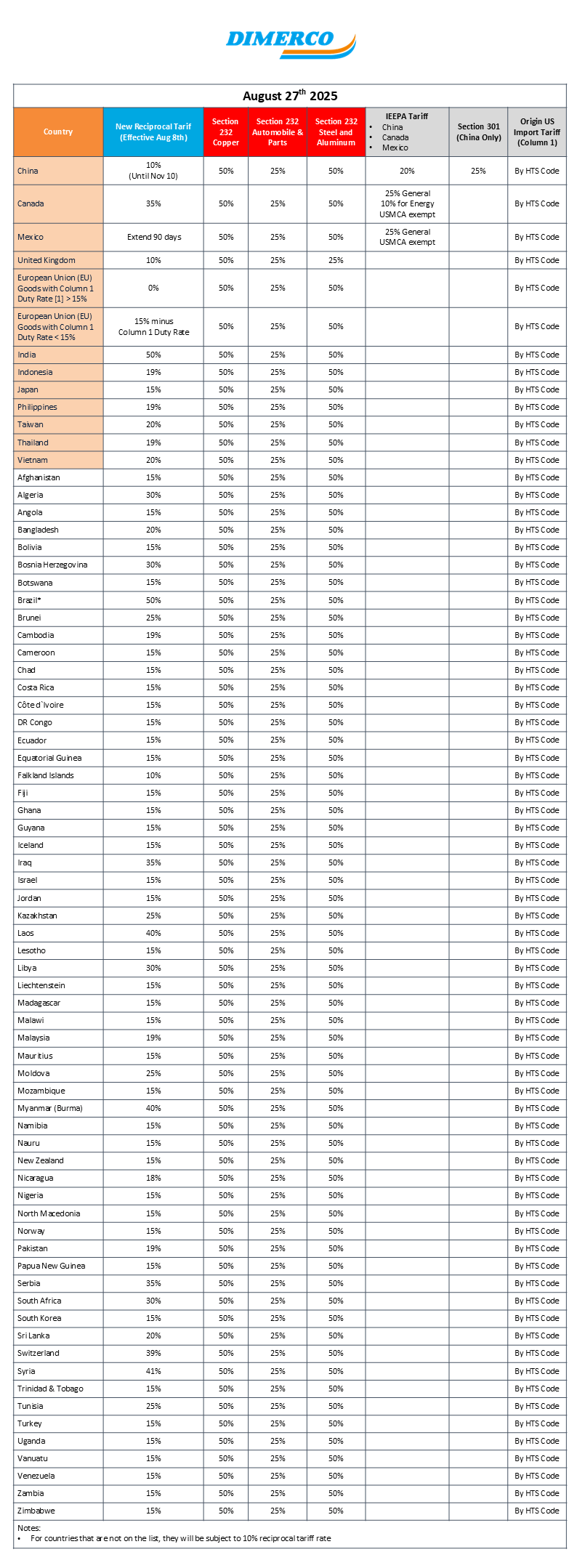

As of August 27th

An additional 25% reciprocal tariff has taken effect on India.

Exemptions:

- Goods in transit before 12:01 a.m. EDT on August 27 and arriving before 12:01 a.m. EDT on September 17.

- Products subject to Section 232 tariffs.

Articles listed under the reciprocal exemption list (Annex II):

- Pharmaceutical formulations and Active Pharmaceutical Ingredients

- Smartphones and mobile components

- Consumer electronics (e.g., laptops, headphones, tablets)

- High-end semiconductors and precision components

- Critical medical devices and diagnostic kits

- Select software and IT hardware exports

Potential New Section 232 Tariffs

The US is considering revisions to Section 232 tariffs that would update the list of critical materials:

- Arsenic and tellurium are proposed for removal.

- New additions include copper, lead, potash, rhenium, silicon, silver, uranium, and metallurgical coal.

These changes reflect an effort to align tariffs with evolving supply chain and security priorities. The Department of the Interior has not proposed including other minerals such as cadmium, gold, helium, iron ore, mica, and phosphates, though they could still appear in the final tariff list.

President Trump has threatened a 200% tariff on China

- Despite China’s exports of rare-earth magnets returning to levels seen before their export restrictions

- So, some believe Administration is just “setting the table” for the Chinese trade delegation arriving in DC next week.

Section 232 Review Re-opens In September (Steel & Aluminum 50%)

- The review may take place in January, May & September yearly

- The BIS will post the list of HTS codes that domestic interests want added to 232’s for a 14-day comment period

- Will decide in 60 days which of those HTS codes to be add to the 232 list (roughly December for the September review)

- Expect that most, if not all, of the requests will be added so we’ll circulate the list once available

- Expectation is the additional codes will be immediately subject to the 50% as was the case that happened in August’2025

Semiconductors Tariff

- Still no update on semiconductors, but additional threats to add new tariffs and export restrictions for countries with digital taxes

Indonesian – Palm Oil, Cocoa, Rubber

- Agreement in principle to lift tariffs on these articles, but nothing official from the White House or CBP

As of August 21st

The White House has released a joint statement on its proposed trade deal with EU today August 21st, 2025.

EU Commitments

- Eliminate tariffs on US industrial goods.

- Provide preferential access for US seafood, agriculture, processed foods, seeds, soybean oil, pork, bison meat, and lobster.

- Commitments are high-level; no tariff codes or conditions yet.

- May reduce tariffs on steel, aluminum, and derivatives under a quota system (details vague).

- Agree to mutual recognition of US auto standards and reduction of non-tariff barriers (e.g., Deforestation Regulation, CBMA, CSDDD, CSRD).

- Will address digital trade barriers.

- Cooperate with US on export restrictions, IP enforcement, and forced labor issues.

US commitments

- Reciprocal tariff cap system:

- If EU duty >15% → no extra tariff.

- If EU duty <15% → tariff = current rate + (15% – current rate).

- Effective Sept 1, 2025: only base duty rate applies to certain EU products (no reciprocal), including:

- Unavailable natural resources (e.g., cork)

- All aircraft/parts

- Generic pharmaceuticals and precursors

- Some chemicals

- Reciprocal tariff formula also applies “promptly” to Section 232 tariffs on pharmaceuticals, semiconductors, and lumber.

- Once EU introduces legislative proposal for tariff reductions, US will apply Section 232 auto/auto parts tariffs using the same formula.

- Rules of origin will be strict, likely with anti-transshipment language.

Mutual commitments

- Consider eliminating reciprocal tariffs on more products in the future.

- Cooperation on critical minerals, export restrictions, IP rights, and labor standards.

- EU making general commitments to procure US goods/services (could be basis to withdraw deal if unmet).

As of August 15th

USCBP has announced 407 additional derivative products which are included under Section 232 – Steel and Aluminum Tariff.

- Effective Date: On or after 12:01 a.m. EDT, August 18, 2025

- Scope: 407 additional HTSUS derivative products now covered under Section 232 steel and aluminum tariffs

- Duty Rate: 50% ad valorem on the value of the steel or aluminum content

- Foreign Trade Zones (FTZ): Applies to products admitted under “privileged foreign status”

- Reporting: Non-aluminum/steel portions may be reported separately but remain subject to reciprocal tariffs based on Country of Origin (COO)

Exemptions:

- United Kingdom – 25% duty maintained

- Russian aluminum – 200% duty maintained

- No Drawback: Duties imposed are not eligible for drawback

- COO Reporting: Products smelted and cast in the US can be reported as “US” for both smelt and cast

Additional Note: 60 HTSUS codes were excluded from this update but remain under investigation under Section 232 or other trade statutes

As of August 11th

As of August 11th, 2025, President Trump has signed an Executive Order (EO) extending the pause for an additional 90 days on China’s Reciprocal Tariff, which means this 10% Reciprocal Tariff on China will be expired at 12:01 a.m. eastern standard time on November 10th, 2025.

- Extension prevents U.S., China tariffs from snapping higher

- Trump says China has been “dealing quite nicely”

- Trade analysts see extension easing path to Trump-Xi meeting

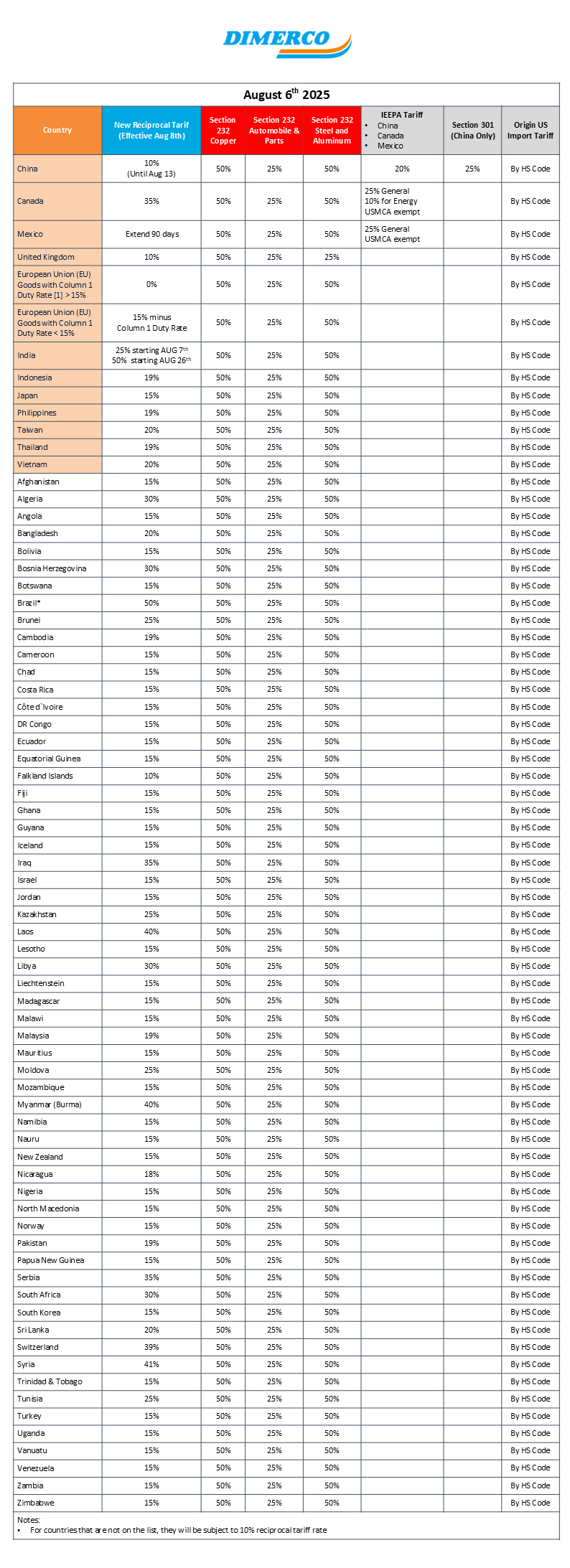

As of August 6th

President Trump has issued an Executive Order (EO) on the “Additional Tariff” to India. Below are the key points from this EO. This EO is going to be effective on or after 12:01 a.m. eastern daylight time 21 days (August 26th, 2025) after the date of this order.

| Trading Partner | Additional Tariff Rate (Starting on August 26th, 2025) |

New Reciprocal Tariff Rate (Starting on August 7th, 2025) |

| India | 25% | 25% |

“To deal with the national emergency described in Executive Order 14066, I determine that it is necessary and appropriate to impose an additional ad valorem duty on imports of articles of India, which is directly or indirectly importing Russian Federation oil. In my judgment, imposing tariffs, as described below, in addition to maintaining the other measures taken to address the national emergency described in Executive Order 14066, will more effectively deal with the national emergency described in Executive Order 14066.”

– President Trump | August 6, 2025

Imposition of Tariffs

- 25% Additional Duty on Indian Imports

Under this order and in line with U.S. law, all goods imported from India into the U.S. will face an additional 25% duty based on their value (ad valorem). - When the Duty Takes Effect

Unless stated otherwise in section 3, the new duty rate will apply to goods brought into the U.S. for use or taken out of storage starting 21 days after this order, at 12:01 a.m. Eastern Daylight Time. However, this duty will not apply to goods that:

- Were already loaded on a ship and in transit to the U.S. before the 21-day deadline.

- Are officially entered into the U.S. before 12:01 a.m. on September 17, 2025.

- Additional Duties Still Apply

The 25% duty is in addition to any other duties, taxes, or charges already in place.

However, if the goods are affected by section 232 of the Trade Expansion Act of 1962, then this 25% duty does not apply. - National Security Exception

The 25% duty does not apply to items excluded under 50 U.S.C. 1702(b) for national security reasons. - Exempted Items from Executive Order 14257

The 25% duty does not apply to goods listed in Annex II of Executive Order 14257, dated April 2, 2025, and any later updates. - When Both Duties Apply

If applicable, the duty from Executive Order 14257 will apply in addition to the 25% duty in this order. - Rules for Foreign Trade Zones

Goods subject to this duty and brought into a foreign trade zone on or after the 21-days effective date must be marked as “privileged foreign status.” Only goods that qualify as “domestic status” under U.S. rules (19 CFR 146.43) are exempt from this requirement.

Definitions (What the Terms Mean in This Order):

- “Russian Federation oil”

This refers to any crude oil or petroleum products that were taken from, processed in, or shipped out of Russia—no matter which company or country is involved in producing or selling them. - “Indirectly Importing”

This includes buying Russian oil through other countries or middlemen if the oil’s origin can be reasonably traced back to Russia. The Secretary of Commerce, together with the Secretaries of State and Treasury, will decide whether the oil is considered to be of Russian origin.

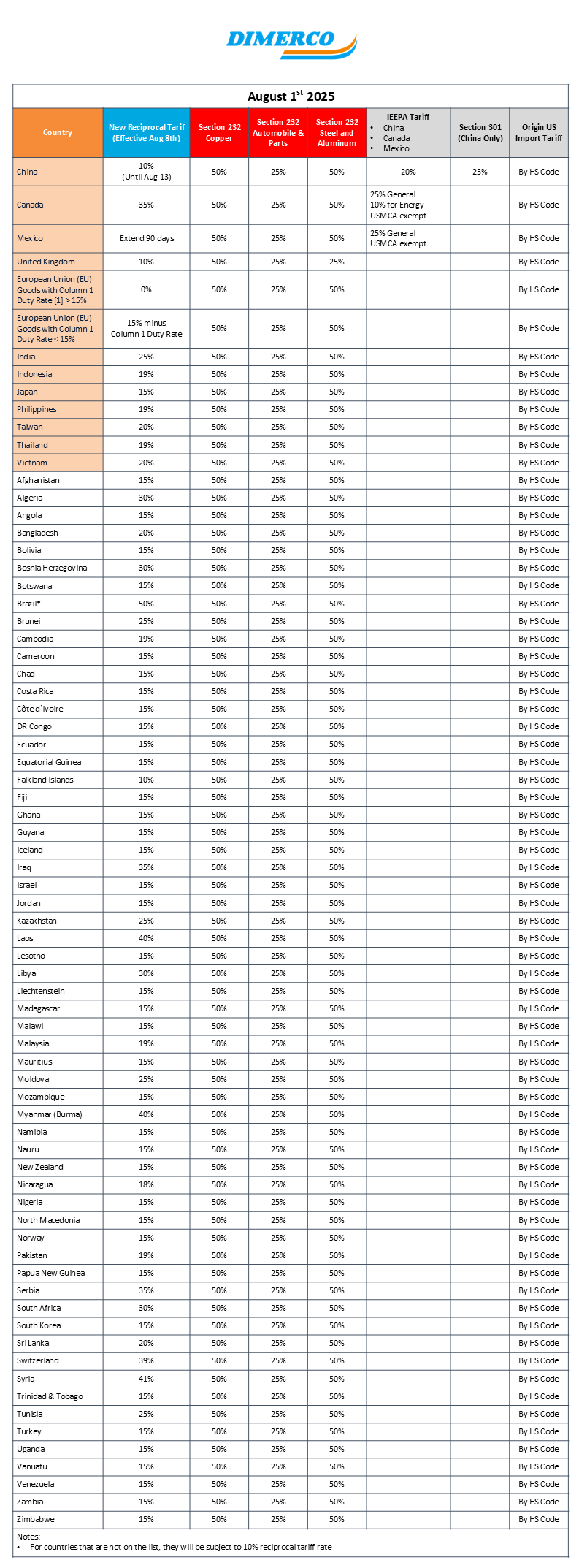

As of July 31st

On July 31st, 2025, President Trump has issued an Executive Order (EO) on the “Reciprocal Tariff” for all countries and below please find the key points from this EO.

Effective Date

These updated Reciprocal Tariffs are going to be effect on or after August 8th, 2025 12:01a.m. eastern daylight time (7 days after the date of this order)

In-Transit Shipments Exception (Ocean Only)

Shipment has to be loaded on the vessel on or before August 8th, 2025 12:01a.m. eastern daylight time and must arrive at the first U.S. port on or before October 5th, 2025 12:01a.m. eastern daylight time in order to use the current reciprocal tariff which is 10% general.

Countries not under this list

Goods of any foreign trading partner that is not listed in Annex I (as below) to this order will be subject to the Reciprocal Tariff of 10% pursuant to the terms of Executive Order 14257, as amended, unless otherwise expressly provided.

This rate shall be effective with respect to goods entered for consumption, or withdrawn from warehouse for consumption, on or after August 8th, 2025 12:01 a.m. eastern daylight time (7 days after the date of this order)

Transshipment

An article determined by CBP to have been transshipped to evade applicable duties under section 2 of this order shall be subject to: (Again, still no specific guideline, is determined by USCBP if shipment is considered as transshipment or not)

- (i) an additional tariff of 40% , in lieu of the additional ad valorem rate of duty applicable under section 2 of this order to goods of the country of origin,

- (ii) any other applicable or appropriate fine or penalty, including those assessed under 19 U.S.C. 1592, and

- (iii) any other United States duties, fees, taxes, exactions, or charges applicable to goods of the country of origin.

CBP shall not allow, consistent with applicable law, for mitigation or remission of the penalties assessed on imports found to be transshipped to evade applicable duties.

European Union (EU)

As provided in Annex I to this order, the additional ad valorem rate of duty applicable to any good of the European Union is determined by the good’s current ad valorem (or ad valorem equivalent) rate of duty under column 1 (General) of the HTSUS (“Column 1 Duty Rate”).

For a good of the European Union with a Column 1 Duty Rate that is less than 15 percent, the sum of its Column 1 Duty Rate and the additional ad valorem rate of duty pursuant to this order shall be 15 percent. For example:

- If the General Tariff Rate is 2%, the Reciprocal Tariff Rate will be 13%. (General Tariff 2% + Reciprocal Tariff 13% = 15% Tariff)

For a good of the European Union with a Column 1 Duty Rate that is at least 15 percent, the additional ad valorem rate of duty pursuant to this order shall be zero. For example:

- If the General Tariff Rate is 18%, the Reciprocal Tariff Rate will be 0%. (General Tariff 18% + Reciprocal Tariff 0% = 18% Tariff)

As of July 30th

U.S. – South Korea Trade Deal

President Trump announced that U.S. is going to charge a 15% tariff on imports from South Korea as part of an agreement with the Asian trading partner that avoids even higher levies, while U.S. exports to South Korea will reportedly enter tariff-free. As part of the trade deal:

- South Korea is going to invest USD350 billion in the U.S.

- USD150 billion from this invest will allocate for “shipbuilding cooperation” providing strong support from Korean companies entering the U.S. shipbuilding industry

- These investments are owned and controlled by U.S. and selected by President Trump

- Purchases USD100 billion of liquefied natural gas (LNG) and other energy products

- Additional investment will be announced later

- South Korea will be completely OPEN TO TRADE and is going to accept America products including Cars, Trucks and Agriculture, etc

- South Korea will not be treated any worse than any other country on semiconductors and pharmaceuticals.

- Steel, Aluminum, and Copper are not included and remain unchanged for 50% tariffs

Section 232 – Copper Tariff 50% starting on or after August 1st, 2025

President Trump issued a Proclamation on Section 232 – Copper Investigation. Below are the key points from this proclamation (HTS code list are not available as of this announcement):

- A 50% Copper Tariff is going to apply to all imports of semi-finished copper products and intensive copper derivative products outlined in the Annex (the Annex is not yet available at this moment)

- This tariff will be effective with respect to goods entered (arriving) on or after 12:01 a.m. eastern daylight time on August 1, 2025

- Within 90 days after the date of this Proclamation, the Secretary shall establish a process to add more derivative copper articles to the scope of these duties

- This 50% Copper Tariff is calculated like the Steel and Aluminum tariff – only the copper component materials

- This 50% Copper Tariffs will not stack on top of the Auto tariffs – Auto Tariffs is going to get applied first

- This tariff is in addition to any other duties and Customs fees

- EXCEPT reciprocal duties and the Canada / Mexico 25% IEEPA tariff

- Reciprocal and Canada/Mexico IEEPA tariffs will apply to the non-copper content of products

- CBP will issue guidance mandating strict compliance with declaration requirements for copper content and outlining maximum penalties for noncompliance, which will include monetary penalties, loss of import privileges, and criminal liability

- Goods subject to the Copper Tariff must be entered into an FTZ in “Privileged Foreign” status

- By June 30, 2026, the Secretary shall provide the President with an update on domestic copper markets so that the President may determine whether imposing a phased universal import duty on refined copper of

- 15 percent starting on January 1, 2027

- 30 percent starting on January 1, 2028

- The Administration will monitor copper markets and could increase or decrease tariffs over time

- The sale of high-quality U.S. copper scrap will be controlled according to the domestic sales requirements in the Administration’s June report

- No drawback is available for the Copper Tariff

- Consistent with the General Terms of the US, UK and Northern Ireland Economic Prosperity Deal, the US intends to coordinate with the UK to adopt a “structured, negotiated approval” to the address the national security threat in the copper sector. (No specify how this will work)

Suspending Duty-Free De Minimis Treatment for ALL Countries

President Trump issued an Executive Order (EO) suspending duty-free de minimis treatment for all imported goods, well ahead of the scheduled 2027 elimination outlined in the recently passed budget bill. Here’s what he has announced in this EO:

- The Executive Order (EO) suspends duty-free de minimis for imports from all countries regardless of value, transport mode, or method of entry

- The global de minimis ban goes into effect for goods entered (arriving) on or after 12:01 am EST on August 29, 2025

- Previously only China and Hong Kong were under a de minimis ban under an IEEPA order

- Going forward, all shipments, except those moving through the international postal network, will be subject to all applicable duties, taxes and Customs fees and a formal or informal entry must be filed

- CBP can require a basic importation bond for informal entries valued at or less than USD2,500.00

- Postal shipments will be subject to the following duty rates:

- A duty equal to the effective IEEPA tariff rate applicable to the country of origin of the product will be assessed on the shipment value:

- countries with an effective IEEPA tariff rate of less than 16 percent: USD80 per item

- countries with an effective IEEPA tariff rate between 16 and 25 percent (inclusive): USD160 per item

- countries with an effective IEEPA rate above 25 percent: USD200 per item

- shipments subject to AD/CVD or a quota must be entered under an appropriate entry type in ACE

- A duty equal to the effective IEEPA tariff rate applicable to the country of origin of the product will be assessed on the shipment value:

- The EO goes to great lengths to say that this de minimis ban is separate and apart from the IEEPA tariffs and so, if the tariffs are declared invalid, the de minimis ban should still stand

- Duty-free de minimis treatment will remain available for postal shipments only until notification there are adequate systems in place to process and collect duties. After this notification, duty-free de minimis treatment will not be available for postal shipments

- General Provision – Nothing in this EO shall be construed to impair or otherwise affect:

- The authority granted by law to an executive department or agency, or the head thereof;

- The functions of the Director of the Office of Management and Budget relating to budgetary, administrative, or legislative proposals

- This EO shall be implemented consistent with applicable law and subject to the availability of appropriations

- This order is not intended to, and does not, create any right or benefit, substantive or procedural, enforceable at law or in equity by any party against the United States, its departments, agencies, or entities, its officers, employees, or agents, or any other person

- The costs for publication of this order shall be borne by the Department of Homeland Security.

| Trading Partner | Trade Deal? | New Reciprocal Tariff Rate | Initial Tariff Rate | Difference |

|---|---|---|---|---|

| Algeria | No | 30% | 30% | 0% |

| Bangladesh | No | 35% | 37% | -2% |

| Bosnia and Herzegovina | No | 30% | 35% | -5% |

| Brazil* | No | 50% | 10% | 40% |

| Brunei | No | 25% | 24% | 1% |

| Cambodia | No | 36% | 49% | -13% |

| Canada | No | 35% | 25% | 10% |

| European Union | Yes | 15% | 20% | -5% |

| Indonesia* | Yes | 19% | 32% | -13% |

| Iraq | No | 30% | 39% | -9% |

| Japan | Yes | 15% | 24% | -9% |

| Kazakhstan | No | 25% | 27% | -2% |

| Libya | No | 30% | 31% | -1% |

| Loas | No | 40% | 48% | -8% |

| Malaysia | No | 25% | 24% | 1% |

| Mexico | No | 30% | 25% | 5% |

| Myanmar (Burma) | No | 40% | 44% | -4% |

| Moldova | No | 25% | 31% | -6% |

| Philippines | Yes | 19% | 17% | 2% |

| Serbia | No | 35% | 37% | -2% |

| South Africa* | No | 30% | 30% | 0% |

| South Korea | Yes | 15% | 25% | -10% |

| Sri Lanka | No | 30% | 44% | -14% |

| Thailand | No | 36% | 36% | 0% |

| Taiwan | On-Going | 32% | ||

| Tunisia | No | 25% | 28% | -3% |

| United Kingdom | Yes | 10% | 10% | 0% |

| Vietnam | Yes | 20% | 46% | -27% |

*BRICS member countries face the threat of an additional 10% tariff.

As of July 27th

US and European Union Deal Reached

President Trump announced that the U.S. and the EU has reached a framework for a trade deal, after talks with European Commission President Ursula von der Leyen in Turnberry, Scotland. Under the deal, 27-nation EU’s goods exported to the U.S. will face a 15% tariff (as opposed to 30% announced in the recent tariff letter), while U.S. exports to EU will reportedly enter tariff-free.

President Trump said the EU is going to agree to purchase $750 billion in U.S. energy and will invest $600 billion more than what EU had already investing in U.S. now. Also, EU is agreed to purchase a vast amount of military equipment from US (other specifics of the deal have not been disclosed at this moment)

Exceptions for Pharmaceuticals

For the pharmaceuticals, President Trump already mentioned to von der Leyen that this wouldn’t be part of the deal. He had repeatedly suggested he would put a 200% tariff on pharmaceuticals that are manufactured outside of the U.S. – the vast majority of US drugs – starting on August 1st, 2025. Pharmaceuticals were the No. 1 ($92.1 billion) good the U.S. imported from the EU last year, according to US Commerce Department data. Ireland, a member of the EU, is the top single foreign country supplying the U.S. with pharmaceuticals.

In the meantime, U.S. Commerce Secretary Howard Lutnick said tariffs on semiconductors will be announced in two weeks. It’s unclear when those could take effect.

No Deadline Extension

U.S. Commerce Secretary Howard Lutnick had said in an interview on “Fox News Sunday” that there would be no further extensions or grace periods for the reciprocal tariffs after August 1st, 2025. But he raised the prospect of potentially some wiggle room, saying “big economies” can continue trade talks with the United States.

| Trading Partner | Trade Deal? | New Reciprocal Tariff Rate | Initial Tariff Rate | Difference | Tariff Letter Issued |

|---|---|---|---|---|---|

| Algeria | No | 30% | 30% | 0% | Link |

| Bangladesh | No | 35% | 37% | -2% | Link |

| Bosnia and Herzegovina | No | 30% | 35% | -5% | Link |

| Brazil* | No | 50% | 10% | 40% | Link |

| Brunei | No | 25% | 24% | 1% | Link |

| Cambodia | No | 36% | 49% | -13% | Link |

| Canada | No | 35% | 25% | 10% | Link |

| European Union | Yes | 15% | 20% | -5% | Link |

| Indonesia* | Yes | 19% | 32% | -13% | Link |

| Iraq | No | 30% | 39% | -9% | Link |

| Japan | Yes | 15% | 24% | -9% | Link |

| Kazakhstan | No | 25% | 27% | -2% | Link |

| Libya | No | 30% | 31% | -1% | Link |

| Loas | No | 40% | 48% | -8% | Link |

| Malaysia | No | 25% | 24% | 1% | Link |

| Mexico | No | 30% | 25% | 5% | Link |

| Myanmar (Burma) | No | 40% | 44% | -4% | Link |

| Moldova | No | 25% | 31% | -6% | Link |

| Philippines | Yes | 19% | 17% | 2% | Link |

| Serbia | No | 35% | 37% | -2% | Link |

| South Africa* | No | 30% | 30% | 0% | Link |

| South Korea | On-Going | 25% | Link | ||

| Sri Lanka | No | 30% | 44% | -14% | Link |

| Thailand | No | 36% | 36% | 0% | Link |

| Taiwan | On-Going | 32% | |||

| Tunisia | No | 25% | 28% | -3% | Link |

| United Kingdom | Yes | 10% | 10% | 0% | |

| Vietnam | Yes | 20% | 46% | -27% |

*BRICS member countries face the threat of an additional 10% tariff.

As of July 22nd

The newest tariff negotiation has been done with Philippines and Japan on July 22nd, 2025, President Trump announced on social media that he has made the trade deals with these two countries and will continue to negotiate with any other countries that are willing to open for discussion.

President Trump has announced the trade agreement with the Philippines came after he met with President Ferdinand Marcos Jr. at the White House today July 22nd, 2025. The agreement with the Philippines marks the fifth struck over the past three months. Both agreements call for 19% Reciprocal Tariffs on goods the U.S. imports from the two countries, paid by American businesses, while American goods shipped there won’t be charged a tariff. The US imported $14 billion worth of goods from the Philippines last year, according to data from the US Commerce Department. Top goods shipped from there include computers and other electronics, processed foods, machinery and apparel. Meanwhile, the US exported $9 billion worth of Filipino goods. Computers and other electronics, as well as processed foods, were also among the top goods the US shipped there.

President Trump has also announced the “massive” trade agreement with Japan today July 22nd, 2025. As part of the deal, U.S. importers will pay 15% Reciprocal Tariffs on Japanese goods and Japan will invest USD550 billion into U.S. as well. Although President Trump did mention that the U.S. will receive up to 90% of the profits from this invest, but he didn’t specify how those investments would work or how profits would be calculated. No official term sheet has been released at this moment. In the meantime, Japan’s Prime Minister Shigeru Ishiba said the government will examine the details of the deal “carefully” and will hold a phone or in-person meeting with President Trump as necessary.

| Trading Partner | New Reciprocal Tariff Rate* | Initial Tariff Rate* | Difference | Trade Details | Tariff Letter Issued |

|---|---|---|---|---|---|

| Algeria | 30% | 30% | 0% | $1.3 billion | Link |

| Bangladesh | 35% | 37% | -2% | $5.7 billion | Link |

| Bosnia and Herzegovina | 30% | 35% | -5% | $116 million | Link |

| Brazil | 50% | 10% | 40% | $6.8 billion | Link |

| Brunei | 25% | 24% | 1% | $118.5 million | Link |

| Cambodia | 36% | 49% | -13% | $11.4 billion | Link |

| Canada | 35% | 25% | 10% | $54.8 billion | Link |

| European Union | 30% | 20% | 10% | $235.5 billion | Link |

| Indonesia | 19% | 32% | -13% | $16.4 billion | Link |

| Iraq | 30% | 39% | -9% | $5.4 billion | Link |

| Japan | 15% | 24% | -9% | $62.6 billion | Link |

| Kazakhstan | 25% | 27% | -2% | $1.1 billion | Link |

| Libya | 30% | 31% | -1% | $899 million | Link |

| Loas | 40% | 48% | -8% | $654 million | Link |

| Malaysia | 25% | 24% | 1% | $22.1 billion | Link |

| Mexico | 30% | 25% | 5% | $22.1 billion | Link |

| Myanmar (Burma) | 40% | 44% | -4% | $524 million | Link |

| Moldova | 25% | 31% | -6% | $72.3 million | Link |

| Philippines | 19% | 17% | 2% | $4.4 billion | Link |

| Serbia | 35% | 37% | -2% | $543 million | Link |

| South Africa | 30% | 30% | 0% | $7.9 billion | Link |

| South Korea | 25% | 25% | 0% | $60.2 billion | Link |

| Sri Lanka | 30% | 44% | -14% | $2.5 billion | Link |

| Thailand | 36% | 36% | 0% | $41.5 billion | Link |

| Tunisia | 25% | 28% | -3% | $599 million | Link |

*Note: The New Reciprocal Tariff Rate will take effect on August 1st, 2025; the Initial Tariff Rate was announced on April 2nd, 2025.

Terms outlined in the tariff letters are still remain the same as:

- New tariff rates will take effect on August 1st, 2025.

- The letters state that the tariff rates are separate from “Sectoral Tariffs.” While it is unclear, that language suggests that the new tariff rate could potentially be stacked on top of (imposed in addition to) Section 232 tariffs on various industrial sectors.

- Goods determined to be “transshipped” to evade a higher tariff will be subject to a higher tariff. There is no definition of this key term.

- Tariffs can be modified, upward or downward, depending on the continued relationship between the US and the specified country.

- Any retaliatory tariff rate will be added to the reciprocal tariff rate specified in the letter.

As of July 14th

Country-Specific Reciprocal Tariff

President Trump announced on social media that the U.S. has now issued tariff letters to 25 countries in total, between those issued on Monday July 7 (22 countries) and those issued today July 14 (3 countries). These letters lay out the country-specific reciprocal tariff rates that will apply to those countries’ goods as of 12:01 a.m. EDT on August 1, 2025, when the latest extension to the pause in the imposition of country-specific reciprocal tariffs expires.

Additional Today’s Tariff Letters:

| Trading Partner | New Reciprocal Tariff Rate* | Initial Tariff Rate* | Difference | Trade Details | Tariff Letter Issued |

|---|---|---|---|---|---|

| Algeria | 30% | 30% | 0% | $1.3 billion | Link |

| Bangladesh | 35% | 37% | -2% | $5.7 billion | Link |

| Bosnia and Herzegovina | 30% | 35% | -5% | $116 million | Link |

| Brazil | 50% | 10% | 40% | $6.8 billion | Link |

| Brunei | 25% | 24% | 1% | $118.5 million | Link |

| Cambodia | 36% | 49% | -13% | $11.4 billion | Link |

| Canada | 35% | 25% | 10% | $54.8 billion | Link |

| European Union | 30% | 20% | 10% | $235.5 billion | Link |

| Indonesia | 32% | 32% | 0% | $16.4 billion | Link |

| Iraq | 30% | 39% | -9% | $5.4 billion | Link |

| Japan** | 15% | 24% | -9% | $62.6 billion | Link |

| Kazakhstan | 25% | 27% | -2% | $1.1 billion | Link |

| Libya | 30% | 31% | -1% | $899 million | Link |

| Loas | 40% | 48% | -8% | $654 million | Link |

| Malaysia | 25% | 24% | 1% | $22.1 billion | Link |

| Mexico | 30% | 25% | 5% | $22.1 billion | Link |

| Myanmar (Burma) | 40% | 44% | -4% | $524 million | Link |

| Moldova | 25% | 31% | -6% | $72.3 million | Link |

| Philippines** | 19% | 17% | 2% | $4.4 billion | Link |

| Serbia | 35% | 37% | -2% | $543 million | Link |

| South Africa | 30% | 30% | 0% | $7.9 billion | Link |

| South Korea | 25% | 25% | 0% | $60.2 billion | Link |

| Sri Lanka | 30% | 44% | -14% | $2.5 billion | Link |

| Thailand | 36% | 36% | 0% | $41.5 billion | Link |

| Tunisia | 25% | 28% | -3% | $599 million | Link |

*Note: The New Reciprocal Tariff Rate will take effect on August 1st, 2025; the Initial Tariff Rate was announced on April 2nd, 2025.

**The Latest announcement of reciprocal tariffs for trading partners on July 22th

Terms outlined in today’s tariff letters mirror those in the tariff letters:

- The letters state that the tariff rates are separate from “Sectoral Tariffs.” While it is unclear, that language suggests that the new tariff rate could potentially be stacked on top of (imposed in addition to) Section 232 tariffs on various industrial sectors.

- Goods determined to be “transshipped” to evade a higher tariff will be subject to a higher tariff. There is no definition of this key term.

- Tariffs can be modified, upward or downward, depending on the continued relationship between the US and the specified country.

- Any retaliatory tariff rate will be added to the reciprocal tariff rate specified in the letter.

USMCA Exemption

Trump’s letter to Mexico did not address if USMCA-compliant goods would still be exempt from the Mexico tariffs after August 1st, 2025. The White House reportedly told news outlets last week that the USMCA exemption would still apply under the Canada’s 35% tariff, but stressed that could change; it is unclear if this same rationale would be applied to goods produced in Mexico.

European Union Reaction

The European Commission President Ursula von der Leyen announced yesterday that the EU’s countermeasures, established in response to President Trump’s initial import taxes on steel and aluminum which were scheduled to take effect tomorrow (July 15th) have been extended until early August to provide room to negotiate a solution with the U.S. The EU trade ministers met today to discuss how to respond to Trump’s letter and contingency plans if negotiations fail to avert the announced 30% tariff rate.

Mexico Reaction

During today’s press conference, Claudia Sheinbaum, President of Mexico, said progress has been made in U.S. bilateral trade discussions regarding security and combating fentanyl trafficking. She stated that only minor details remain.

On-going Trade Negotiations with Other Countries

South Korea says that a framework US trade deal may be possible by August 1st, 2025. It has signaled some willingness to allow greater U.S. access to farm markets to achieve this deal.

India and US trade representatives are currently meeting in D.C. to negotiate a trade deal.

New Section 232 Tariff Investigations

It is announced that 50% Section 232 tariff will be imposed on imports of copper, effective August 1st, 2025. No corresponding Executive Order, Proclamation, or documentation has been released to date.

The U.S. Department of Commerce also announced the initiation of two new Section 232 national security investigations—one targeting polysilicon and its derivatives, and the other focusing on unmanned aircraft systems. Notably, the scope of “polysilicon derivatives” was not defined in the announcement. If Commerce determines that imports of these products threaten US national security, President Trump can impose Section 232 tariffs on imports of these products, similar to those currently imposed on steel and aluminum and derivative articles of steel and aluminum and automobiles and auto parts.

Polysilicon derivatives are critical components used in the manufacturing of semiconductor wafers and solar technologies. Their inclusion in the investigation suggests an intent to broaden the scope of scrutiny on semiconductors and the electronics supply chain, which are already the subject of a separate Section 232 investigation.

As of July 9th

Country-Specific Reciprocal Tariff

President Trump announced on social media that the U.S. has now issued tariff letters to 22 countries in total, between those issued on Monday July 7 (14 countries) and those issued today July 9 (8 countries). These letters lay out the country-specific reciprocal tariff rates that will apply to those countries’ goods as of 12:01 a.m. EDT on August 1, 2025, when the latest extension to the pause in the imposition of country-specific reciprocal tariffs expires.

Additional Today’s Tariff Letters:

| Trading Partner | New Reciprocal Tariff Rate* | Initial Tariff Rate* | Difference | Trade Details | Tariff Letter Issued |

|---|---|---|---|---|---|

| Algeria** | 30% | 30% | 0% | $1.3 billion | Link |

| Bangladesh | 35% | 37% | -2% | $5.7 billion | Link |

| Bosnia and Herzegovina | 30% | 35% | -5% | $116 million | Link |

| Brazil** | 50% | 10% | 40% | $6.8 billion | Link |

| Brunei** | 25% | 24% | 1% | $118.5 million | Link |

| Cambodia | 36% | 49% | -13% | $11.4 billion | Link |

| Indonesia | 32% | 32% | 0% | $16.4 billion | Link |

| Iraq** | 30% | 39% | -9% | $5.4 billion | Link |

| Japan | 25% | 24% | 1% | $62.6 billion | Link |

| Kazakhstan | 25% | 27% | -2% | $1.1 billion | Link |

| Libya** | 30% | 31% | -1% | $899 million | Link |

| Loas | 40% | 48% | -8% | $654 million | Link |

| Malaysia | 25% | 24% | 1% | $22.1 billion | Link |

| Myanmar (Burma) | 40% | 44% | -4% | $524 million | Link |

| Moldova** | 25% | 31% | -6% | $72.3 million | Link |

| Philippines** | 20% | 17% | 3% | $4.4 billion | Link |

| Serbia | 35% | 37% | -2% | $543 million | Link |

| South Africa | 30% | 30% | 0% | $7.9 billion | Link |

| South Korea | 25% | 25% | 0% | $60.2 billion | Link |

| Sri Lanka** | 30% | 44% | -14% | $2.5 billion | Link |

| Thailand | 36% | 36% | 0% | $41.5 billion | Link |

| Tunisia | 25% | 28% | -3% | $599 million | Link |

*Note: The New Reciprocal Tariff Rate will take effect on August 1st, 2025; the Initial Tariff Rate was announced on April 2nd, 2025.

**The Latest announcement of reciprocal tariffs for trading partners on July 9th

Terms outlined in today’s tariff letters mirror those in the tariff letters released on Monday July 7th:

- New tariff rates will take effect on August 1st, 2025.

- The letters state that the tariff rates are separate from “Sectoral Tariffs.”

- Goods determined to be transshipped to evade a higher tariff will be subject to a higher tariff. There is no definition of this key term.

- Tariffs can be modified, upward or downward, depending on the continued relationship between the US and the specified country.

- Any retaliatory tariff rate will be added to the reciprocal tariff rate specified in the letter.

In addition to trade imbalance concerns, the Brazil letter states that the 50% tariff rate is based in part on Brazil’s alleged attacks on its own free elections and on American’s free speech rights. The letter also states that President Trump has instructed the US Trade Representative to “immediately” initiate a Section 301 investigation of Brazil, due to Brazil’s alleged attacks on the digital trade activities of American companies and other unspecified unfair trade practices.

As of July 7th

Late this afternoon, President Trump issued an Executive Order, Extending the Modification of the Reciprocal Tariff Rates, extending the current suspension of the country-specific reciprocal tariffs on imports from all countries except China (which is subject to its own rate) and Canada and Mexico (which are not subject to reciprocal tariffs) from Wednesday July 9th to August 1st, 2025. Goods will continue to be subject to a 10% baseline tariff rate during this new extension of the suspension on country-specific reciprocal tariffs.

The separate tariff suspension issued to China, including Hong Kong and Macau, (suspending 24% of its 34% rate for 90 days, or until August 11, 2025) remains in effect. Effective August 12, 2025, the reduced 10% duty rate on Chinese-, Hong Kong, and Macau-origin goods will revert to 34%, unless the administration indicates otherwise.

Below are the 14 countries that President Trump has sent out the letters to them already. These new Tariff Rates is going to start on August 1st, 2025.

Today’s Tariff Letters:

| Trading Partner | New Reciprocal Tariff Rate* | Initial Tariff Rate* | Difference | Trade Details | Tariff Letter Issued |

|---|---|---|---|---|---|

| Bangladesh | 35% | 37% | -2% | $5.7 billion | Link |

| Bosnia and Herzegovina | 30% | 35% | -5% | $116 million | Link |

| Cambodia | 36% | 49% | -13% | $11.4 billion | Link |

| Indonesia | 32% | 32% | 0% | $16.4 billion | Link |

| Japan | 25% | 24% | 1% | $62.6 billion | Link |

| Kazakhstan | 25% | 27% | -2% | $1.1 billion | Link |

| Laos | 40% | 48% | -8% | $654 million | Link |

| Malaysia | 25% | 24% | 1% | $22.1 billion | Link |

| Myanmar (Burma) | 40% | 44% | -4% | $524 million | Link |

| Serbia | 35% | 37% | -2% | $543 million | Link |

| South Africa | 30% | 30% | 0% | $7.9 billion | Link |

| South Korea | 25% | 25% | 0% | $60.2 billion | Link |

| Thailand | 36% | 36% | 0% | $41.5 billion | Link |

| Tunisia | 25% | 28% | -3% | $599 million | Link |

*Note: The New Reciprocal Tariff Rate will take effect on August 1st, 2025; the Initial Tariff Rate was announced on April 2nd, 2025.

As noted by Treasury Secretary Bessent, additional letters to other countries will continue to be released throughout the next 72 hours (leading up to Wednesday, July 9, 2025).

Terms outlined in today’s tariff letters:

- New tariff rates will take effect on August 1st, 2025.

- The letters state that the tariff rates are separate from “Sectoral Tariffs.” While goods which were subject to the “Sectoral Tariffs” on steel and aluminum and derivative articles thereof (Section 232 tariffs) were originally not subject to reciprocal tariffs, this language suggests the reciprocal tariffs are now stacked on top of (imposed in addition to) Section 232 tariffs on steel and aluminum and their derivative articles as per recent changes.

- Goods determined to be “transshipped to evade a higher tariff” will be subject to a higher tariff, per the letters issued. The letters are silent as to what will be considered to be “transshipment,” including whether it will be limited to goods wholly produced in one country but shipped through another or will also include goods manufactured in one country using inputs from another country.

- Any tariff rate imposed by a country in retaliation will be added to the reciprocal rate stated in the respective letter.

- Tariffs can be modified, upward or downward, depending on the continued relationship between the US and the specified country.

Previous Trade Deal:

Vietnam

- Trade deal announced on July 2nd, 2025, via social media. The parties are still negotiating, and the draft of the agreement has not been circulated publicly.

- Under the agreement:

-

-

- Vietnamese goods imported into the U.S. will face a 20% tariff.

- Goods determined to be “transshipped” through Vietnam will be subject to a 40% tariff. Like today’s letters, the announcement did not specify what was meant by the term “transshipment” and whether it includes goods that are manufactured in Vietnam using inputs sourced from a different country. Commerce Secretary Howard Lutnick defined transshipping via Twitter and recent press conferences as, “if another country sells their content through products exported by Vietnam to us — they’ll get hit with a 40% tariff.”

- In return, Vietnam has agreed to grant the United States total market access for trade. According to the president’s statement, this includes allowing U.S. products to enter Vietnam at 0% tariff.

-

- Prior to this agreement, Vietnam was assigned a 46% country-specific tariff rate under the country-specific reciprocal tariff measures announced on April 2.

As of June 4th

President Trump will double the current tariff on steel and aluminum imports from 25% to 50% starting June 4, 2025.

- UK Exception: Imports from the United Kingdom will still face a 25% tariff. However, this may change or include quotas starting July 9, 2025, depending on the progress of the U.S.-UK Economic Prosperity Deal.

- Scope: The 50% tariff applies only to the steel and aluminum portion of imported goods. Other materials in the product will be taxed under different applicable tariffs.

How is the New Section 232 Tariff Determined?

-

- If an entry is filed on June 3, but the shipment arrives in the U.S. on June 4, the new 50% tariff will apply.

- If both the entry and arrival occur on June 4, the new 50% tariff applies.

- For shipments entering the U.S. under Inland Transfer (IT):

- The tariff is based on the first U.S. landing port date.

- Example: If the IT was filed on June 3, but the first U.S. landing is on June 4, the new 50% tariff will apply.

Additional Information:

-

- Any imports of articles set forth in Annex II to this proclamation that were admitted into a United States foreign trade zone under “privileged foreign status” as defined in 19 CFR 146.41 before 12:01 a.m. eastern daylight time on June 4, 2025, shall be subject upon entry for consumption made on or after 12:01 a.m. eastern daylight time on June 4, 2025, to the provisions of the tariff in effect at the time of the entry for consumption.

- Any article set forth in Annex I to this proclamation, except those eligible for admission under “domestic status” as defined in 19 CFR 146.43, that is subject to a duty imposed by this proclamation and that is admitted into a United States foreign trade zone on or after June 4, 2025, may be admitted only under “privileged foreign status” as defined in 19 CFR 146.41, and will be subject upon entry for consumption to any ad valorem rates of duty related to the classification under the applicable HTSUS subheading.

- No drawback shall be available with respect to the duties imposed pursuant to this proclamation.

As of May 13th

U.S. Treasury Secretary Bessent has announced that the United States and China have reached an agreement on a 90-day tariff pause and a substantial reduction in current tariff levels. Both countries are expected to lower their tariffs by 115%, marking a far more aggressive move than anticipated.

- The reciprocal tariff rate on Chinese imports is reduced to 10%. Including the existing 20% tariff under the International Emergency Economic Powers Act (IEEPA), the total U.S. tariff on Chinese goods would fall from 145% to 30%.

- Existing exemptions from the reciprocal tariffs are expected to remain in place. For instance, companies already paying the 25% steel and aluminum, automobile and parts tariff will be exempt from the new 10% reciprocal tariff rate, though the 20% IEEPA tariff is still likely to apply

- A surge in ocean and air cargo traffic between the U.S. and China is expected as businesses move to capitalize on the 90-day window. Freight rates are likely to rise sharply, and space will be limited, particularly given the recent withdrawal of capacity from the Trans-Pacific trade lane.

- Refunds are available in China for recent U.S. imports, while in the U.S., no refunds are offered, but reduced rates will apply moving forward.

As of April 14th

U.S. Probes Pharma, Chip Imports Over Security Risks

On April 14, 2025, the U.S. Department of Commerce’s Bureau of Industry and Security (BIS) launched investigations into the national security risks of importing pharmaceuticals and semiconductors, including manufacturing equipment. These reviews fall under Section 232 of the Trade Expansion Act of 1962, which allows the President to restrict imports that may harm national security.

While these investigations usually take up to 270 days, the Trump administration aims to act faster, with tariffs possibly being introduced within 60 to 90 days. Like the recent probes into copper and wood products, public comment periods are short, and no hearings are planned.

The semiconductor review covers chips, semiconductor manufacturing equipment, and related products. The U.S. relies heavily on suppliers from East Asia—including Taiwan, South Korea, Malaysia, Japan, and China. Proposed tariffs may start at 25% and could increase, as the administration looks to boost domestic production and reduce dependence on foreign sources.

As of April 11th

Executive Order on Reciprocal Tariff Exemptions – Effective April 5

The Administration has issued a new Executive Order providing exemptions from existing reciprocal tariffs—10% for all countries (except China) and 125% for China—on products classified under specific tariff codes.

While media coverage focuses on smartphones, semiconductors, and computers, many other products may also qualify. Importers are advised to review their HTS codes to determine eligibility and ensure their customs broker systems are set to automatically apply the exemptions.

The exemptions apply to entries filed on or after April 5. Brokers should amend affected entries to remove the reciprocal tariffs before duties are paid. If duties have already been paid, a Post Summary Correction (PSC) should be filed to secure a refund.

Importantly, this exemption does not override the applicability of IEEPA (International Emergency Economic Powers Act), which remains in effect.

List of Exempted HTS Codes:

- 8471 – Automatic data processing machines and their unit equipment, including computers and their accessories, such as computers, servers, workstations, motherboards, etc.

- 8473.30 – Portable automatic data processing machines, weighing not more than 10 kg, consisting of at least a central processing unit, a keyboard and a display

- 8486 – Machines and apparatus of a kind used solely or principally for the manufacture of semiconductor boules or wafers, semiconductor devices, electronic integrated circuits or flat panel displays; machines and apparatus specified in note 11(C) to this chapter; parts and accessories:

- 8517.13.00 – Smartphones

- 8517.62.00 – Machines for the reception, conversion and transmission or regeneration of voice, images or other data, including switching and routing apparatus

- 8523.51.00 – Solid-state non-volatile storage devices

- 8524 – Flat panel display modules, whether or not incorporating touch-sensitive screens

- 8528.52.00 – Capable of directly connecting to and designed for use with an automatic data processing machine of heading 8471

- 8541.10.00 – Diodes, other than photosensitive or light-emitting diodes (LED)

- 8541.21.00 – With a dissipation rate of less than 1 W / Unmounted chips, dice and wafers / With an operating frequency not less than 100 MHz

- 8541.29.00 – Unmounted chips, dice and wafers / With operating frequency not less than 30 MHz

- 8541.30.00 – Thyristors, diacs and triacs, other than photosensitive devices / Unmounted chips, dice and wafers / Photosensitive semiconductor devices, including photovoltaic cells whether or not assembled in modules or made up into panels; light-emitting diodes (LED)

- 8541.49.10 – Other diodes / Unmounted chips, dice and wafers

- 8541.49.70 – Transistors / Unmounted chips, dice and wafers

- 8541.49.80 – Optical coupled isolators

- 8541.49.95 – Other semiconductor devices

- 8541.51.00 – Semiconductor-based transducers

- 8541.59.00 – Unmounted chips, dice and wafers

- 8541.90.00 – Parts

- 8542 -Electronic integrated circuits

As of April 10th

President Donald Trump has announced a 90-day pause on all country-specific reciprocal tariffs—with the exception of China. The update, effective April 10, 2025, includes the following key changes:

- China, Hong Kong, and Macau:

Reciprocal tariffs on imports from these regions have increased to 125%, effective immediately. These imports are now subject to:

Base duty rate + Section 301 duties (7.5% or 25%, if applicable) + 20% IEEPA tariff + 125% reciprocal duty. - All other countries (excluding China, Hong Kong, Macau, Mexico, and Canada):

A temporary 10% reciprocal tariff will apply through July 8, 2025. This reduction is part of the 90-day suspension of higher rates originally outlined in the Executive Order. - Entries filed on April 9 for non-China origin cargo at the higher reciprocal rates will not qualify for the 10% temporary reduction.

- Exemptions:

All previous exemptions remain in effect. This includes goods from Mexico and Canada, as well as imports already subject to steel, aluminum, and auto tariffs—which continue to be exempt from reciprocal tariffs.

As of April 9th

President Donald Trump has increased the reciprocal tariff for China from 34% to 84%, in response to the retaliatory tariff of 34% placed by China to the US.

| Final Export Date | Tariff Applied | Notes |

|---|---|---|

| On or after April 9 | Reciprocal Tariff Rate | Country-specific rate applies. For China and by extension, Hong Kong and Macau): rises to +84% |

Example: How New Tariffs Impact Duty & Tax Calculation for China

Below is a sample breakdown for products classified under HTSUS 8538.90.8180, showing how tariffs may vary depending on country of origin and export date.

Country of Origin: China

- If final export date on/after April 9: General 3.5% + Section 301 China 25% + IEEPA China 20% + IEEPA Reciprocal 84% → Total:132.5%

As of April 3rd

10% Additional Tariff (April 5 Onward)

An additional 10% tariff applies to all countries, effective 12:01 AM EDT on April 5.

- Exemption: Shipments that depart their country of origin before this time are not subject to the 10% tariff.

Higher Country-Specific Duty Rates (April 9 Onward)

For countries with a reciprocal tariff rate above 10%, that higher rate will replace the 10% tariff on April 9 at 12:01 AM EDT.

- Exemption: Shipments that depart from origin before 12:01 AM EDT on April 9 are exempt.

- Clarification for China:

- For China (and by extension, Hong Kong and Macau), the rate rises

from 10% on April 5 to 34% on April 9, unless action is taken to reduce the rate beforehand. - Any country with a rate higher than 10% will follow this two-step increase schedule unless noted otherwise.

- For China (and by extension, Hong Kong and Macau), the rate rises

Find the quick breakdown below:

| Final Export Date | Tariff Applied | Notes |

|---|---|---|

| On or after April 5 and before April 9 | +10% Tariff | Applies to all countries uniformly |

| On or after April 9 | Reciprocal Tariff Rate | Country-specific rate applies. For China and by extension, Hong Kong and Macau): |

Exemptions from These Tariffs:

These new duties do not apply to:

- Products already covered by the February 10 steel & aluminum tariff order.

- Automobiles and parts covered by the March 26 order.

- Specific industries: copper, pharmaceuticals, semiconductors, lumber, critical minerals, and energy products.

- Countries under Column 2 duty rates (those without Normal Trade Relations).

- Future Section 232 products.

- Goods containing 20% or more U.S.-made content (by transaction value) are not subject to the new reciprocal tariffs. In other words, if 20% or more of the transaction value (the amount the importer is paying the supplier) of the product is US made, then the US content is not dutiable at the new reciprocal tariff rate. The non-US content, though, is dutiable at the reciprocal rate. For example:

Total product value: $100

U.S.-made component: 25% of $100 = $25

Non-U.S. component: 75% of $100 = $75

In this case, the $25 U.S. made portion is exempt, while the $75 portion is subject to the applicable reciprocal tariff.

USMCA Exemptions and Special Cases:

- The 25% tariff exemption for Canada (CA) and Mexico (MX) is extended.

- Non-USMCA goods from CA/MX still face a 25% tariff.

- Non-USMCA energy products from CA/MX are subject to a 10% tariff.

- Reciprocal tariffs do not apply to CA/MX—the new 10% tariff is not added to the existing 25% rate.

- If existing CA/MX orders are canceled or suspended, then USMCA-qualifying goods and energy/potash resources will not face reciprocal tariffs. Non-qualifying goods will be subject to a 12% tariff.

Additional Requirements:

- Goods subject to these duties must enter FTZs under privileged foreign status.

- Items covered by the new tariffs are eligible for de minimis treatment until the Secretary of Commerce finalizes systems for duty collection.

De Minimis Ban for China and Hong Kong – Effective May 2, 2025

On April 2, President Trump signed an Executive Order ending duty-free de minimis treatment (for shipments under 800 USD) for goods originating from China and Hong Kong, effective 12:01am EDT, May 2, 2025. This includes packages shipped via international postal services.

- Full duties (base + Section 301, 232, and IEEPA) will apply.

- Formal entry and duty payment is required for all affected shipments.

- Macau may be added to this ban pending further review.

- Postal carriers must either: Pay 30% of declared value per package, or Pay a 25 USD fee per item starting May 2, increasing to 50 USD per item starting June 1.

- Carriers must post a bond and comply with enhanced reporting.

This policy change ends de minimis exemptions for low-value goods from China and Hong Kong, affecting e-commerce and small parcel flows to the U.S.

Possible Future Adjustments:

- If a country retaliates with tariffs on US exports, US tariffs may increase or expand.

- If countries adjust to create fairer trade, the US may reduce or limit duties.

- If US manufacturing weakens further, the US may increase tariffs under the order.

Example: How New Tariffs Impact Duty & Tax Calculation

Below is a sample breakdown for products classified under HTSUS 8538.90.8180, showing how tariffs may vary depending on country of origin and export date.

Country of Origin: China

- If final export date on or before April 4: General 3.5% + Section 301 China 25% + IEEPA China 20% → Total: 48.5%

- If final export date on/after April 5 but on/before April 8: General 3.5% + Section 301 China 25% + IEEPA China 20% + IEEPA Reciprocal 10% → Total: 58.5%

- If final export date on/after April 9: General 3.5% + Section 301 China 25% + IEEPA China 20% +

IEEPA Reciprocal 34% → Total: 82.5%

Country of Origin: India

- If final export date on or before April 4: General 3.5% → Total: 3.5%

- If final export date on/after April 5 but on/before April 8: General 3.5% + IEEPA Reciprocal 10% → Total: 13.5%

- If final export date on/after April 9: General 3.5% + IEEPA Reciprocal 26% → Total: 29.5%

Recommendation

- Book shipments now if your inventory and supplies are ready, as air freight capacity is expected to be tight. Partner with a reliable freight forwarder, like Dimerco, to secure space.

- Utilize Free Trade Zones (FTZs) to defer duty payments until products are sold, improving cash flow management.

- Review U.S. trade compliance basics to stay informed on the latest regulations. Consult a trade compliance expert, like Dimerco, for guidance on navigating current policies. Listen to our recent podcast featuring recognized experts on U.S. tariffs and trade compliance for latest insights.