As global supply chains shift in the midst of China Plus One strategies and ongoing geopolitical changes, trade between ASEAN and China is set to grow even further. This creates new opportunities for businesses in the region—but also new complexities. Understanding how to navigate the full benefits of free trade agreements is the key to staying competitive. With proper use of these agreements, companies can reduce costs, speed up customs clearance, and gain a competitive edge in an increasingly connected and competitive market.

Intra-ASEAN & China-ASEAN Trade

The Association of Southeast Asian Nations (ASEAN) was formed in 1967 by Indonesia, Malaysia, the Philippines, Singapore, and Thailand to promote peace and cooperation in the region. Later, Brunei, Vietnam, Laos, Myanmar, and Cambodia joined, making it a 10-member group.

The Association of Southeast Asian Nations (ASEAN) was formed in 1967 by Indonesia, Malaysia, the Philippines, Singapore, and Thailand to promote peace and cooperation in the region. Later, Brunei, Vietnam, Laos, Myanmar, and Cambodia joined, making it a 10-member group.

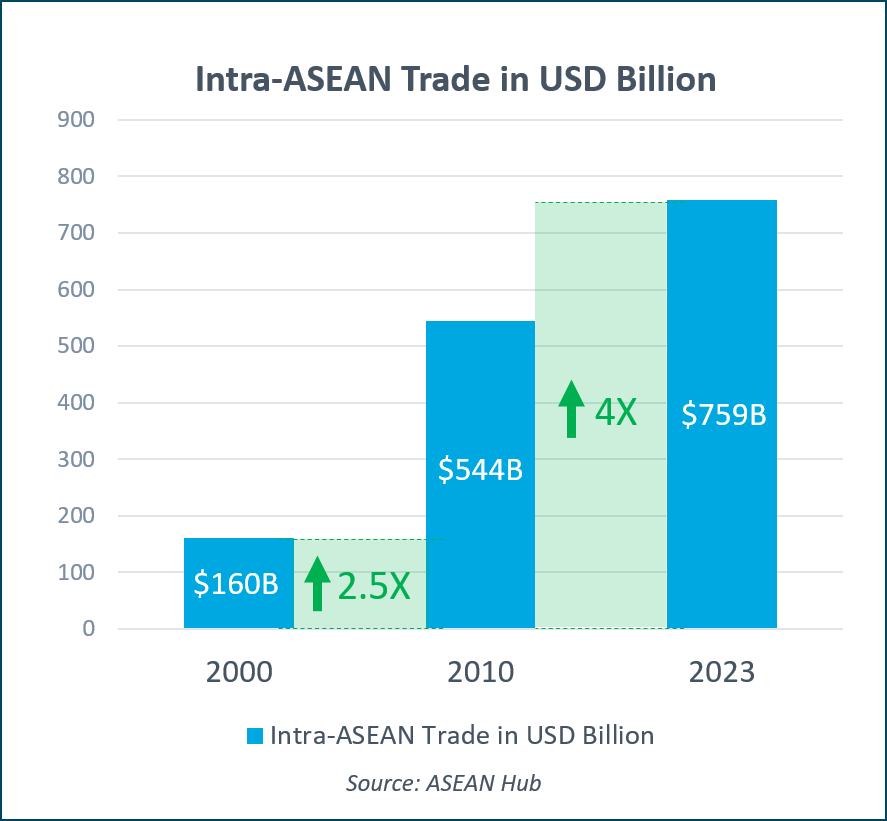

To boost trade among member countries, ASEAN launched the ASEAN Free Trade Area (AFTA) in 1992. The goal was to lower tariffs and make the region more competitive. Since then, trade between ASEAN countries has grown steadily, showing how important AFTA is for the region’s economy.

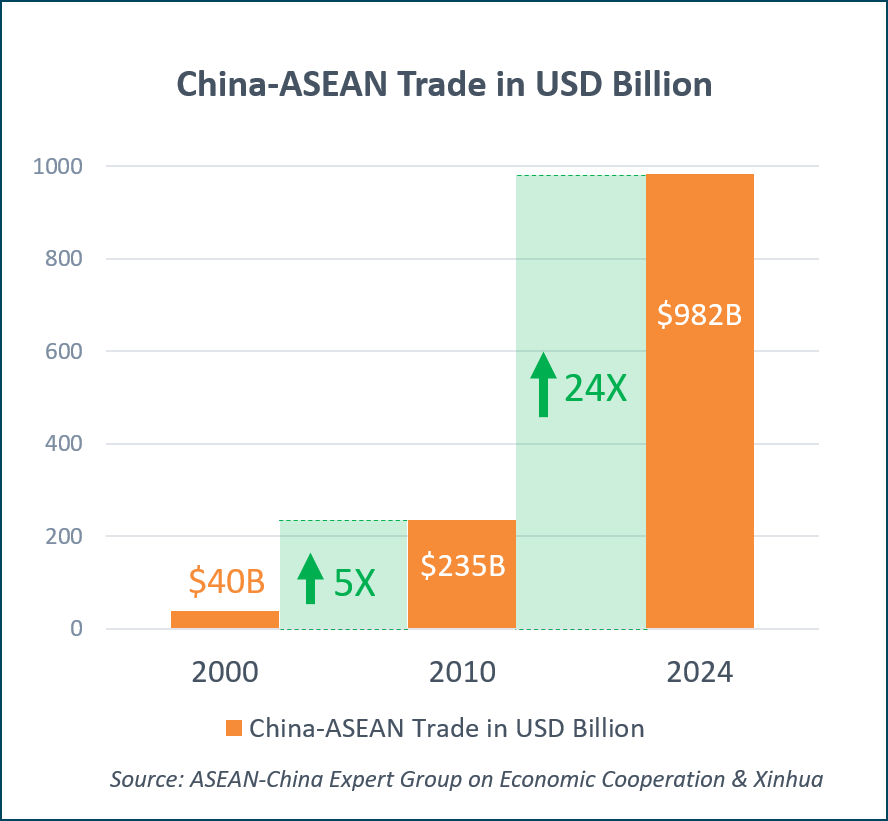

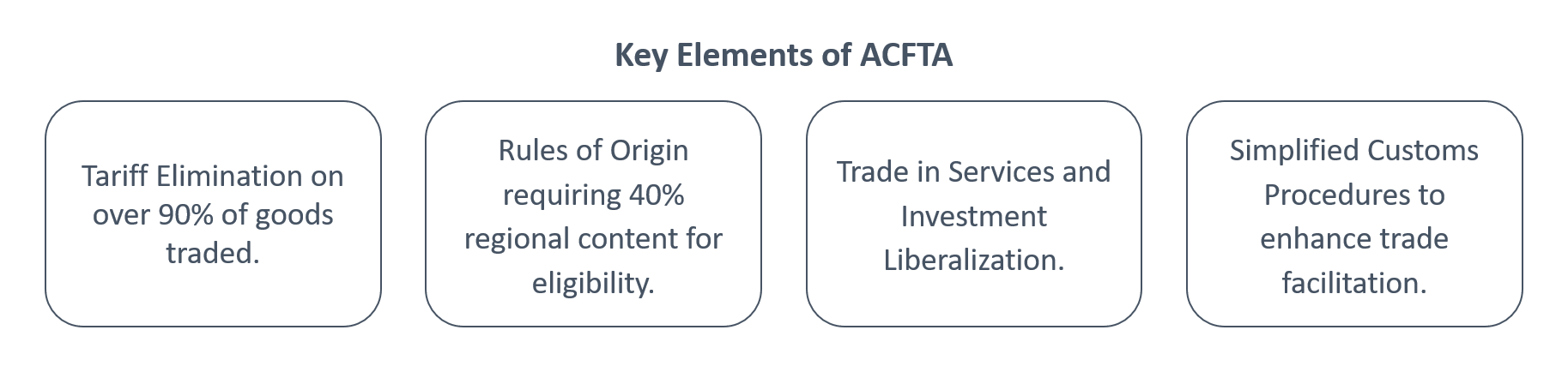

on that success, ASEAN took a major step toward expanding its trade ties beyond the region in 2002. ASEAN signed a Framework Agreement with China to create the ASEAN-China Free Trade Area (ACFTA), which officially came into effect in 2010 for the original ASEAN-6 countries: Brunei, Indonesia, Malaysia, the Philippines, Singapore, and Thailand. The remaining members—Cambodia, Laos, Myanmar, and Vietnam—joined later, with full tariff reductions in place by 2015.

on that success, ASEAN took a major step toward expanding its trade ties beyond the region in 2002. ASEAN signed a Framework Agreement with China to create the ASEAN-China Free Trade Area (ACFTA), which officially came into effect in 2010 for the original ASEAN-6 countries: Brunei, Indonesia, Malaysia, the Philippines, Singapore, and Thailand. The remaining members—Cambodia, Laos, Myanmar, and Vietnam—joined later, with full tariff reductions in place by 2015.

ACFTA significantly lowered or eliminated tariffs on thousands of products, making it one of the largest and most impactful trade agreements in Asia. Since the early 2000s, trade between China and ASEAN has grown more than 20 times, highlighting the strong influence of this partnership on the region’s economic growth.

Leveraging Free Trade Agreement: Certificate of Origin Form D and Form E

When shipping within ASEAN or between ASEAN and China, businesses can take advantage of lower import duties through two key documents: Form D and Form E. These are certificates of origin that prove the goods meet the Rules of Origin under the respective free trade agreements, allowing them to qualify for preferential tariff treatment.

- Form D is used under the ASEAN Free Trade Area (AFTA). It applies when goods are made in one ASEAN country and shipped to another ASEAN member state.

- Form E is used under the ASEAN-China Free Trade Area (ACFTA). It covers trade between China and any ASEAN country, whether the goods are exported from ASEAN to China or from China to ASEAN.

Example: An electronics manufacturer in China exports other articles of copper classified under HS Code 7419.80.90 to Thailand.

- General Tariff Rate: 10%

- ACFTA Preferential Tariff Rate: 0%

By meeting the “PE” criterion (Product-specific Rule or Regional Value Content ≥ 40%), the exporter obtains a Form E. The Thai importer submits it to customs, reducing duty from 10% to 0%. Without the Certificate of Origin Form E, the importer must pay the full tariff rate, resulting in higher costs and possible delays.

Shipments with Routing Hubs: Back-to-Back Form E and Form D

Sometimes, shipments pass through a routing hub before reaching their final destination. In these cases, customs at the destination may need to verify the validity of the Certificate of Origin—Since the bill of lading or airway bill lists the hub, not the original exporting country, as the origin.

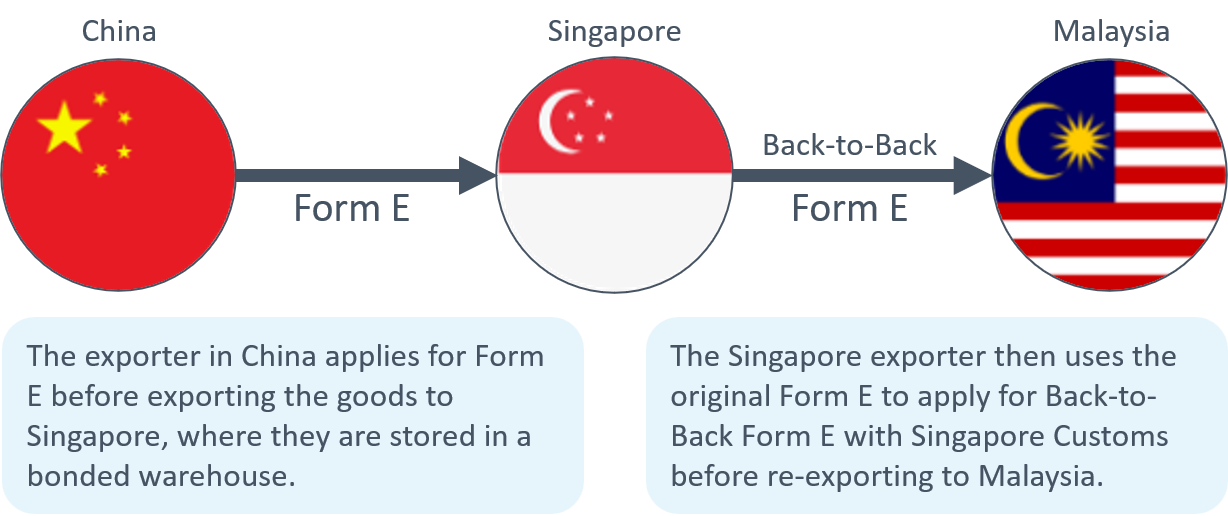

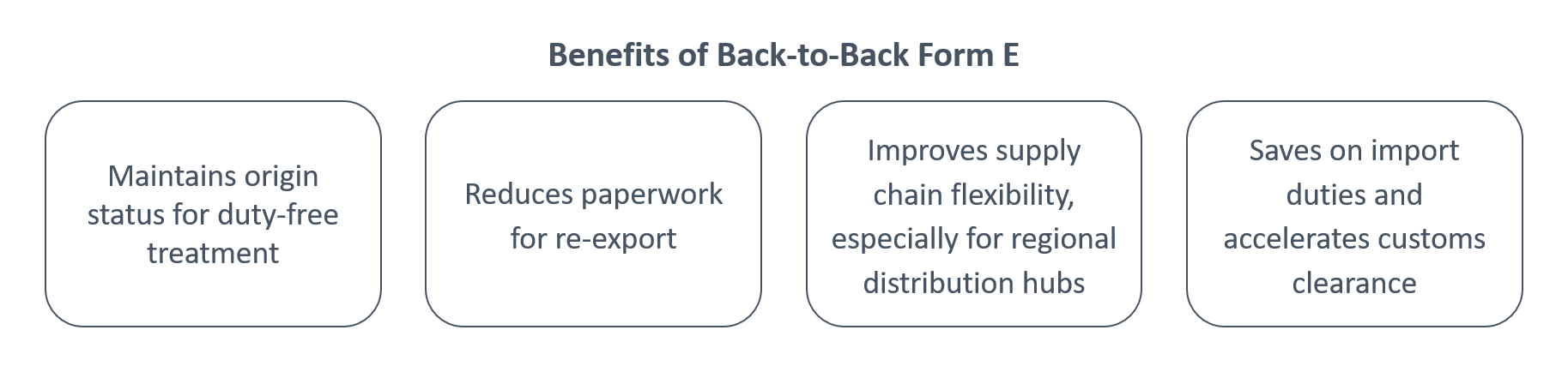

This is where Back-to-Back Form D or Form E becomes important. These certificates are used when goods are re-exported from one ASEAN country or China to another ACFTA country through an intermediate country, without any change to the goods.

Example: A shipment moves from China to Singapore, where it’s stored temporarily before being re-exported to Malaysia. In this case, Singapore customs can issue a Back-to-Back Form E, which confirms that the goods are still of Chinese origin and allows the importer in Malaysia to enjoy preferential tariff treatment.

The back-to-back Form D or E must adhere to certain requirements such as:

- Goods must remain unprocessed (no repacking, labelling, or modification).

- Goods must be stored in a bonded warehouse or Free Trade Zone during transit.

- Goods must be supported by the original certificate of origin Form E from the export country.

- Certificate must be issued by a competent authority in the intermediate country, such as the Singapore Customs in Singapore.

Case Study 1

A Dimerco customer urgently needed to ship a large volume of cargo from Shanghai, China to Johor Bahru, Malaysia. Due to limited direct air freight capacity between Shanghai and Johor, Dimerco arranged for part of the cargo to transit via Singapore, followed by cross-border trucking into Johor. As a result of this routing, the customer was required to apply for a Back-to-Back Form E with Singapore Customs before the shipment could proceed to Johor. This step was necessary to qualify for preferential tariff treatment under the ASEAN-China Free Trade Area (ACFTA).

Common Mistakes to Avoid

- Incorrect reference to the original Form D or Form E – Ensure consistency across supporting documents such as the original Form E, commercial invoice and packing list. Any mismatch may lead to customs rejection or loss of tariff benefits.

- Using an expired original Form E – A Back-to-Back Form D or Form E must be issued before the original certificate expires.

- Altering or repackaging goods during storage – Goods must remain unchanged while stored to maintain their origin status under the FTA

- Using non-approved warehouses or issuing authorities – Only authorized bonded warehouses and official issuing bodies should be used to comply with customs regulations.

Case Study 2

A multinational company operates a manufacturing facility in Indonesia and a distribution hub in Vietnam. Since the goods are produced in Indonesia, the Certificate of Origin is issued from Indonesia. The company intended to ship products from its Vietnamese distribution hub to Thailand and use a Back-to-Back Form D to qualify for preferential tariff treatment under the ASEAN Free Trade Area (AFTA). However, because the transaction was invoiced through the company’s regional office in Singapore, the commercial documents indicated Singapore as the country of origin. This discrepancy led to a mismatch between the Certificate of Origin and the invoice details, resulting in the rejection of the Back-to-Back Form D and disqualification from the AFTA tariff benefits.

Boost Your ASEAN-China Trade

Understanding the Certificate of Origin, including Form E and Form D, is essential for businesses navigating trade within ASEAN and between ASEAN and China. Proper use of these certificates ensures companies can fully leverage the preferential tariff treatments under AFTA and ACFTA, reducing costs and avoiding customs delays. Whether dealing with direct shipments or complex routings involving Back-to-Back forms, attention to detail and compliance with the rules of origin are critical for smooth cross-border trade. Want to optimize your supply chain and fully leverage these trade agreements? Start a discussion with us today!