For manufacturers looking to expand into Southeast Asia, Thailand offers attractive investment incentives, including exemptions on import duties for used machinery. Explore the key requirements and conditions for importing used machinery under BOI promotion, and the critical role of experienced logistics partners in navigating Thailand Customs and ensuring a smooth shipping process.

Why Thailand is a Magnet for Manufacturers

Thailand continues to attract foreign manufacturers looking to diversify their production footprint. The country’s strategic location, solid infrastructure, and supportive government policies make it a top choice in Southeast Asia.

The Thailand Board of Investment (BOI) plays a key role in this strategy by offering tax incentives to encourage foreign investment. These include:

- Up to 13 years of corporate income tax (CIT) exemption

- Exemption of import duties on raw materials used in exported goods

- Exemption of import duties on machinery (including certain used machinery)

Learn more about BOI incentives here.

Used Machinery Import Incentive

One of the most commonly used BOI benefits is the exemption of import duties on used machinery. This allows companies to bring in existing equipment to maintain production consistency while avoiding the high costs of new machinery. However, qualifying for these incentives involves more than just meeting BOI criteria—it also requires full compliance with Thailand Customs regulations. The machinery must be in good condition, environmentally safe, and supported by proper documentation including:

- Details of reconditioning and remaining life cycle analysis

- Test-run results and year of manufacture

- Reasonable price estimation

- Inspection reports with date and place of inspection

- Reports on environmental impact, safety standards, and energy consumption (advisable)

If the imported machinery is brand new, it may qualify for preferential tariff rates under Form E (for machinery imported from China) or Form D (for machinery imported from other ASEAN countries).

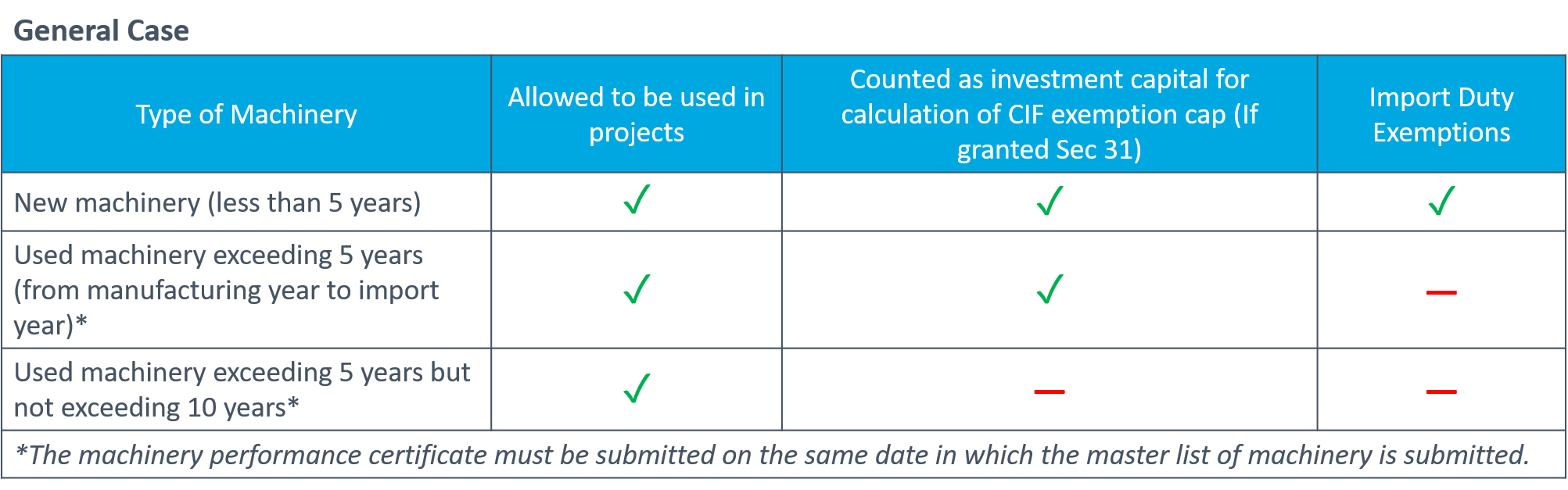

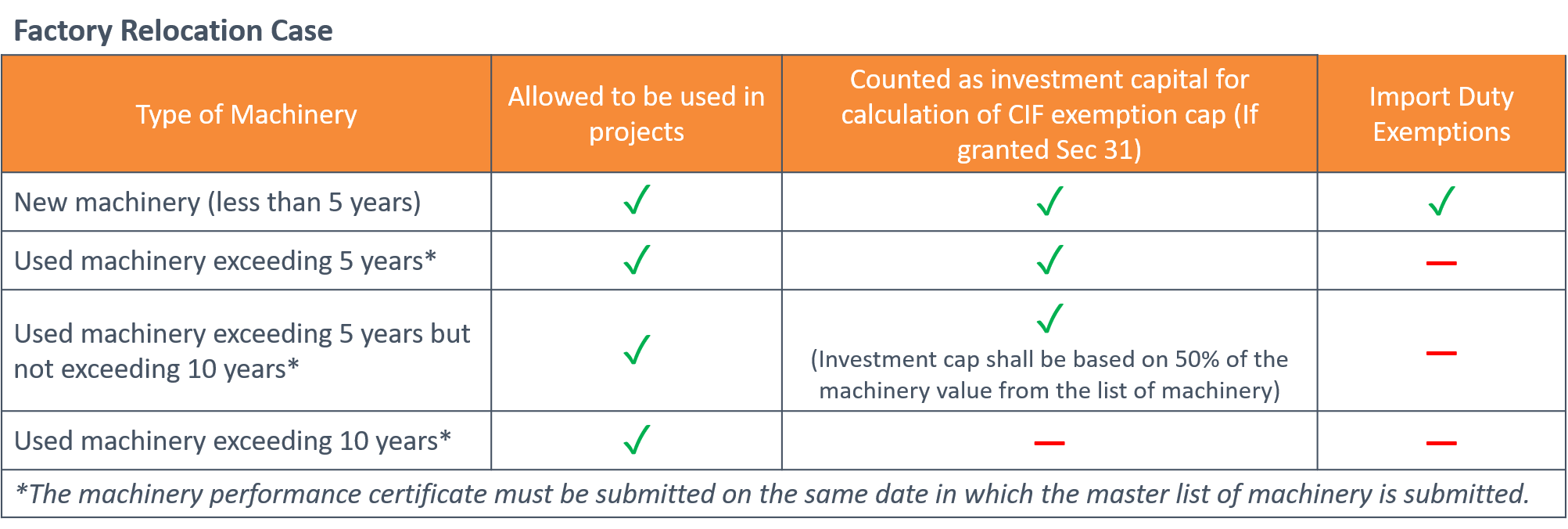

Criteria Under Thailand BOI

Investment promotion for machinery under Thailand’s BOI covers three categories: new domestic machinery, new imported machinery, and used imported machinery. However, it’s important to note that used domestic machinery have specific conditions to meet in order to qualify investment promotion benefits. Used domestic machinery is generally excluded from BOI promotion, but under specific SME promotion criteria, it may be allowed if the total machinery value does not exceed 10 million THB, and at least 50% of the machinery used in the project is new.

The conditions for each machinery category are outlined by the Thailand Board of Investment and must be carefully reviewed to ensure compliance when applying for incentives.

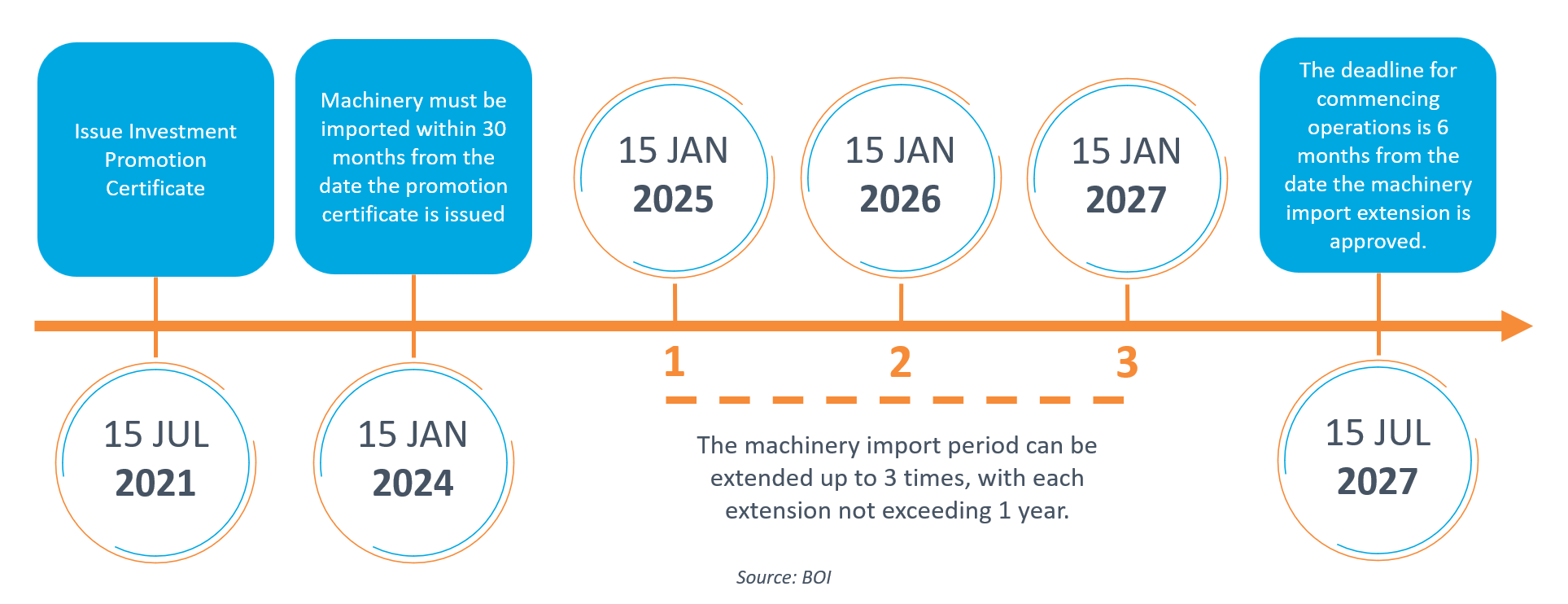

Import Deadlines and Extensions

If your machinery qualifies for the exemption, it must be imported within 30 months of your promotion certificate being issued. If that’s not feasible, there are two types of extensions available:

-

- General Machinery Import Extension

You may apply for this up to three times, with each extension lasting one year. - Retroactive Machinery Import Extension

This covers machinery imported after the BOI application but before project approval. Only one request is allowed per project.

- General Machinery Import Extension

Shipping with Confidence

While BOI incentives can help reduce setup costs, navigating Thailand’s customs procedures—especially for used machinery imports—can be complex. Engaging an experienced logistics partner is essential to ensure compliance with the Thailand Customs and minimize delays.

Dimerco has supported numerous manufacturers in relocating operations, providing end-to-end services such as HS code classification, BOI documentation, customs coordination, and shipment scheduling.

For instance, an automotive parts supplier for BYD engaged with Dimerco Thailand to relocate its facility from Xiamen to Thailand. The project aimed to enhance supply chain resilience and reduce costs. Dimerco Thailand guided the BOI application process, managed import documentation for used machinery, and coordinated vessel schedules to meet critical timelines.

Shipping to Thailand

Thailand offers real advantages for manufacturers, especially when leveraging BOI incentives. But success depends on careful planning—both in navigating the Thailand Customs process and managing your used machinery import. When it comes to shipping to Thailand, choosing the right partner can make all the difference in ensuring a smooth, compliant, and cost-effective transition. Looking to expand into Thailand and want guidance on how to make your machinery imports smoother and more efficient? Start a discussion with us!