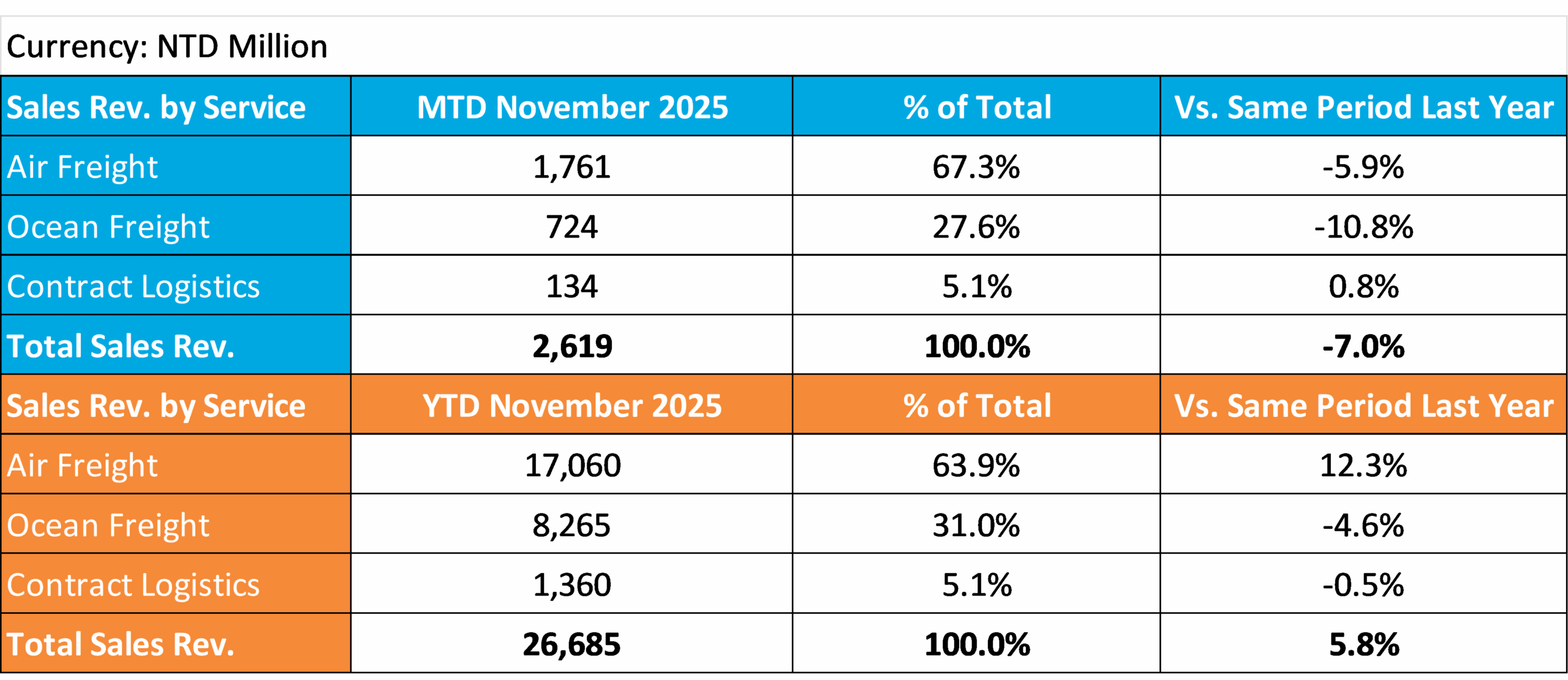

Dimerco Express Group (5609) today announced the consolidated sales revenue for November 2025, reaching NT$2,619 million, a 7% decrease compared to the same period last year, but an 11.9% increase from October, marking the highest monthly revenue this year. Driven by simultaneous growth, air and ocean freight volumes in November grew nearly 20% year-over-year and increased by over 10% compared to the previous month. However, due to lower freight rates compared to the same period last year, the revenue growth was affected. From January to November, total air and ocean freight volumes increased about 20% year-over-year, and the group’s accumulated revenue reached NT$26.685 million, representing a 5.8% year-on-year increase.

In the air freight market, the transpacific routes have shown strong peak-season momentum, driven by Black Friday and Thanksgiving promotions, resulting in a significant surge in e-commerce shipments to the United States. Additionally, robust demand for AI servers and high-tech products has boosted Air freight capacity utilization at key transit hubs including Taipei, Hong Kong, Seoul, Tokyo Narita, and Singapore. Within the Asia-Pacific region, intra-regional routes mainly benefit from raw material transshipment supporting regional production, maintaining active cargo flows between China and Southeast Asia.

Kathy Liu, VP of Global Sales and Marketing at Dimerco Express Group, stated: “Intra-Asia Pacific lanes continue to be active, especially between China and Southeast Asia, where cargo volume stays stable due to the regional movement of raw materials. For 2026 BSA talks, airlines are indicating that 2026 rates will likely stay close to this year, even though many expect a softer market next year.”

Regarding the ocean freight market, two major uncertainties affecting the industry’s outlook remain under observation: the pace of inventory replenishment and the recovery status of Red Sea/Suez Canal shipping routes. The market has now entered the traditional lull ahead of the Chinese New Year. Although shipping companies are adjusting supply by cutting sailings and scheduling blank sailings, the reduction in available space offers limited support to freight rates, with the overall market remaining soft.

Ted Chen, Director of Ocean Freight, Global Sales and Marketing at Dimerco Express Group, noted: “If carriers can safely resume routes passing through the Suez Canal, freight rates might decline as capacity flows back into the market. However, based on current assessments, a large-scale return to the Suez route in the short term is unlikely, and no significant recovery is expected at least through the first half of next year. If carriers continue rerouting via the Cape of Good Hope, the longer voyage will slow equipment turnaround and increase the risk of equipment shortages on the land side. Whether supply becomes excessive or tight, the ocean freight market will face a certain degree of volatility and instability in the foreseeable future.”

Looking ahead, leveraging its existing resources and capabilities, Dimerco will continue to deepen its presence in niche markets across the Asia-Pacific region and globally. With over fifty years of service experience in Taiwan’s semiconductor industry, Dimerco aims to create more resilient supply chain networks for global semiconductor and high-tech clients. By capitalizing on logistics opportunities arising from AI development and shifts in regional manufacturing landscapes, Dimerco will continue to optimize its operations and achieve steady growth.

Spokesperson: Jack Ruan +886 921-062500 / +8862 2796-3660#222

Find out more on Financial Overview