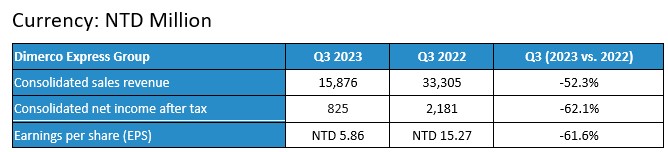

Dimerco Express Corporation (5609) today announced the consolidated financial report of the third quarter of 2023. Consolidated sales revenue of Q3 2023 is NTD 15,876 million, a decrease of 52.3% compared to the same period last year. Consolidated net income after tax is NTD 825 million, a decrease of 62.1% compared to the same period last year. Earnings per share is NTD 5.86, a decrease of 61.6% compared to the same period last year.

Due to the continuous slow of global economy and international trade in Q3 2023, Dimerco dedicates to its global network of forwarding and logistics locations and cloud-based SCM international logistics service platform with clear market positioning and effective digital marketing to attract customers while Dimerco has been able to deliver solid results. Plus, especially in response to the US-China tensions and considering geopolitical risks, many European and American customers have been requesting manufacturers to adopt a “China plus one” policy. This involves relocating some production lines to Southeast Asia and India. As a result, regional freight volumes have increased with the increasing demand of eCommerce growth in China and AI Supply Chain product from Asia to USA. Companies like Dimerco have benefited from having established long-term marketing and service points in Southeast Asia and India, which has led to significant business growth. Besides, compared with the same period last year, although there’s a 10%-20% decrease in Q3 2023 on tonnage/volume, which is much lower than the 50% decrease on revenue, it shows the stable profit with gross profit margin at 17.4%, an increase of 3.6% compared to the same period last year at 13.8%.

On the other hand, Dimerco cares about worldwide customers with sound financial capability and account receivable management. As of September, 2023, the current ratio is 2.81, which is above average in our industry, with NTD 4.77 billion of cash while NTD 5.53 billion of shareholder’s equity, excluding difference of currency exchange with overseas operating units, which shows outstanding solvency, along with Fixed Assets to Equity Ratio: only 9.2% and Debt to Equity Ratio: only 31.9%.

After the ISO 14064-1:2018 verification at the end of 2022 and declaration of commitment to green supply chain and carbon reduction goals to reduce the carbon footprint, Dimerco has taken further steps in 2023. Implemented the EcoTransIT World system certified by the international organization Smart Freight Centre (SFC), Dimerco utilizes this system to calculate carbon emissions for air, sea, and land transportation, aligning with the Global Logistics Emissions Council (GLEC) framework and meeting the requirements of the GHG Protocol (corporate standards).

With the development on Digital Platform and Cloud Networking SCM Platform of Dimerco Value Plus System®, flatter organization and ISO 27001 Cyber Security Certification by BSI, Dimerco internally upgrades digital capability to strengthen operation & management efficiency and cost-effective solutions for our customers with mobility via application of Robotic Process Automation (RPA) while externally upgrades online services and integrates off-line & online services via its upgraded MyDimerco platform and POMS (Purchase Order Management System) to further enhance customer services. The services include not only the coordination of purchase orders between customers and their suppliers, supplier performance management, product management, and logistics cost analysis but also online booking of cargo space and online customer support, through various channels, regardless of when or where they need assistance.

Looking to the future, through promotion with digital marketing and clear market positioning from brick-and-mortar to online platform, Dimerco enhances not only on supply chain value to customers and business development but also on additional benefits and productivity to worldwide network via application of Semi-Automation during its Digital Transformation. Dimerco provides a faster response to market changes with diversified solutions and mutual growth with our customers.

Spokesperson: Jack Ruan +886 921-062500 / +8862 2796-3660#222

Find out more on Financial Overview.