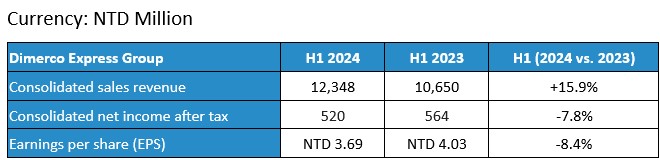

Dimerco Express Corporation (5609) today announced the consolidated financial report of the first half of 2024. Consolidated sales revenue of H1 2024 is NTD 12,348 million, an increase of 15.9% compared to the same period last year. Consolidated net income after tax is NTD 520 million, a decrease of 7.8% compared to the same period last year. Earnings per share is NTD 3.69, a decrease of 8.4% compared to the same period last year.

For the first half of 2024, the international transportation and logistics market remains challenging, with the ongoing Russia-Ukraine conflict, the persistent Red Sea crisis, and the ongoing tensions between Iran and Israel. These issues not only affect regional stability but also cause fluctuations in freight rates and create significant difficulties for airlines and shipping companies in planning routes and carrying cargo. Additionally, the U.S. Federal Reserve’s decision not to lower interest rates has kept business operating costs high, increasing the risk of bankruptcies and further challenging international logistics providers. Faced with these global uncertainties and a volatile market, the challenges and operational risks have multiplied.

Despite these challenges, Dimerco’s well-established physical network and virtual digital platform have provided seamless, comprehensive services. With clear market positioning and a strategic focus on differentiation and regional deployment in key niche markets, the company has successfully leveraged the competitive advantages of its over 150 operating units. Simultaneously, Dimerco’s commitment to technology and digital transformation, including its cloud-based, cybersecurity-certified supply chain management platform—Dimerco Value Plus System®—has enhanced its ability to provide value-added services across the international logistics value chain. The company’s efforts in semi-automation have increased efficiency, productivity, and service quality. Through digital marketing, Dimerco has strengthened its ability to expand its business and has successfully increased its roster of high-quality multinational customers, achieving significant profits in the challenging international logistics market during the first half of 2024.

In addition to enhancing profitability, Dimerco has long prioritized customer quality, carefully selecting premium customers and effectively managing accounts receivable. The company’s strong financial management has maintained an excellent financial structure. As of the end of June 2024, Dimerco’s current ratio stood at 2.82, significantly outperforming industry averages, reflecting exceptional liquidity and debt repayment capabilities. The company’s fixed assets account for only 9.3% of shareholders’ equity, demonstrating the flexibility and agility of its asset-light logistics model. Additionally, total liabilities represent only 31.3% of total assets, indicating a highly healthy and stable financial structure.

Looking ahead, Dimerco’s competitive edge, derived from its physical network and virtual digital platform, will continue to drive success. With a clear market positioning, the company will use digital marketing to promote value-added services in supply chain management, strengthening its ability to expand its business. Through ongoing digital transformation, semi-automation, and efforts to increase productivity and enhance service quality, Dimerco is poised to continue generating profits.

Spokesperson: Jack Ruan +886 921-062500 / +8862 2796-3660#222

Find out more on Financial Overview.