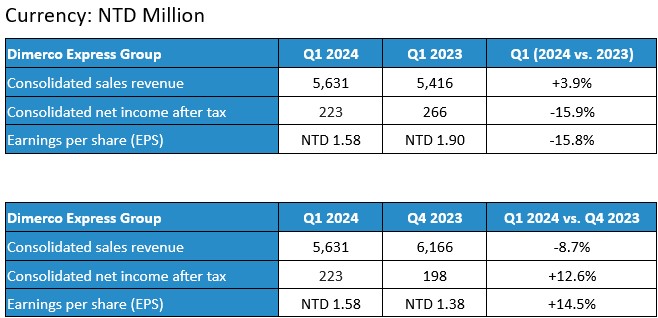

Dimerco Express Corporation (5609) today announced the consolidated financial report of the first quarter of 2024. Consolidated sales revenue of Q1 2024 is NTD 5,631 million, an increase of 3.9% compared to the same period last year. Consolidated net income after tax is NTD 223 million, a decrease of 15.9% compared to the same period last year. Despite a decrease in revenue by 8.7% compared to the fourth quarter of last year, due to the reduced number of working days during the first quarter of the lunar new year, the after-tax net profit still increased by 12.6%. Earnings per share stood at NTD 1.58, reflecting a decrease of 16.8% compared to the same period last year but an increase of 14.5% compared to the previous quarter.

In the international transportation and logistics market of 2024, challenges abound. The ongoing conflict between Russia and Ukraine, the persistent Red Sea crisis, along with tensions between Iran and Israel, not only disrupt regional stability but also cause fluctuations in freight rates. These geopolitical issues greatly impact the routing and cargo carriage arrangements of airlines and shipping companies, posing significant challenges. Moreover, the decision of the United States not to lower interest rates increases operating costs for businesses, elevating the risk of closures and further adding to the challenges faced by international transportation and logistics providers.

In the face of these geopolitical uncertainties and volatile market conditions, challenges multiply, and business risks escalate. However, Dimerco, with its established physical channels and virtual digital platforms, offers comprehensive professional services. By clearly positioning itself in key niche markets and adopting strategies based on differentiation and regionalization, Dimerco leverages the competitiveness of its strong global network. Additionally, Dimerco is committed to digital transformation, offering cloud-based digital supply chain management platforms like the Dimerco Value Plus System®, which is certified for information security. This system enhances the value chain of international logistics services, streamlines processes through semi-automation, boosts productivity, and improves service quality. Through digital marketing, Dimerco promotes the value-added services it provides in customer supply chain management, thereby strengthening its ability to expand business and continuously increase revenue from numerous high-quality multinational clients. Despite the challenges in the international transportation and logistics market in the first quarter of 2024, Dimerco has managed to achieve considerable profitability.

On the other hand, Dimerco cares about worldwide customers with sound financial capability and account receivable management. As of March, 2024, the current ratio is 2.3, which is above average in our industry, with NTD 4.78 billion of cash while NTD 5.55 billion of shareholder’s equity, which shows outstanding solvency, along with Fixed Assets to Equity Ratio: only 9.9% and Debt to Equity Ratio: only 38.4%.

Looking to the future, through promotion with digital marketing and clear market positioning from brick-and-mortar to online platform, Dimerco enhances not only on supply chain value to customers and business development but also on additional benefits and productivity to worldwide network via application of Semi-Automation during its Digital Transformation. Dimerco will undoubtedly continue to generate profits.

Spokesperson: Jack Ruan +886 921-062500 / +8862 2796-3660#222

Find out more on Financial Overview.