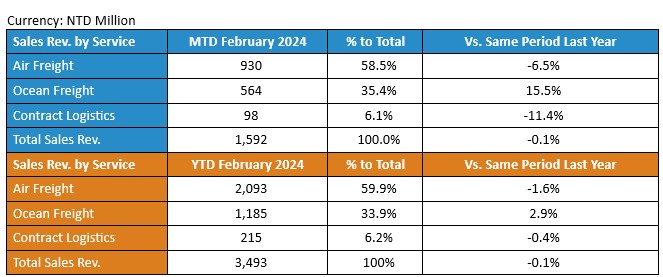

Dimerco Express Corporation (5609) today announced the consolidated sales revenue for the month of February 2024. The consolidated sales revenue of February 2024 is NTD 1,592 million while the consolidated sales revenue of February 2024 YTD is NTD 3,493 million. Although the number of working days decreased in February due to the Lunar New Year, Dimerco’s ocean and airfreight volume still grew by nearly ten percent in February while the revenue for February this year remains the same as the same period last year due to the decrease in freight rates compared to the same period last year.

In February, the airfreight market overall performance was affected by the reduced number of working days in Taiwan, Hong Kong, and mainland China, which were only 16, 19, and 18 days respectively. Under the influence of the main hub ports, Taiwan’s import, export, and airfreight volumes each decreased by 22%, 14%, and 19% compared to January. During the Chinese New Year period, overall airfreight demand slowed down. Although e-commerce businesses claimed to operate normally during the New Year, export volumes were far below normal working periods, leading to a soft market for both long and short haul prices during the first 10 days after the holiday. However, most factories resumed operations on February 26th or March 1st. The market inquiry atmosphere became active in the last week of February, and based on past trends, market demand in March will activate the overall airfreight market transactions, especially with increasing export demand from Asia to India and the United States. Airlines stated that space bookings from South China, East China, Taiwan, Hong Kong, Southeast Asia to North America were over 90% full from last weekend to March 9th and 10th weekend. Therefore, it is estimated that prices for shipments from Taiwan to the United States/Canada/Mexico will gradually increase from March onwards. As for the markets in Asia and Europe, the situation remains stable.

On March 26th, the U.S. Department of Transportation (USDOT) announced that starting from March 31st, the number of round-trip direct flights operated by Chinese airlines between China and the United States would increase from 35 to 50 per week. USDOT stated that this is an important step towards further normalization of the China-U.S. market as the summer transportation peak season approaches. However, the impact on the overall airfreight supply and demand situation in China is minimal because even though the number of round-trip flights between China and the United States is expected to increase to 100 per week (50 each for China and the United States) starting from March 31st, it is still far below the pre-pandemic levels. According to a previous report by Global Times, during 2019, the number of round-trip flights between China and the United States exceeded 300 per week.

As for the ocean freight market in February, in response to the poor freight situation after the Lunar New Year holiday, capacities for westbound Europe/Mediterranean and eastbound trans-Pacific were reduced by approximately 35% and 25% respectively in weeks 8, 9, and 10. However, prior to the Lunar New Year, in order to effectively cope with the crisis in the Red Sea and the trend of ships rerouting from the Suez Canal via the Cape of Good Hope to transport goods, container shipping carriers swiftly deployed 17 new Panamax and ultra-large container vessels in the first seven weeks of this year to maintain weekly operations. Looking at the entire shipping alliance, the 2M alliance stood out in terms of average number of voyages among many alliances, with an average of 7.4 voyages to the Northern Europe region and 7.3 voyages to the Mediterranean region, surpassing the performance of THE alliance and Ocean alliance. Due to this additional capacity, the advance arrangements made before the Lunar New Year significantly reduced the container dumping rate in Asian ports to below 20%. Although freight rates dropped slightly after the Lunar New Year in February, the magnitude was not significant: $4000/FEU for westbound Europe, $4400/FEU for the US West Coast, and $6200/FEU for the US East Coast. These figures demonstrate that carriers can adjust capacity in a timely manner according to market conditions while coping with the challenges of the crisis in the Red Sea, avoiding significant impacts on market freight rates.

Due to Dimerco’s global network of forwarding and logistics locations and our cloud-based SCM international logistics service platform with clear market positioning and effective digital marketing to attract customers, Dimerco has been able to deliver solid results. Furthermore, with strong relationships with high-quality multinational corporate clients, although the number of working days decreased in February due to the Lunar New Year, Dimerco’s ocean and airfreight volume still grew by nearly ten percent in February while the revenue for February this year remains the same as the same period last year due to the decrease in freight rates compared to the same period last year.

After the ISO 14064-1:2018 verification at the end of 2022 and declaration of commitment to green supply chain and carbon reduction goals to reduce the carbon footprint, Dimerco has taken further steps in 2023. Implemented the EcoTransIT World system certified by the international organization Smart Freight Centre (SFC), Dimerco utilizes this system to calculate carbon emissions for air, sea, and land transportation, aligning with the Global Logistics Emissions Council (GLEC) framework and meeting the requirements of the GHG Protocol (corporate standards). Besides, in this January, Dimerco has aligned ESG goals with Cathay’s vision on its Corporate Sustainable Aviation Fuel (SAF) Programme, to support the earth with practical action on reduction of greenhouse gas emissions associated with aviation.

Dimerco is dedicated to technological and digital transformation, elevating the level of Information Security Management (ISM). The implementation of the latest ISM and protection framework ensures that information security measures align with the development of digital transformation. Continuous improvement of management and operational processes is undertaken to address the ever-changing external environmental threats. With the development on Digital Platform and Cloud Networking SCM Platform of Dimerco Value Plus System®, flatter organization and ISO 27001:2022 Cyber Security Certification (BSI Certification N0. IS 743553) by BSI, Dimerco internally upgrades digital capability to strengthen operation & management efficiency and cost-effective solutions for our customers with mobility via application of Robotic Process Automation (RPA).

Externally, Dimerco upgrades online services and integrates off-line & online services via its upgraded MyDimerco platform and POMS (Purchase Order Management System) to further enhance customer services. The services include not only the coordination of purchase orders between customers and their suppliers, supplier performance management, product management, and logistics cost analysis but also online booking of cargo space and online customer support, through various channels, regardless of when or where they need assistance.

Looking to the future, through promotion with digital marketing and clear market positioning from brick-and-mortar to online platform, Dimerco enhances not only on supply chain value to customers and business development but also on additional benefits and productivity to worldwide network via application of Semi-Automation during its Digital Transformation to meet our customers’ needs and achieve our business goals.

Spokesperson: Jack Ruan +886 921-062500 / +8862 2796-3660#222

Find out more on Financial Overview.