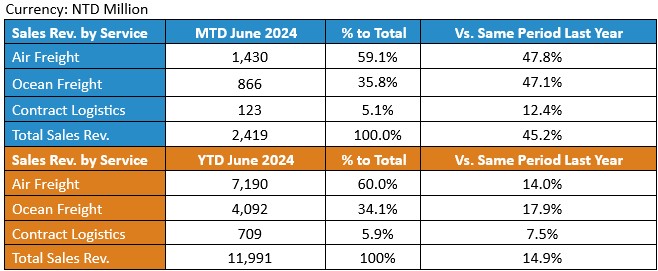

Dimerco Express Corporation (5609) today announced the remarkable consolidated sales revenue for the month of June 2024, contributed by the competitive advantages and operational strengths of our outstanding physical network and virtual digital platform. The consolidated sales revenue of June 2024 is NTD 2,419 million, an increase of 45.2% compared to June 2023. The consolidated sales revenue of June 2024 YTD is NTD 11,991 million, an increase of 14.9% compared to the same period last year.

In June, the airfreight market, the demand for eCommerce goods, AI chips, and servers continues to drive a significant increase in airfreight demand. Despite recent months seeing increased enforcement measures by U.S. Customs and Border Protection on eCommerce goods entering the United States, the number of freighters from Northeast Asia to North America has not been significantly affected. With global consumer demand steadily increasing, a more pronounced growth is expected in the third quarter of this year. As the peak airfreight season approaches in September, the airfreight market is also anticipated to experience more significant growth.

As for the ocean freight market in June, amid the disruptions caused by the Red Sea crisis and the subsequent ripple effects on the global supply chain, the demand for ocean freight remains strong due to replenishment surges and cargo backlogs. Adding to this, the extension of Section 301 tariffs by the U.S. and increased tariffs on certain Chinese imports (notably solar panels and electric vehicles, EV), along with the EU’s imposition of a 38.1% tariff on Chinese EV starting in July, has led to early container shipments of Chinese EV. As a result of these factors, ocean freight rates have continued to soar. Ocean carriers have been raising rates biweekly and imposing peak season surcharges three times higher than usual. Long-haul floating rates for Europe Westbound (EUWB) and Trans-Pacific Eastbound (TPEB) cargo have increased by 130% and 100%, respectively, compared to the lowest rates in March.

With ongoing supply chain challenges, the gap between ocean and airfreight rates has significantly narrowed, reaching the smallest margin since Q3, 2022. Currently, global ocean freight rates are only six times lower than airfreight rates, whereas historically, airfreight rates have been 12 to 15 times higher than ocean freight rates. As the gap continues to close, nearing 2021 levels, this trend is expected to keep driving up both ocean and airfreight rates in the coming months. More ocean freight shipments, especially on the TPEB routes, will likely shift to airfreight. Dimerco, with its competitive strengths in both air and ocean freight, is well-positioned to benefit from this trend.

Due to Dimerco’s global network of forwarding and logistics locations and our cloud-based SCM international logistics service platform with clear market positioning by focusing on niche market & differentiation, strategical localization and effective digital marketing to attract customers, Dimerco has been able to deliver solid results. The implementation of the latest Information Security Management (ISM) and protection framework ensures that information security measures align with the development of digital transformation. With the development on Digital Transformation, Cloud Networking SCM Platform of Dimerco Value Plus System® and Cyber Security Certification, Dimerco enhances not only on supply chain value to customers and continuous business development with multiple high-quality multinational clients but also on additional benefits and productivity to worldwide network via application of Semi-Automation.

In June, cargo volume grew by 30% and revenue increased by 45.2%, marking the highest monthly revenue for the year. This also set a new revenue record for the 19-month period since the end of the pandemic in December, 2022. Looking ahead, both the air and ocean freight markets remain promising. Leveraging its strong physical network and competitive virtual digital platform, Dimerco is poised to continue growing its revenue, constantly reaching new heights in both revenue and profitability.

Spokesperson: Jack Ruan +886 921-062500 / +8862 2796-3660#222

Find out more on Financial Overview.