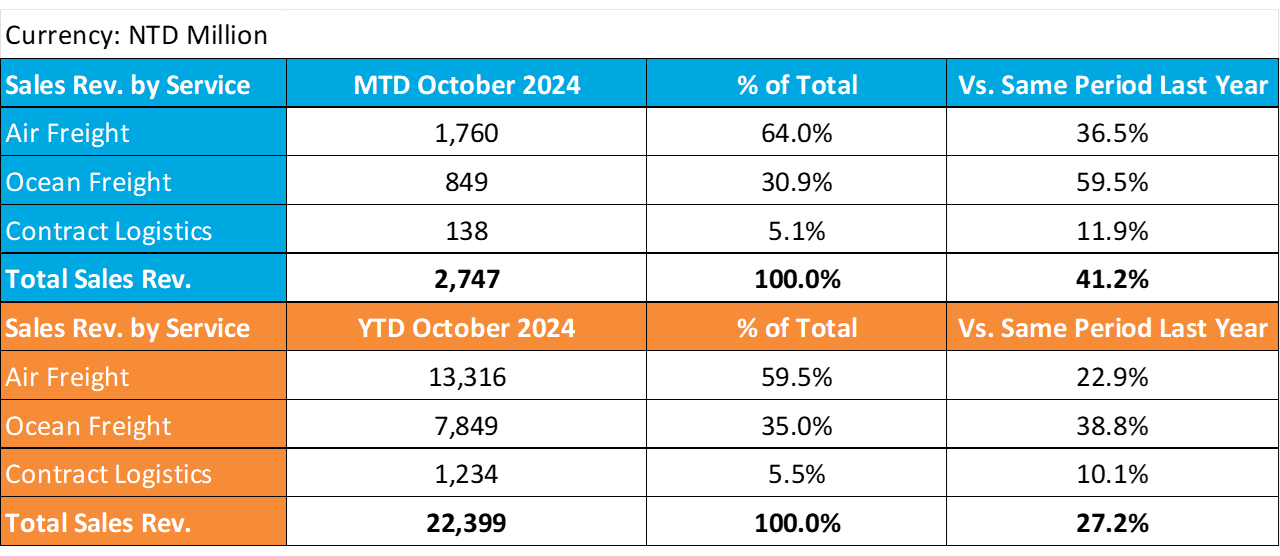

Dimerco Express Corporation (5609) today announced the excellent business performance and continuous growth in revenue during the period, can be attributed to the competitive advantage and operational strengths of Dimerco’s extensive physical network in over 150 key niche markets and its powerful digital platform. This combination enables the company to provide customers with seamless, integrated international logistics value chain services that are accessible and efficient. The consolidated sales revenue of October 2024 is NTD 2,747 million, an increase of 41.2% compared to October 2023, and a growth of 4.5% compared to the previous month while cargo volume grew by 30% year-over-year, marking the highest monthly revenue for the year. This also set a new revenue record for the 24-month period since the end of the pandemic in November, 2022. The consolidated sales revenue of October 2024 YTD is NTD 22,399 million, an increase of 27.2% compared to the same period last year.

In October, the airfreight market remains strong, driven by demand for AI and intelligent computing-related products and a shift from ocean to airfreight. Meanwhile, the ocean freight market has seen an increase in rates due to the significant reduction of blank sailing deployments. The US East Coast and Gulf Port strike ended sooner than expected, so the ports could quickly clear the backlog from the strike. According to Drewry’s weekly analysis on October 18th, 70 sailings will be canceled out of the originally scheduled 692 voyages, resulting in a cancellation rate of 10%. Cancellation rates by lane are significant, with 61% on the Transpacific Eastbound (TPEB), 24% on Europe Westbound, and 14% on Transatlantic Westbound. In addition to these sailing reductions, carriers are also implementing General Rate Increases (GRI) effective November 1st, leading to rate hikes of more than 18% for TPEB and 40% for Europe/Med Westbound.

Dimerco offers diverse services such as China-Europe rail, sea-air and charter flights to meet customer needs. The company also leverages AI and process automation to enhance productivity, improve service efficiency, and generate benefits. Through digital marketing, Dimerco continues to strengthen its value-added supply chain management services, successfully attracting high-quality customers and maintaining steady revenue growth. As a result, Dimerco achieved a record-high sales revenue during the past 24-month period.

For the Earth Sustainability, Dimerco has aligned ESG goals with Cathay’s vision on its Corporate Sustainable Aviation Fuel (SAF) Programme, to support the earth with practical action with our worldwide customers and stakeholders on reduction of greenhouse gas emissions associated with aviation.

Due to Dimerco’s global network of forwarding and logistics locations and our cloud-based SCM international logistics service platform with clear market positioning by focusing on niche market & differentiation, strategical localization and effective digital marketing to attract customers, Dimerco has been able to deliver solid results. The implementation of the latest Information Security Management (ISM) and protection framework ensures that information security measures align with the development of digital transformation. With the development on Digital Transformation, Cloud Networking SCM Platform of Dimerco Value Plus System® and Cyber Security Certification, Dimerco enhances not only on supply chain value to customers and continuous business development with multiple high-quality multinational clients but also on additional benefits and productivity to worldwide network through optimizing the service efficiency via artificial intelligence and process automation. Looking ahead, attributed to the competitive advantage and operational strengths of Dimerco’s extensive physical network in over 150 key niche markets and its powerful digital platform, Dimerco is poised to continue growing its revenue, constantly reaching new heights in both revenue and profitability.

Spokesperson: Jack Ruan +886 921-062500 / +8862 2796-3660#222

Find out more on Financial Overview.