Philippines Market Focus

Questions?

Accredited Philippines Freight Forwarding and 3PL Services

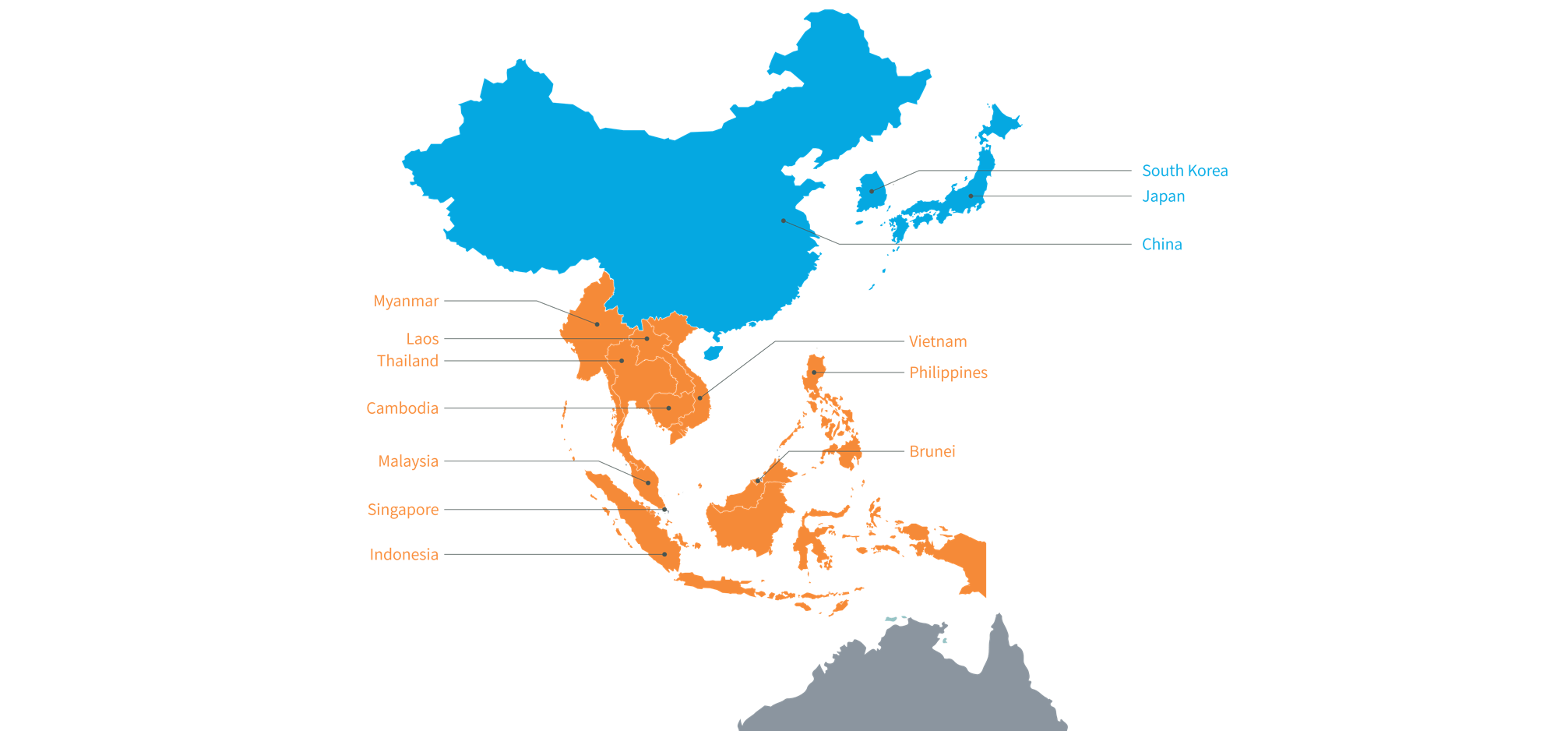

Dimerco offers integrated shipping and contract logistics solutions to support trade with your customers and suppliers in the Philippines. Our offices are strategically located in Metro Manila, Cebu and Subic. We established operations in the Philippines in 1978 and, since that time, have established strong relationship with carriers, local vendors and Philippines Customs. We leverage that experience to commit the freight capacity you need and to keep your supply lines flowing.

Do you need an accredited freight forwarder in the Philippines?

Let us put our 40+ years of experience in this market to work for you.

| Market Entry | 1978 |

| Offices | 3 |

| Services |

3PL and freight forwarding services in the Philippines include:

|

| Special Accreditations |

|

| Specialized Solutions |

Specialized Philippines freight forwarding and 3PL solutions include: Project Logistics After-Hours Arrangements |

Frequently Asked Questions

Do I need accreditation to export and import in the Philippines?

Yes. Companies must obtain a Certificate of Registration from the Bureau of Customs in addition to registering with the Philippine Government.

What are the accreditation requirements for new exporters?

Requirements are set by the accrediting agency and detailed in Customs Memorandum Orders (CMO) No. 19-2019 and CMO 26-2019.

Do I need permits to export?

Yes. Required permits and regulating agencies are listed in the Philippine National Trade Repository

What are the accreditation requirements for new importers?

The requirements can be found at the Philippines Customs Website

What are the requirements for importing commodities?

The requirements needed for different commodities may vary. General commodities have less requirements compared to fresh products and oil and gas. For the complete information, you may check on the Philippines Customs Website.

Is there free storage at the Manila terminal?

No. Storage charges apply from the day the shipment arrives and continue until the cargo is released. Charges are billed per receipt.

Do you process Certificates of Origin?

Yes, but complete documents must be provided for customs approval. Check with Dimerco Philippines for your complete 3PL services.

How long does the clearance process take in Manila?

For bonded consignees: 1-2 days (excluding Sundays). For non-bonded consignees: 3-5 working days, provided all documents are complete and there are no follow-up questions from the Bureau of Customs (BOC).

What is the VAT rate in the Philippines?

The VAT rate is 12%.

Can we use a Certificate of Origin (FORM E) to waive the duty rate?

Yes, preferential tariff treatments under the GSP, ASEAN CEPT, and ACFTA Schemes allow for reduced or eliminated tariffs. For more information, check with your accredited Philippines Freight Forwarder.

What articles are subject to duty?

All imported articles are subject to duty unless exempted by the Tariff and Customs Code or other laws.

When does importation begin and end?

Importation begins when the vessel or aircraft enters the Philippines to unload goods. It ends when duties, taxes, and charges are paid or secured, and the legal permit for withdrawal is granted, or when duty-free articles leave Customs jurisdiction.

What are special economic zones?

Special Economic Zones are areas with developed infrastructure for agri-industrial, tourist/recreational, commercial, banking, investment, and financial activities. Goods can flow duty- and tax-free within these zones but are subject to duties and taxes when brought out.

What are prohibited/regulated importations?

Prohibited importations are items not allowed into the country except under highly controlled conditions. Examples include:

• Explosives, firearms, and weapons of war

• Materials inciting treason, rebellion, or sedition

• Obscene or immoral materials

• Articles for unlawful abortion

Check with your Philippines freight forwarder for more informtaion.

Asia Pacific Articles

Start a Discussion

Tell us your global logistics challenge and we can recommend a solution that meets your objectives – at the right price.

For immediate attention contact a local office.