Vietnam Market Focus

Questions?

Vietnam Freight Forwarding and Logistics Services

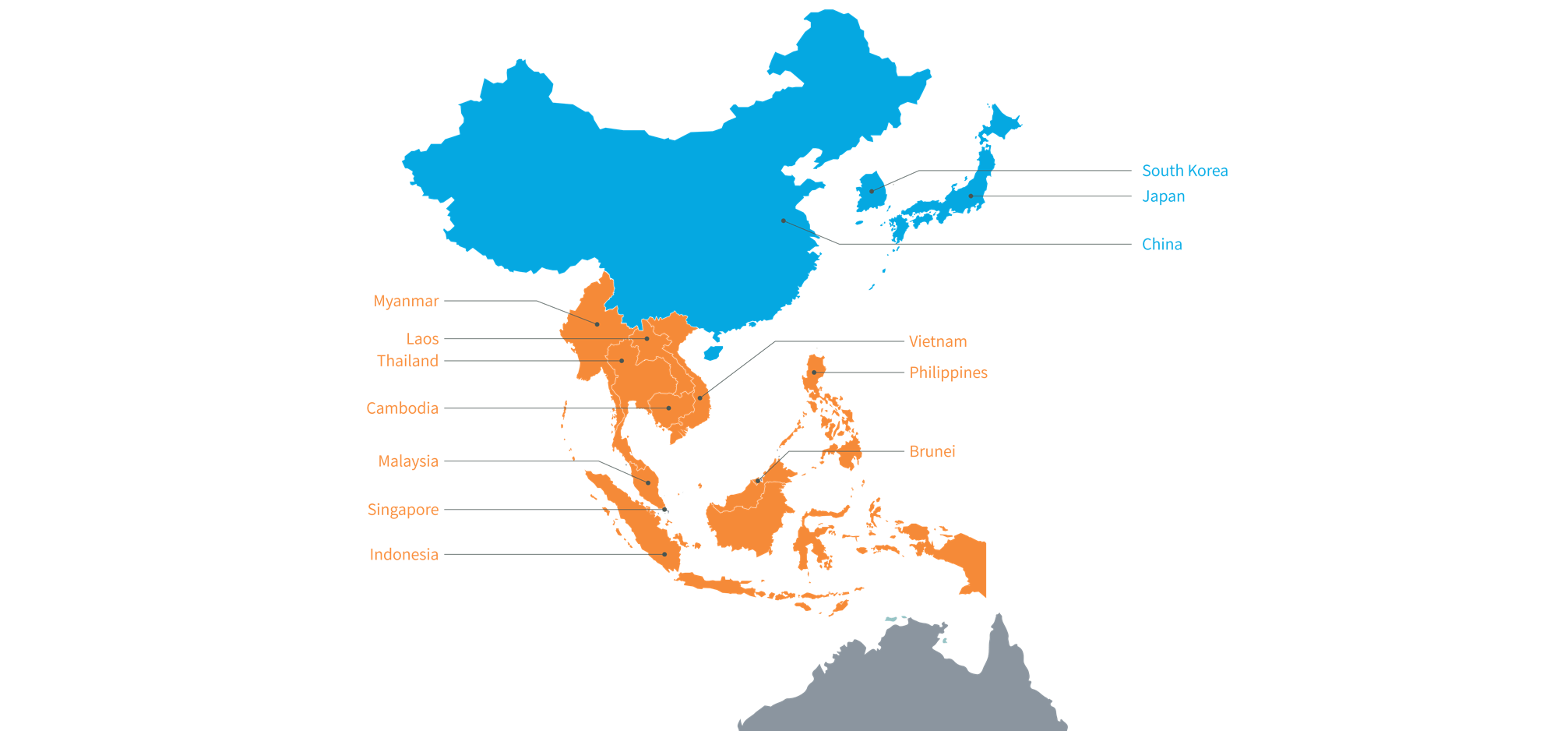

Dimerco is a Vietnam freight forwarder that can provide the logistics support you need to trade efficiently with Vietnam-based customers and suppliers. With offices in Hanoi, Haiphong, Da Nang & Ho Chi Minh City, we provide cost-effective, multimodal shipping to and from Vietnam.

Dimerco established offices in Vietnam in 1995 and, since then, has built strong relationships with carriers, vendors and local authorities here to give you the freight capacity and logistics know-how you need to succeed. Freight capacity can be tight out of Vietnam, so we offer multimodal freight solutions, including Sea/Air and Air/Sea services, to overcome space shortages. We also offer consulting services on the Foreign Contractor Tax (FCT) to help you understand and take advantage of all potential duty/tax benefits.

Are you looking for a Vietnam freight forwarder and logistics partner?

Dimerco’s knowledge of the local market, plus our strong relationships with Asia-based carriers, allow us to commit to the freight capacity you need into and out of Vietnam and keep your supply lines flowing. Explore our specialized bonded warehouse facilities for added support. Read more

| Market Entry | 1995 |

| Offices | 4 |

| Services |

As a Vietnam freight forwarder, Dimerco offers the following transportation and logistics services:

|

| Special Accreditations |

|

| Specialized Solutions |

To support freight shipping to and from Vietnam, our solutions include: Customs Brokerage Cross-Border Road Freight (FTL/LTL) |

Frequently Asked Questions

Where can I get more information on Vietnam import?

You can connect to our Dimerco Vietnam import team via email: [email protected]

Why is my shipment not telex released yet?

This could be due to either the original bill not being available or the shipper not having paid the fees at the Port of Loading, preventing the telex release.

Can I apply for a certificate of origin to reduce import tax to the US?

In Vietnam, only a Vietnamese shipper or their authorized customs broker can apply for a Certificate of Origin. When ordering from a Vietnamese factory, make sure the product qualifies for Form B. While Vietnam doesn’t have a formal agreement with the US for preferential import tax, products with a Vietnamese Certificate of Origin might still enjoy lower import taxes in the US than those from countries like China. You may check with your Vietnam Logistics Partner or Dimerco to learn more about this process. Learn more about Shipping from Vietnam to the US here: Shipping from Vietnam to the US

What are the Duties and Tax Policy for Free Trade Agreements (FTA) in Vietnam?

If the certificate of origin aligns with Vietnam’s Free Trade Agreement (FTA), preferential tax rates may apply or be waived entirely. Regarding Value Added Tax (VAT), if the cargo is imported for trading purposes, VAT is typically required to be paid. Check with your Vietnam Logistics Partner for more details.

What documents are required for customs declaration in Vietnam?

The documents needed and prices vary depending on your product and where your company is located. To assist you further, simply share the English product name and your company address with us.

Does Dimerco Vietnam offer warehousing service?

Dimerco Vietnam offers a variety of warehousing services, including CFS Warehouse and Bonded Warehouse options, tailored to your needs. Our warehouses are strategically located near major airports, seaports, and Industrial Zones in Ho Chi Minh, Dong Nai, Hai Phong, and Da Nang for quick order processing and deliveries. In addition to core services like Stuffing/Un-stuffing and Inventory Management, we also provide Value Added Services such as Multi-Modal Transportation, Customs Agency support, Sorting, Pick and Pack, Packaging, and Labelling, a one stop shop for Vietnam Freight Fowarding and Logistics Services.

What services does Dimerco Vietnam offer?

Dimerco ensures smooth trade with customers and suppliers in Vietnam. With offices in key cities like Hanoi, Haiphong, Da Nang, and Ho Chi Minh City, we offer various shipping options, including air, ocean, and cross-border road freight. Additionally, we provide warehouse services, cargo insurance, and ocean consolidation & deconsolidation, a one stop-shop for Vietnam Freight Forwarding and Logistics Services. Learn more about Shipping from Vietnam here: Shipping from Vietnam

What is the Foreign Contractor Tax (FCT)?

The Foreign Contractor Tax (FCT) is levied on overseas companies or individuals providing services to Vietnamese companies and paid from Vietnam. The FCT is collected from the Vietnamese recipient company on behalf of the overseas entity. The tax rate ranges from 1% to 10% depending on the type of service provided. (Please refer to Circular No. 103/2014/TT-BTC). Check with your Vietnam Logistics Partner for more details.

How many days is the free storage charge in Noi Bai Airport?

Free storage is 2 days at Noi Bai Airport

What are the main airport and seaports in Vietnam?

• North: Noi Bai airport (HAN) | Haiphong seaport | Cai Lan Seaport

• Central: Da Nang airport (DAD) | Danang seaport

• South: Tan Son Nhat airport (SGN) | Ho Chi Minh seaport | Cat Lai Seaport | Cai Mep Seaport”

Asia Pacific Articles

Start a Discussion

Tell us your global logistics challenge and we can recommend a solution that meets your objectives – at the right price.

For immediate attention contact a local office.