Home »

How to Reduce International Air Freight Costs

Contents

Introduction

9 Practical Tips

- More Flexible Transit Times

- Redesign Upstream Processes

- Curb Expedited Shipping

- Monitor Use of Special Shipping Services

- Segregate Dangerous Goods

- Use Indirect Routing

- Build Pallets to Utilize Capacity

- Build Pallets to Minimize Chargeable Weight

- Issue an RFP

Is it Time for an Air Freight Expense Audit?

9 practical tips to move high-value freight fast, without overspending

Introduction

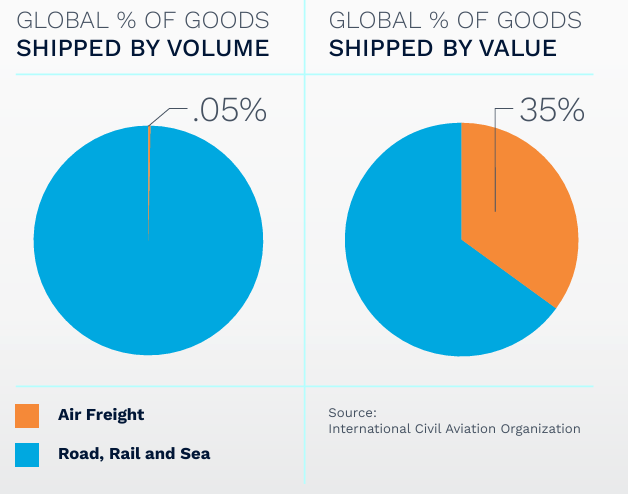

Air freight is the fastest, most predictable mode of transport. That’s why it’s a mode of choice for companies with high-value, high-demand products such as semiconductor equipment and pharmaceutical products.

But it’s also the most expensive way to move goods – according to a recent World Bank Study, as much as 12–16 times the cost of sea freight. While freight expenses may represent a smaller percentage of overall revenue for companies with high-value freight, these companies still can’t afford to overspend. This eBook provides 9 practical tips to easily find six- or seven-figure savings opportunities in your air freight shipping program.

Download Guide

If you prefer to download this article as a PDF, just complete the form. Otherwise, keep reading.

9 Practical Tips

1. Consider More Flexible Transit Times

In international transportation, you pay for speed. Air freight is the most expensive shipping method by far. But there are different tiers of service within air freight, each with a different price point:

The more flexible you can be with transit time requirements, the more you’ll save.

It’s no different in our personal lives. Let’s say you need a car service for a one-hour trip to the airport for an important 2:00 PM flight, but you can’t leave until noon. You may need to book a limo with a precise pick-up and drop-off time. But if you have freed up your morning for the trip to the airport, other options become available – like a multi-passenger airport shuttle bus. The trip will be slower as you pick up eight other passengers in route. But you’ll make your flight – and you’ll save a bunch of money in the process.

Similarly, shifting from standard air to deferred air opens up huge cost-saving possibilities. If a freight forwarder like Dimerco Express Group has five extra days to move air freight, they can combine your load with other air freight to build more economical, consolidated loads. These loads can be built with the ideal size and weight combination to minimize the carriers’ chargeable weight.

Longer transit times also broaden the number of carriers and routing possibilities that can be considered. More competitors and more routing options typically yield a much better rate.

How much can you save? In our experience, 10–30% savings is possible with a little added flexibility. If you are a large semiconductor company with an annual air freight budget of $30 million, the math gets pretty compelling.

Check out the following case study on a technology company that shifted a greater portion of its freight from standard to deferred air.

Case Study: Shift to deferred air service yields more than $1.5 million in savings for leading global semiconductor company

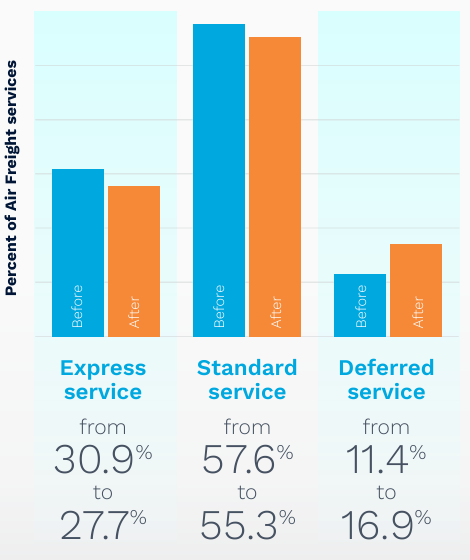

A leading global semiconductor company sends close to 25,000 critical equipment shipments a year from the U.S. to its semiconductor manufacturing customers in China, Japan, and Southeast Asia. Express and standard air service accounted for close to 90% of the shipments, with the balance being deferred.

As part of a cost cutting effort, the company identified certain products that were less urgent and shifted these shipments to deferred air, bumping the percentage of deferred from 10% to 15%. The average cost differential between the two service levels: $0.60/kg.

This small shift generated annualized savings of more than $1.5 million – with no impact on customer production schedules in Asia.

The shift to more deferred air effectively gave the company’s freight forwarder more time – several weeks, if needed – to arrange consolidations and otherwise optimize the freight. But in actual practice, loads sat for no more than a week before being shipped.

The accompanying “Before & After” chart illustrates how a relatively minor shift in service levels can have an enormous impact on a company’s profit line.

2. Redesign Upstream Processes

Lots of money can be saved in air freight when the logistics team challenges its internal customers with one key question: “Do you need it that fast?”

Too often, the logistics team assumes that service level agreements put together by the manufacturer’s sales team or the part request from the field engineer reflect necessary ship-time requirements.

Most times they do, but not always.

To win a sale, a salesman may commit to an aggressive level of service that’s more reflective of what the client wants versus what they require. It’s important for the sales team to have clear data on the cost implications of certain ship-time commitments, and then set proper expectations with the customer.

Another upstream change that can lower air freight costs is the actual equipment design. Tall, oversized machines are far costlier to ship via air. Should that be ignored during the design process?

In the prefab housing industry, not only is transportation a key consideration during model design, it’s the primary consideration. All homes are designed so they can travel legally on the highway.

Can equipment (and the accompanying crates) that moves by air be designed in a modular fashion so that components can be shipped more economically?

Bottom line

Air freight costs are not top of mind during the product design and selling process. But often high air freight costs are more attributable to these upstream functions rather than the logistics team’s inability to secure a good rate.

Freight professionals should work with their colleagues to promote a total landed cost approach to getting a product to market – one that considers product design, manufacturing, sales, and logistics.

3. Curb Organizational Abuse of Expedited Shipping

Critical expedites cost about 5x more than a standard air shipment. Lack of corporate oversight on requests for expedites can lead to eye-popping budget surprises, if left unchecked.

Let’s say a fabric company in Italy is talking to a New York based buyer who wants to see a swatch as soon as possible. “We’ll get it there tomorrow” says the rep in Italy. Responsive? Yes. Practical? No – especially if the buyer has another week to make a decision.

Sometimes inefficiency is baked into the process. Big companies with lengthy approval processes for expedited freight are the worst offenders. As the decision process lengthens, cheaper shipping options disappear.

Other times, ERP workflows lack a way to flag requests for expedited shipments that are, in fact, not urgent. We see it with critical spare parts. Field engineers are given unchecked freedom to specify the shipping mode and service level. We’ve shipped parts to engineers on the other side of the world in a day, only to find out the same part was sitting in a local warehouse 5 miles from the field technician.

Our advice

Clearly define the criteria for where and when air express services can be used and integrate this guidance into a system-based workflow used by shipping partners and those requesting and approving the spend.

This results in faster processing of requests in a more disciplined, budget-conscious way. Also, the knowledge that freight spend reports will identify the requesting party for costly expedites tends to influence behavior in the field and bring these costs down.

4. Monitor Use of Temperature – And Climate – Controlled Shipping Services

It’s probably 3x to 4x more expensive to ship products via air when there is a tight temperature and humidity range requirement. This cost uptick includes the temperature-controlled trucking and warehousing portions of a door-to-door, air freight shipment.

In most cases, there’s a clear QC requirement for temperature control to maintain product integrity throughout the cold chain. Think pharmaceuticals and certain chemicals. Also, maintaining temperature control within a specific range is necessary to ensure the proper function of certain electronic devices that operate using semiconductors. Tightly regulated temperature control is even more critical when shipping semiconductor manufacturing equipment.

But not all technology product shipments using standard crates and boxes (versus “Cooltainers”) warrant this costly requirement. Engineers may specify temperature- and humidity-controlled shipping as a safeguard against temperature extremes, but in many cases product integrity would not be compromised with standard shipping.

Frankly, the ability of airlines to reliably deliver a climate-controlled environment throughout the shipping process is inconsistent if a specialized container is not used. On the aircraft itself, temperature control, in practical terms, may amount to nothing more than keeping the pallet away from aircraft doors.

Transportation professionals tend not to question shipping specifications handed down from their manufacturing or engineering team. But it’s worth reviewing the true climate control requirements for your specific products given the large cost delta between standard and climate-controlled air freight shipping.

5. Segregate Dangerous Goods from Non-Dangerous Goods

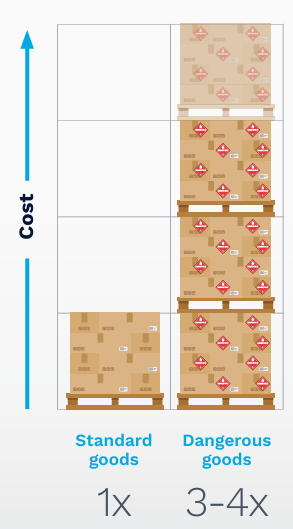

When dangerous goods (DG) and non-DG cargo are part of the same shipment, it’s important to separate them so the entire shipment is not assigned the higher DG rate, which can be 3x to 4x higher than standard air freight.

Let’s say a company has a 10-pallet air freight shipment and only one of the pallets is classified as DG. If all pallets are combined and shipped under one common invoice and one packing list, it’s treated by the airline as one shipment at the higher DG rate.

But if you split the shipment, the DG would be charged at the higher rate, let’s say $5 USD/kilo, while the rest of the goods could be shipped at $2 USD/kilo.

While this seems like common sense, such shipping inefficiencies are not always top of mind for manufacturers scrambling to meet a strict ship-time requirement. It helps to have a freight forwarder that routinely flags these types of cost inefficiencies.

When shipping dangerous goods, it’s not just segregating shipments that can save money, it’s consolidating shipments, as well.

For one of Dimerco’s semiconductor customers, we noticed that the company was regularly shipping single lithium batteries from the U.S. West Coast to the same Singapore location. These moved as minimum price shipments at $600 USD each.

The shipments were quickly flagged to the customer and we began holding the one- and two-battery shipments at Dimerco’s CFS warehouse in order to create weekly, 10-battery shipments in a single box. So, the customer’s costs went from $6,000 USD to ship 10 batteries ($600 x 10 shipments) to $600.

6. Use Indirect Routing When Possible

Direct, point-to-point air freight shipments typically will cost more than indirect routes. This goes back to the issue of flexible transit times.

If the ship-time requirement is 2 days, you’ll likely be limited to 2–3 direct carriers. But if that ship-time requirement expands to 4–5 days, you might have 6–12 carriers in play using indirect routing. It opens up a lot of options for your freight forwarder to find savings of up to 30%. Many of these added options are passenger flights for which carriers will offer favorable pricing in order to fill available cargo space.

One note on indirect routing. It’s less carbon friendly than direct routes because a disproportionate amount of a plane’s fuel consumption occurs during takeoff and landing.

7. Build Pallets to Utilize Lower-Cost Belly Capacity in Passenger Aircraft

Globally, 85% of the world’s aircraft are used to transport passengers versus cargo only. When deciding whether to ship your air cargo using a freighter or as belly freight (lower deck of a passenger aircraft), you’ll have many more flight options using passenger flights. The added choices and the sometimes greater discounts for passenger flight cargo versus freighters can save you 10%–20% on some lanes.

But to access these savings, you need to make sure you build your pallets to fit the smaller loading door dimensions of passenger aircraft. Generally, ideal specifications will be within these dimensions:

Wide Body

| Length | Width | Height |

| 125in (315cm) | 96in (240cm) | 63in (160cm) |

Narrow Body

| Length | Width | Height | Weight |

| 48in (120cm) | 40in (100cm) | 31in (80cm) | 330 pounds (150kg) per piece |

For freighter aircraft, the length and width of cargo can exceed the 125in x 96in limits of a wide body passenger plane. The greater size flexibility that freighters allow does not extend to the height of the shipment, which remains constant and cannot exceed 118in (300cm) tall.

In the U.S., a key to using passenger plane belly capacity is becoming a TSA known shipper – a Transportation Security Administration program that signifies the shipper is a trusted entity to ship securely on both passenger and freighter aircraft.

Let’s say you are shipping from USA to Singapore. A known shipper can choose daily passenger flights like SQ Daily for faster transit. Unknown shippers that are restricted to cargo aircraft may encounter less direct service, leading to potential delays and increased costs.

Bottom line

Build your pallets to give yourself as much flexibility as possible in shipping options.

8. Build Pallets to Minimize Chargeable Weight Based on the Load’s Dimensions

Air carriers have limits on the space they can allocate to cargo on particular aircraft and the total weight they can load. So their pricing to you – what carriers call “chargeable weight” – can reflect the weight or the dimensions of your load.

You may be charged by gross weight (weight of the product plus packaging, like pallets) or by volumetric weight (a carrier-defined estimated weight based on a load’s length, width and height).

Chargeable weight is the air carriers’ assurance that they can earn a fair profit from a wide variety of shipment types. They calculate the gross weight and the volumetric (AKA dimensional) weight and charge based on the higher of the two.

With strictly weight-based pricing, a shipment of cotton balls would yield little revenue for the large amount of space it takes up on the plane. With volumetric pricing, the freight expense for a shipment of bowling balls would be small compared to the percent of the plane’s maximum cargo weight the load represents.

Ideally, you want your load to achieve the right balance of heavy and lighter products to minimize chargeable weight. The right freight forwarder should build your pallets with chargeable weight in mind because the cost savings can be significant.

One large, global semiconductor company was paying the freight for inbound shipments from its suppliers. That company had its freight forwarder audit these inbounds to identify suppliers that were abusing chargeable weight – in other words, not building pallets, when possible, to optimize chargeable weight. Yes, the audit identified many bad actors, including one that shipped two 12x12x12 boxes on a single pallet and was charged, using the higher volumetric weight calculation, for a 48x40x24 pallet shipment.

The principles of dimensional weight pricing are easy enough to understand. But disciplines around this significant cost factor are inconsistent. It requires constant policing.

The chargeable weight of your air freight shipment will always be calculated on whichever is greater: the actual weight or volumetric weight.

9. Issue an RFP to Secure Competing Bids

This cost-cutting strategy may seem obvious, but it can’t be ignored. More competition correlates to better, market-driven pricing.

Of course, you’ll want to weigh other factors, in addition to costs. The best value doesn’t always equate to the lowest rate. For instance, if you are a small to mid-sized shipper that values customer service, you may struggle to get the attention of such providers if a critical need arises since you represent such a small portion of their overall business.

For different air freight forwarders, the freight capacity and rate they can offer will vary significantly by lane, so it makes sense to secure competing bids by lane or by region. For instance, a freight forwarder that focuses on freight moving to, from and within Asia PAC will have strong relationships with Asia-based carriers and good capacity and rates in these lanes – perhaps the same or even better rates than the large mega-forwarders. As a result, they could be an excellent fit for companies whose supply chains run through Asia.

Other freight forwarders occupy industry/product specific niches that can be attractive to shippers whose products have unique handling characteristics, like garment-on-hanger or sensitive semiconductor equipment.

When issuing an air freight RFP, it helps to know the players and where specialty providers can help.

Is it Time for an Air Freight Expense Audit?

Air freight is costly – as much as 16x the cost of ocean freight.

That doesn’t mean it shouldn’t be a central part of your global shipping strategy; it just means you need to examine your air freight costs with much greater diligence. Otherwise, it’s easy to overspend.

For a $500 million company reliant upon air freight, even a 5% cost savings can equate to a $25 million increase in bottom-line profit. What company can afford to ignore that?

Your best weapon against overspending could be a freight forwarding partner that ships a large volume of air freight and has the experience to recognize and act on some of the cost-saving opportunities outlined in this eBook.

If you haven’t taken a hard look at your air freight expenditures in a while, perhaps it’s time.