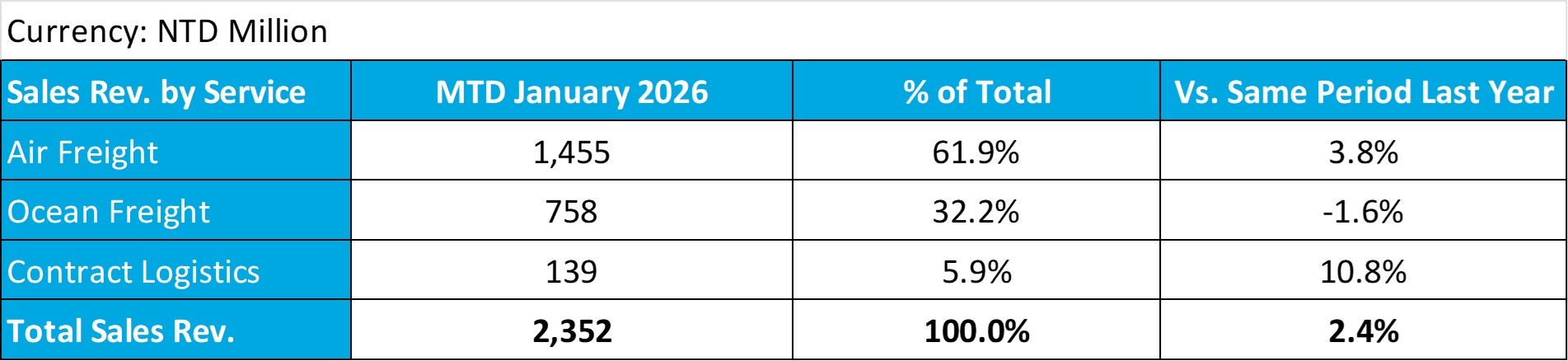

Dimerco Express Group (5609) today announced the consolidated sales revenue for January 2026, reaching NT$2,352 million, a 2.4% increase compared to the same period last year. The growth was driven by continued expansion in shipping volumes. Overall freight volumes in January showed strong performance compared with the same period last year, with air freight volumes increasing by nearly 30% and ocean freight volumes rising by nearly 20%. However, due to a decline in overall market freight rates compared with the same period last year, the pace of revenue growth was moderated to some extent.

Air Freight Market

In the air freight market, demand for exports from Asia to the U.S. and Europe has shown signs of easing. Market activity is primarily reflecting anticipated pre Lunar New Year shipments, while e-commerce volumes continue to soften. As a result, spot rates on U.S. and Europe trade lanes have remained broadly stable but are facing mild downward pressure. Performance, however, continues to vary by origin and trade lane. By contrast, intra-Asia cargo movements remain active. Supported by shipments of high-tech, high-value, and time-sensitive goods, demand on regional trade lanes has been relatively resilient, despite a modest pullback from the fourth quarter peak. As the Lunar New Year approaches, capacity on key regional routes is expected to tighten gradually. This is particularly evident on lanes from China to Taiwan, Singapore, Malaysia, India, and Thailand, where high-tech and time-sensitive cargo places greater demands on capacity and transit time. Tightening capacity conditions are likely to become more pronounced, underscoring continued underlying support from intra-Asia supply chain activity.

Ocean Freight Market

In the ocean freight market, rates on transpacific trade lanes have remained relatively stable despite softer demand. Since late 2025, carriers have sought to defend rate levels on the eastbound transpacific lanes through GRI and capacity management. However, this does not indicate a meaningful recovery in cargo demand. Overall market sentiment is more aligned with avoiding a return to price competition, reflecting carriers’ recognition that excessive rate cutting is not conducive to the long-term health of the industry. Although multiple attempts have been made to push through rate increases since January 1, their effectiveness has remained limited. Looking ahead, the Lunar New Year is expected to be one of the key demand factors supporting freight rates. That said, a clear pre-holiday shipping peak has yet to materialize, leaving the overall market outlook uncertain.

From an operational perspective, Dimerco noted that as the global supply chain environment continues to adjust, market attention is gradually shifting beyond freight rates and capacity toward risks related to regulatory frameworks and execution. While tariff policy uncertainty was a primary challenge for global supply chains in 2025, market focus in 2026 may increasingly turn to enforcement and compliance risks.

AI and Digital Transformation Outcomes

In response to the rapidly evolving global supply chain environment and increasing operational complexity, Dimerco continues to deepen its AI and digital transformation initiatives. AI technologies are widely applied across operational management, process automation, and decision support functions, driving comprehensive improvements in service quality and operational efficiency. At the same time, a systematic and data-driven operating model has strengthened document management, process consistency, and risk control capabilities, supporting diverse market requirements for compliance and operational standards.

Dimerco continues to actively invest in the research and application of automation software, AI, and machine learning technologies as part of its ongoing digital transformation efforts. Through the practical implementation of advanced technologies, the company aims to comprehensively enhance service quality and operational efficiency while strictly adhering to ISO 27001 information security management standards. This ensures that all automated processes operate reliably under 24×7 high service continuity requirements.

These AI-driven applications have helped the majority of Dimerco’s global operating locations achieve average productivity improvements of over 25%. At selected locations, more than 50% of orders are now processed through AI automation. In certain financial workflows, fully unattended operations have been achieved, with 100% of processes executed accurately by AI. These advancements have delivered significant benefits in operational cost control and overall efficiency enhancement.

Looking Ahead

Leveraging its resources and capabilities built upon its positioning as “the most competitive global logistics service provider,” Dimerco will continue to draw on over 50 years of experience serving Taiwan’s semiconductor industry. The company aims to help global customers navigate U.S. trade compliance requirements, regional manufacturing adjustments, and evolving market structures, transforming uncertainty into manageable and predictable supply chain operations. These efforts are expected to support the Group’s steady, long-term growth.

Spokesperson: Jack Ruan +886 921-062500 / +8862 2796-3660#222

Find out more on Financial Overview