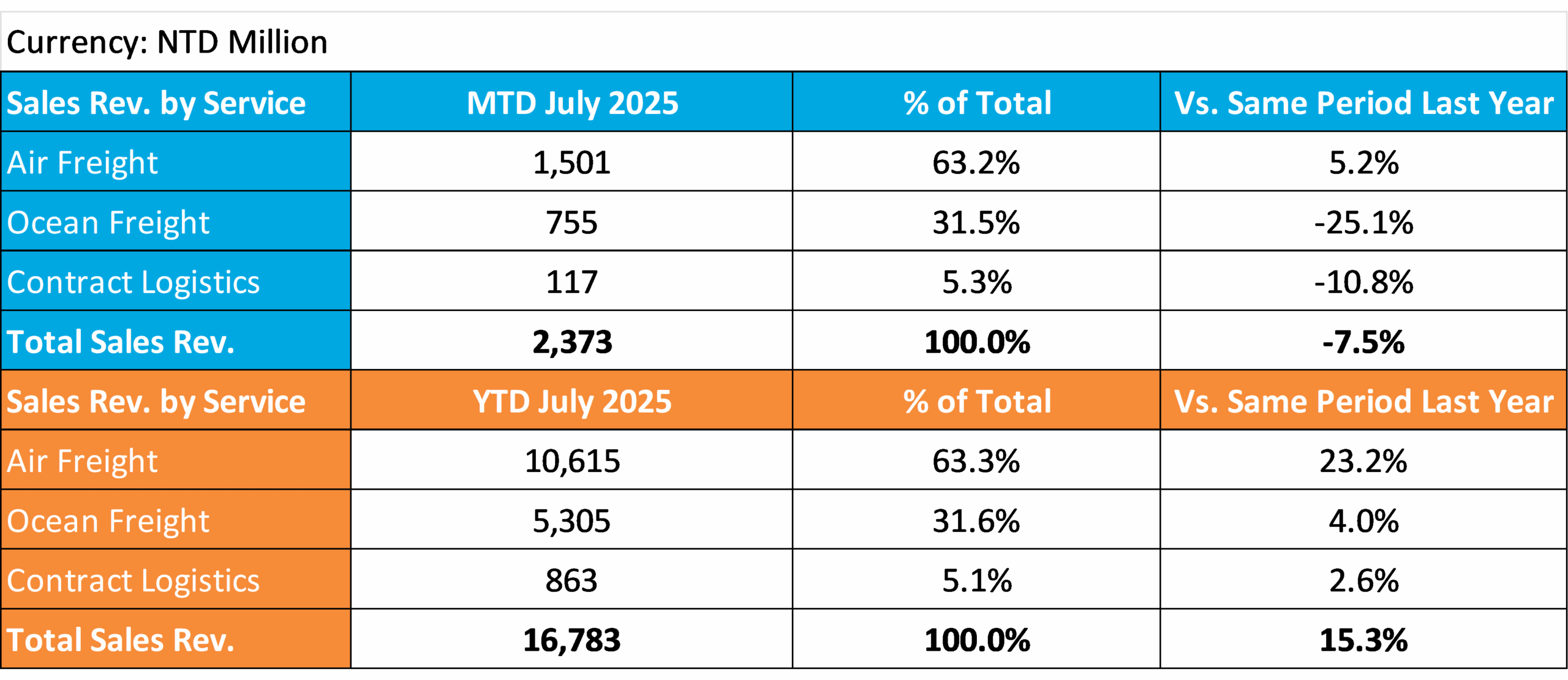

Dimerco Express Group (5609) today announced the consolidated sales revenue for July 2025, reaching NT$2,373 million, representing a 7.5% decrease compared to the same period last year. Due to the significant appreciation of the New Taiwan Dollar (NTD) against the U.S. Dollar (USD), the average exchange rate strengthened from NT$32.65 in July 2024 to NT$29.27 in July 2025, representing a 10.3% increase. Air freight volume in July increased by approximately 20% year-over-year, while ocean freight volume grew by 10%. However, the appreciation of NTD affected revenue conversion and limited overall growth. The consolidated sales revenue for July 2025 YTD is NTD 16,783 million, marking an increase of 15.3% compared to the same period last year.

In the air freight market for July, demand for artificial intelligence and high-tech products continued to rise as the new U.S. tariff was set to take effect on August 1st. The Asian market remained highly active, helping to keep freight rates stable. Following the peak shipping seasons in May and June, the overall ocean freight market slowed down in July. Overcapacity and high inventory levels in the U.S. exerted downward pressure on freight rates, while rates in the Asia region remained relatively stable with limited fluctuations.

Dimerco positions itself as “the most competitive global logistics service provider.” Through clear market positioning and a differentiated regional strategy, Dimerco has built a global network of over 150 locations in key niche markets, including 130 across the Asia-Pacific region. Dimerco’s deep-rooted strategy in Asia-Pacific has proven effective in leveraging local expertise to drive growth, particularly amid challenges posed by U.S. tariffs and trade tensions. At the same time, Dimerco is actively expanding into high-growth regions like the USA, Mexico, and Brazil, helping customers extend their reach with its proven expertise. In response to the complexities of U.S. tariff policies, Dimerco plays a critical role by offering a consultative approach, which has proven vital in trade compliance, particularly among U.S. importers trying to understand the financial and supply chain implications of shifting U.S. trade policies. This expertise has earned the trust and recognition of its customers.

Spokesperson: Jack Ruan +886 921-062500 / +8862 2796-3660#222

Find out more on Financial Overview