As of October 4, 2024, the International Longshoremen’s Association (ILA) and the United States Maritime Alliance (USMX) have reached a tentative agreement on wages, averting a potential devastating strike that could have disrupted U.S. East Coast ports and impacted billions in trade.

The Tentative Agreement

The two sides have extended their existing contract through January 15, 2025, to provide more time to negotiate a new contract. This agreement comes after a week-long strike that had snarled East Coast and Gulf Coast ports, leading to significant disruptions in the U.S. supply chain.

Next Steps

- Continue to monitor the negotiations between the ILA and USMX for updates on the final contract agreement.

- Assess your supply chain’s ability to withstand disruptions and identify areas for improvement.

- Develop contingency plans to address potential future challenges, such as disruptions or changes in trade policies.

- Stay updated on industry news and developments that could impact your supply chain.

Previous Considerations and Challenges (Prior to Strike)

- The ILA strike would have disrupted sea freight operations across all US East Coast ports, potentially accounting for between 42-49% of US cargo volumes.

- Severe congestion and backlogs were expected at East Coast ports, leading to significant disruptions in the U.S. economy.

- The disruption would have likely led to an increase in air freight volumes into the U.S., but limited capacity at key air freight hubs like JFK could have constrained the ability to handle the increased demand.

- The ongoing delays and rail congestion at West Coast ports could have impacted the effectiveness of rerouting goods via rail versus transloading.

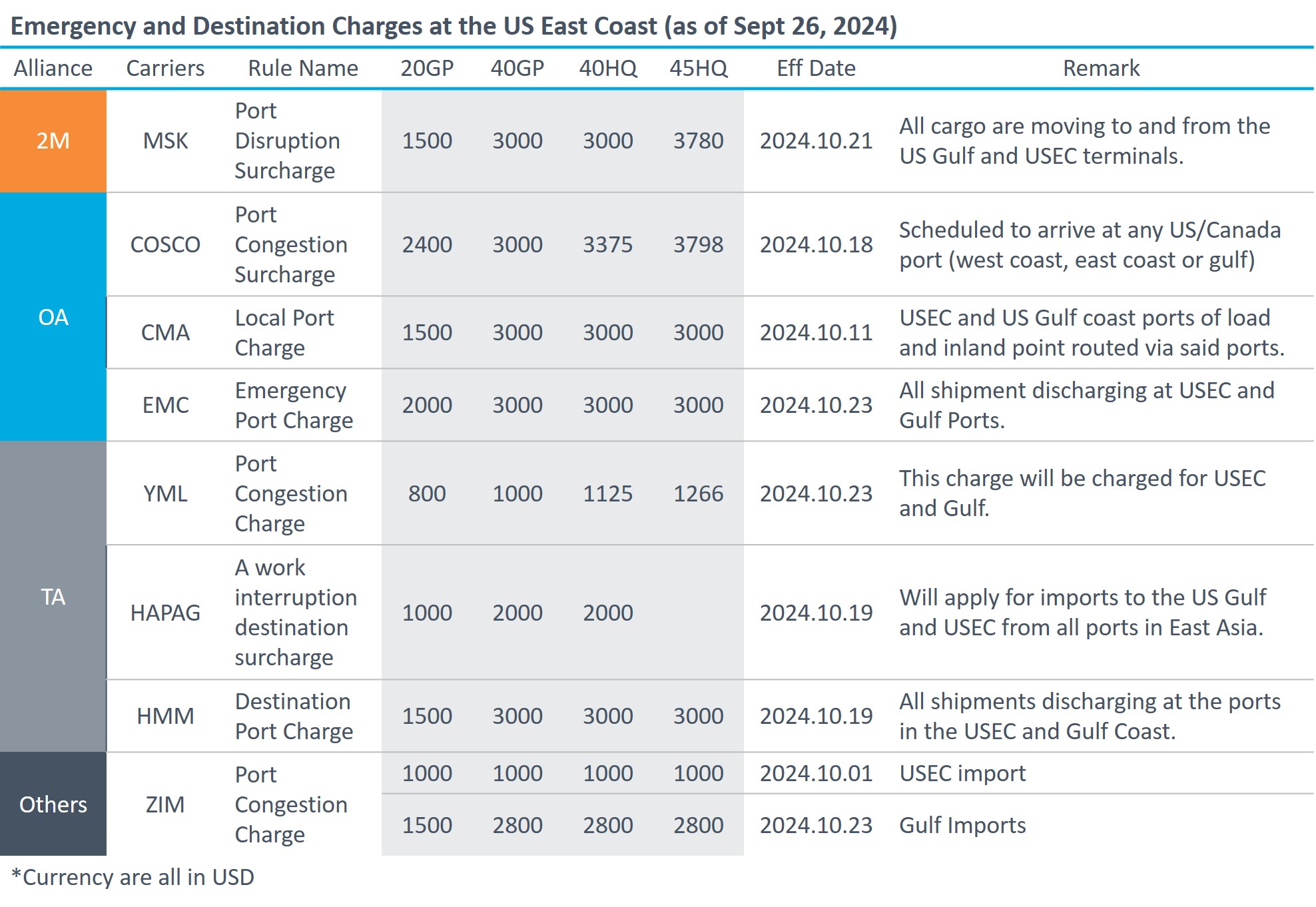

Emergency and Destination Port Charges

Carriers implemented Emergency Port Charges (EPCs) and Destination Port Charges (DPCs) during the period of the potential strike. These charges were designed to help offset the additional costs incurred by carriers due to the disruptions caused by the strike. Below is a table reference of the port charges as of Sept 26, 2024. While the strike has been averted, the EPCs and DPCs may still be in effect or could be implemented in the future if the situation changes.

Air – Truck Service: ORD as Gateway to East Coast

To address the anticipated surge in air freight demand, Dimerco offered flexible Air-Truck service with the following advantages to overcome space issues:

- Weekly B747-800 freighter charter via Cathay Cargo, ensuring dedicated capacity from PVG to ORD during the peak season (This route has 30 weekly flights, significantly more than the PVG to JFK route, which only operates 9 flights per week)

- Block space agreements with other airlines to provide the space required.

- Own CFS warehouse that manages the breakdown of ULDs, ensuring quicker processing and shorter lead times.

- 5 to 7 days of trucking from ORD to most East Coast destinations avoiding congestion at JFK and bypassing sea freight delays due to the strike.

Avoid IPI to East Coast – Use Transloading

While IPI (Intermodal Prepaid Inland) shipments to the East Coast via West Coast ports might seem like an option, it is important to note that the additional inland transportation costs and potential delays may outweigh the benefits. We may expect the following trend with the upcoming situation at the east coast:

- Current west coast delays already around 8 days without taking the strike into account

- Containers could be buried among the several thousands of containers in the rail terminal due to the delays and there is no priority method

- ILA actions could also affect the intermodal transport

Transloading via U.S. West Coast ports (LAX, LGB, OAK) is a safer and faster solution compared to IPI. Dimerco has established teams and infrastructure to support our transloading operations at U.S West Coast ports. We also have our own CFS bonded warehouse for transloading in Oakland, further streaming the process.

The Strike Threat Has Been Defused: Implications for the Supply Chain

While the immediate threat of a strike has been avoided, it is important to note that the supply chain may still be experiencing some lingering effects from the recent disruptions. Factors such as port congestion, backlog, and increased shipping costs could continue to impact operations.

Dimerco is here to support you and help you navigate any challenges that may arise. Please reach out to one of our representatives to start a discussion.