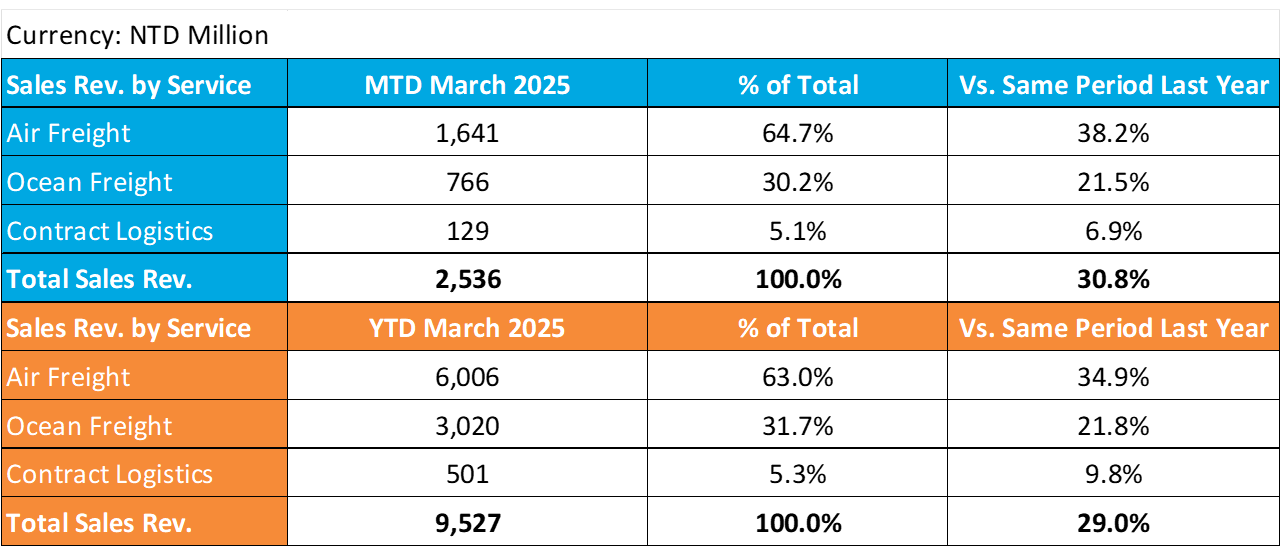

Dimerco Express Corporation (5609) today announced the consolidated sales revenue of April 2025, reaching NTD 2,536 million, representing a 30.8% increase compared to the same period last year. The consolidated sales revenue of April 2025 YTD is NTD 9,527 million, marking an increase of 29.0% compared to the same period last year.

In April, due to the impact of U.S. tariffs, demand for air freight shipping capacity from various regions in China to major U.S. cities has dropped significantly. Meanwhile, demand in Southeast Asia and Taiwan remains relatively strong, driven by the active import, export, and transshipment of raw materials and components among countries in the region. In the ocean freight market, concerns over U.S. tariff policies and port fees on vessels made in or operated by China have accelerated supply chain shifts. Southeast Asia has seen growing demand due to increased order transfers and cargo transshipment, which in turn has supported freight rates. Dimerco was praised for its ability to understand market changes and offer diverse services to meet customer needs. By leveraging AI and process automation to enhance productivity and improve service efficiency, the company has been able to solve problems and create value for clients even in a disrupted market, contributing to a notable increase in revenue.

Entering May, with the rapid depreciation of the U.S. dollar posing exchange rate risks, Dimerco’s operations across 16 countries and its diverse currency portfolio provide a natural hedge. This is further reinforced by a balanced business structure emphasizing both imports and exports. Exchange rate trends are monitored weekly—and even daily under the “Trump 2.0” scenario by the finance team. To minimize conversion losses, remittances are routed through OBU, delivering effective hedging results against the weakening U.S. dollar.

Spokesperson: Jack Ruan +886 921-062500 / +8862 2796-3660#222

Find out more on Financial Overview