The U.S. Trade Representative (USTR) has finalized a new port fee structure that is set to take effect October 14, 2025, impacting Chinese-owned, Chinese-operated, and Chinese-built vessels. These changes follow an April directive from the White House and reflect efforts to reduce U.S. reliance on Chinese-controlled maritime assets. The phased-in fees will affect ocean freight costs and may influence which vessels or carriers shippers choose for U.S. bound shipments.

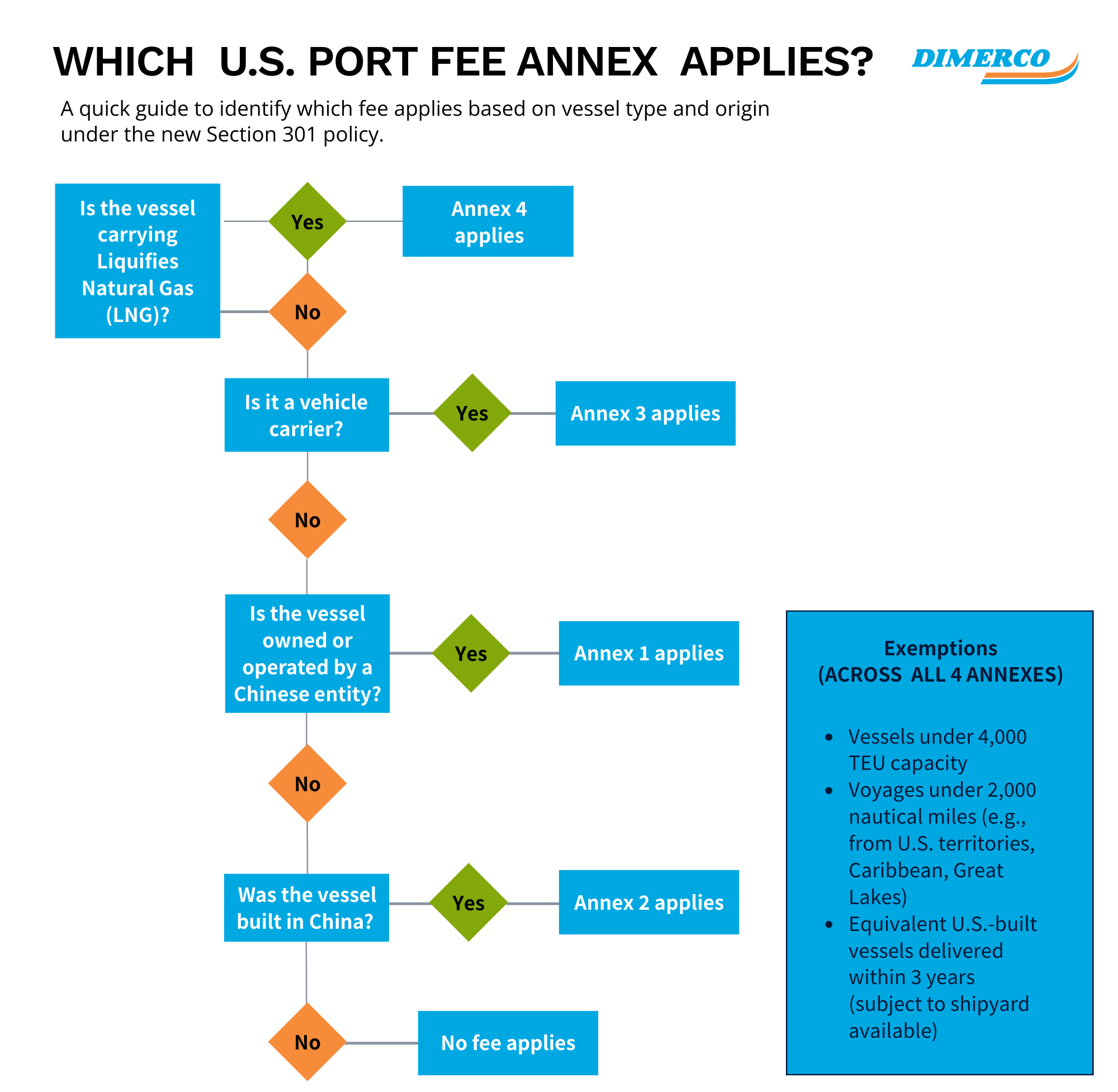

The fees will be assessed based on the following priority order and are not cumulative. Only one fee may apply per vessel rotation, depending on which condition is met first:

- Annex 4: Applies to Liquefied Natural Gas (LNG) vessels

- Annex 3: Applies to vehicle carriers

- Annex 1: Applies to vessels that are owned or operated by a Chinese entity

- Annex 2: Applies to Chinese-built vessels, but only if Annexes 1, 3, and 4 do not apply

What’s Changing

We will focus mainly on Annexes 1 and 2, as these contain the most significant impacts.

Annex 1: Chinese-Owned or Operated Vessels

Annex 1 applies to any vessel that is owned or operated by a Chinese entity. Starting Oct 14, 2025, a port entry fee of $50 per net ton per rotation will be applied to any vessel that is Chinese-owned or operated before the first US port call, with charges assessed per vessel rotation, not per port call. The maximum charge is capped at 5 rotations per year for each individual vessel.

Annex 1: Port Fee Schedule for Chinese-Owned or Operated Vessels

| Effective Date | Fee Per Net Ton per rotation, capped at 5 rotations/year |

Description |

|---|---|---|

| Apr 17, 2025 | $0 | Initial phase, no fees applied |

| Oct 14, 2025 | $50/net ton | Official fee begins |

| Apr 17, 2026 | $80/net ton | Second phase increase |

| Apr 17, 2027 | $110/net ton | Third phase increase |

| Apr 17, 2028 | $140/net ton | Final phase, maximum fee rate reached |

Note: Net tonnage measures only the cargo-carrying capacity of a vessel. It excludes parts of the ship that don’t hold cargo, like the engine room, bridge, or crew areas.

According to maritime expert Lars Jensen, a typical COSCO container vessel with a capacity of approximately 13,000 TEU has an estimated net tonnage of 65,000. At the $50 per net ton rate, this results in a $3.25 million fee per rotation, which equates to approximately $250 per TEU if the vessel is fully loaded.” In 2028, that would equal to $8.4m per rotation or $646/TEU if the vessel is fully loaded.

How is “of China” Defined?

The regulation, takes a broad view of what qualifies as “of China” based on any of the following criteria:

- Country of citizenship of the owner

- Location of corporate headquarters or parent company headquarters

- Principal place of business

- Entity ownership or control

- Jurisdiction to which the entity is subject

- Place of incorporation or organization under Chinese law

- Ownership of 25% or more voting interest by Chinese parties

- Chinese representation on the board of directors

- Operation by a Chinese crew

Even if a vessel is not Chinese-flagged, meeting any of these criteria could trigger the new fee requirements.

Annex 2: Vessels Built in China

Effective October 14, 2025: the higher of $18/net ton or $120/container per rotation (not per port call) paid before the first US port call, capped at a maximum charge of 5 rotations per year.

Annex 2: Port Fee Schedule for Chinese-built Vessels

| Effective Date | Fee Per Rotation ($/net ton or $/container whichever is higher) capped at 5 rotations/year |

Description |

|---|---|---|

| Apr 17, 2025 | $0 | Initial phase, no fees applied |

| Oct 14, 2025 | $18/net ton or $120/container | Official fee begins |

| Apr 17, 2026 | $23/net ton or $153/container | Second phase increase |

| Apr 17, 2027 | $28/net ton or $195/container | Third phase increase |

| Apr 17, 2028 | $33/net ton or $250/container | Final phase, maximum fee rate reached |

To illustrate, a generic vessel of approximately 13,000 TEU capacity and 60,000 net tons, the fee would be calculated as follows: Based on net tonnage: 60,000 × $18 = $1.08 million per rotation; based on container count: 13,000 × $120 = $1.56 million per rotation. The $1.560m fee will apply. In 2028, applying the container-based fee would result in a charge of approximately $3.25 million per rotation for a vessel of this size or $250 per TEU.

Exemptions and Special Considerations on US ship orders

Carriers may qualify for an exemption if they have an equivalent U.S.-built vessel on order and take delivery within three years. However, given current U.S. shipyard capacity constraints, especially since most of the key components of the vessel must also be US-made, achieving this exemption may be difficult. (This applies to both Annex 1 & 2)

Annex 3: Vehicle Carriers (RoRo Vessels)

This annex applies to Roll-on/Roll-off (RoRo) vessels, which are specifically designed to transport wheeled cargo such as cars, trucks, and trailers. These vessels feature built-in ramps that allow vehicles to roll on and off the ship efficiently at ports. If a RoRo vessel falls under the ownership or operational criteria defined in the regulation, it will be subject to the applicable U.S. port entry fees beginning October 14, 2025.

Annex 4: LNG Vessels

This annex applies specifically to Liquefied Natural Gas (LNG) vessels, which are specially designed to transport LNG at extremely low temperatures across long distances. Starting April 17, 2028, at least 1% of all LNG exports by vessel must be shipped using U.S.-built vessels.

Exemptions (Apply Across Annexes)

- Vessels arriving empty

- U.S. government cargo

- U.S.-owned, U.S.-flagged, or military-use vessels

- Vessel capacity < 4,000 TEU or 55,000 deadweight tons

- Short voyages < 2,000 nautical miles, such as those departing from U.S. territories, the Caribbean, or the Great Lakes.

Who is Affected

- Vessels owned or operated by entities from China, Hong Kong, or Macau.

- Chinese-built ships, regardless of current ownership.

- Vehicle carriers that are not built in the U.S. even if U.S.- flagged or owned.

Key Impact to Prepare For

- Ocean freight costs may rise, especially on Transpacific Eastbound (TPEB) routes.

- Shippers may start choosing alternative carriers to avoid higher fees.

- Long-term contracts and rate strategies should be reviewed now to account for these changes.

- Carriers subject to the 5-rotation fee cap may seek to recover costs elsewhere. For instance, if a carrier makes 10 U.S. port rotations annually but fees are only applied to five, they may spread the cost across all sailings—potentially passing the surcharge to customers as part of freight rates or accessorial charges.

As companies look to adapt, recent insights from global carriers suggest that some effects of the new rules are already being felt across the industry.

Industry Concerns Over U.S. Port Fees

In a new episode of the Freight Buyers’ Club, Joe Kramek, President and CEO of the World Shipping Council, offers a candid, carrier-side view of the U.S. port fee policy targeting Chinese-built and Chinese-operated vessels.

He explains that while the policy is framed as a move to strengthen the U.S. shipbuilding industry, it could end up raising long-term costs for U.S. importers and exporters, particularly manufacturers and farmers without achieving its intended goals.

One key issue is how the fees are calculated. Because they’re based on net tonnage (the internal volume of cargo space), carriers could face high costs even if their vessels are not fully loaded.

Kramek also points to the uncertainty created by shifting tariffs and regulations, which are forcing both carriers and shippers to constantly adjust with little notice. “The zigzagging in policy signals,” he notes, “increases the risk of whiplash effect” where supply and demand are thrown off balance, causing reliability issues that ripple across global trade lanes.

To move forward, he emphasized the need for long-term planning. A 10-15-year U.S. maritime strategy focused on shipyard investment, workforce development, and industrial capacity was described as essential to building resilience.

Watch the full interview.

Carrier Response & Market Adjustments

- COSCO and OOCL, both members of the Ocean Alliance, may redeploy Chinese-built vessels to non-U.S. trades, leaning on CMA CGM or Evergreen via vessel swaps.

- Carriers may accelerate short-term contract discussions ahead of the October fee start.

- Pricing adjustments may potentially reflect both the new fees and added administrative overhead.

- Port fee eligibility may likely be determined using the vessel’s Certificate of Registry or other documentation related to ownership and control.

Annex V: Proposed Tariffs on Chinese-Made Equipment

The USTR is also proposing additional duties of 20–100% on containers, trailers, semi-trailers, chassis, chassis parts, and ship-to-shore cranes made in China. A public hearing is scheduled for May 19, 2025, after which the government will determine whether to implement the duties in 180 days or over a phased-in period of 6 to 24 months.

These proposed tariffs would be in addition to existing tariffs and could impact both ocean and domestic transportation costs. To avoid the new duties, importers must certify that their products were not manufactured by a company owned or controlled by a Chinese entity—with broad definitions around control and ownership.

This marks a significant escalation in trade enforcement and could signal future restrictions not just on “Made in China” goods, but also made in some other country by a company under Chinese ownership or control (with a broad definition of those terms). Importers should start assessing exposure across their entire equipment supply chain.

What You Can Do Now

- Audit current routings, vessel origins, and carrier dependencies.

- Explore alternate service options or alliances that may reduce tariff exposure.

- Review existing contracts to understand pass-through clauses.

As trade compliance becomes increasingly complex, it’s more important than ever to work with trusted experts. To revisit the fundamentals, feel free to explore our Trade Compliance 101 eBook — a practical guide for global shippers.