Sustainable Aviation Fuel (SAF) is a critical lever for the air freight industry to achieve net-zero carbon emissions goal.

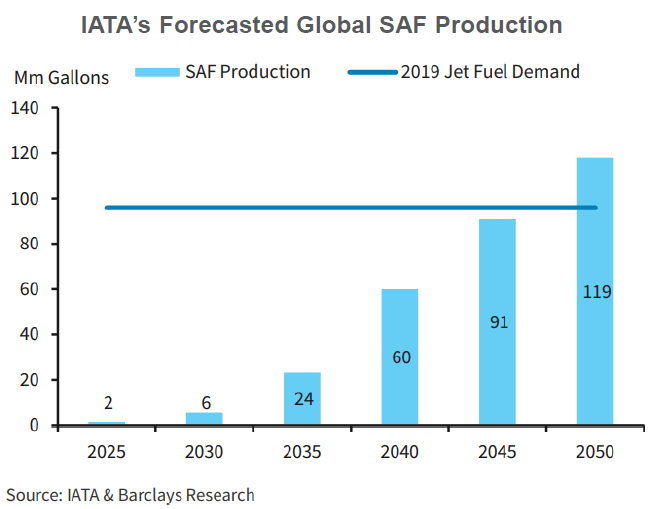

Currently, supply of SAF is low due to the huge investment in producing SAF. And this is why the price of SAF is 3X to 8X more expensive than conventional jet fuel. If weak supply continues, the price of SAF will remain unaffordable and, ultimately, the current net-zero timelines will be virtually impossible to meet.

What is sustainable aviation fuel?

SAF is produced from sustainable feedstocks like used cooking oil and animal fat or plant oils, along with solid waste and food scraps from homes and businesses that would otherwise be incinerated or go to a landfill. Believe it or not, its ultimate chemistry is very similar to fossil jet fuel.

An airplane emits 47X the greenhouse gases (GHGs) per one ton mile as a cargo ship (source: EDF Green Freight Handbook). Using current energy sources, air freight is the least carbon-efficient mode of transport. (NOTE: ocean freight can also benefit from alternate fuel sources for container ships.)

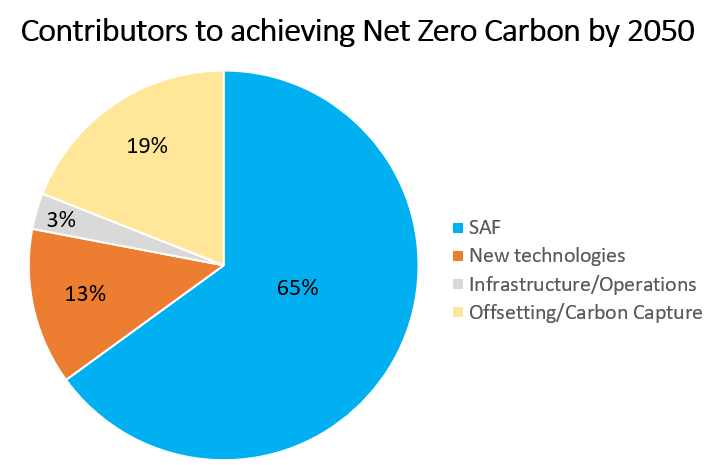

SAF is a key to the continued viability of air freight. In 2021, IATA members agreed to commit to net-zero carbon emissions by 2050. A shift from conventional jet fuel to SAF is the key contributor to this goal, as noted in this IATA chart.

The benefits of SAF include:

- Up to 100% lifecycle emissions reduction (source: Cathay Pacific)

- SAF is blended with conventional jet fuel to use in existing aircraft without any equipment change

- SAF is co-processed with conventional jet fuel and flows through the existing aircraft fuel supply chain (pipeline to terminals and airports) in a business-as-usual fashion

High prices are restricting the use of SAF

SAF is 3X to 8X more expensive than fossil fuel, so it’s a profit-draining drag on carriers. Some carriers, like Cathay Pacific, are working to create more demand for SAF to spur production and lower costs.

If that does not happen, SAF producers will lose confidence to invest in the technology required to scale up production to meet the massive increase in capacity required to achieve net zero by 2050.

Less supply means higher prices, which in turn limits demand – and the cycle would continue. The SAF production plant/infrastructure will take a few years to be built, so every delay now has a huge impact on future SAF production and availability.

Why should shippers care?

It’s important for more shippers to be dedicated to the use of SAF right now. Will it cost more than conventional jet fuel? Yes, carriers will likely charge a premium to cover their additional cost.

But it’s a question of pay now to invest in the future or pay later when you have no choice. Greater demand in the short term will lower prices, spur production, and continue to drive prices to more affordable levels.

SAF requires shippers to take a long-term view.

Here are other reasons why shippers should care about SAF:

- It reduces Scope 3 carbon emissions, which fulfills carbon disclosure requirements. Carriers, and their freight forwarder partners, can report carbon reduction data to shippers.

- Take the lead in accelerating the use of SAF and ensure future SAF availability.

- Demonstrate to stakeholders a commitment to sustainable air cargo.

Government Intervention: A Catalyst for Change

Governments around the world are recognizing the crucial role SAF plays in achieving net-zero emissions goals. Several countries and regions are implementing initiatives to make SAF more accessible:

Tax Breaks for Producers: The European Union is exploring tax breaks specifically targeted at SAF production facilities. This financial incentive aims to stimulate investment in building new production plants and expanding existing ones, ultimately increasing SAF supply and driving down costs.

Airline Subsidies: Some US states are considering subsidies for airlines that choose to utilize SAF for their cargo operations. These subsidies can help offset the additional costs associated with SAF, making it a more financially viable option for airlines and ultimately lowering the price point for shippers.

Sharing the Responsibility with Carbon Offsetting Programs

Carbon offsetting programs provide another avenue for mitigating the cost barrier of SAF. Companies can participate in these programs by investing in SAF projects. These investments contribute to increased SAF production, and the carbon emission reductions achieved through these projects can be used to offset a company’s air cargo emissions, fulfilling their carbon disclosure requirements. Established programs like the CORSIA (Carbon Offsetting and Reduction Scheme for International Aviation) and organizations like the International Air Transport Association (IATA) facilitate this approach.

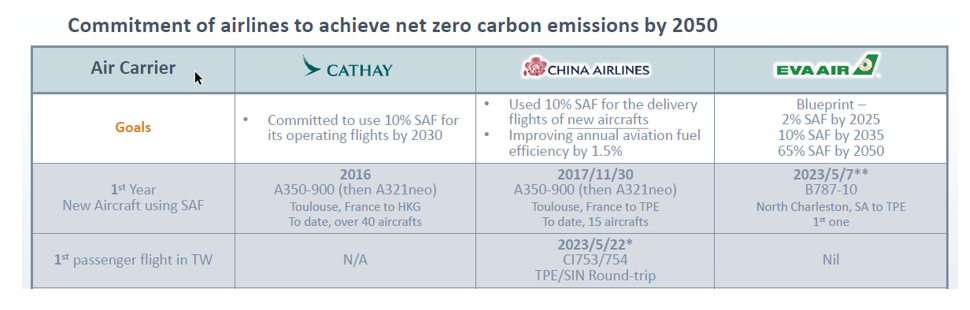

Dimerco carrier partners are committed to SAF

One of Dimerco Express Group’s sustainability strategies is to partner with carriers, such as the ones shown below, that have green-friendly shipping practices like the use of SAF.

A stronger market for SAF must be developed

SAF is not an optional product. It’s indeed the necessary enabler for the future viability of the air cargo industry.

The growth of the SAF market will require continued industry commitment.

It will require governments to provide the right incentives for businesses to scale up SAF production.

Most of all, it will require shippers to communicate to freight forwarders and carriers their willingness and preference to move freight on SAF-powered jets.

Dimerco provides custom reporting to clients on emissions reduction in line with the Science-Based Targets Initiative (SBTi). To discuss how a freight forwarder can help you in your sustainable freight journey, talk to a Dimerco specialist today.