With most insurance – life, health, home – you buy it in the hope you’ll never have to use it.

Cargo insurance is much the same. But global shippers often overlook insurance details and assume they are fully covered when, in fact, they’re not. That creates huge risk for your company, particularly if you’re shipping high-value goods.

Here are 7 of the most common misperceptions about cargo insurance.

1. “Events are rare. I don’t really need to insure my cargo.”

Insurance industry losses from natural catastrophes and man-made disasters across the globe equaled US$83 billion in 2020 – the 5th costliest year for the insurance industry (source: Swiss Re Institute). Natural catastrophes caused US$76 billion of global insured losses in 2020 – an increase of 40% from 2019. In its annual cargo theft report for 2020, Sensitech noted a 23% rise in cargo thefts in the US over 2019.

You never think it’s going to happen to you – until it does. And when it does, the costs if you are not adequately insured can really harm your business. In California in 2020, a full truckload of footwear worth US$846,000 was stolen. A couple of years earlier, in Kentucky, thieves got away with a trailer of electronics worth US$1 million.

Homeowners understand that catastrophic events like fires are rare, but they insure anyway because without insurance they could not financially withstand the loss. Global shippers must look at cargo insurance more like home insurance.

2. “My cargo is covered under the carrier’s policy.”

Carriers are liable – but only if it is proven that their negligence caused the loss. Even if it is, carrier liability is limited. You’ll receive only a small percent of the product’s value.

- Under US COGSA, carrier coverage on ocean shipments is limited to US$500 per package or customary freight unit (CFU). If the CFU is a pallet and each of your pallets contains US$10,000 worth of products, you’ll receive only 5% of the value of your goods.

- Carrier coverage on air shipments is limited to 22 Special Drawing Rights (SDR) per kilo (actual weight).

- Carrier coverage on domestic trucking shipments is limited to US$50 per shipment or transaction.

Special Drawing Rights (SDR) are an international reserve asset created by the IMF to supplement the official reserves of its member countries. 1 SDR = US$1.41 (as of August 18, 2021), so air shipment coverage will be about US$31/kg of actual weight.

The best option to avoid this woefully inadequate coverage is to purchase All Risk Cargo Insurance when booking your global shipment. All Risk Cargo Insurance is the broadest, most comprehensive form of coverage. It insures for the full value of the cargo in transit, from pickup to final delivery (normally 110% of cargo value).

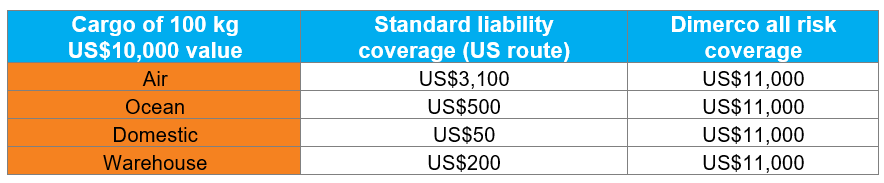

In the chart below, we look at the difference in what you would receive under the carrier’s liability insurance and an All Risk Cargo Insurance policy. The actual cost of the insurance, on a shipment-by-shipment basis, is quite small compared to the product value you would lose as a result of being under-insured with standard liability coverage.

Liability Coverage for Standard vs. All Risk Cargo Insurance

3. “My cargo is covered under my company’s blanket insurance policy.”

It’s possible, but unlikely, that your blanket coverage would match what is offered under All Risk Cargo Insurance. In particular, many blanket policies fall short when it comes to international shipments. Be sure to evaluate this blanket coverage carefully and compare it with your benefits under a specific cargo insurance policy.

4. “When I purchase on CIF terms, I don’t have to worry about insurance; it’s the seller’s responsibility.”

CIF literally stands for Cost, Insurance and Freight and refers to an incoterm where the seller pays to cover the cost of ocean shipping and insurance to the buyer’s port. So yes, the seller must provide insurance. But they are only obligated to provide minimal coverage and may leave many risks uncovered. For instance, they may insure only the ocean passage and not door-to-door.

The other problem with relying on the seller to insure your cargo is that any claims would go through the seller. You are not in control. You would have to file and coordinate the claim with an overseas insurance agent that likely won’t have its own representatives in the US. With time zone differences and possible language barriers, it adds to the time and frustration associated with managing a claim.

One possible solution is to contractually mandate that the seller obtain All Risk Cargo insurance and add you as a “co-insured.” If the seller refuses and you are the one at risk, bring the insurance responsibility over to your side.

5. “The only time I’ll ever need coverage is when my cargo is lost or damaged.”

That would seem to make sense, but it’s not always accurate. There is a maritime law referred to as “General Average” that allows a vessel to jettison certain cargo in order to save life, the vessel or other cargo. The expense of the lost freight is then shared proportionally by all the other shippers. Under General Average, the vessel operator will not release your cargo until General Average Security is paid in full – in cash or cash equivalent. When you obtain All Risk Cargo insurance, general average is included and the insurance will post the guarantee needed to release your freight

In some cases, General Average can be declared even when no cargo is lost. The best example is when the vessel Ever Given got stuck in the Suez Canal in March of 2021, resulting in billions of dollars in delayed shipments and General Average Security at 25% of cargo value for uninsured cargo.

6. “If my product is rejected due to packaging damage, I am covered.”

Not true. Cargo insurance covers only damage to the goods and often will not pay to replace damaged packaging. If a retailer rejects your product based solely on package damage, cargo insurance will not protect you.

That’s why it’s so important to invest the time and money to properly package your international shipments to prevent damage. We touch on packaging and shipment preparation in our eBook on managing global logistics for electronics products.

7. “Managing insurance directly is complex and time-consuming. We don’t have the resources to handle it.”

Actually, insuring your cargo can be quite a simple process if you use a freight forwarder that offers insurance coverage. Many large, reputable forwarders, like Dimerco, offer All Risk Cargo Insurance and can handle many of the details. Coverage is secured using a standard set of documents, so it’s a quick process for you. More importantly, the right forwarder can make the process of filing a claim fast and simple. Once you provide certain information about the loss or damage, your forwarder takes it from there. They manage all communication with the insurer and settle the claim on your behalf.

Is it time to consider All Risk Cargo Insurance?

Companies generally do a good job of managing risk when it comes to things like computer systems going down, buildings being damaged, and employees filing workman’s compensation claims. But when it comes to protecting products while in transit, there is still a lot confusion and, as a result, significant risk. The higher the value of your goods, the greater your risk.

Incidents that lead to cargo damage, both man-made and natural disasters, are on the rise. When it comes to your cargo being impacted, it’s not a question of if, but when. The only sure way to adequately manage your risk of cargo loss is All Risk Cargo Insurance, where compensation is based not on weight, piece count or some carrier-defined limit, but on the value of your product.

To discuss your options to protect your cargo, contact a Dimerco international shipping specialist to start a discussion.