Special reports on the national nightly news. Presidential press conferences. Emergency legislation. Few business stories are more visible these days than the congestion at global seaports and the related supply chain slowdowns.

But there are hidden consequences of these port delays that few are talking about – and that put you at greater risk for cargo loss. For instance, moisture build-up within containers is resulting in more damaged product, and long container unload times at ports have led to a sharp uptick in cargo theft. Supply chain experts know well that cargo at rest is cargo at risk. Global shippers should consider more comprehensive insurance coverage, like All Risk Ocean Cargo Insurance, to manage their risk – at least until delays subside.

Steamship Line’s Limit of Liability Offers Little Protection

Don’t confuse a steamship line’s limited liability with cargo insurance. Our article on cargo insurance misperceptions can help to clarify this issue. Carriers are only liable if it is proven that their negligence caused the loss. Even if negligence is proven, you’ll receive only a small percent of the product’s value.

Protection from Moisture Damage Requires Comprehensive Ocean Cargo Insurance

The most invisible, and insidious, consequence of having cargo sit in containers for an added 15 to 30 days is moisture damage.

Shipping containers are supposed to be watertight, but they are not airtight. That’s an important distinction.

According to Trade Risk Guaranty, an international surety agency, about 10% of all container shipments must be discarded due to moisture-related damage. That’s under normal circumstances. Port delays are making this an even bigger problem.

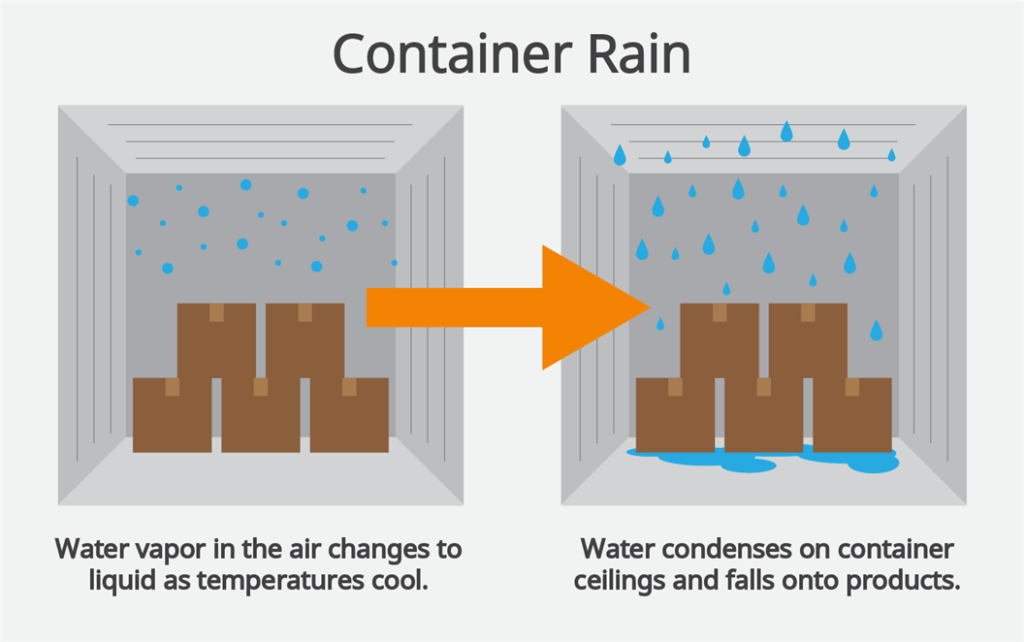

Without getting too technical, here’s a quick explanation of how moisture puts your cargo at risk. A certain amount of moisture vapor is naturally in the air. As temperatures cool, this vapor converts to water – a process known as condensation. Water accumulates on the coldest surfaces, like the container’s ceiling, causing “container sweat” to fall onto products. Water can also accumulate directly on product surfaces.

The financial impact of moisture damage can be significant. Here’s a real example. A food industry company shipping yeast extract in 300-gallon totes experienced a long delay entering its destination port in Southern California. When the product was finally delivered, the consignee, a bio-science facility, rejected two of the totes due to a mold formation. Product disposal and container clean-up cost the food company $60,000, not to mention the value of the lost product.

Here are other ways prolonged exposure to moisture puts certain products at risk:

- Food can go bad or develop odors

- Electronics can malfunction

- Metal parts can corrode and rust, or simply discolor

- Wood can warp and weaken

- Organic materials can develop mold and mildew

- Dry goods, such as powders or husks, can clump or cake

What About Cargo Theft?

Cargo at rest is cargo at risk. As containers wait longer at ports to be unloaded or at yards to get transferred to warehouses, it creates more opportunities for theft. CargoNet reported a 42% rise in cargo theft cases in Q3 2021 compared to the same prior-year period. Electronics and refrigerated food cargo seem to be what thieves like best. If incidences happen at a container terminal or rail ramps while technically under the custody of a carrier, the carrier’s limited liability may apply – if it’s proven that its negligence caused the loss.

The Solution: All Risk Cargo Insurance

Right now, you’re probably paying higher rates than you ever have for ocean shipping. It’s difficult to think about spending even more to protect your company against product loss or damage. But if the value of your product far exceeds a carrier’s limited liability coverage, it probably makes sense.

There are different types of ocean cargo insurance. When it comes to things like moisture-related damage and theft from an unattended container, what’s actually covered can be as murky as the seas the containers travel on. Your best option may be to purchase All Risk Cargo Insurance. As the name implies, this coverage provides you the most comprehensive level of protection available, and enables you to recover the full value of goods that are lost, damaged or stolen.

All Risk Cargo Insurance provides:

- The broadest door-to-door coverage – anywhere on any mode

- Settlements that are based on the actual value of the goods, along with all related transportation costs

- Coverage for any eventuality while in transit, EXCEPT what is specifically excluded in the policy

Relative to the value of your goods, the cost of All Risk Cargo Insurance is reasonable. Origin, destination, and commodity will all impact the price and it is subject to underwriter approval, but as a general rule you can estimate the cost at $0.50 per $100 of CIF value + 10%. (Check out our Incoterms blog post for an explanation of CIF.)

If you’re shipping high-value cargo, a “pennies-on-the-dollar” settlement from a steamship line just won’t cut it. In fact, such a loss could be devastating for smaller businesses. All Risk Cargo Insurance can protect you from the risk you face in today’s complex global supply chain, giving you peace of mind so you can focus on what you do best – growing your business.

To discuss options to protect your cargo, contact a Dimerco international shipping specialist to start a discussion.