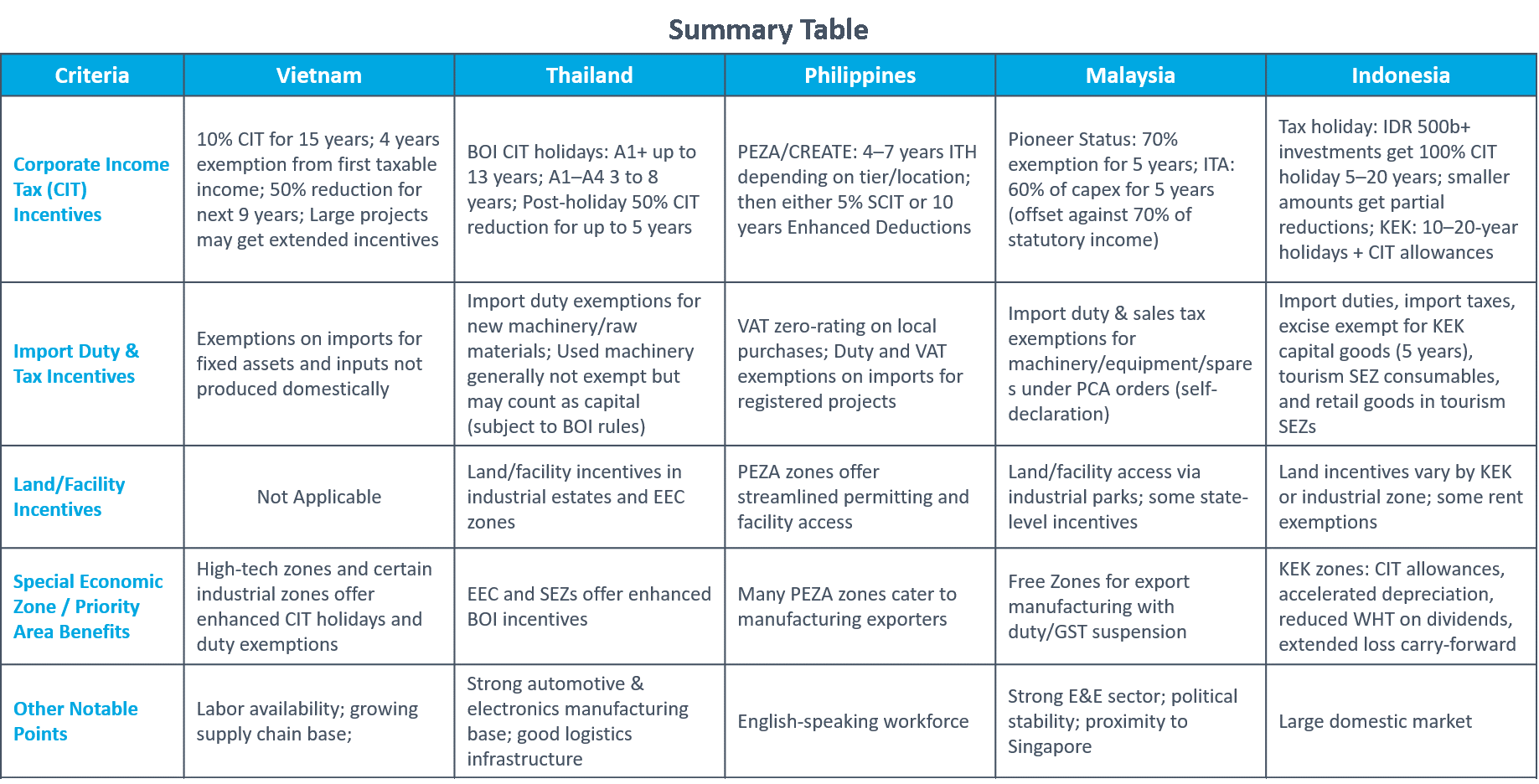

Southeast Asia is one of the most attractive regions for global manufacturers and investors due to its strong economic growth, strategic location, and government-backed incentives. Countries across the region are offering preferential tax schemes, import duty exemptions, and special investment zones to encourage foreign investment. For companies planning expansion, it is essential to understand and make the most of these incentives.

The Developing Southeast Asia

For companies expanding into this region, understanding preferential tax policies is critical. This helps businesses navigate complex regulations, maximize available incentives, and avoid costly compliance mistakes. A reliable logistics service provider should offer the expertise needed to interpret evolving trade regulations and ensure businesses remain compliant while capturing these benefits. Let’s look at some of the preferential tax policies across major developing countries in Southeast Asia.

Vietnam

Vietnam has rapidly grown as a key manufacturing hub in Southeast Asia, thanks to its young labor force and attractive government incentives designed to draw foreign investment. These incentives include tax breaks and import duty exemptions targeted at priority industries and disadvantaged regions. Companies can assess their eligibility for such incentives and align projects with the country’s investment priorities.

Corporate Income Tax (CIT) Incentives

To encourage investment in strategic sectors and regions, Vietnam offers preferential Corporate Income Tax rates and holidays that significantly reduce tax burdens for qualifying companies.

- A preferential 10% CIT rate for 15 years, starting from the year of first recorded revenue.

- A full CIT exemption for 4 years, starting from the first year a company has taxable income.

- A 50% reduction on CIT (effectively 5%) for the following 9 years after the exemption period.

These benefits are available to high-tech sectors such as information technology, new material technology, and automation. Large manufacturing projects also qualify if they invest at least VND 6,000 billion and either reach VND 10,000 billion in annual revenue by year 4 or employ over 3,000 workers, or if they invest VND 12,000 billion and use specific advanced technologies.

Import Duty Exemptions

Vietnam further supports businesses by exempting import duties on certain goods critical to production and research, lowering upfront costs for investors. Companies can be exempted from import duties when importing goods for:

- Fixed assets of eligible projects.

- Export processing contracts.

- Raw materials for software production or scientific research that cannot be sourced domestically.

Since 2019, Dimerco Vietnam has supported more than five companies in relocating their manufacturing operations from Suzhou and Shenzhen to Hanoi and Ho Chi Minh City, providing end-to-end expertise in import requirements, customs declarations, and logistics. The team successfully managed the import of used machinery, equipment, and production lines while strategically planning duties and securing tax and VAT exemptions to maximize savings.

Thailand

Thailand is actively pursuing its Thailand 4.0 vision, aiming to transform the country into a value-driven, innovation-led economy. To support this goal, the Board of Investment (BOI) has introduced a range of preferential tax policies designed to attract foreign investors and encourage companies to establish their production operations within Thailand. Leveraging on this preferential tax policies help businesses correctly classify projects to maximize these BOI incentives.

Corporate Income Tax (CIT) Exemptions

the CIT incentives help reduce tax burdens and improve the overall business environment for both foreign and local investors. Projects approved by the BOI are classified into activity groups (A1+, A1–A4), with tax exemption periods based on the type of industry and its importance. This exemption period begins from the date the company starts generating revenue:

- Group A1+ (Highly Promoted Activities): Up to 13 years of CIT exemption, with no cap on the amount of investment.

- Groups A1 and A2: Up to 8 years of CIT exemption, with no cap on the amount of investment.

- Groups A3 and A4: Up to 5 years and 3 years of CIT exemption, respectively, with the exemption amount capped at 100% of the investment (excluding land and working capital).

Following the exemption period, eligible projects can benefit from a 50% reduction in corporate income tax for up to 5 additional years. This extension applies based on the project’s activity group or geographic location, such as investment in the Eastern Economic Corridor (EEC) or BOI-designated industrial estates.

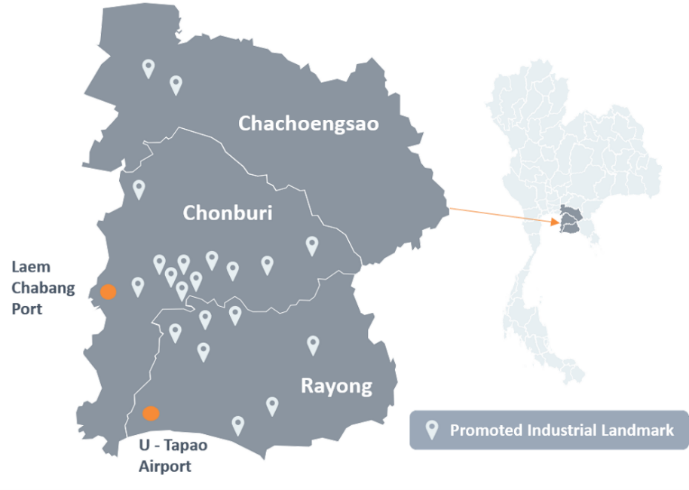

Special Geographic Zones and Industry Enhancements

These zones receive enhanced incentives, especially in CIT exemptions, to encourage companies to establish or expand operations in less-developed or strategically important areas. These zones include Eastern Economic Corridor (EEC), Special Economic Zones (SEZs) near the borders, Science and Technology Parks, and the Industrial Estates and Zones. Some of the benefits of establishing operation in these zones include:

Longer tax holidays: Up to 13–15 years of CIT exemption – longer than standard periods.

Longer tax holidays: Up to 13–15 years of CIT exemption – longer than standard periods.- Post-exemption tax cuts: 50% CIT reduction for up to 5 years after exemption ends.

- Import duty exemptions: Preferential treatment on machinery and raw materials.

- Improved infrastructure: Enhanced logistics, transportation, and utilities.

- Streamlined procedures: Faster licensing and customs clearance to reduce delays.

- Support for innovation: Additional incentives for projects in science & technology parks.

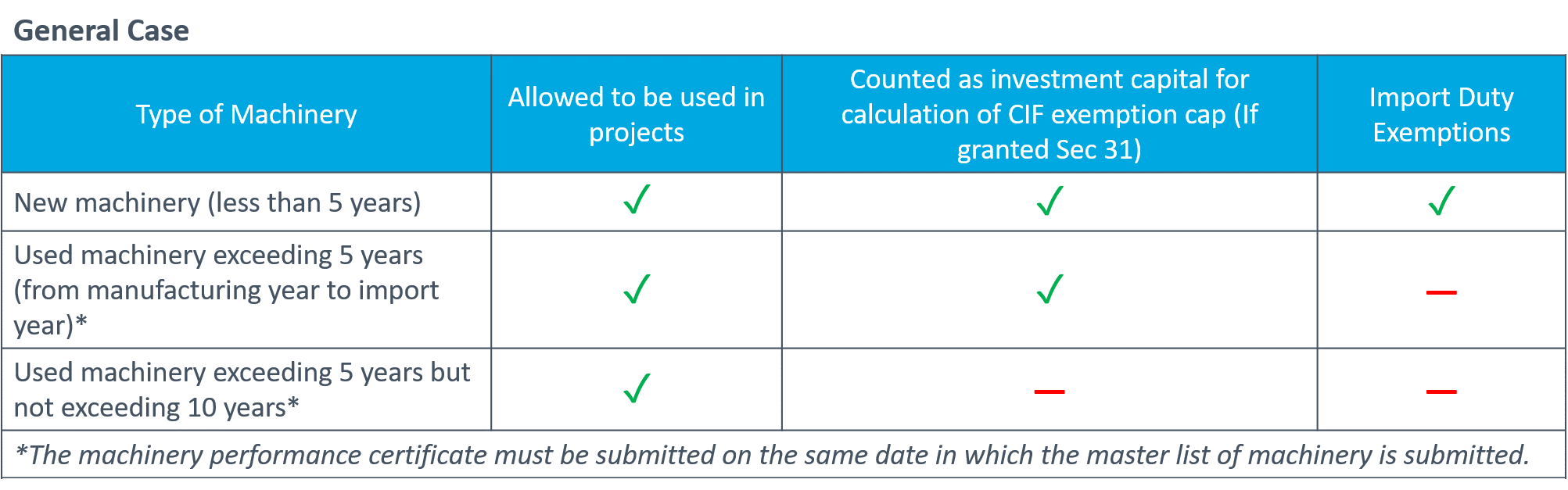

Machinery Import Incentives

New machinery is generally exempt from import duties and can be included as investment capital for CIT purposes. Used machinery, however, is not exempt from import duties but can still be counted as investment capital when calculating CIT, provided that the machinery’s manufacturing year does not exceed 10 years.

Dimerco has supported numerous manufacturers in relocating operations, providing end-to-end services such as HS code classification, BOI documentation, customs coordination, and shipment scheduling. For instance, an automotive parts supplier for BYD engaged with Dimerco Thailand to relocate its facility from Xiamen to Thailand. The project aimed to enhance supply chain resilience and reduce costs. Dimerco Thailand guided the BOI application process, managed import documentation for used machinery, and coordinated vessel schedules to meet critical timelines.

The Philippines

Under the Special Economic Zone Act of 1995 (RA 7916), the Philippines Economic Zone Authority (PEZA) can grant incentives to registered projects or activities with investment capital of P1 Billion (USD 17 million) and below. These incentives include tax holidays, special corporate income tax (CIT), or enhanced CIT deductions.

Income Tax Holidays

Export enterprises may be granted an Income Tax Holiday (ITH) of four (4) to seven (7) years depending on the location and industry priorities. After ITH, export enterprises can take advantage of a 5% Special Corporate Income Tax (SCIT) OR Enhanced Deductions (ED) for 10 years. Below are the tiers that determine the eligible incentives.

- TIER I – Activities that have strong job-creation potential, address market failures, foster value creation through innovation and upgrading, support key industries essential for industrial development, and offer promising comparative advantages.

- TIER II – Activities that manufacture essential supplies, parts, components, and intermediate services unavailable locally but vital for industrial growth, including import-substituting operations such as crude oil refining.

- TIER III: Activities include research and development that deliver significant value-added outcomes, boost productivity and efficiency, drive breakthroughs in science and health, and create high-paying jobs; generation of new knowledge and intellectual property that is registered or licensed in the Philippines; commercialization of patents, industrial designs, copyrights, and utility models owned or co-owned by registered business enterprises; highly technical manufacturing; and activities critical to the structural transformation of the economy that require substantial catch-up efforts.

| Industries | TIER I | TIER II | TIER III |

|---|---|---|---|

| National Capital Region (NCR) | 4 Years of ITH + 10 Years of SCIT or ED | 5 Years of ITH + 10 Years of SCIT or ED | 6 Years of ITH + 10 Years of SCIT or ED |

| Metropolitan areas or areas contiguous and adjacent to NCR | 5 Years of ITH + 10 Years of SCIT or ED | 6 Years of ITH + 10 Years of SCIT or ED | 7 Years of ITH + 10 Years of SCIT or ED |

| Other Areas | 6 Years of ITH + 10 Years of SCIT or ED | 7 Years of ITH + 10 Years of SCIT or ED | 7 Years of ITH + 10 Years of SCIT or ED |

Import Duty and VAT Exemptions

Companies are granted tax- and duty-free importation of capital equipment, raw materials, spare parts, and accessories. Companies also receive VAT exemption on imports and VAT zero-rating on local purchases of goods and services used directly and exclusively in the registered project or export enterprise throughout the registration period.

Malaysia

Malaysia offers a mix of direct and indirect tax incentives through key schemes administered by the Malaysian Investment Development Authority (MIDA). A reliable freight forwarder helps manufacturers identify the best incentive scheme and secure the proper approvals.

Corporate Income Tax Incentive

There are two main incentive schemes available for manufacturing sector: Pioneer Status (PS) and the Investment Tax Allowance (ITA).

- Pioneer Status (PS): Qualifying companies enjoy a 70% exemption on statutory income for 5 years, paying tax only on the remaining 30%. The exemption period commences from its Production Day (defined as the day production levels reach 30% of capacity or first invoice).

- Investment Tax Allowance (ITA): Companies can deduct 60% of qualifying capital expenditure from statutory income over 5 years. The allowance offsets up to 70% of statutory income, with unused allowances carried forward indefinitely.

Import Duties and Sales Tax Exemptions

Manufacturers operating in Malaysia’s Principal Customs Area (PCA), which covers all areas outside designated Free Zones, can claim import duty and/or sales tax exemptions on machinery, equipment, and spare parts. These benefits, granted under the Customs Duties (Exemption) Order 2017 and the Sales Tax (Persons Exempted from Payment of Tax) Order 2018, can be accessed through a self-declaration process.

An IT infrastructure manufacturer planned to relocate its production from Singapore to Malaysia, a complex 48-week project requiring careful coordination of both equipment movement and customs compliance. Dimerco provided end-to-end support, managing the physical transfer while securing import duty exemptions to reduce costs and streamline the process. As a result, the project was completed in just 36 weeks, 12 weeks ahead of schedule, delivering both time and cost savings.

Indonesia

Corporate Income Tax Holiday

Under the amended PMK-69/2024, Indonesia offers attractive tax holidays for priority industry investments. Projects of IDR 100–500 billion receive a 50% corporate income tax reduction for five years, while investments of IDR 500 billion or more qualify for a 100% exemption lasting up to twenty years. After the main period, companies can enjoy an additional two years at 50% for larger investments above IDR 500 billion and 25% for smaller ones.

| Investment Value | Tax Holiday Duration | Tax Exemption |

|---|---|---|

| IDR 100M – 500B (USD 6 to 30M) | 5 Years | 50% |

| IDR 500B to IDR 1T (USD 30 to 60M) | 5 years | 100% |

| IDR 1T to IDR 5T (USD 60M to 300M) | 7 years | 100% |

| IDR 5T to IDR 15T (USD 300M to 900M) | 10 years | 100% |

| IDR 15T to IDR 30T (USD 900M to 1.6B) | 15 years | 100% |

| M – Million | B – Billion | T – Trillion | ||

Special Economic Zones

Special Economic Zones (Kawasan Ekonomi Khusus or KEKs) in Indonesia are designated areas established to promote economic development by offering various incentives to investors. These zones are strategically located across the country and are aimed at fostering industrial growth, attracting foreign and domestic investments, and creating employment opportunities. Each KEK is tailored to specific sectors such as manufacturing, logistics, tourism, and renewable energy.

Depending on the investment size, companies can enjoy income tax holidays of 10–20 years. For investments exceeding 100 billion rupiah (US $7 million), the incentives become even more attractive, including:

- 30% net income reduction on total fixed asset investments, applied over six years

- Up to 100% accelerated depreciation for both tangible and intangible assets

- Lower dividend withholding tax—just 10% or the applicable treaty rate, whichever is lower

- Extended tax loss carry-forward for up to 10 years

These incentives are designed to enhance returns, reduce operational costs, and strengthen long-term competitiveness for businesses in KEK zones. Below is a map showing the KEK zones:

Import Exemptions

Import duties, import taxes, and excise duties are fully exempted for capital goods used in SEZ construction or development (for five years), for consumable raw materials used in service industries within tourism SEZs, and for goods intended for sale in shops or shopping centers within tourism SEZs.

Preferential Treatment via Free Trade Agreements

One of the most effective ways to reduce import duties is through Free Trade Agreements (FTAs). Many Asia Pacific countries participate in FTAs that allow reduced or even zero duties, provided that proper documentation like the Certificate of Origin (CO) is submitted during import customs clearance. Each FTA has its own form type to be submitted to the customs authority. Examples include:

- Form E for trade between China and ASEAN (ACFTA)

- Form D for trade within ASEAN (AFTA)

However, in order to enjoy the preferential tax treatment, is important to get the Country of Origin Right (COO) right. The COO is not always the country from which the finished product ships. For example, a consumer goods brand imported stainless steel pans and lids from China into Vietnam, then attached plastic handles in Vietnam before exporting the completed cookware sets. The company listed Vietnam as the COO, but the Court of International Trade later ruled that, since the essential character of the product remained unchanged, the COO was still China. Don’t make assumptions on issues like country of origin. Get advice from qualified trade compliance experts. Learn more about Certificate of Origin in ASEAN here.

Leveraging Preferential Tax Policies

The wide range of preferential tax policies across Southeast Asia demonstrates the region’s commitment to attracting foreign investment and strengthening its role in global supply chains. While these incentives offer significant savings, they also come with complex rules and strict compliance requirements. Companies can gain a competitive edge by leveraging trade compliance consulting services to ensure they qualify for incentives, reduce risks, and streamline customs processes. With expert guidance from experienced logistics partners such as Dimerco, businesses can confidently expand into Southeast Asia and unlock the full benefits of its preferential tax policies. Looking to leverage preferential tax policies in Southeast Asia? Start a discussion with us.