Home »

Aerospace Logistics in a VUCA Era

Contents

Logistics advice

Aerospace industry

Challenge 1:How to avoid punishing tariffs

Challenge 2:How to maintain reliable supply lines

Challenge 3:How to expand to China

Challenge 4:How to maintain precise delivery schedules

Challenge 5:How to create a agile and resilient supply chain

Challenge 6:How to support longer aircraft life cycles

Challenge 7:How to manage effective and efficient air freight operations

- Why is air freight so important in aerospace logistics?

- Helpful tips to improve speed, reliability and efficiency

Challenge 8:How to ship oversized aerospace components

- Why is shipping out-of-gauge (OOG) aircraft parts such a challenge?

- Moving helicopters from Italy to Indonesia

- Tips to minimize shipping problems with big parts

Challenge 9:How to identify the right logistics partner

Logistics Partners can be your “on switch”

Logistics advice to help aerospace suppliers survive and thrive in an era of Volatility, Uncertainty, Complexity, and Ambiguity

The aerospace industry continues to suffer from a collective case of PCSD – post-COVID stress disorder.

The most alarming symptom is the current eight-year backlog on new airplane orders. When orders tanked during COVID, the ripple effect on suppliers was devastating. To stay afloat, many shifted to serve other industries. The process of replacing them has been long and painful due to the strict certification requirements for aerospace suppliers.

For the component parts suppliers that remain, there is intense pressure to ramp up production and improve logistics to ensure reliable, predictable delivery. That pressure is intensified by a whole set of other challenges, including raw material shortages, labor shortages, tariff wars, actual wars, and OEM-driven sustainability mandates. Many suggest these aerospace supply chain challenges are not transitory but more the new normal in an era characterized by Volatility, Uncertainty, Complexity, and Ambiguity – or VUCA.

Commenting at a meeting of the International Aviation SME Solution of China (IASC), Christoph Schrempp, General Manager of Airbus’s Tianjin Delivery Center, said “The degree of unpredictability faced by the aerospace industry today may surpass anything we’ve experienced before.”

This eBook is a collaboration between IASC and Dimerco Express Group, a leading global provider of logistics services to aerospace companies. Based on conversations with dozens of aerospace supply chain executives, the eBook outlines the biggest supply chain challenges OEMs and suppliers tell us they face, and how to solve them.

Download Guide

If you prefer to download this article as a PDF, just complete the form. Otherwise, keep reading.

Challenge 1:How to avoid punishing tariffs while staying compliant with trade regulations

Aerospace suppliers are not immune to trade tensions, particularly between the U.S. and China. To stay price-competitive, many are looking to diversify production and/or distribution to “tariff-friendly” countries.

But be careful here. Moving production from China to Southeast Asia, for instance, doesn’t necessarily eliminate the tariff. Ultimately, customs agencies like Customs and Border Protection (CBP) in the U.S., have their own ways to determine Country of Origin and whether products are eligible for favorable tax treatment.

One large industrial machinery manufacturer is now shifting some of the company’s manufacturing from China to Southeast Asia. According to the company’s logistics director, “It’s essential to have a firm grasp of how Country of Origin is determined to ensure full compliance before moving forward.”

When a product and all its sub-components come from a single country, then the Country of Origin issue is clear. But if you are assembling a product in Malaysia, for instance, made-up of parts from China, the principle of “substantial transformation” is used to determine Country of Origin.

According to the International Trade Administration, that means the product “underwent a fundamental change in form, appearance, nature, and character.” Let’s examine a couple of hypothetical examples to illustrate the principle of substantial transformation.

- If multiple components of a bicycle (wheels, handlebars, pedals, etc) were all made in China and shipped to Mexico for final assembly, the Country of Origin would be China since the product’s character did not change.

- If fabric, buttons, and zippers coming from countries A, B, and C are used to create a jacket in country D, the level of transformation would establish country D as the Country of Origin.

BOTTOM LINE

Country of Origin determination is a gray area. Aerospace suppliers should seek advice from trade compliance experts, starting with your customs broker and freight forwarder, to ensure any planned relocation strategy passes muster with relevant customs authorities.

Challenge 2:How to maintain reliable supply lines when relocating to new markets

The global aviation production and supply map is undergoing a massive shift. A supply chain that used to be concentrated in North America and Europe today sees heavy concentrations of OEMs and suppliers in China and throughout Asia.

What’s behind this shift?

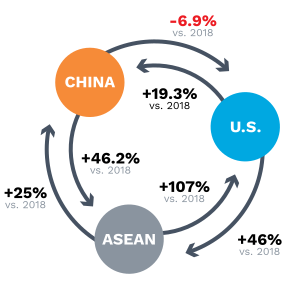

For one, the changing aerospace supply chain reflects broad global trade patterns as noted in the accompanying chart. China’s exports to the U.S. were down 7% from 2018 to 2023, while intra-Asia trade is growing. The trends shown are expected to continue.

5 Year Trend of Global Trade Patterns

Source:UN Comtrade, Huatai Securities

Aerospace companies are establishing operations in China to capitalize on the rapid growth of the country’s civil aviation market. But, as part of a China Plus One strategy, many are expanding beyond China into Southeast Asia and India to reduce costs, enhance supply chain resilience, avoid tariffs – or all the above. Procurement teams are also chasing resilience by diversifying the supplier base.

Ludovic Boisrame, Group Director of Asia Supply Chain Development for Safran Group, says “Dual sourcing creates a more resilient supply chain in the event of disruptions.”

Whatever the reason, expanding aerospace operations to new countries has massive logistics implications. Without proper foresight and planning, these logistical challenges can undermine the hoped-for benefits of expansion.

Critical questions to ask prior to expansion:

- Is there sufficient freight capacity to ship in and out of the new market? Freight-related delays are unacceptable in today’s backlogged aerospace supply chains.

- What are the transit-time impacts? For critical parts that move via air, shipments to the U.S. that took two days from Hong Kong will take four days from Bangkok, to take one example.

- How will customs processes and costs change? Each country has unique requirements for customs documentation, clearance and tariffs.

Read the eBook “The Logistics of China +1” for a detailed look at this issue.

BOTTOM LINE

When establishing operations in a new country, work with a logistics partner that not only understands the aerospace supply chain, but also understands the local market and can provide expert guidance on shipping, warehousing and customs clearance.

Challenge 3:How to expand to China

Nowhere is the appetite for new planes bigger than in China, which will account for 22% of global demand over the next 20 years, according to a Airbus Global Market Forecast.

That’s why expansion to China is high on the priority list of every growth-oriented aerospace supplier.

Another reason is the Commercial Aircraft Corporation of China (COMAC) – a state-owned airplane manufacturer formed in 2008 that is growing fast through market demand for its aircraft, as well as cooperative agreements with Boeing and other OEMs to help build their planes in China. Suppliers not working with COMAC today view it as an important relationship to develop.

But capitalizing on the growth potential in China is tough for suppliers not located in the country, where there is a real emphasis on localized supply chains.

“Building a more localized supplier base in China will result in a more sustainable, more resilient Airbus supply chain,” says Alexis Gonzalez Chiappe, Head of Procurement at Airbus China. “The company’s goal is to have all necessary parts sourced as close as possible to their production sites.”

The ingredients are in place for an aerospace supplier to successfully expand to China, but quality-obsessed OEMs and Tier 1 suppliers are cautious of new component suppliers. To even get on their radar screens, suppliers must complete rigorous certification requirements – a process that can take many years.

Niklas Schilling, Manager International Affairs for Hamburg Aviation, says “Suppliers that do not currently operate in China face challenges like language, culture, and regulatory differences.”

IASC is one resource to lean on, since its mission is to help SMEs grow in the China market. Another path to entering the China market is through your local aerospace cluster – a group of aerospace-focused OEMs, suppliers and service companies that collaborate for mutual benefit. You may need to do some digging to identify the cluster nearest you, but clusters can be found wherever there is a concentration of aerospace-related manufacturing.

“Clusters provide a forum to forge new relationships and help SMEs expand their markets,” says Schilling. “There’s no ‘easy card’ when it comes to breaking into the China market, but clusters can help.”

BOTTOM LINE

When it comes to establishing operations in China, it’s not just what you know, it’s who you know.

Clearing aerospace products through China customs: Understanding HS Codes

Speed is paramount in the aerospace supply chain and customs delays in China can jeopardize your delivery promises. If you’re unfamiliar with the strict procedures of China Customs, it’s best to partner with a forwarder and broker that understand the China market and work with China Customs daily.

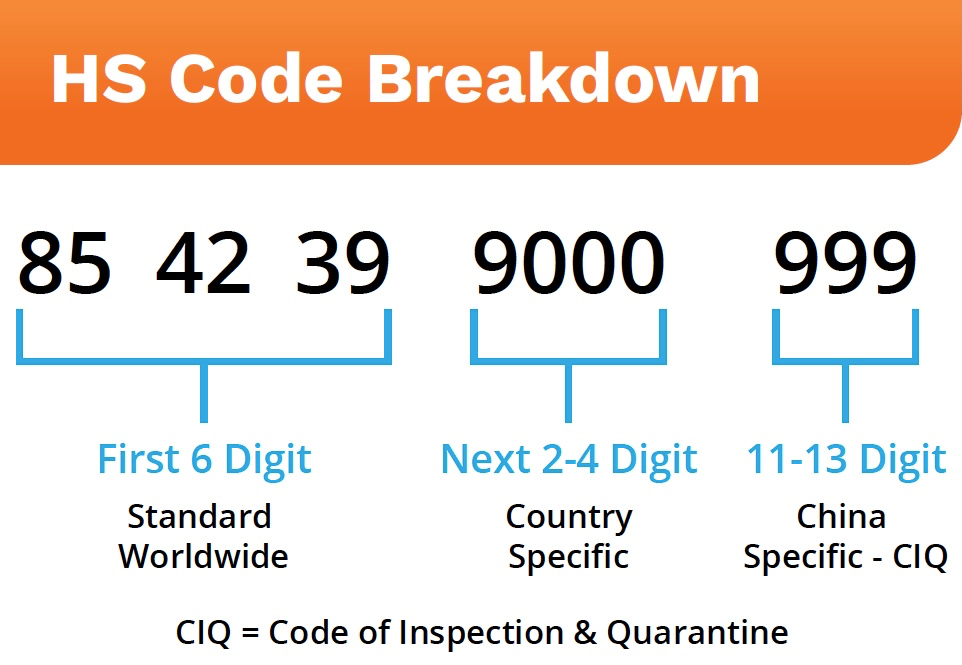

One critical aspect of clearing China Customs quickly is selecting the correct Harmonized System, code (HS code), which classifies the type of product it is and helps to determine the duty, tax rate and other potential government fees.

Almost all countries follow a worldwide standard that classifies goods with a 6-digit code. Most countries add 2 or 4 extra numbers to the HS code for further clarification of commodity type. In 2018, China increased the total number of digits in its commodity code to 13. (See the accompanying diagram to see what HS code numbers represent in China). This makes classification more specific, but creates a greater potential for misclassification and questions from customs officials.

Thomas Dorn, CEO of Asia for adhesive film manufacturer, Adhetec, says “When you import products into China, the HS code is slightly different. You need to know how to switch the code from Europe to its China equivalent or it can slow you down.”

Questions about HS codes are just one of the things that might trigger a customs inspection. Here are tips for a fast, smooth clearance process in China.

- Work with an AEO-certified forwarder. The Authorized Economic Operator (AEO) program was developed by the World Customs Organization to promote and secure global trade. It allows Customs authorities to quickly identify operators who meet rigorous standards for supply chain integrity. In China, forwarders with the highest level of AEO status can cut clearance time as much as one full workday.

- Work with an air freight forwarder approved to process ULDs near the port of entry. Manpower shortages at airport terminals in China can add many days to the clearance process for air freight. You can avoid such delays by working with a forwarder that is approved by China Customs to receive air freight containers or pallets at a bonded warehouse located in a Customs-supervised restricted zone near the destination airport

- Go paperless. A simple data entry mistake can hold up your aerospace shipment for days. Using optical character recognition, the right forwarder can help you eliminate manual transfer of customs-related data to save time and avoid errors.

Challenge 4:How to maintain precise delivery schedules for global transport

100% of commercial aircraft are comprised of parts made by companies other than Boeing, Airbus, and other aircraft manufacturers. As such, production schedules for new aircraft are at the mercy of thousands of inbound supply chains involving primary, secondary, and tertiary suppliers. One disruption anywhere along the chain can halt production lines, trigger fines, and anger customers.

Not pretty.

Aerospace production schedules are so tight that today there’s no margin for error, says Philippe Mechin, Sales Director within Eaton’s Asia-Pacific Interconnect Technology Division. “The environment is different since COVID,” he says. “Delivery networks must run like clockwork.”

But when it comes to those delivery schedules, perfection is a pipe dream. There are so many variables – weather, port slowdowns, carrier delays – that supply chain disruptions are inevitable. The only thing you can plan for is how you manage those disruptions. Your ability in that regard is tied to the quality and characteristics of your primary freight forwarders.

Here’s what you should demand from these forwarders:

- 24/7/365 availability to troubleshoot problems – from a live human being with the knowledge and power to address the issue

- ISO-certified, process-driven operations

- Smart visibility systems that proactively alert you to exceptions

- Customs brokerage expertise to enable fast, smooth clearance

- Agile, multi-mode transport to support any level of service, from efficient ocean transport to next-flight-out and same-day delivery for AOG

- A flexible culture where your assigned team members at the 3PL are empowered to act swiftly and decisively, without a long approval chain

BOTTOM LINE

To ensure consistently reliable shipping performance in an industry where disruptions are common, you need a 3PL partner that understands the aerospace industry and thinks and acts like a member of your team.

Challenge 5:How to create a supply chain that is agile and resilient

COVID shocked aerospace companies into the realization that supply chain agility is not just a nice to have, but a business imperative.

“COVID made timely delivery so difficult, we now invest considerable time thinking about how to sustain delivery performance in the face of a similar disruption,” says Eaton’s Sales Director, Mechin.

The words agile and resilient often refer to a character trait you can activate in response to a challenge. But when it comes to aerospace supply chains, agility is the result of a long and carefully planned journey that can take many years.

Supplier sourcing is a good example. If a key supplier cannot meet production quotas, you can’t simply call another supplier to pick up the shortfall. It can take many years for suppliers to earn the requisite certifications to qualify as an approved supplier. That’s why dual sourcing was an obsessive focus for almost all the OEMs and major component manufacturers we spoke with for this eBook.

Safran Group’s Ludovic Boisrame, believes the primary challenge in today’s aerospace supply chains is building resilience. “Safran has adopted a dual-source strategy for critical components,” he says. “Each part must have at least two suppliers, preferably in different countries.”

As companies build out their supplier networks, they can’t ignore the logistics implications. To maintain agility and resilience as your supplier base expands, it helps to forge a strategic relationship with a global logistics company. The right partner can help you:

- Access its existing warehouses, avoiding the need for your team to locate and lease space

- Identify the optimal location for a new warehouse

- Ensure you can get the freight capacity you need on a critical new lane

- Handle expedited shipments when delivery deadlines are in jeopardy

3PLs can be a key enabler of greater supply chain agility.

BOTTOM LINE

Agility is not only a behavior; it is a business capability that is both intentional and well planned. How agile and resilient your aerospace supply chain is five years from now will depend on decisions you make today.

Challenge 6:How to support longer aircraft life cycles with efficient MRO operations

There is heightened interest in aircraft maintenance and repair operations (MRO). The primary reason: an eight-year wait for new airplanes increases reliance on the existing fleet.

“Aircraft can have a lifespan of 25 – 30 years,” says Mike Xu, COO of Embraer China. “But many aircraft are retired from the passenger market after just 20 years operation in China. There are still a lot of potential life cycles to be used.

Even with the current backlog for new aircraft, the global fleet of aircraft is expected to rise from 28,398 in 2024 to 35,413 in 2034 (Statista), an increase of 25%. That calls for more MRO facilities with expanded capabilities.

The challenge of expanding and improving MRO operations is most acute in Asia-Pac, home to many of the fastest growing MRO hubs. In China, in particular, double-digit growth is expected in the coming years. That’s more than double the average global growth rate for MRO of 5%, according to MRO operations expert, Yang Suili, Chairman of FL ARI Aircraft Maintenance & Engineering.

With the rapid expansion of fleets in Asia and the Pacific Rim, Southeast Asia has also become a magnet for MRO activity. A 6% growth rate through 2029 will create a USD $7.12 billion market across this region (Mordor Intelligence).

One of the challenges of increased MRO operations in Asia is ensuring your logistics capabilities are adequate to support them. Dimerco has seen increased interest in its MRO logistics services based on the company’s 130 locations across Asia, its strong local market knowledge across China and Southeast Asia, and its strategic focus on time-critical freight deliveries.

Look for an MRO logistics partner that can help you:

- Respond to the need. That requires 24/7/365 service, globally. When the phone rings or pings, someone needs to respond – someone with the ability to take action on AOG or other critical needs.

- Get it there on time. That requires a forwarding partner that operates a global shipping network, with direct offices at your key origin and destination points.

- Tell you where it is. That requires tracking systems to monitor progress and update that progress on a convenient web portal.

BOTTOM LINE

The next decade will see many more planes in the air, including more older aircraft, elevating the importance of reliable MRO operations to an aerospace company’s success.

Challenge 7:How to manage effective and efficient air freight operations

Air cargo accounts for less than 1% of global freight by volume, but about 35% by product value (IATA). In the aerospace industry, air freight is far more strategically important than in most other industries.

Tier 1 aerospace supplier, Eaton, ships most of its high-value cargo via air rather than wait for over a month for it to arrive on the water. “Customers like the air service due to the speed,” says Eaton APAC Sales Director, Philippe Mechin. “Even though the shipping cost is much higher, this cost is still a very small percentage of the value of the cargo.”

Dimerco sees that same situation in other industries with high-value cargo. For instance, our average air freight shipment of semiconductor capital equipment is anywhere from 18 to 30 crates, with an equipment value between USD $5–$7 million. The delivery window for these shipments, even for transcontinental routes, is four hours. The aerospace sector adheres to similarly exacting requirements.

Why is air freight so important in aerospace logistics?

Aerospace supply chains are global, with thousands of parts, assemblies and components sourced from all corners of the globe. Delays in one region can create ripple effects, impacting production schedules in other regions and causing cascading delays. Air freight is critical to reducing lead times in these vulnerable supply chains.

“I have contracts with Embraer customers that, if I do not meet my delivery commitment on an AOG situation, I am penalized,” says Mike XU, CEO of the company’s China business unit. “It’s critical for us to have reliable 3PL partners experienced with urgent global shipments. The stakes are high.”

Helpful tips to improve speed, reliability and efficiency

- Establish strategic relationships with shipping partners. The more your forwarders and freight brokers know about your business and its unique shipping challenges, the better they’ll be able to align all stakeholders – suppliers, airlines, customs authorities, 3PLs – around your timeline, handling requirements, and special circumstances.

- Get customs details right. Why pay big money to ship cargo halfway around the world in a day only to have it sit at the airport for two days due to a customs delay? Find a broker to ensure that required documentation is accurately prepared. It can help if your freight forwarder also provides customs brokerage and trade compliance advisory services.

- Work with a freight forwarder that has a global shipping network. Coordination is easier when offices at origin and destination work on the same system following the same global SOP.

- Work with a partner that offers every level of service. Delivery speed is a priority in aerospace logistics, but cost is always a consideration. You’ll pay the most for express cargo, but if your customer is OK waiting several extra days for deferred air service you can save 10 to 30%. For a large aerospace supplier with an air freight budget of USD $30 million, the math gets pretty compelling.

BOTTOM LINE

Work with an air freight shipping partner that makes its living managing high-stakes, time-defined deliveries.

Challenge 8:How to ship oversized aerospace components

A Boeing 787 is made up of millions of parts. Almost all are fasteners and other easily “ship-able” components. But a handful of oversized components – including the really important stuff…. engines, fuselages, wings, landing gear – present unique shipping challenges.

“Some of our parts are very large, oddly shaped and require customized packing,” says Emrys Quan, Head of Civil Aviation at Hunan Xiangtou Goldsky Titanium Metal Co.,Ltd. “Frankly, not a lot of logistics providers have the specialized knowledge to do this well.”

Why is shipping out-of-gauge (OOG) aircraft parts such a challenge?

- Size and weight restrictions preclude the use of standard shipping containers and air cargo holds. This requires the use of specialized equipment that is not always readily available.

- Complex routing and logistics. Shipping oversized loads over the road could involve detours or road closures, and these large parts may require permits, escorts, or other special considerations from local authorities.

- Air transport limitations. If the cargo needs to move by air, only a few aircraft, such as Antonov An-124 or Boeing 747-8F, have the capability to carry exceptionally large and heavy aircraft components.

- Fragility and sensitivity. Many oversized aerospace parts, such as avionics, landing gear, or composite components, require temperature, humidity, and shock controls to prevent in-transit damage.

- Regulatory compliance and documentation. The bigger and more expensive the part, the more likely it is to attract the attention of customs officials.

Moving helicopters from Italy to Indonesia

For a leading aerospace manufacturer, Dimerco managed the successful and cost-effective shipment of 11 Leonardo helicopters from Italy to Indonesia. The Dimerco team in Jakarta helped manage the end-to-end process that included customized protection and last-mile delivery from port to customer. Dimerco’s helicopter logistics team carefully planned out a safe, compliant route from the port to the final destination. Unloading required 2 cranes, 2 forklifts, and 3 special nine-meter dollies. In addition, Dimerco arranged for a certified lashing company to make 2 customized wing boxes to ensure secure carriage.

Tips to minimize shipping problems with big parts

If shipping oversized parts to meet strict customer delivery dates is a challenge for you, here are some tips for getting it right.

- Choose your shipping partner wisely. Not all can do the pre-planning and detailed coordination required for these aerospace OOG delivery projects.

- Real-time tracking and monitoring. Leverage GPS tracking, RFID, or IoT-enabled devices to monitor the cargo’s location and condition throughout the journey. This allows your logistics team to identify potential issues, such as delays and route diversions, before they escalate.

- Think compliance first. To avoid delays, it’s essential to have in-depth knowledge of the regulatory requirements for your oversized cargo. Do your homework early and complete necessary documentation in advance.

BOTTOM LINE

Just because you can drive a Mercedes-Benz sedan doesn’t mean you can drive an 18-wheeler. Likewise, not all freight forwarders and 3PLs have the experience and training to handle shipping of oversized and delicate aerospace components.

Challenge 9:How to identify the right logistics partner to create supply chain resilience in a VUCA era

For each of the prominent supply chain executives at aerospace companies we spoke to in preparation for writing this eBook, we ended each conversation with this question: “What do you most need from a logistics partner?” Here are their answers, in rank order, with representative comments from executives.

1. Reliable Service

- “Price is always an issue, but service reliability and trustworthiness are paramount.” – Philippe Mechin, APAC Sales Director at Eaton

- “Each month we look at the on-time delivery rates for our logistics partners. For every failure, we want to know why.” – Mike Xu, CEO of Embraer China

2. Strong global delivery network

- “The short-haul shipment is easier, there are many options for trucking partners. But we typically would need 3PL partners with global network and industry expertise that can manage urgent, time-definite shipments.” – Charlie Jing, Vice President, Collins Aerospace China

- “My China 3PL providers are good, until we ask them to pick up in another country and have it delivered to our factory here in China. We benefit from 3PLs that are global and offer a seamless, door-to-door service for international transport.” – Ing. Thomas Dorn, CEO Asia, Adhetec

3. Flexibility

- “Today, aerospace companies must be agile in the face of unprecedented uncertainty. Change will happen, sometimes without warning, and reaction time must be swift. The right logistics partners can enable that level of agility.” – Christoph Schrempp, General Manager, Airbus Tianjin Delivery Center

- “The global flow of goods is not as seamless as it was before COVID. Having adaptable logistics partners is important.” – Ludovic Boisrame, Director of Asia Supply Chain Development, Safran Group

4. Customs Knowledge

- “As we diversify production to new countries, it’s helpful to have a logistics partner that can advise on issues such as local customs regulations, tariff implications, and even how Country of Origin is determined.” – Group Logistics Commissioner at a large, global industrial manufacturer

- “As several aviation supply chain companies expand into new markets, they often face challenges navigating complex regulatory and customs requirements. Partnering with experienced freight forwarders with deep trade compliance expertise can streamline operations, mitigate risks, and ensure smooth cross-border transactions.” – Andy Cheung, Founder, International Aviation SME Solution of China

5. Knowledge of the Aerospace Industry

- “We had one global shipment where there were probably 30 emails from the 3PL asking questions because they didn’t know our business. We can’t afford that kind of inefficiency.” – Philippe Mechin, Sales Director – Asia Pacific Interconnect Technology Division, Aerospace Group, Eaton

- “Procedural adherence is key for 3PLs that serve the aerospace industry. Quality management systems that relate to logistics and distribution in aerospace are ISO9001 and AS9120. There needs to be an SOP and it needs to be followed.” – Emrys Quan, Head of Civil Aviation Department, Hunan Xiangtou Goldsky Titanium Metal Co.

BOTTOM LINE

A few other key topics were noted, like the drive toward decarbonization and the desire to work with 3PLs that offer a broad suite of services. But these top five seem to be the hot button issues on 3PL selection for aerospace supply chain executives.

Logistics Partners can be your “on switch” for supply chain agility and resilience

In most markets, the winners are companies with either the best product, the lowest cost, or the best customer service.

Among aerospace suppliers, the winners will be those with the best supply chains. Specifically, companies that have built out:

- Reliable supply networks to meet production commitments to OEMs

- Global logistics operations that meet the rigorous delivery demands of the industry, while remaining highly agile in the face of constant change

Logistics partners – often thought of as commodity service providers – are anything but in an aerospace industry urgently playing catch-up after a COVID-induced downturn.

You need a partner that can manage your delivery network faster, with greater precision, in full compliance with customs and local regulations, and with complete visibility – all in an industry where constant change is the new normal.

The right 3PL can be your “on switch” for supply chain agility and resilience in this VUCA era. Choose wisely.