Importing goods into Thailand comes with various costs, and one of the most significant is import duty in Thailand. Businesses that trade internationally must understand how these duties are calculated and explore legal ways to reduce or defer them.

Whether you’re an importer looking to optimize costs or a business expanding into the Thai market, knowing how to navigate import duty in Thailand can provide a competitive edge. The issue of Thailand import duty rates has become more significant recently as increasing U.S. tariffs on China-made goods cause companies manufacturing there to look for more “tariff-friendly” alternatives in Southeast Asia and elsewhere. If you’re facing such a challenge, check out our eBook on The Logistics of China Plus One.

What Determines Thailand Import Duty Rates?

Understanding the factors that influence import duty in Thailand is crucial for businesses looking to manage costs effectively. By getting familiar with these factors, businesses can identify opportunities to lower import costs and ensure compliance with Thai customs regulations.

-

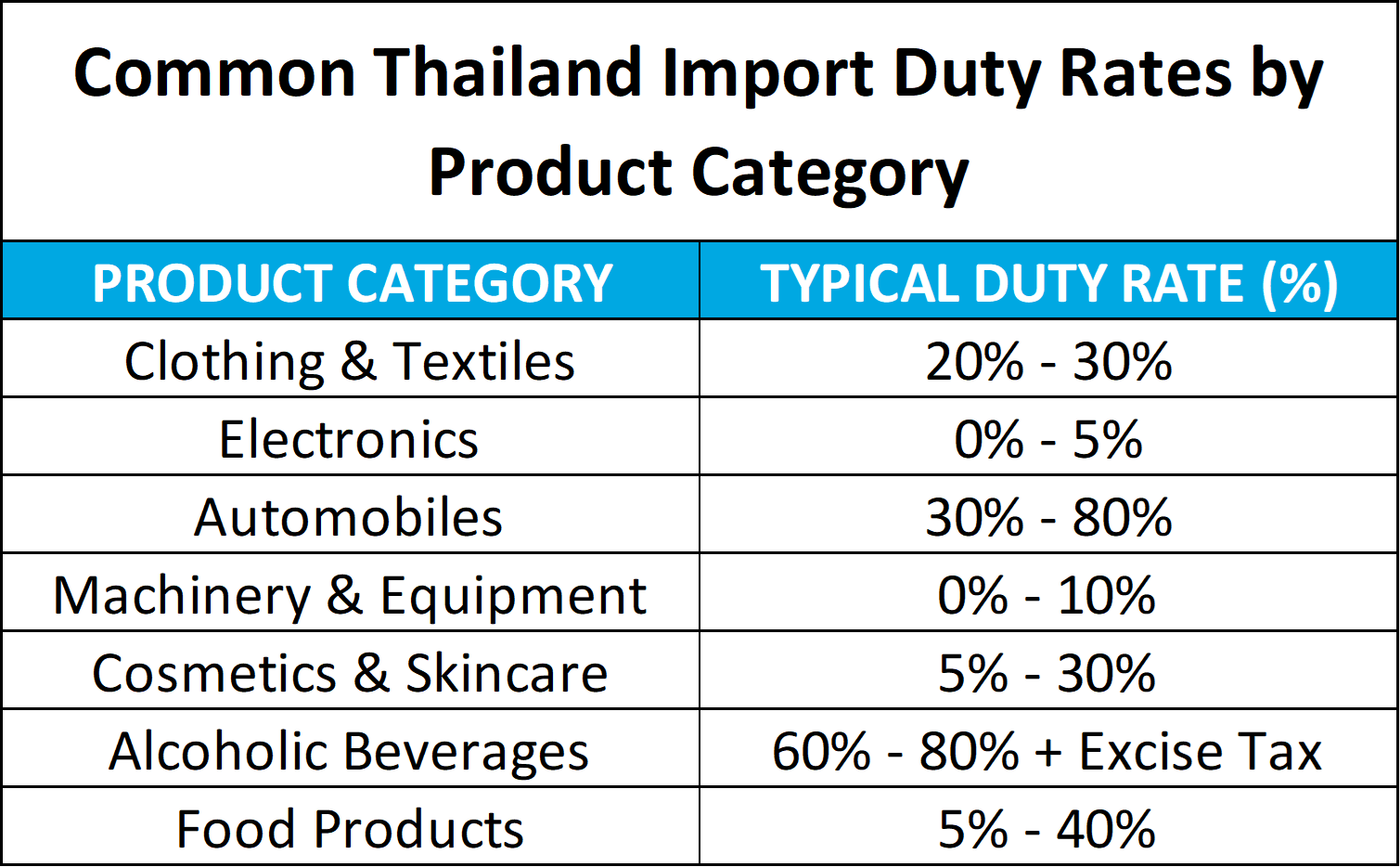

- Type of Goods – The Harmonized System (HS) Code classification dictates the applicable rate.

- Country of Origin – Trade agreements (e.g., ASEAN, FTAs) can reduce or exempt duties

- Tariff Schedule – Thailand’s Customs Tariff Decree outlines duty rates for different categories.

- Special Regulations & Exemptions – Some industries or goods may qualify for reduced duties, such as BOI incentives.

- Storage/Location – Storing goods in a bonded warehouse or free trade zone can help defer or avoid duties.

- Customs Valuation – Import duty in Thailand is typically calculated based on the CIF (Cost, Insurance, and Freight) value. The formula is: Import Duty = CIF Value × Duty Rate (%). For example, if a company imports clothing worth USD 10,000 at a 30% duty rate:

- Import Duty = USD 10,000 × 30% (3,000)

- Total Taxable Value = USD 10,000 + USD 3,000 (13,000)

- VAT (7%) = USD 13,000 × 7% = (910)

- Total Payable Taxes = USD 3,910

Strategies to Reduce or Defer Import Duties in Thailand

Many businesses struggle with high import costs, but Thailand offers various methods to reduce or defer Thailand import duties. Implementing these strategies can lead to significant cost savings and better financial planning.

-

- Customs Valuation Optimization – Businesses can reduce import duty in Thailand by properly classifying and valuing imported goods. For example, purchasing under FOB (Free on Board) terms instead of CIF terms ensures duties are only applied to the product cost, excluding shipping expenses.

- Duty Drawback Programs – If a company imports raw materials, manufactures products from these raw materials, and later exports them, it can apply for a duty refund. For example, a machinery manufacturer in Thailand importing steel can reclaim duties when exporting the finished goods.

- Free Trade Agreements (FTAs) – Thailand has Free Trade Agreements (FTAs) with ASEAN, China, Australia, and other countries. Importers can claim reduced or zero import duty in Thailand by obtaining a Certificate of Origin (COO) to prove goods meet FTA requirements.

- Free Zone Privileges – Companies can store imported goods in Free Zone areas and defer payment of import duties until the goods are used or sold. This reduces upfront costs, enhances cash flow, and provides businesses with greater flexibility in managing imports, making Free Zones an efficient and cost-effective solution.

- BOI Incentives and Special Exemptions – Thailand’s Board of Investment (BOI) offers tax incentives for businesses in export-oriented industries. Importing machinery and raw materials for production may qualify for Thailand import duty exemptions.

Thailand Trade Compliance and Risk Management

Ensuring compliance with Thai customs regulations is critical to avoid fines, shipment delays, and additional costs. Importers must be aware of common compliance pitfalls and take proactive steps to prevent regulatory issues. Proper documentation, accurate duty calculations, and adherence to customs policies are essential for smooth import operations.

Common mistakes that can lead to penalties include:

- Incorrect HS Code Classification – Leads to higher import duties or shipment delays.

- Undervaluation of Goods – Customs audits can result in fines and penalties.

- Incomplete Documentation – Missing invoices or certificates of origin can cause delays.

- Non-Compliance with FTAs – Claiming duty exemptions without proper documentation can lead to penalties.

- Failure to Pay Duties on Time – Late payments can result in fines or shipment holds.

- Not Adhering to Packaging and Labelling Regulations – Failure to comply with Thai labelling laws can lead to rejected shipments or fines.

- Inaccurate Weight or Quantity Declaration – Discrepancies in reported weight or quantity can trigger customs inspections and penalties.

To ensure compliance and a smooth customs clearance, It’s wise to work with a customs broker and freight forwarder in Thailand, Like Dimerco, that is intimately familiar with local regulations and customs procedures.

Case Study: How Dimerco Helped a Client Reduce Thailand Import Duties

A client importing goods from Sydney to Bangkok wanted to minimize import duty in Thailand. Dimerco advised using AANZFTA (ASEAN-Australia-New Zealand Free Trade Agreement), allowing the importer to claim reduced duty rates with a Certificate of Origin from Australia. While the client still had to pay the standard 7% VAT, they significantly reduced their costs for import duty in Thailand.

Recent Changes to Thailand’s Customs Policies

Thailand recently has implemented several notable updates to its customs policies, which importers should be aware of to stay compliant and optimize their operations:

-

- Ban on Plastic Waste Imports

Effective January 2025, Thailand introduced a ban on the importation of plastic waste to combat the growing issue of environmental pollution. - Tighter Controls on Low-Quality Imports

Since July 2024, Thailand has strengthened regulations and inspections to curb the influx of low-quality goods, particularly from China. This move has led to a 20% reduction in these imports. - Introduction of a 7% VAT on Low-Value Imports

Starting July 2024, Thailand applied a 7% Value-Added Tax (VAT) on imported goods valued under 1,500 baht (approximately $44).

- Ban on Plastic Waste Imports

Controlling Customs Import Duty in Thailand

Managing import duty regulations can be complex, but the right strategies can help businesses optimize costs and stay competitive. A logistics expert with experience in Thai customs can help businesses identify cost-saving opportunities, ensure compliance, and streamline the import process. For more insights on managing logistics and shipping needs in Thailand, be sure to check out our other blog Shipping to Thailand.

Are you looking for ways to reduce import costs and navigate customs more efficiently? Start a discussion with us today.