China is the European Union’s largest trading partner. Last year, more than USD $550 billion worth of goods made its way from China to Europe (Statista) – 20.5% of the EU’s total imports (Eurostat). The vast majority of that freight moved via ocean container. But a combination of factors has made China to Europe rail freight a viable alternative to ocean freight for this critical trade lane – in terms of speed, reliability, and even cost.

This article explores what’s driving a shift to rail shipping by China-based manufacturers.

Why the Increasing Use of Rail Freight from China to Europe?

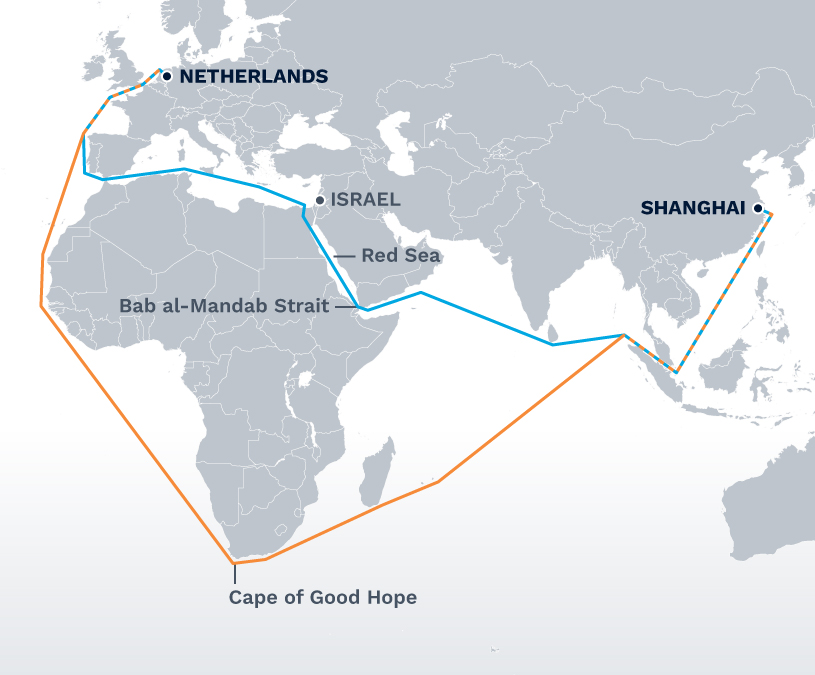

One key factor impacting the shift to rail freight from China to Europe is the continuing conflict in the Red Sea, causing steamship lines to reroute freight from the Suez Canal to around the Cape of Good Hope, and adding 8–12 days of ocean shipping time in the process.

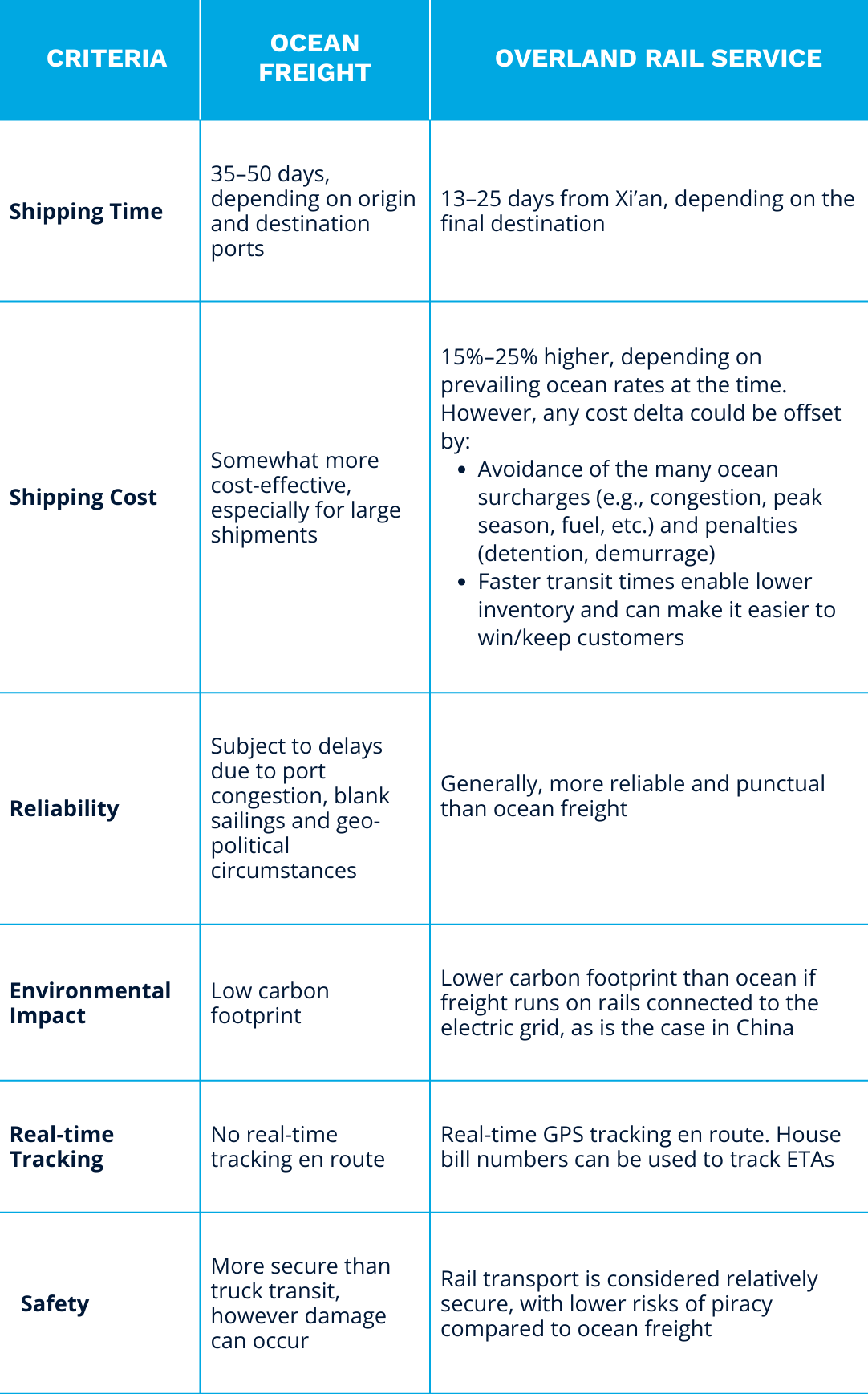

Depending on your specific origin and destination points in China and Europe, we estimate that a China to Europe rail service can deliver your freight in 13–25 days versus 35–50 days on the water.

This rerouting has also eliminated much of the cost advantage of sea freight over rail. The added sailing days have constrained container capacity, causing container rates to rise. Shipping on the water remains a bit cheaper than shipping by rail, but ocean shipping rates are far less predictable than rail due to seasonal fluctuations and other factors.

Here’s a broader comparison of rail vs ocean freight for the China to Europe shipping lane.

Shipping Goods from China to Europe

The main driver of rail freight’s popularity from China to Europe is the relatively faster speed and reliability that rail freight offers China-based manufacturers. Many of these companies are under pressure from European customers to meet specific delivery-time window.

We see that in the aerospace, solar, and electronics industries – and particularly in the automotive sector, as exemplified by the accompanying case study.

Key Auto Supplier Switches to China-to-Europe Rail Service; Reduces Freight Costs 10% and Transit Time by 45 Days

A key component supplier in the automotive industry relied on ocean shipping to supply European auto plants from its Chinese factories. But the Red Sea crisis delayed containers up to a month. This caused serious production line issues for customers, even causing one OEM to stop production due to lack of supply.

The parts supplier paid the price for missing ship-time commitments, being forced to pay delay compensation and absorb costly air freight shipments to replenish supply lines. This was not sustainable.

SOLUTION

The company collaborated with its freight forwarder, Dimerco Express Group, to shift most of its China to Europe freight from ocean to rail service – both FCL and LCL. As a result, transit times were reduced by 45 days and costs by 10%.

KEYS TO SUCCESS

- Shortened transit times. Dimerco’s excellent relationships with rail carriers helps secure the earliest available rail space. Additionally, efficient customs clearance and final delivery coordination ensures fast delivery, often the same day after arrival at the rail terminal.

- Track and Trace. Compared to container shipments, the customer gained more visibility to in-transit freight through GPS tracking.

- Multi-mode flexibility. Depending on the urgency of the shipment, Dimerco’s multi-mode shipping model routes certain critical freight via air, but only when required.

Door-to-Door Options for China to Europe Rail Freight

Shifting freight strategies from ocean to rail involves some coordination, but the right freight partner can make this seamless. You want a freight forwarder that can arrange door-to-door, global shipping from your factory to your customer’s dock – with little to no hands-on involvement from your team.

Dimerco’s solution, for instance, has four elements:

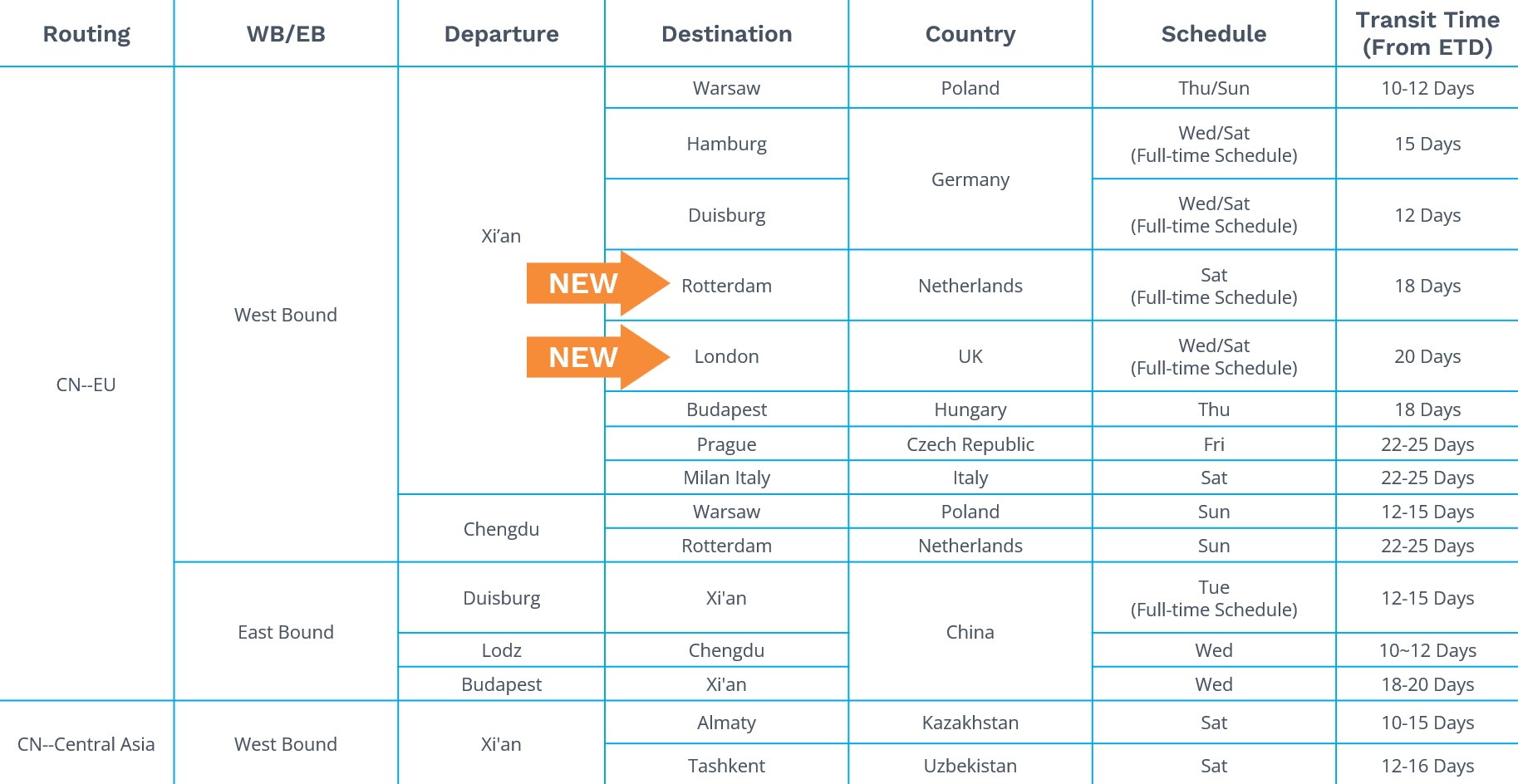

- INBOUND. A domestic trucking service in China picks up cargo from locations across the country and delivers it to the main origin train terminal in Xi’an. Rail origin points can also include Chengdu, Chongqing and Wuhan. Pick-ups include LCL freight for later consolidation at the rail terminal.

- NOTE: China to Europe rail freight shipments can also originate outside of Mainland China from Japan, Korea, Hong Kong, and Southeast Asia, with goods initially moving via ocean or air and eventually connecting to the rail terminal.

- WAREHOUSE CONSOLIDATION. Freight arrives at Dimerco’s consolidation warehouse at the Xi’an rail hub. Here, LCL freight is consolidated based on destination, which delivers significant savings for small-volume shippers.

- RAIL SERVICE. Dimerco offers reliable rail service into many cities in Eastern and Western Europe with good frequency.

- FINAL DECONSOLIDATION AND DELIVERY. Dimerco partners de-stuff containers at their warehouse near the destination port and then coordinate last-mile delivery to the consignee, with full visibility.

While almost all China to Europe rail freight terminates in Mainland Europe, Dimerco can arrange transit from China to the UK’s Felixstowe Port via multi-mode Rail-Sea service (40-ft containers only). The current transit time for this service is 28 days from Xi’an to Felixstowe.

Rail Freight from China to Europe: Worth a Closer Look

If freight modes were high school students, rail wouldn’t be the cool kid. Historically, rail freight has been viewed as less reliable and more the mode of choice for commodities like grain or coal or oil.

But that’s changing.

As global container shipping continues to be roiled by military conflicts, port disruptions, container capacity shortages, and other challenges, cross-border rail freight is emerging as a compelling alternative for China-based manufacturers that ship regularly to Europe.

Certainly, cross-border rail freight is not immune to the same challenges facing ocean freight. From China to Europe, for instance, the rail lines that move through Russia are unacceptable to most USA- and EU-headquartered companies due to the Russia/Ukraine war. Alternate routes via Central Asia work well, but transit times are longer. Dimerco now works with a large, global customer to move its goods from China to Europe via the Black Sea and the Caspian Sea to Poti, (Georgia) with a transfer from there to Istanbul, Turkey and then on to other points in Europe.

While these kinds of alternative routings are viable, the benefit that has attracted more businesses to consider rail is that China to Europe rail freight is 22–25 days faster than ocean freight and up to 30% cheaper than air freight.

For China-based manufacturers needing to ship into Europe efficiently with greater transit-time reliability, cross-border rail freight is worth a closer look. If you need help assessing whether rail freight from China to Europe makes sense for your business, contact the China to Europe rail specialists at Dimerco Express Group.