Launched in 2005, the European Union’s Emissions Trading System (ETS) stands out as a powerful initiative in the ongoing battle against climate change. Operating as a cap-and-trade system, this market-based approach is strategically designed to cut down on greenhouse gas (GHG) emissions, especially in sectors such as power generation and heavy industry. With ambitious targets of reducing GHG emissions by 55% by 2030 and achieving net-zero emissions by 2050, the EU ETS sets a high standard for environmental goals.

How does the EU ETS apply to the shipping industry?

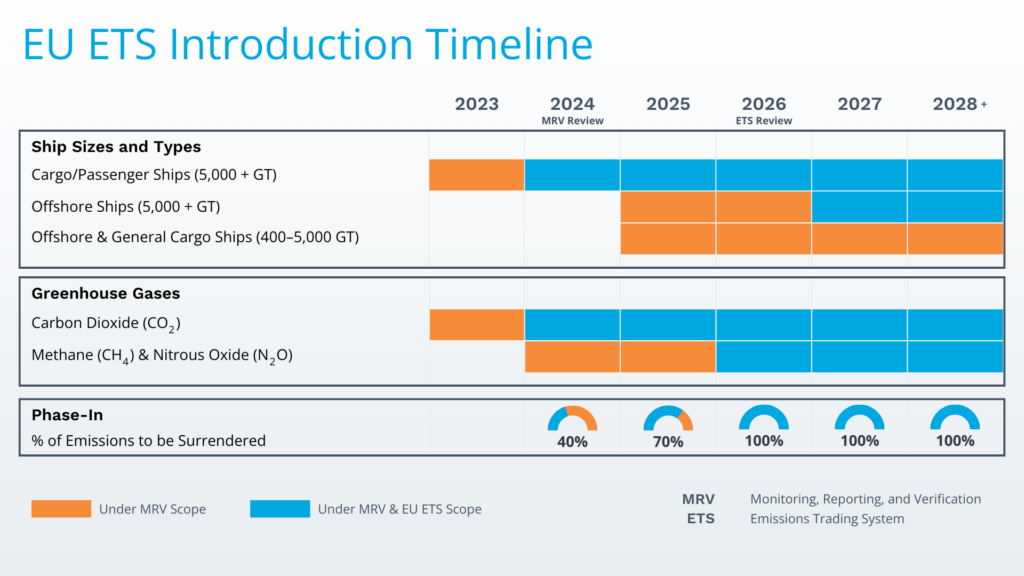

In a notable expansion, the EU ETS will extend its influence to the shipping sector, marking a significant step forward towards addressing emissions in additional industries. Starting January 1, 2024, the EU ETS will apply to all large ships (over 5,000 gross tonnage) entering EU ports, irrespective of their flag state. This means that shipping companies will be required to surrender emission allowances for a portion of their CO2 emissions generated during voyages to, from, or within EU ports.

The Basics of EU ETS:

In the maritime industry, the ETS operates as a cap-and-trade system, utilizing a predetermined emissions allowance for shipping companies. Simply put, these companies are assigned a restricted number of emissions they can generate. Within this cap, they retain the flexibility to either buy or sell allowances. This approach not only encourages meeting targets but also creates a sustainable and collaborative market, where businesses actively engage in the exchange of emission allowances.

The Monitoring, Reporting, and Verification (MRV) regulations ensure transparency through the THETIS-MRV platform, operated by the European Maritime Safety Agency (EMSA).

Non-compliance penalties further emphasize the weight of environmental responsibilities, with shipping companies facing penalties for excessive emissions and public disclosure of their non-compliance.

EU ETS for Shipping

Emission Coverage

The EU ETS will extend its purview to cover all large ships, above 5,000 gross tonnages:

- 100% of emissions from voyages between EU ports

- 100% of emissions from voyages that include a berthing at an EU port

- 50% of emissions from voyages that depart from an EU port to a non-EU port and vice versa

Phased Implementation

The EU ETS will be implemented in three phases:

- 2024: Shipping companies must submit allowances for 40% of their ETS-covered emissions.

- 2025: Shipping companies must submit allowances for 70% of their ETS-covered emissions.

- 2026 and beyond: Shipping companies must submit allowances for 100% of their ETS-covered emissions.

While the initial focus of the ETS is on carbon dioxide (CO2) emissions, the industry will witness an expanding scope as the system progressively includes methane (CH4) and nitrous oxide (N2O) emissions starting in 2026.

What Can Customers Expect

Shipping companies are now required to purchase European Union Allowances (EUAs) for each ton of carbon dioxide (CO2) they emit.

1 ton of reported CO2 = 1 European Union Allowance

The price of EUAs fluctuates on exchanges like ICE, EEX, and Nasdaq, and shipping companies are responsible for acquiring these allowances to cover their emissions. To ensure transparency and accountability, the emissions surcharge applied to customer shipping costs will be adjusted quarterly based on the average EUA price during the preceding quarter. This means that customers will directly experience the impact of fluctuating EUA prices on their shipping costs. However, by using a publicly available index for the emissions surcharge, customers will be kept informed about the factors influencing changes in their shipping costs.

Implications for the Shipping Industry

The inclusion of maritime emissions under the EU ETS brings a wave of implications for the shipping industry, sparking a strategic industry response to navigate the ensuing challenges.

- Increased Freight Rates & Unclear Rate Levels: Logistics providers can expect to see increases in freight rates as shipping companies factor in the cost of carbon allowances. This could impact the overall cost of goods and services transported by sea. On another note, different calculation methodologies used by carriers for ETS surcharges will create ambiguity in rate levels, making it difficult for shippers to track individual carrier charges accurately. This might create challenges for shippers in effectively tracking the “total ocean freight” rates paid to each carrier, hindering the implementation of optimal cost control measures.

- Consumer Impact: As shipping companies navigate the financial implications of the ETS, there is the potential for these increased costs to be passed on to consumers with higher retail prices.

- Route Optimization: Shipping companies and logistics providers will have to optimize their routes to minimize emissions and reduce their carbon footprint, which could lead to changes in shipping schedules and delivery times.

- Supply Chain Adaptation: The increased costs associated with emission allowances could lead to a reevaluation of global supply chain strategies. Companies might reassess sourcing locations and distribution networks to optimize costs and emissions.

- Investment in Cleaner Technologies: The pressure to reduce emissions could drive shipping companies and logistics providers to invest in cleaner technologies, such as alternative fuels or energy-efficient vessels. This could lead to long-term cost savings and environmental benefits.

- Adaptability and Innovation: Logistics companies will need to adapt their operations and embrace innovative solutions to navigate the changing landscape of maritime transport under the EU ETS. This could lead to new business models and partnerships.

In summary, the EU ETS for shipping will have a significant impact on the logistics industry, requiring companies to adapt their operations, manage costs, and invest in sustainable practices. The industry will need to be flexible and innovative to meet the challenges and opportunities presented by the transition to a low-carbon maritime sector.

If you’re fascinated by the topic of greenhouse gas emissions, read our most recent blog to learn how 3PLs play a pivotal role in helping companies to achieve their corporate GHG reduction targets, shaping a sustainable future for the shipping industry.