Over 1,000 American and Chinese companies have established the Netherlands as the hub for their Pan European logistics and product distribution. The reason: money. The country’s central location makes it Europe’s most economical transportation hub. And favorable trade policies allow importers to avoid payment of value added tax (VAT) upon import, greatly improving cash flow. Let’s look further into why your product distribution to European customers should move to and through the Netherlands.

Distribute Faster, For Less

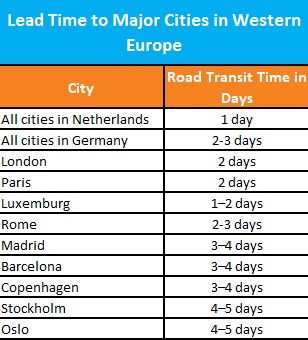

Transportation cost savings are the biggest reason to establish the Netherlands as your Pan European logistics hub. The country’s impressive port infrastructure includes the #1 container port in Europe in Rotterdam and the #3 cargo airport in Europe in Amsterdam (Schiphol). When it comes to final-mile delivery, a Netherlands DC gives you access to 244 million consumers within 1,000 kilometers (see chart on road freight transit times to major European cities). Other key facts:

- The Netherlands imports 4x more in value per capita than the other 2 top Western Europe countries, Germany and the UK.

- Germany, France and the UK can be reached in one day, with regular road freight.

- The Netherlands is the leading European location for distribution centers, including the 2nd-largest cooling and freezing storage capacity in the EU.

- Another factor that aids international trade is that the Dutch are a multi-lingual people. In addition to the native language, over 90% speak English and most are conversational in a third language.

Avoid VAT Payments to Improve Cash Flow

Normally when entering a foreign market, you have to pay taxes and duties to the tax authorities at the moment of clearance. But the Netherlands provides VAT deferment to improve cash flow.

Without this benefit, importers pay 21% VAT for non-food items, which is refunded at the end of the tax period. But this refund can take several months to more than a year. The Netherlands “VAT deferment” system, based on Article 23 of the Dutch Tax regulations, lets you defer paying VAT on imports until your periodic VAT return. At that time, VAT needs to be declared, but can be deducted in the same return, effectively avoiding the need to pay these taxes. That alone is a powerful reason to establish a Pan European logistics hub in the Netherlands.

This type of delayed accounting does not apply in other EU countries like Germany, Ireland, Italy, Spain and Sweden. Only Belgium provides a similar arrangement.

Establishing a local legal entity is not necessary when shipping goods to and through the Netherlands. Importers have the option to work with a fiscal representative that acts on behalf of the non-European shipper, clearing Customs and dealing with all VAT obligations (VAT declarations, listing and paying VAT). Dimerco, for instance, serves as fiscal representative for both American and Chinese companies wishing to import to the Netherlands under the country’s favorable tax treatment.

The formula for VAT deferral on an import shipment worth $1 million USD would be $1 Million + Import Duty x 21% VAT. If the import duty on this purchase was 0%, the importer would retain $ 21,000 USD – just on this single shipment. For a frequent shipper, the ongoing cash flow advantage would be substantial.

For goods imported into the Netherlands that then ship to other EU country customers, these goods can circulate free of VAT within the EU, creating a very economical Pan European logistics strategy. For a Dimerco shipment, the process could work like this:

- Seller/shipper sends out invoice to buyer (consignee) in Italy

- Dimerco Netherlands applies for VAT deferment and ships goods to consignee.

- If the 1st buyer in Italy sells the goods to a 2nd buyer in Germany, the invoice would be sent directly to the 2nd buyer and the goods will go, via Dimerco Netherlands, to the German buyer, with the 1st buyer never physically receiving goods.

- VAT will only be paid once, by the end-user / consumer where the final sale is made.

New Silk Road Facilitates China-to-Europe Trade

Many options exist for moving cargo from China to Europe.

Goods that ship via ocean container to Rotterdam can be deconsolidated and shipped within days via road freight to end customers throughout Europe.

With all the COVID-related supply chain challenges, rail freight transport from China to Europe has become increasingly popular. This cross-border option can cut transit time by 20 days vs. ocean freight and can be as much as 30% cheaper than air freight.

For high-value products that need to get to market fast, air freight from China takes just 1–3 days door to door traveling via Amsterdam, depending on the final destination. The map below shows the transit time for air + truck routes via Amsterdam for Pan European distribution.

No Shortage of 3PL Support for Pan European Logistics

The Netherlands has the highest concentration of logistics service providers in Europe. Foreign companies can leverage 3PL capabilities in the Netherlands for supply chain design, global freight forwarding services, customs clearance, warehousing, final-mile distribution, and a host of special services.

Dimerco opened its first office in the Netherlands in 2000 and today has locations in Amsterdam (Schiphol Airport), Rotterdam and Venlo. If you are looking for a global 3PL that can assist your company with Pan European logistics support from the Netherlands, let’s start a discussion.