Thailand is a leading destination for the China + 1 strategy, as manufacturers are increasingly relocating some of their factories out of China. The Thai government has taken the initiative to attract these manufacturers by offering a number of incentives including tax breaks and streamlined regulations.

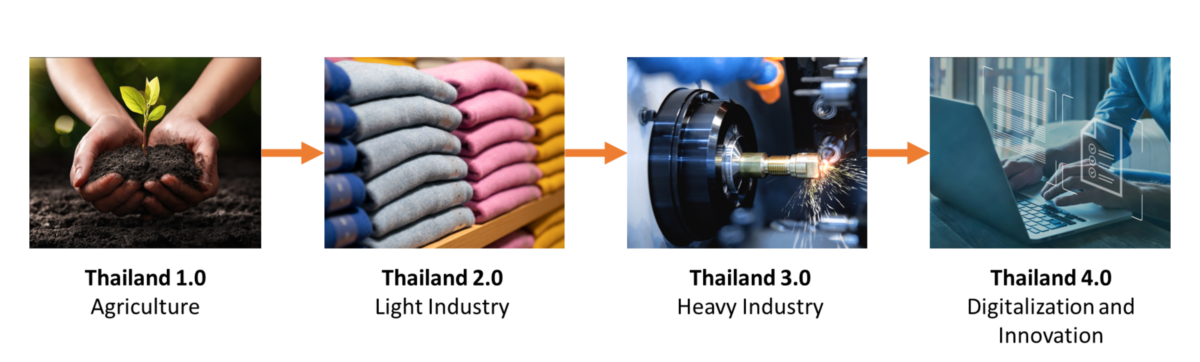

What is Thailand 4.0?

Thailand 4.0 is the fourth economic development plan initiated by the Royal Thai government to transform Thailand into a high-income country by 2030. The plan focuses on digitalization and innovation, building on the country’s previous economic development plans in agriculture (Thailand 1.0), light industry (Thailand 2.0), and heavy industry (Thailand 3.0).

Eastern Economic Corridor (EEC)

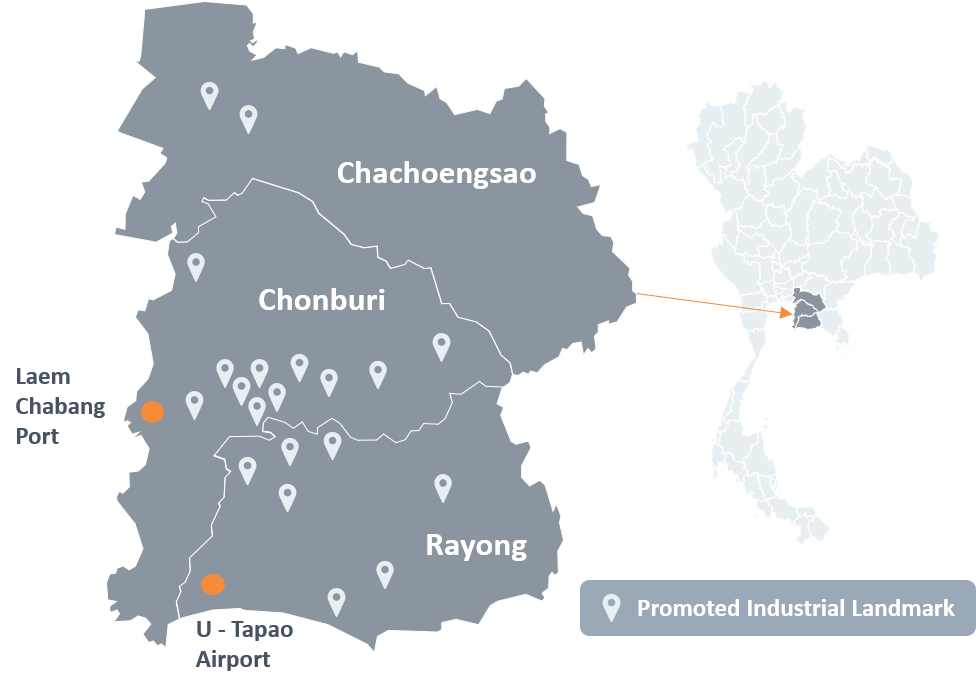

The heart of Thailand’s 4.0 strategy lies on the Eastern Economic Corridor (EEC), a special economic zone in eastern Thailand that is intended to be developed into a hub for high-tech industries and innovation. The plan involved various initiatives focused on improving infrastructure, attract investment, and develop human resources. The EEC consists of 3 eastern provinces namely Rayong, Chonburi, and Chachoengsao, covering a total area of around 13,000 square kilometers.

The heart of Thailand’s 4.0 strategy lies on the Eastern Economic Corridor (EEC), a special economic zone in eastern Thailand that is intended to be developed into a hub for high-tech industries and innovation. The plan involved various initiatives focused on improving infrastructure, attract investment, and develop human resources. The EEC consists of 3 eastern provinces namely Rayong, Chonburi, and Chachoengsao, covering a total area of around 13,000 square kilometers.

Initiatives by the Thailand Board of Investments

To support the Thailand 4.0, The Board of Investments of Thailand (BOI) has a set of initiatives to strengthen its investment promotion strategy for the new economy. The strategy is focused on three key drivers:

Below are some of the incentives provided by the Thailand BOI:

Tax Incentive |

Non-Tax Incentive |

Retention & Expansion |

Relocation |

|

|

|

|

Don’t Ignore the Logistics Challenge of Expansion to Thailand

As enticing as these government incentives are, relocating operations from one country to another can be complex. It’s a bit easier for labor-intensive production, such as garment assembly, but relocating production of sophisticated technology products requires careful consideration of logistics challenges, like ensuring adequate inbound and outbound freight capacity. On top of that, doing business in Thailand is different than in China. Companies must look at potential differences in labor productivity, workforce skill, and regulatory and legal requirements.

Companies that don’t anticipate and plan for freight, cultural and regulatory issues could face delays that undermine the promised benefits of Thailand 4.0 incentives. We review this issue at length in our eBook: The Logistics of China Plus One.

It’s critically important to identify a global logistics partner that can assist with shipping and warehousing needs, but also advise you on legal, customs and regulatory requirements.

A global freight forwarder like Dimerco, with over 150+ worldwide, can help – particularly given its strategic focus on Asia-Pac logistics. With Thailand offices in Bangkok, Laem Chabang, and Chiang Mai, Dimerco has the local know-how to support a faster, seamless expansion to Thailand, with a customized supply chain solution to match your exact needs. now and find out more.