Home »

China Plus One Strategy: Logistics Challenges and Opportunities

Contents

What is China Plus One?

What is driving companies to set up additional production outside China?

- The US-China trade war

- The impact of China’s zero-COVID policy

- Increasing costs and long-term labor constraints in China

What are the challenges associated with moving operations to another country?

- Challenge: Freight Capacity

- Challenge: Transit time impacts

- Challenge: Supply of inbound materials

- Challenge: Warehouse space and services

- Challenge: customs processes and government regulations

- Challenge: Labor skill, work ethic and availability

Which countries are benefiting most from a China Plus One strategy?

The Impact of RCEP

China Plus One: Choosing the Right Partner

A primer on the freight, regulatory, and cultural issues that must be considered when diversifying production beyond China to other Asian countries.

What is China Plus One?

The phrase “China Plus One” captures the strategy many large manufacturers and retailers are employing to reduce global supply chain risk management by moving certain sole-sourced China procurement and production operations to other countries.

This trend is not new. It has been taking shape for many years as increasing labor costs in China, US/China trade tensions, and strict COVID-19 containment policies have led manufacturers to look beyond China.

While it has been relatively easy to move labor-intensive production, such as garment assembly, out of China, relocating production of sophisticated technology products like smartphones is costly and presents significant logistical challenges. Nevertheless, high-tech companies are making these changes, building factories in other parts of the world to hedge their bets.

China Plus One: Easy in principle; harder in practice

The logic behind a China Plus One strategy is sound, but implementing it is another story. Doing business in Malaysia or Vietnam, for instance, is different than in China, where the supporting infrastructure is strong. Companies must plan carefully for a move, looking at issues like inbound and outbound freight capacity, road systems, workforce skill and availability, and the relative “business friendliness” of the governments and regulating agencies.

While no one issue presents an insurmountable barrier to expanding production outside China, companies that don’t anticipate and plan for these logistical issues will delay or short-circuit the hoped-for benefits of a China Plus One strategy.

Download Guide

If you prefer to download this article as a PDF, just complete the form. Otherwise, keep reading.

What is driving companies to set up additional production outside China?

The answer is complicated but can be broken down into three primary driving forces. These forces create ripple effects throughout the global supply chain.

- The US-China trade war

- The impact of China’s strict zero-COVID Policy (relaxed in late 2022)

- Increasing costs and an aging/constrained labor force in China

The US-China trade war

The US-China trade war began in 2018, with the US imposing additional tariffs of 25% on $34 billion worth of Chinese imports. Under pressure from customers to avoid this added expense, the tariff hike caused manufacturers to speed expansion of additional/alternative production lines in SE Asia.

Additionally, these same manufacturers were also under pressure to avoid a “made in China” label. This stigma relates to what some perceive as unethical manufacturing practices in China, like those related to forced labor practices.

The impact of China’s zero-COVID policy

Many manufacturers saw their supply chains fail during the COVID-19 pandemic when China factories could not keep up with production. Factory closures occurred on a massive scale, material shortages became the norm, sailing times tripled, and costs increased precipitously. As a result, these firms started looking for other options for manufacturing and sourcing.

That decision was reinforced by China’s Zero-COVID policy, which lasted 3 years before a relaxation in late 2022. The policy put far-reaching curbs on the movement of people and goods throughout the country. The regulations left senior supply chain executives from China-dependent companies in a constant state of anxiety.

Increasing costs and long-term labor constraints in China

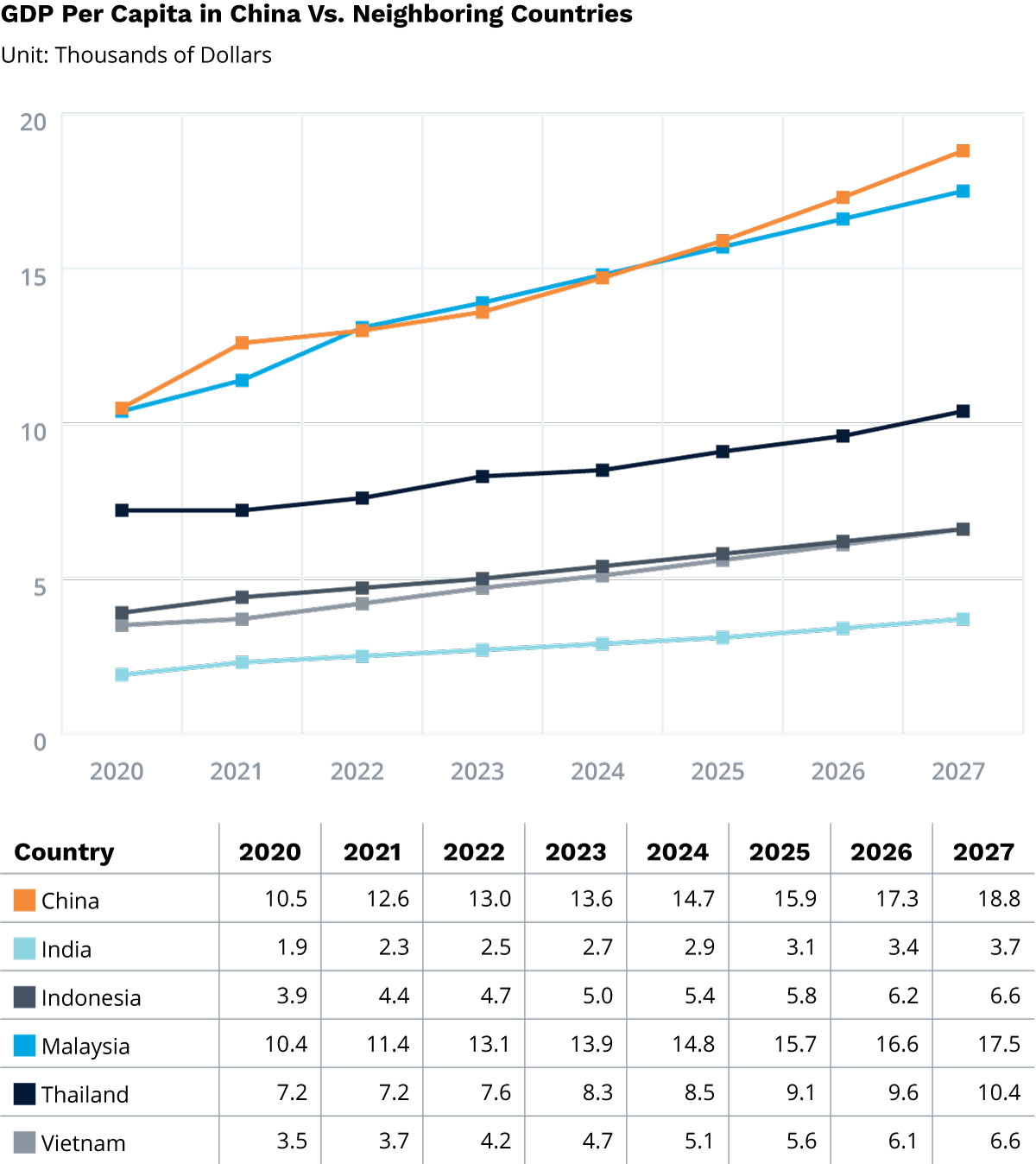

The cost of doing business in China has risen steadily over the last decade. Salaries have nearly doubled in the last 7 years (Trading Economics). The advantages of the cheap labor and market demand that China initially provided have increasingly been overshadowed by the advantages that other Asia-Pacific countries now offer.

At the same time, China’s aging workforce is causing labor constraints for the first time in decades. While the Chinese government has relaxed its longstanding 1-child policy (now a 3-child policy), younger Chinese are hesitant to have large families due to a rising cost of living. Experts predict China’s labor force will shrink by about 5% over the next decade.

Companies are not abandoning China entirely. They simply are hedging their bets and reducing their risk exposure through supply chain diversification.

What are the challenges associated with moving operations to another country?

The logistics of moving operations to another country are complex. Issues include, but are not limited to, ensuring adequate:

- Freight capacity

- Transit times

- Supply of inbound materials

- Warehouse space and services

- Understanding of customs processes and government regulations

- Labor skill and availability

We’ll look at each in turn and why manufacturers are seeking help from third-party logistics providers (3PLs) that have existing operations in the new market.

Challenge: Freight capacity

Freight capacity obviously differs from market to market. You need to make sure that, in your new location, you can quickly move out what you make. You can’t risk costly inventory backlogs, slower cash cycles and unhappy customers.

“We ship mostly air and when we shifted factory operations from South China near Hong Kong to Penang, Malaysia we learned that the outbound air freight capacity from Penang was about 3% that of Hong Kong International Airport, our previous gateway. Fortunately, we leaned on our Asia freight forwarder to secure the capacity to make this work. Companies should consider the issue of freight capacity before a move.” — Global logistics director at a large heating equipment company

Capacity solutions in your new country could look different and still work.

- One tech product manufacturer’s factory in Penang uses Kuala Lumpur and Singapore Airports as gateways to connect to the US, Europe, and other countries, using a 3PL to coordinate the Road + Air solution.

- A fast fashion company struggling with long-haul air freight capacity out of Vietnam during peak season uses its freight forwarder to manage a multi-stop, air-to-air solution from Hanoi to Singapore, where it connects with worldwide gateways.

Bottom Line

Lean on 3PL partners to both understand potential freight capacity constraints in a new market and provide creative solutions, if needed.

Challenge: Transit time impacts

Transit time and cost are obviously critical influencing factors for any supply chain decisions. The chart below examines outbound transit times for major European and North American logistics hubs.

Outbound Transit Times Asia to US and Europe Gateways

Los Angeles |

New York |

Rotterdam (OCEAN)

|

Frankfurt (AIR) |

|

|---|---|---|---|---|

| Hong Kong air | 2 days | 2 days | 2 days (Ams) | 2 days |

| Hong Kong ocean | 18 days | 34 days | 28 days (Rott) | |

| Shanghai air | 2 days | 2 days | 2 days (Ams) | 2 days |

| Shanghai ocean | 14 days | 30 days | 35 days (Rott) | |

| Hanoi air | 4 days | 4 days | 3 days (Ams) | 3 days |

| Hanoi ocean | 24 days | 37 days | 32 days (Rott) | |

| Malaysia air | 3 days | 3 days | 3 days (Ams) | 3 days |

| Malaysia ocean | 29 days | 36 days | 29 days (Rott) | |

| Singapore air | 3 days | 3 days | 3 days (Ams) | 3 days |

| Singapore ocean | 22 days | 25 days | 20 days (Rott) | |

| Delhi air | 3 days | 3 days | 3 days (Ams) | 3 days |

| Delhi ocean | 42 days | 25 days | 25 days (Rott) | |

| Bangkok air | 4 days | 4 days | 1 day (Ams) | 1 day |

| Bangkok ocean | 27 days | 35 days | 32 days (Rott) |

*Transit time counted PTP (Port to Port)

**Delhi Ocean is an inland city, included 5 days from Delhi ICD to MUM port

One important question in the transit time discussion is whether your freight can travel directly from origin to destination. For example, many port-to-port ocean shipments out of Southeast Asia logistics hubs will stop in China prior to sailing, adding 3–7 days to the journey.

Bottom line:

A newly configured supply chain must meet your customers’ delivery requirements and your own company’s cash cycle goals.

Challenge: Supply of inbound materials

When you move production, you lose your ecosystem of local suppliers. It’s certainly possible to recreate that inbound supply chain with the same or new suppliers, but it takes time.

When a major electronics firm moved a factory out of China right before COVID, the company’s main suppliers promised they would relocate around the new production plant. When COVID hit, the moves didn’t happen, and the manufacturer was unable to localize its raw material supply as quickly as planned.

Said the firm’s logistics manager: “It was bad luck to a certain extent and taught us the importance of having a local supply base in place before moving. Because Malaysia has a limited supply of packaging material, we spent a lot to ship bulky packaging from China until we found local supply.”

The following example from Resilink further demonstrates that relocation of finished goods production must carefully consider inbound supply.

Indian smartphone assemblers suffered two months of shutdowns during the height of the COVID pandemic because of the lockdowns in China. While domestic production of smartphones had expanded dramatically in India prior to the pandemic, manufacturers remained highly dependent on Chinese suppliers, which provided 45% of smartphone components. The Chinese lockdown put Indian production at risk.

Bottom line:

When relocating, take the time to ensure inbound supply lines are in place and ready for Go-Live.

Challenge: Warehouse space and services

Access to good warehousing is a critical component of any China Plus One strategy. The quality and availability of appropriate warehousing vary tremendously and are one of the challenges that must be addressed when considering any new country option.

Unless you’re building your own warehouse, here are questions you should consider as you plan requirements for inbound and outbound warehousing:

- Is adequate space available for both you and your suppliers to store inventory? Changing warehouses is disruptive, so look for a solution that can scale to meet your needs for at least 5 years.

- Can the warehouse support mechanization? Companies want high-density, high-throughput warehouses to handle increasing volumes and complexity. That will require robots and mechanization. As such, warehouses need the proper floor strength, column spacing, and adequate power supply and charging points.

- Can systems support highly accurate order processing? Manual, paper-based processes should be a red flag. Look for partners that use scanning technology and robotic process automation to speed processes and ensure accuracy.

- Does it have advanced security for high-value products? Look for 24/7 security system/guards and 24-hour CCTV.

Bottom line:

Warehousing is not a commodity service. Don’t assume any country you move to will have what you need.

Challenge: Customs processes and government regulations

Different countries have different customs declaration/clearance processes, different documentation requirements, and different tariff structures and regulations. And some are just more complicated than others.

A tech appliance manufacturer found that out the hard way after it relocated from China to Malaysia. According to the company’s global logistics director, “Customs procedures in the new country were not as business-friendly. For instance, if you are 5 short on a supplier delivery of 500 screws, you don’t want to have to go back to the supplier to ship 5 more screws to get the goods through customs. That’s the kind of thing we dealt with initially.”

It helps to work with 3PLs well-versed in customs and compliance in Asia, including regulatory licensing, environmental packaging requirements, and country-specific documentation. If those partners have Authorized Economic Operator (AEO) status, it can speed clearances and reduce inspections.

Here are a few examples of how Dimerco turns its local market knowledge into an advantage for relocating companies:

- Dimerco India has a special program to help semiconductor companies expand to India with advice on Indian government subsidies, local district regulations, and customs requirements.

- When a global memory products manufacturer was unable to set up a distribution operation in Singapore because it wasn’t a registered company there, Dimerco worked with the Inland Revenue Authority of Singapore to establish itself as the company’s agent, paving the way for the company to seamlessly enter the Singapore market.

- A maker of steel equipment for the solar panel industry relocated from China to Malaysia to avoid China-origin tariffs. Dimerco advised the company on local duties, compliance regulations, and free trade zone usage in Malaysia. Operations transitioned seamlessly with no loss of customers.

Bottom line:

The regulatory differences between countries are complex. Logistics is just one part of it; licensing, product standards, and tax regulations can all influence how successful your expansion will be.

Challenge: Labor skill, work ethic, and availability

Running new factories, warehouses, and transportation in a new country requires people to do the work. Don’t assume that productivity and skill levels will be the same as those in China. Not understanding cultural elements can be an expensive mistake when locating to a China Plus One country, as one supplier to the semiconductor industry learned.

“When planning our move from China to Malaysia, we budgeted to hire the same number of production workers – 500,” said the company’s logistics director. “But due to lesser skill levels, more vacation days, fewer daily work hours, and more national holidays, we learned it takes 1,000 workers in Malaysia to generate the same production output as in China. This fact would not have changed our decision, but we should have known this when planning.”

The work ethic issue is hard to quantify, but real. An example was offered by the global logistics manager at one technology distributor, “Singapore workers get it. They understand that time is money. But move to a neighboring country and it’s more relaxed…’Hey it’s almost 5 pm, let’s solve this problem tomorrow.’”

It’s also wise to assess the level of talent you’ll require in a new country, according to the logistics director of a global maker of wireless networking products with operations in Taiwan, Mainland China, and several Southeast Asia countries. “A good import/export person is harder to find in Vietnam, Indonesia, and Malaysia,” he says. “You’ve got to plan for that and perhaps be willing to pay a little more.”

Bottom line:

Explore labor and related cultural issues as you plan your China Plus One strategy. Immigration laws, local hiring quotas, and visa timelines also vary and should be factored into your timeline.

Which countries are benefiting most from a China Plus One strategy?

To promote new investments, all ASEAN countries, to one degree or another, are implementing tax cuts, enacting business-friendly policies, offering fiscal incentives for special economic zones/industrial parks, and boosting infrastructure spending. But according to Dr. Sara Hsu, clinical professor of supply chain management at the University of Tennessee (US) and an expert in China economic development, the countries that seem primed to benefit most from a China Plus One strategy are Vietnam, Malaysia, and Thailand.

Vietnam shares a border with China to the north and has been a key part of the China Plus One strategy for both Western and Chinese firms. While Vietnam’s infrastructure is far behind that of China, the country’s 2030 master plan for transport infrastructure aims to construct 5,000 kilometers of expressways, a deep-water port and high-speed rail routes, and complete the Long Thanh International Airport near Ho Chi Minh City. Some Chinese firms have chosen to relocate to Vietnam to avoid US tariffs.

Malaysia has received increasing foreign direct investments (FDI), in part because the country has a strong legal system and telecommunications/internet infrastructure. Over the past few years, Malaysia’s FDI grew 383.4% year-on-year. The Northern Malaysia city of Penang, a burgeoning hub for high-tech manufacturing, has benefited from many of these investments. Going forward, Malaysia’s Digital Blueprint Program is projected to further improve FDI flows, particularly for high-tech trade.

Thailand is rapidly building out its supply chain/manufacturing infrastructure. As a result, in the last several years, FDI applications have increased as much as 80% — particularly along Thailand’s Eastern Economic Corridor. While the medical sector attracted the most FDI projects, foreign direct investment has also been increasing in other manufacturing industries, such as the metals and machinery sectors.

While India is further away from China’s prime production hubs than these Southeast Asia countries, it is attracting foreign investments through a variety of aggressive incentive programs across industries. India has officially overtaken China as the world’s most populous nation, according to the United Nations, and that population has a higher percentage of working-age people than China. It’s a well-educated, largely English-speaking workforce (English is the second official language in India), with comparatively low labor costs – all key demographic enticements for foreign investment.

The Impact of RCEP

Accelerating the China Plus One trend is the Regional Comprehensive Economic Partnership (RCEP) – the world’s largest trade agreement – which entered into force in January 2022.

RCEP will harmonize rates and standards across the bloc, and the deal is expected to reduce tariffs on up to 92% of the goods traded between the 10 member countries. It will take the region closer toward a coherent trading zone, like that of Europe and North America, offering benefits for supply chain efficiency, market access, and investments.

The trade agreement is likely to be a boon to the China Plus One trend over time, depending on how quickly countries can upgrade their logistics and information infrastructures. According to Dr. Sara Hsu, “The RCEP will allow firms with supply chains distributed among several Asian nations to take advantage of the common rules of origin for the entire bloc.”

RCEP

Regional Comprehensive Economic Partnership

- SOUTH KOREA

- CHINA

- JAPAN

- MYANMAR

- VIETNAM

- LAOS

- THAILAND

- CAMBODIA

- MALAYSIA

- PHILIPPINES

- INDONESIA

- BRUNEI

- SINGAPORE

- AUSTRALIA

- NEW ZEALAND

China Plus One: Choosing the right partner

Recent years have demonstrated the significant risk of 100% reliance on China for production. Rising labor costs there further undermine the “China factory” advantage.

But companies exploring expansion grossly underestimate the logistical, regulatory, and cultural issues that must be addressed as part of a China Plus One strategy.

The good news is that 3PLs can provide much of the know-how needed for a successful transition. A 3PL that has operated in the market for many years can help with a range of challenges – from legal guidance, like how to establish a business entity in the new market, to strategic logistics advice, like how to design a distribution network with adequate freight and warehouse capacity.

Beware of consultants who promise full-service relocation advice but whose expertise is limited to overcoming governmental hurdles. At the end of the day, products need to be optimally stored, consolidated, shipped, and tracked. You need local experts to make these things happen with precision and 100% compliance. That requires local logistics experts with the know-how and infrastructure to get things done.

Your China Plus One strategy partner must be able to deliver both.