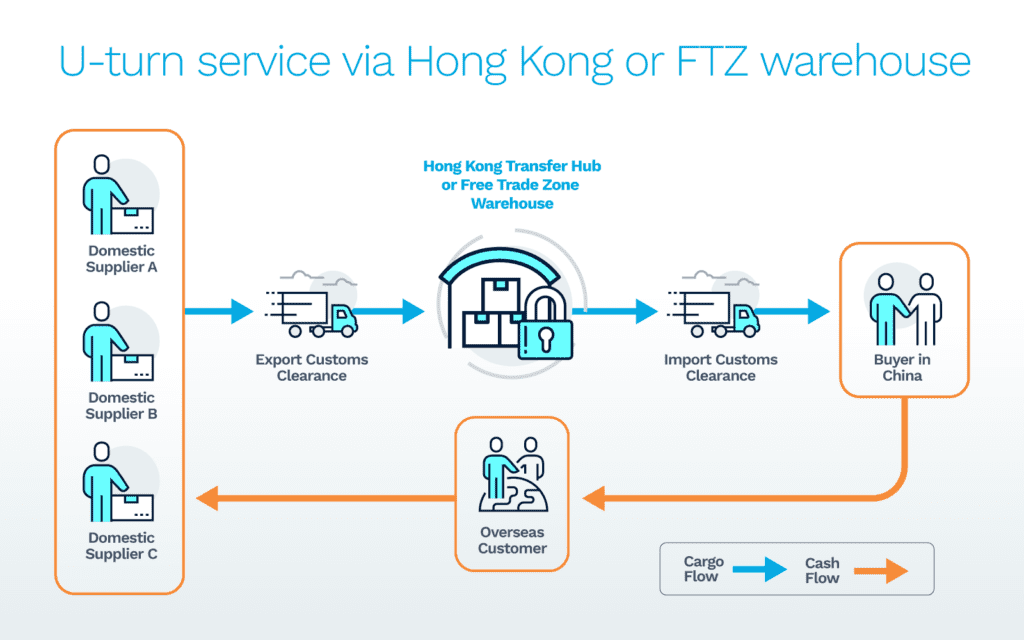

China is the world’s biggest manufacturer. A good percentage of products made in China are also consumed there. These domestic sales are subject to taxes that can be avoided or lessened through a strategy called the Hong Kong U-turn. Let’s see how.

What is the Hong Kong U-turn strategy?

Manufacturers in China import over $1 trillion USD worth of parts and raw materials every year and they must pay huge sums in value added taxes (VAT) to the Chinese government on these imports. But if the imported goods are used to create finished goods that are then exported, these Chinese manufacturers can apply for a VAT rebate, recouping a portion of the import taxes paid.

This tax advantage becomes more difficult for domestic sales to buyers in China. That’s where the Hong Kong U-turn strategy comes in.

Hong Kong, a special administrative region (SAR) of China, is a free port that does not levy any customs tariffs on imported or exported goods. China manufacturers can take advantage of Hong Kong’s trade-friendly practices to treat domestic sales as exports by shipping goods to Hong Kong and then having them immediately re-imported for a buyer in China.

For sellers, the products are treated as exports for tax purposes even though the buyer is in China and the goods never leave what is officially China territory.

The Chinese government issues the VAT rebate on exports to prevent double taxation on the same goods (import and manufacture) and to promote exports.

Sellers can apply for the VAT rebate when they complete the export to Hong Kong. The buyer will pay the VAT or duty (the amount is based on the HS code) when the product is reimported into China. If these finished goods are re-exported to a customer outside of China (e.g., Europe or U.S.), the cycle can repeat itself and that same buyer can also apply for the VAT rebate without the need for the Hong Kong U-turn strategy.

Some companies will use the Hong Kong U-turn strategy for more than just a simple transshipment and would require a Hong Kong 3PL warehouse.

Can you get the same benefit without the need to ship goods to Hong Kong?

The answer is yes, through the use of free trade zone warehousing in China.

The manufacturer in China can store finished goods in bonded space within a free trade zone awaiting purchase by a domestic customer. Once that transfer is completed, the seller can immediately apply to the Chinese government for a VAT rebate. So, in such circumstances, a transshipment through Hong Kong is not necessary to secure the maximum tax advantages for the sale of goods between two Chinese companies.

However, customs authorities at various China ports have different Identifications for product tax numbers. This can lead to inconsistencies in the commodity tax numbers between shippers and receivers. The discrepancy in HS code numbers makes it more difficult to use the FTZ solution. In these cases, the Hong Kong U-turn strategy would work.

Here’s an example of a company using the FTZ strategy. Dimerco Express Group works with a large toy company based in Hong Kong that sources all its toys from Chinese manufacturers and then has them “exported” into a Dimerco-operated FTZ warehouse in the Shenzhen Yantian Free Trade Zone. A Beijing-based buyer then “re-imports” the goods into China. All parties gain the same benefits afforded by the Hong Kong U-turn strategy, but without the time and expense of having to ship to Hong Kong.

Maximize the tax benefits for sales within China using a Hong Kong U-turn or FTZ warehouse strategy

Chinese manufacturers import trillions of dollars in raw materials and components, incurring huge tax and duty costs. For products that are then re-exported to the U.S., Europe and elsewhere, they can recoup a portion of these costs through a VAT rebate. This critical tax advantage is not as simple for products sold to Chinese buyers. But the Hong Kong U-turn strategy and FTZ warehousing in China provide ways to treat their domestic sales as exports and realize similar tax rebate benefits.

To take advantage of these programs, it helps to work with a 3PL, like Dimerco, that understands China Customs and how to set up and implement these programs. Dimerco operates bonded warehouses and free trade zones throughout China and Southeast Asia. To discuss how a Hong Kong U-turn strategy or FTZ warehousing in China could benefit your company, contact Dimerco today.