Global sales of electric vehicles will increase from 2 million in 2020 to about 73 million in 2024, according to Goldman Sachs Research. It’s a market that is growing faster than the ability of EV supply chains to keep up.

EV supply chains are vastly different than those for gas-powered vehicles, with different suppliers, new freight lanes, and new production hubs. As a result, supply chain and logistics professionals in the auto industry must completely adapt how they manage logistics operations. Let’s look at the key ways EV supply chains will change and the logistics challenges these changes create.

For an in-depth view, explore our infographic: The EV Supply Chain Challenge.

Changing freight lanes

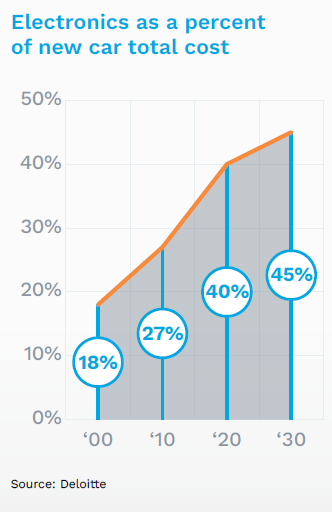

Electronics as a percent of new car costs will go from 18% in 2000 to 45% in 2030 (Deloitte). Where are most of the world’s semiconductor chips made? In Asia. In 2021, when automakers struggled to get chips, the auto industry produced 11 million fewer vehicles and lost more than $200 billion USD.

Electronics as a percent of new car costs will go from 18% in 2000 to 45% in 2030 (Deloitte). Where are most of the world’s semiconductor chips made? In Asia. In 2021, when automakers struggled to get chips, the auto industry produced 11 million fewer vehicles and lost more than $200 billion USD.

What it means

Automakers and their suppliers must develop a reliable supply chain for semiconductor products sourced in Asia. That means aligning with 3PLs that can help you move freight reliably and affordably – to, from and within Asia.

You’ll need strong freight forwarding partners with good relationships with regional carriers in Asia and the freight buying power to get you the freight capacity you need – particularly when capacity is tight.

New component parts

As cars have become more like computers on wheels, chips and EV batteries have assumed outsized roles in EV supply chains. These components are more challenging to ship and store.

EV batteries are shipped as ”dangerous goods” and are subject to many regulations and restrictions. Semiconductor chips require special packaging, handling and shipping to ensure uncompromised quality throughout the journey.

What it means

Managing the quality of inbound components will require much more diligence. Automakers have a near-zero tolerance for quality defects, and the fact is that it’s much easier to damage a chip in transit than a brake pad. And spark plugs won’t create a fire in transit, whereas lithium batteries could.

The 3PLs that have traditionally supported the supply chains for gas-powered vehicles may lack the experience necessary to adequately support EV supply chains. To reduce risk, it’s critical to work with logistics partners that have experience warehousing and shipping semiconductors, batteries and other sensitive products. Auto OEMs and suppliers who don’t have these 3PL relationships in place should look to develop them.

New production hubs

DIGITIMES research reports that ASEAN countries and India will become central hubs for EV production through 2030, with Thailand, Indonesia and India leading the way in terms of growth.

- India is now the world’s most populous country. The EV market there will grow from $3.2 billion in 2022 to $114 billion in 2029, according to Fortune.

- Indonesia has abundant mineral resources for EV battery production and will become the ASEAN region’s battery manufacturing center.

- Taiwan is the epicenter of global, semiconductor manufacturing and we will become even more important to automakers.

- Thailand is expected to become the most important EV production hub among the ten Asian countries. In fact, some refer to Thailand as the “Detroit of the East.”

- Vietnam has become a prime beneficiary of the China Plus One strategy, as auto industry companies expand beyond China to avoid the consequences of China’s worsening trade relations with Western countries.

What it means

As EV production expands from China into India and ASEAN countries, auto OEMs and their suppliers will need to set up operations in these countries. Such expansion creates a range of challenges, including:

- Sourcing freight capacity to and from these markets

- Sourcing local warehousing, including bonded facilities to defer duties and taxes

- Understanding local customs agency requirements to clear goods quickly

- Setting up operations and understanding all the legal and regulatory requirements to do so

- Dealing with a new language and culture

We cover these things in detail in our eBook on The Logistics of China Plus One.

To address these challenges, it helps to work with a 3PL with a strong presence across India and ASEAN countries, as well as China. A 3PL that has operated in these markets for years can provide advice that can speed entry into new markets and avoid supply chain disruptions.

EV supply chains: changing strategies might require new logistics partners

As you adapt your automotive supply chain to manage the unique logistics challenges of electric vehicle production, it’s important to have the right strategic logistics partners. The ideal partner will have:

- Auto industry experience, with people who understand the precision expected for auto supply chains

- A strong presence across Asia to give you the freight capacity and local market know how you’ll need

- Experience shipping semiconductor chips and batteries to ensure product quality as products move through a long and sometimes complex supply chain.

Dimerco Express Group combines all these strengths in a single partner. To talk to an EV supply chain expert, contact Dimerco today to arrange a discussion.