Happening Now

The Israel-Palestine conflict, as of November 20, 2023, remains a complex and evolving situation. Customs and regulation authorities continue to function, but border crossings have experienced closures and restrictions, impacting the movement of goods. Heightened security measures and disruptions are evident in roads, airports, seaports, and rail services in central and southern Israel. This dynamic situation will require transportation professionals to prepare for potential delays and adapt accordingly.

Here’s a breakdown of key transportation points and the latest updates as of November 20, 2023:

Air Transportation:

- Major international airlines have suspended flights to Israel, resulting in substantial disruptions.

- Delays are anticipated, and extra fuel is recommended for flights to Israel.

- Ben Gurion International Airport (TLV) remains open but with expected delays. When there are rocket attacks in the area near Ben Gurion Airport, the Israeli Air Force (IAF) routinely implements a security hold. This means that all flights are grounded until the situation is deemed safe.

- El Al and Challenge Air continue to be operational and provide cargo services.

Ocean Transportation:

Israel’s ports are witnessing an increasing backlog of ships as the country ramps up its shipping operations. The Israeli Navy controls all sea traffic in areas around and near the Ports of Ashdod and Ashkelon.

- Port of Ashdod: Located just 50 kilometers from the Gaza border, Ashdod Port is currently in “emergency mode,” with special restrictions for vessels carrying hazardous materials. As the exclusive state-owned port in Israel, Ashdod Port operates around the clock, 24/7.

- Port of Ashkelon: Located a mere 15 kilometers from the Gaza border, the Port of Ashkelon and its oil terminal have been closed in the aftermath of the ongoing conflict.

- Port of Haifa: The Port of Haifa, which also includes Haifa Bay Port and Israel Shipyard Port, is operating as usual. The Home Front Command regulates the handling of hazardous materials in the port, designating specific storage areas for different types of HAZMAT and requiring ship agents to provide a 24-hour advance notice for incoming HAZMAT-carrying ships.

- Port of Hadera: The port of Hadera is operating as usual.

- Port of Eilat: The Port of Eilat is operating as usual.

- Hadarom Container Terminal (HCT): HCT is working daily until 19:00.

Land Transportation:

The Israel Defense Forces (IDF) have closed main roads near the border with the Gaza Strip. Inland services, including road and rail, are fully operational in most areas around the country, except for those around the Gaza strip.

- Cargo operations at the Allenby/King Hussein/al-Karama Bridge are partly operational between 08:00–16:30. The services are available for palletized cargo (import), prioritized export for food shipments, and handling of bulk cement (silo) and scrap iron (import/export).

- Cargo operations at the Jordan River/Sheikh Hussein Border Crossing are open, subject to availability of workers, between 08:30–17:00 for all types of cargo. Priority will be given to reefer containers arriving from Haifa.

- Nitzana Border Crossing between Israel and Egypt is open for exported goods.

- Yitzhak Rabin/Arava Crossing Between Israel and Jordan, near Eilat, is operational.

On November 20, 2023, all types of cargo, including containers, can freely move from Israel to the Palestinian Authority through the specified crossings. However, goods moving from the Palestinian Authority to Israel require prior approval.

- Tarqumiyah Crossing: Located in southern Yehuda and Shomron.

- Gilboa/Jalama Crossing: The northernmost crossing in Yehuda and Shomron.

- Sha’ar Ephraim (Ephraim Gate): Positioned in the center of the Yehuda and Shomron region. Notably, humanitarian goods traveling from west to east are prioritized at this crossing.

- Beitunia Crossing: Exclusively dedicated to handling goods in the center of the Yehuda and Shomron region.

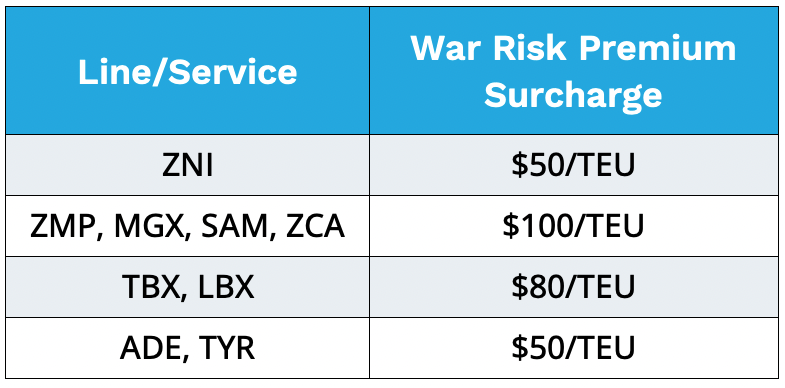

Insurance and War Risk Premium

Insurers have imposed an additional war risk insurance premium on vessels calling Israeli ports. To maintain service to and from Israel, ZIM will charge the war risk premium on all cargo to and from Israel. This surcharge is subject to changes every 24 hours and will be updated accordingly.

Possibilities to Consider and the Need to Manage Risk

The Israel-Hamas war introduces several uncertainties with direct and indirect impacts on the logistics and transportation industry:

- Shipping Chokepoint Risks: The conflict’s escalation could risk shipping chokepoints, such as the Suez Canal and the Strait of Hormuz. Any disruptions to these critical waterways would have far-reaching implications for global trade routes and the movement of goods. Ships may face unexpected delays and route changes, which inevitably affect supply chains and logistics planning.

- Land Transportation Bottlenecks: The closures and restrictions at border crossings and land routes could create logistical holdups, impacting the movement of goods regionally and beyond. Companies relying on timely deliveries should brace for interruptions and consider contingency plans to mitigate these bottlenecks.

- Trade Disruptions: The Israel-Hamas conflict has the potential to disrupt Israel’s exports to major global markets. These markets include economic powerhouses like China, the United States, Turkey, Germany, Italy, and India. Such disruptions can ripple through various industries, creating uncertainties and supply chain challenges. Businesses must anticipate potential delays.

- Tech Industry Challenges: Israel’s tech sector, a significant part of the GDP, may face manufacturing disruptions due to conflict. High-tech exports to China and the U.S. may encounter imminent challenges. If the situation escalates further, the tech industry may witness short-term diversions of resources.

- Oil Price Surge: In the event of a more severe escalation, Bloomberg Economics estimates that oil prices could surge to as high as $150 per barrel. Such a price surge can significantly impact businesses across sectors

- Trade Project Uncertainty: Ambitious projects like the India-Middle East-Europe Economic Corridor (IMEC), designed as a Western counterpart to China’s Belt and Road Initiative, face uncertainties in light of the conflict. The conflict introduces unforeseen variables that may impact the development and execution of these, and many other, projects.

Due to the capacity and limitations imposed by the conflict, please be prepared for potential shipment delays. It’s crucial to keep a close eye on the evolving situation and adjust your logistics plans accordingly. We are here to support you through these challenges and keep your cargo moving.

The information has been obtained from “Swords of Iron” Bulletin, published by The Israeli Federation of International Freight Forwarders and Customs Clearing Agents.