Home »

Trade Compliance 101: A Practical Guide for Global Shippers

Contents

Chapter 1: Trade Compliance Basics

Chapter 2: Who Owns Trade Compliance?

Chapter 3: The Cost of Getting It Wrong

Chapter 4: HS Codes, Origin, Valuation, and Quantity

Chapter 5: Tariff Engineering – Strategy or Red Flag?

Chapter 6: Compliance Isn’t Just a Cost Center

Chapter 7: Building a Strong Trade Compliance Program

Chapter 8: Staying Compliant in a Changing World

Why Trade Compliance Is a Competitive Advantage

What Every Importer Should Know About Trade Compliance

Whether you’re shipping circuit boards from Shenzhen or apparel from Dhaka, your supply chain has to move across borders without delay. But behind every successful shipment lies a maze of rules, regulations, and declarations that must be handled with care. That’s trade compliance.

Unlike driving a car or filing taxes – where there’s typically one playbook – international trade doesn’t offer a single rulebook. Every country has its own requirements, and those rules change depending on the product, its origin, and even how it’s packaged. That complexity leaves many importers exposed to risk they don’t fully understand.

For fast-moving supply chains, especially in sectors like electronics, medical devices, and fashion, a misstep in trade compliance can grind everything to a halt. Delays. Inspections. Fines. Seizures. All of them eat into margins and damage your reputation with customers.

In this eBook, we break down the essentials of global trade compliance. You’ll learn what’s required, where companies go wrong, and how the right logistics partner can help keep your goods moving and your business protected.

Download Guide

If you prefer to download this article as a PDF, just complete the form. Otherwise, keep reading.

Chapter 1: Trade Compliance Basics

The Four Questions Customs Always Asks

No matter what you’re importing, customs authorities in any country are trying to answer the same four questions:

-

- What is it?

- What is it worth?

- Where is it from?

- How much is being imported?

Get one of these wrong – intentionally or not – and you risk delays, fines, or worse. Let’s take a closer look.

1. What Is the Product? (HS Code)

Every item must be classified using the Harmonized System (HS) code, a standardized global method for identifying products. This code forms the foundation for assessing duties, taxes, and trade restrictions.

Importers often choose the code with the lowest duty rate. That’s a mistake. The selected code must truthfully reflect the item’s essential character, not its cost implications. Misclassification is a common error that customs officials actively audit.

Beyond duty calculation, the HS code can also trigger requirements from other agencies. Certain classifications may fall under the jurisdiction of Partner Government Agencies (PGAs), such as the FDA, USDA, or Fish & Wildlife. That means more paperwork, inspections, or certifications – compliance steps you’ll need to factor into your process. Beyond duty calculation, the HS code can also trigger requirements from other agencies. Certain classifications may fall under the jurisdiction of Partner Government Agencies (PGAs), such as the FDA, USDA, or Fish & Wildlife. That means more paperwork, inspections, or certifications—compliance steps you’ll need to factor into your process.

Example: A USB charging cable might seem straightforward, but depending on how it’s constructed or used, it could fall under multiple HS codes, each with different duty rates and potentially different regulatory requirements depending on its end use.

2. What Is It Worth? (Valuation)

Customs wants to know the actual value of the transaction, not just what’s printed on the invoice. That includes all assists – any design, engineering, molds, or tools provided by the buyer at no cost to the seller.

If you’re underreporting the value (even unintentionally), you could be underpaying duties. That’s a problem. Customs will flag it, and the penalties can add up fast.

If the seller and buyer are related parties – like two divisions of the same company – most customs authorities will require the declared value to reflect what’s known as an “arm’s length” transaction. In other words, the price must be comparable to what unrelated parties would pay in a similar deal. If not, it may be adjusted by customs.

In the U.S., the transaction value is based on the price paid or payable for the goods alone and does not include freight and insurance costs. Duty is calculated on this net value, not the CIF (Cost, Insurance, and Freight) amount. However, in many other countries, duty is based on the CIF value, which includes freight and insurance. Misunderstanding this difference can lead to costly mistakes when calculating duties.

Tip: If you’re paying for packaging or design support separately, those costs may still be dutiable.

Simple Rule of Thumb: Declared Value = The full price the importer pays the exporter + any assists (free items or services that helped make the product).

3. Where Was It Made? (Country of Origin)

The Country of Origin (COO) isn’t necessarily where the product shipped from. It’s where the goods were substantially transformed. This distinction is critical, especially when tariffs vary by country.

Example: A smartphone assembled in Vietnam using parts made in China may still be considered Chinese in origin depending on how much value or materials were added in Vietnam.

Reporting COO inaccurately can affect eligibility for free trade agreements or trade preference programs like USMCA and could even trigger penalties under anti-dumping or forced labor laws. Understanding and applying USMCA rules of origin correctly is a vital part of any effective trade compliance strategy.

4. How Much Is Being Imported? (Quantity Reporting)

Import declarations must match the commercial invoice and packing list exactly. The HS code dictates which statistical units you need to report – pieces, kilograms, liters, etc.

These numbers aren’t just for duty calculations; they’re also used by national agencies (like the U.S. Census Bureau) for trade statistics.

Common Mistake: Reporting net weight when gross weight is required, or listing the wrong unit of measure.

Bottom Line: It’s All About the Money

At the end of the day, customs agencies want to make sure they’re collecting the right amount of revenue. That’s why they audit. That’s why they ask questions. If the answers don’t add up, your shipment, and your business, could be in trouble.

Chapter 2: Who Owns Trade Compliance?

Understanding Roles, Responsibilities, and Risk

Trade compliance isn’t optional, and it’s not something that can be fully outsourced. Someone has to own it inside your business. That ownership can be organized differently depending on the size and structure of your company, but the responsibility always falls on one party: the importer of record.

The Importer Is Legally Liable

When goods cross borders, the importer of record is responsible for ensuring all data is correct and all requirements are met. That includes selecting the correct HS code, declaring the accurate value, and confirming the product’s country of origin. If something is wrong – even if the information came from a supplier or customs broker – it’s the importer who pays the price.

A customs broker can assist with classification and filing, but they don’t carry the legal risk. Think of them as advisors. The decisions and liabilities remain yours.

Internal Responsibility Depends on Company Size

In larger companies, trade compliance may be handled by a dedicated team. There might be a Global Trade Compliance Officer with staff supporting classification, documentation, audits, and internal training. In smaller firms, however, trade compliance can be just one part of someone’s already full job – often logistics, procurement, finance, or even the CEO in very small organizations.

That makes it easy to let things slip. Trade compliance gets treated as a secondary task, checked quickly rather than handled carefully. But that shortcut can become costly, especially when U.S. Customs and Border Protection (CBP) or another agency decides to take a closer look.

Many Touchpoints, One Owner

It’s not uncommon for information to be passed between multiple parties – supplier, distributor, customs broker – before it lands with the importer. But even if your supplier gives you the HS code and your broker submits the customs entry, it’s still your company that’s responsible if the wrong HS code is used and the entry is flagged.

Let’s say Retailer C imports goods from Distributor B, who sourced from Manufacturer A. Even though C is relying on information from B, it’s still C’s responsibility to verify all compliance data, including a reasonable check that Manufacturer A is not violating forced labor rules or other trade restrictions.

In other words, trade compliance might be a shared workflow, but it’s not a shared responsibility.

Compliance Can’t Be an Afterthought

Too often, trade compliance is treated as a checklist item – something to deal with only when a shipment is about to clear customs. That’s a mistake. Compliance considerations should be built into your sourcing process, product design reviews, and contract negotiations with suppliers.

Taking the time to verify key compliance elements up front – rather than just before your shipment hits port – helps you avoid delays and penalties that can derail your supply chain.

It also signals to regulators and trading partners that your business takes compliance seriously. That reputation matters.

Chapter 3: The Cost of Getting It Wrong

What Happens When Trade Compliance Fails?

Trade compliance mistakes don’t just create paperwork headaches. They come with real consequences – the kind that can shut down a line, strain customer relationships, and wipe out months of profit. When shipments are flagged, time is the first thing you lose. But it doesn’t stop there.

Inspections and Supply Chain Disruption

If customs or another agency suspects something’s off – say, a misclassified HS code or inconsistent valuation – they may inspect your shipment. That’s not just a delay. It’s a disruption to your entire supply plan. And here’s the kicker: you pay for the inspection.

Some inspections are random. Many are not. Companies that fail to comply consistently are more likely to get flagged, more often.

And the impact goes beyond delays. Repeated violations can lead to higher customs bond premiums. In some cases, sureties or insurance providers may even require a cash deposit or additional collateral to secure the bond, creating extra financial pressure for your business.

One way to reduce this risk is by becoming a CTPAT (Customs Trade Partnership Against Terrorism) participant. CTPAT-certified companies are considered lower risk and are less likely to face customs exams. They also get a direct point of contact, a trusted advisor at CBP, who can help expedite resolutions if something does go wrong.

Fines, Seizures, and Long-Term Penalties

When mistakes are found, the fines can be steep. And for repeat offenses, the penalties escalate quickly. These can include:

- Six- and seven-figure fines

- Seizure of goods

- Exclusion from importing (debarment)

- Years-long customs audits

These are not just hypotheticals. One importer in the food sector was recently fined over half a million dollars for bringing in goods made with forced labor – a clear violation of U.S. law. That’s why having a reliable trade compliance strategy in place isn’t just smart, it’s essential.

Reputation Damage

Trade compliance issues don’t just hurt your bottom line. They damage your credibility with government agencies, partners, and customers. Significant customs actions, fines, and penalties are a matter of public record and often become headline news. A company known for compliance failures will have a harder time securing favorable treatment at the border, negotiating terms with suppliers, or maintaining trust with buyers.

Once that trust is gone, it’s difficult to earn back.

You Don’t Have to Be Doing Something Wrong

Here’s the hard part: you can face these consequences even if your mistake was unintentional. Customs officials aren’t just looking for fraud, they’re looking for accuracy. If your HS codes are wrong, your origin claims are inaccurate, or your valuations are inconsistent, it doesn’t matter if it was an honest mistake. You’re still responsible under the “reasonable care” legal standard mandated by customs. That’s why a compliance-first mindset is critical – not just for avoiding fines, but for protecting your business continuity.

Chapter 4: HS Codes, Origin, Valuation, and Quantity

Where Most Mistakes Happen

By now, you’ve seen how trade compliance rests on four pillars: HS codes, declared value, country of origin, and accurate quantity reporting. But even for experienced importers, these are the areas where most mistakes – and most audits – originate.

This chapter dives deeper into the technical nuances of each of these data elements, offering clarity on how to get them right and what to watch out for.

HS Codes: The Heart of Classification

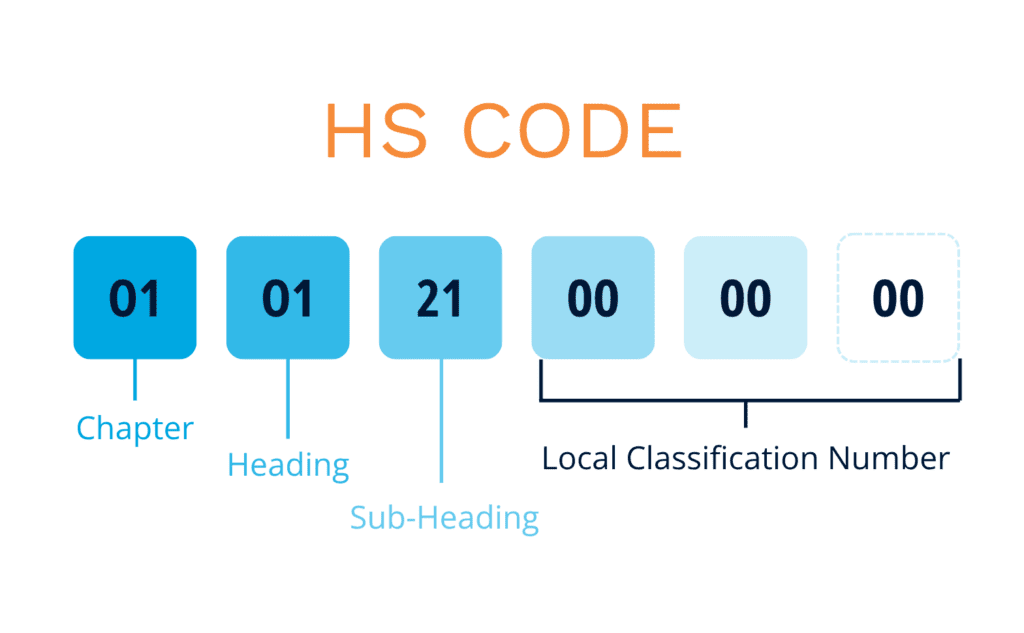

The HS is used to classify traded products. It’s a standardized six-digit structure created by the World Customs Organization (WCO) and adopted by virtually every country. These six digits form the base level of classification and are consistent across all participating nations.

However, countries often expand the HS code by adding more digits for additional specificity. For example, the United States adds four extra digits to create a 10-digit code known as the Harmonized Tariff Schedule (HTS) code. These country-specific extensions determine duty rates, special restrictions, and statistical tracking requirements.

But classification is rarely black and white. A single item – like a lithium battery or a motor assembly – can potentially fall under multiple codes depending on how it’s constructed, used, or integrated into a product.

Accurate classification is essential, and companies frequently run into trouble when they:

- Rely on supplier-provided codes without verification

- Choose a classification based on duty savings instead of technical accuracy

- Overlook subtle differences in design or function that influence classification

Remember: Customs authorities aren’t just checking if you picked a code – they’re checking if you picked the right one.

Declared Value: It’s More Than the Invoice

Customs wants to know the real transaction value, not just what’s printed on the invoice. This includes the actual price paid plus any assists, such as:

- Engineering or design work provided by the buyer

- Free tools, dies, or molds used in manufacturing

- Packaging or labeling supplied at no charge

Failing to include these costs underreports value and underpays duties, which may look like intentional fraud to customs authorities. To stay compliant, always ensure your declared value reflects the total economic value of the shipment.

Country of Origin: Not Always Where It Shipped From

The COO is where the item was substantially transformed – where it took on its final name, character, or use.

A product assembled in Mexico using Chinese components may still be considered Chinese in origin if the work in Mexico is minimal.

This is especially important when tariffs vary by country or when forced labor rules apply. An incorrect origin claim can disqualify you from trade benefits or flag your company for CBP scrutiny – particularly when working under frameworks like USMCA rules of origin.

Quantity and Statistical Accuracy

Each HS code has a statistical unit required for reporting. This could be kilograms, pieces, liters, or another measure.

If your commercial invoice lists “12 boxes,” but the HS code requires reporting in kilograms, that needs to be calculated and declared accurately. Getting this wrong may result in customs delays, rejections, or audits – all of which slow your supply chain.

Chapter 5: Tariff Engineering – Strategy or Red Flag?

How Smart Importers Reduce Costs Without Breaking the Rules

Tariff engineering is the deliberate design or modification of a product to fit a lower-duty classification – legally. It’s a strategy used by well-informed importers to manage costs, but it must be approached with caution.

What Is Tariff Engineering?

At its core, tariff engineering means altering a product’s design or composition so that it falls into a different HS code – one that carries a lower duty rate.

This could involve:

- Adding a plastic coating to a textile to shift it from “fabric” to “plastic product”

- Modifying a product’s packaging to qualify under a different code

- Sourcing components from different countries to shift the COO

It’s perfectly legal – if it’s done in advance, documented clearly, and applied consistently. When used as part of a broader trade compliance strategy, tariff engineering can help reduce costs while staying within the boundaries of the law.

Where Companies Go Wrong

Problems arise when companies:

- Apply a new HS code retroactively without modifying the product

- Use vague product descriptions to justify reclassification

- Lack the documentation that supports the reasoning behind the new classification

Reclassification can trigger audits, retroactive penalties, or even claims of misrepresentation.

Legal, but Not Easy

There are over 5,000 HS codes and many gray areas. That’s why this work is best done with the help of a customs expert who understands your product and industry.

If you’re reengineering a product to change its tariff treatment, you’ll need:

- A clear justification for the new code

- Engineering documentation showing how the change was made

- Consistent application of the new code across all entries

You’ll also need to conduct an impact study. If CBP disagrees with your original classification, they may require you to apply the new HS code retroactively to all previous, unliquidated entries, which could result in significant back duties and penalties.

If you’re not confident your change would hold up during a CBP audit, it may not be worth the risk.

Chapter 6: Compliance Isn’t Just a Cost Center

Why Getting It Right Actually Saves You Money

Many importers view compliance as a cost – one more layer of red tape in an already complex global supply chain. But that mindset misses the real opportunity.

Especially in today’s complex trade compliance and tariff environment, having a team that understands how changes impact the bottom line is mission-critical. Done right, trade compliance reduces risk, cuts costs, and improves supply chain speed. And the savings are measurable.

Three Real Benefits of Proactive Compliance

- Lower Duty Spend

- Correct HS codes mean proper (and potentially lower) duty rates

- Use of Free Trade Agreements (FTAs), such as USMCA

- Eligibility for Foreign Trade Zones or duty deferral programs

- Ability to recover overpaid duties through duty drawback programs

- Fewer Delays

- Accurate entries are less likely to be flagged or inspected

- Pre-clearing shipments with accurate documentation helps shorten customs processing times

- Reliable data improves your ability to plan and promise delivery dates

- Lower Risk of Fines and Damage to Your Brand

- No more guesswork in valuation, classification, or COO – you have accurate landed cost data

- Fewer audits

- Better internal controls and audit trails

Proactive Compliance Builds Confidence

You’re not just avoiding trouble – you’re creating a more predictable, more competitive supply chain. Customers trust your timelines. Internal teams trust the numbers. And your finance team sees lower landed costs and better margins.

That’s why investing in compliance resources, whether internally or through a partner like Dimerco, makes financial sense. It’s a smart bet.

Reactive vs. Proactive Compliance

Many companies approach trade compliance reactively, only addressing issues when something goes wrong. But the real value comes from being proactive.

| Reactive Compliance | Proactive Compliance |

|---|---|

| ✓ Short-term cost savings on resources | ✓ Long-term savings via duty reduction |

| ✗ Frequent shipment delays | ✓ Fewer customs holds or inspections |

| ✗ Higher risk of audits and fines | ✓ Strong audit trail, lower risk exposure |

| ✗ Missed FTA or FTZ opportunities | ✓ Leverage FTAs and deferment tools |

| ✗ Limited internal knowledge | ✓ Stronger coordination across teams. Data at your fingertips with the ability to stay nimble amidst tariff changes |

| ✗ Viewed as a cost center | ✓ Drives financial and operational performance |

Chapter 7: Building a Strong Trade Compliance Program

Where to Start and How to Keep It Going

You don’t need a large in-house team to build an effective trade compliance program. What you need is consistency, ownership, and a commitment to doing things right the first time.

Whether you’re starting from scratch or fine-tuning an existing process, these steps are the foundation of a strong trade compliance strategy.

Step 1: Assign Ownership

Someone in your organization, even if it’s just one person, needs to own trade compliance. That doesn’t mean they have to do it all, but they should be accountable for making sure it gets done.

In larger firms, this could be a dedicated trade compliance officer or global logistics manager. In smaller businesses, it might be the person who already oversees purchasing or international shipping.

Step 2: Know What You Ship

Maintain an accurate, up-to-date product database that includes:

- HS codes

- Country of origin

- Product descriptions

- Pricing and valuation details

- Relevant documentation (e.g., technical specs, COO certificates, FTA eligibility)

This is the foundation of your compliance program. If your product data is wrong, everything else falls apart. Consider using some of the budget-friendly automation tools available in trade compliance today.

Step 3: Document Your Processes

Consistency matters. That means building repeatable, documented procedures for:

- Classifying products

- Vetting suppliers

- Preparing customs documentation

- Responding to audits or requests from authorities

- Managing recordkeeping and updates

If your compliance lives in a spreadsheet or just one person’s head, it’s vulnerable. In the U.S., customs requires importers to have written compliance processes that are regularly updated and reviewed.

Step 4: Review and Audit Regularly

Mistakes happen – but it’s better to catch them yourself than to let customs find them for you. Set a schedule to review a sample of entries, verify documentation, and validate HS code usage.

If you spot a pattern of errors, fix the root cause, whether it’s training, supplier communication, or lack of oversight.

Step 5: Get Help From the Experts

Leverage the expertise of your freight forwarders, customs brokers, and consultants. These partners can help you stay current on regulatory changes, fine-tune classifications, and avoid compliance blind spots.

Bringing them into the conversation earlier, especially during product development or sourcing changes, can help avoid problems before they occur.

5 Essentials of a Trade Compliance Program

- Assign a dedicated owner

- Maintain an accurate product classification database

- Document procedures for classification, filing, and audit response

- Conduct regular internal audits

- Involve expert partners early

- Bonus: Stay current with trade regulations via trade associations or newsletters

Chapter 8: Staying Compliant in a Changing World

Why Trade Compliance Is Always a Moving Target

Trade compliance isn’t something you can set and forget. Regulations change. Tariffs shift. New reporting requirements emerge. And geopolitical forces continue to reshape how and where goods are made and moved.

To stay compliant – and competitive – companies need to stay alert and informed.

Emerging Issues to Watch

- Forced Labor Enforcement

CBP continues to crack down on goods suspected of being produced with forced labor, particularly from regions like Xinjiang, China. Importers must now do deeper due diligence, including supply chain tracing and factory vetting. - Trade Agreement Updates

New bilateral and regional trade agreements are reshaping duty rates and eligibility rules. The USMCA, for instance, added new requirements for verifying origin, especially in the automotive sector. - Country of Origin Scrutiny

Tariff wars have pushed some importers to shift sourcing or reclassify origin, sometimes without sufficient transformation to justify a new COO. Customs officials are on high alert for origin fraud. - Digital Trade Enforcement

CBP is using AI-driven risk detection at its National Targeting Center to quickly and easily identify compliance and security anomalies, resulting in more stringent and accurate targeting of non-compliant cargo. Be sure you know at least as much about your supply chain as they do and build compliance into every shipment. - “Friendshoring” and Nearshoring Trends

As more companies look to shift production to “friendlier” nations for stability, they must also reassess the trade rules in those countries and understand how new sourcing affects classification, duties, and compliance requirements.

Compliance Must Stay Agile

The most successful companies don’t just react to these changes, they build compliance programs that can adjust quickly.

That might mean subscribing to trade updates, joining associations, or assigning someone internally to track regulatory news. It also means keeping close ties with your logistics partners, who often hear about these changes first.

When your compliance processes are agile, your supply chain is too.

Why Trade Compliance Is a Competitive Advantage

And Why Dimerco Is the Partner to Help You Get It Right

Trade compliance used to be viewed as a back-office burden, a box to check. That view is outdated.

In today’s supply chain, compliance is a strategic function. It protects your revenue, strengthens your delivery performance, and gives you confidence at every customs checkpoint.

Programs like CTPAT are a perfect example. Importers who participate and work with CTPAT-certified partners throughout their supply chain enjoy fewer inspections, faster clearance, and a lower risk profile in the eyes of CBP.

Dimerco is a CTPAT-certified freight forwarder, and we extend that security and compliance advantage to our customers. When your logistics partner is aligned with your own compliance programs, it adds an extra layer of protection and speed.

At Dimerco, we combine global logistics strength with deep trade compliance expertise, especially across complex Asia–North America and Asia–Europe lanes. Our integrated solutions help you move freight faster, with fewer issues, and with full confidence that your documentation and processes are aligned with the latest global trade compliance standards.

If your internal team is stretched, or you want a second set of eyes on your compliance program, we’re here to help. From classification guidance to customs clearance to bonded warehouse management, we’ve got the experience and the agility to support your success.

Let’s talk. Dimerco can help you move more than goods. We can help you move smarter.