Do you need a customs consultant?

For most companies involved in global trade, the answer is “yes.”

Without some help from an expert, the trade compliance landscape is simply too complex for the average importer to successfully capitalize on available cost savings opportunities and to manage the significant downside risks of non-compliant trade practices. This article will explore this important question a little further.

Trade Compliance is a Complex Challenge

Business experts tell us companies should hire a consultant when they face complex challenges that they don’t have the internal expertise or resources to address on their own. The facts are that only the largest companies have dedicated trade compliance teams. At most companies, the function is an added responsibility to a primary job like logistics or purchasing or finance.

It’s an under-resourced function, as we discuss in our article: Trade Compliance: Understanding the Basics.

Need evidence that U.S. Customs compliance qualifies as a complex challenge? Read on:

- There are 78 ongoing anti-dumping investigations that would increase duties exponentially AND 678 current anti-dumping orders that add high duties for products from steel to textiles.

- $2.6 billion in goods have been detained under the Uyghur Forced Labor Prevention Act (UFLPA), not including withhold release orders. Have you tracked your supply chain to the source level to know you are not at risk?

- There are 14 free trade agreements between the U.S. and 20 countries that can be leveraged to dramatically reduce duty payments.

- 47 Partner Government Agencies, like the Food and Drug Administration, have enforcement authority over imports. Which may impact your products?

- There is increased audit activity focused on CBP’s priority enforcement areas, like valuation. Companies need to understand these key enforcement areas and take steps to avoid audits.

- Country of origin determinations are becoming more complex and comprehensive as importers diversify their supplier base beyond China into Southeast Asia and other countries.

If any of these issues could impact your company – negatively or positively – you want to know. The only way to do that is through reading and research – time-consuming activities that get pushed to the back burner as you fight today’s fires.

The truth is it’s next to impossible for under-resourced teams to become trade compliance experts on a part-time basis. Hiring a customs consultant is a smart bet to save money and mitigate risk.

Trade Compliance Consultant: Expense or Investment?

Customs consultants are experts for a reason, so their specialist knowledge comes at a cost. But the money you save and the penalties you avoid by following their expert advice suggest this cost may be more of an investment than a straight-up expense.

It’s kind of like having a good tax accountant. Such professionals can pay for themselves 10 times over by leveraging a detailed knowledge of the tax code to your advantage. Don’t expect a part-time compliance team to have the same kind of impact – unless they can lean on outside experts for support.

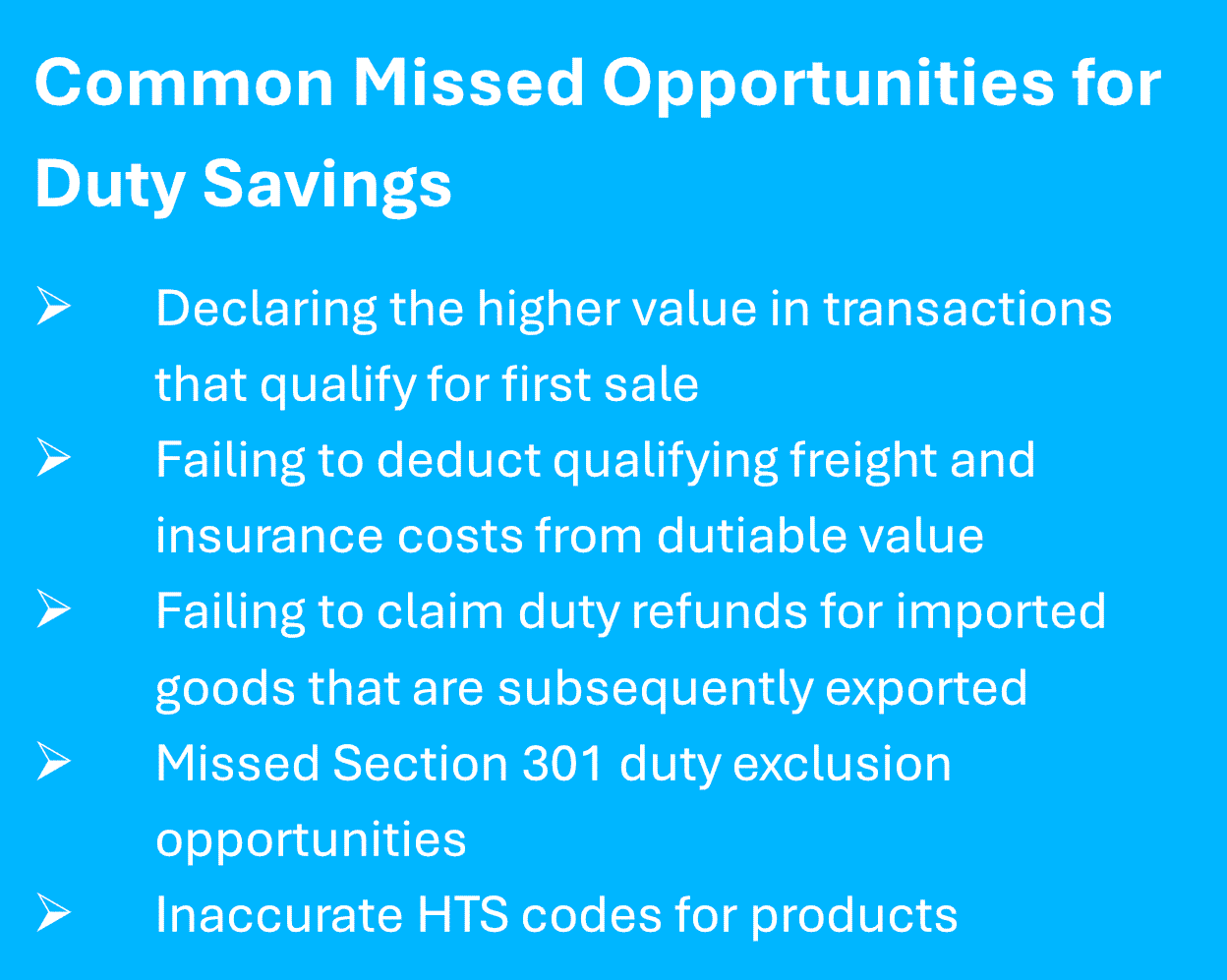

A customs consultant can consider a wide range of strategies for duty savings.

A customs consultant can consider a wide range of strategies for duty savings.

First Sale valuation is just one example. That’s a rule that allows U.S. importers to base the valuation of a product entering the U.S. on the first in a series of transactions, rather than the last one. For example, an item may be produced in China, sold to a middleman in Hong Kong, and then sold to a buyer/importer in Los Angeles.

Experts estimate that First Sale usually saves the importer 10-20% – but less than 50% of eligible companies leverage this option.

A consultant can vet your import program for “first sale” savings opportunities, as well as savings from drawback programs, FTZ utilization, free trade agreement eligibility, anti-dumping rate reviews, and other strategies to reduce import duties in the U.S.

Here are two real-world, cost-saving examples:

- When an electronics importer recently moved production of a product from China to Mexico, they thought the product would qualify for duty free status under the USMCA free trade agreement. When the first order was ready for shipment to the U.S., however, it was discovered that all components had been sourced from China and the product was merely assembled in Mexico, resulting in almost $200,000 USD in unanticipated duties until the supply chain could be retooled.

- A customs consultant recently helped a U.S. importer recover close to $500,000 in 301 duties previously paid to CBP by confirming that some of the company’s products qualified for an exclusion. And the company no longer pays 301 duties on those products, saving 25% on future imports.

Customs Consultants Help Avoid Risk

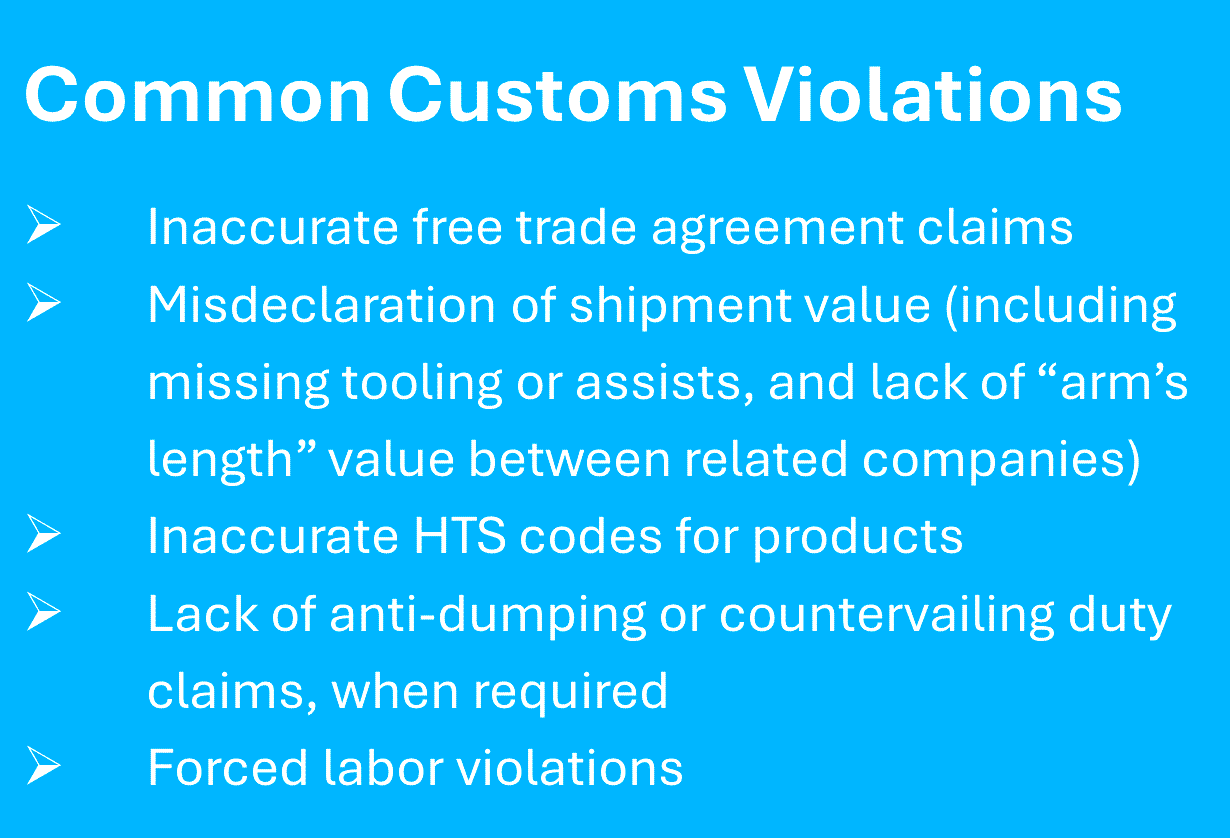

The downside of poor trade compliance practices can impact a company far beyond inflated duty payments. Consequences could easily equate to a 6- or 7-figure profit loss linked to delays, lost revenues and fines.

One recent compliance failure involved a civil enforcement action against an importer that markets a branded sweetener product. The company is alleged to have violated laws that prevent goods made with forced labor from entering the USA. CBP assessed $575,000 USD in fines on this enforcement action.

One recent compliance failure involved a civil enforcement action against an importer that markets a branded sweetener product. The company is alleged to have violated laws that prevent goods made with forced labor from entering the USA. CBP assessed $575,000 USD in fines on this enforcement action.

Customs consultants can work with compliance teams on risk mitigation strategies that help avoid future supply chain delays, fines, onerous penalties, forfeitures, seizures, duty recoveries, and interest payments.

Most importantly, compliance risk mitigation protects a brand’s reputation against the negative publicity that can come with the more public side of CBP enforcement actions.

In 2023, for example, CBP seized 5,000 textile shipments valued at more than $129 million USD, and conducted a laboratory analysis on 323 shipments, 42% of which were found to be mis-declared or mis-described by importers.

CBP has issued between $40 million and $132 million in importer penalties each year during the last five years. No importer wants to be part of these statistics. A trade compliance consultant can help avoid costly compliance mistakes and protect your reputation.

Why Hire an Independent Consultant?

Some of the reasons for hiring a customs consultant are, frankly, the same as hiring any business consultant.

- Fast and effective diagnosis. Outside consultants come to the table with a frame of reference based on years of experience. As a result, they can quickly assess your operation against best practices.

- Neutral and objective outside view. Insiders can be “too close” to recognize opportunities and challenges. Consultants see the big picture and their advice is neutral and free from internal politics or allegiances.

- Cost-effective investment. Consultants are often short-term and don’t come with the ongoing overhead expenses of a full-time person. Part of their responsibilities could even include training company personnel to manage a particular function well – eventually without the need for outside help.

- Optimized internal resources. Consultants are often engaged to concentrate on a singular initiative that had been a part-time focus for an under-resourced staff. An outside consultant has a dual benefit of completing a critical initiative AND freeing up time for team members to focus on other strategic tasks.

Trade Compliance Consultant Expertise Could Be Closer Than You Think

There’s a mountain of risk associated with poor trade compliance. Don’t ask team members to perform the function on a part-time basis without help, and then expect them to consistently find hidden savings opportunities and flag compliance breaches. That’s not realistic. Trade compliance is too complex a discipline, with thousands of rules, regulations, and exceptions that regularly change.

While your business may not warrant a full-time compliance expert, it’s still possible to get that outside expertise without breaking the bank. In fact, you may not have to look any further than your freight forwarder.

Global forwarders like Dimerco Express Group offer customs brokerage and trade compliance as a core service. To discuss how to get your customs and trade compliance practices to the next level, contact a Dimerco expert today to start a conversation.