Driving a car, filing your taxes, or even playing a board game—each of these activities follows specific rules and guidelines. The same applies to international trade. Businesses operating across borders must navigate a complex web of regulations to ensure compliance with government agencies worldwide.

This set of rules governing international business transactions is broadly known as global trade compliance. It involves the processes importers and exporters use to adhere to the laws and regulations that control the movement of goods, services, and information between trading partners and government agencies.

Unlike a standardized rulebook, trade compliance regulations vary by country and industry, making it a significant challenge for businesses, especially those in the U.S., to maintain compliance. In this article, we break down the essentials of global trade and compliance in a question-and-answer format to help you navigate this critical aspect of international business.

What is global trade compliance?

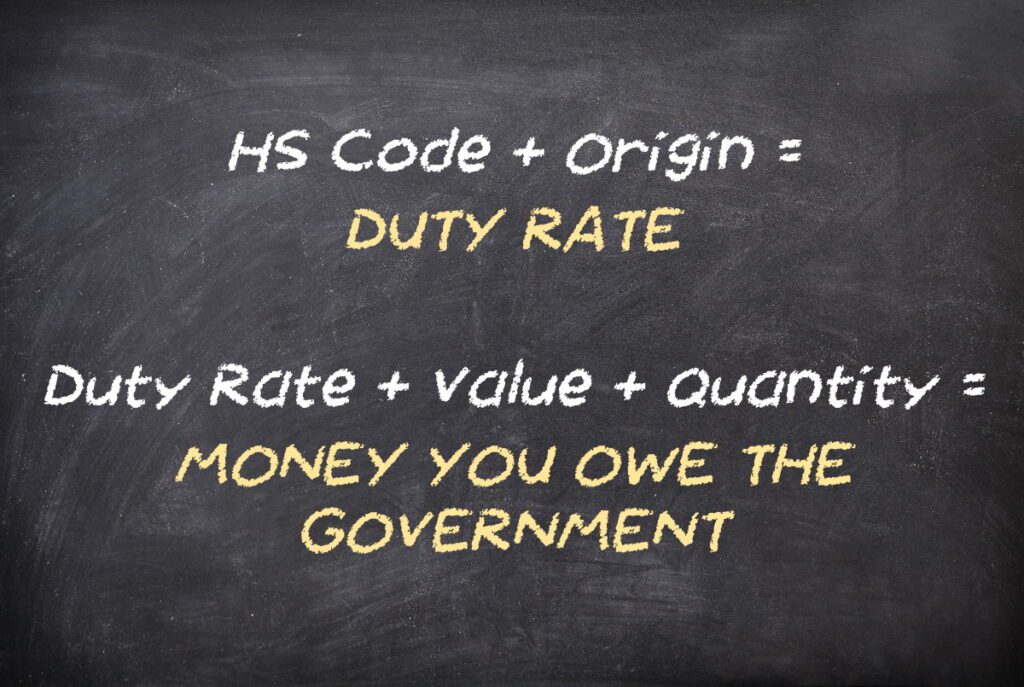

At its core, global trade compliance ensures that businesses correctly classify, value, and declare their imported and exported goods. Customs and government agencies generally require answers to four key questions:

At its core, global trade compliance ensures that businesses correctly classify, value, and declare their imported and exported goods. Customs and government agencies generally require answers to four key questions:

- What’s the product?

Every product you import must have a Harmonized System code (HS code) that classifies the type of product it is and helps to determine the duty, tax rate and other potential government charges or fees. The code selected must be accurate and not based on which code has the lowest duty. - How much is it worth?

This value equals the total amount you, as the importer, paid to the foreign seller. Many importers believe that the value is what is listed on the commercial invoice, but that may not be true. Additional items and services (packaging, engineering services) that are provided by the buyer to the seller are also dutiable. These are called “assists.” - Where was the product made?

The Country of Export is not necessarily the product’s actual Country of Origin, and it’s up to you, the importer, to report the accurate origin of the goods to US Customs and Border Protection (CBP). Accurate reporting of the country of origin is critically important and may cause an increase or decrease in the duty. - How much of it is there?

The quantity, weight or other related data about the items you’ve purchased are typically sourced from the commercial invoice or packing list. The HS code determines which statistical data elements you must report. These are required by both CBP to determine the total duty and tax that is owed and by the Department of the Census to compile international trade statistics.

In the end, all these factors boil down to one thing: money. U.S. Customs and Border Protection (CBP) and other global agencies audit companies to ensure governments receive the revenue they are owed.

What are the consequences of non-compliance?

Failure to comply with trade regulations—whether intentional or accidental—can result in severe consequences, including:

- Supply chain disruptions due to customs holds and government inspections, which the importer must pay for.

- Hefty fines and penalties, especially for repeat offenses.

- Customs audits and potential debarment, meaning companies could lose import/export privileges altogether.

Consequences could easily equate to a 6- or 7-figure profit loss linked to delays, lost revenues and fines.

One recent compliance failure involved a civil enforcement action against an importer that markets a branded sweetener product. The company is alleged to have violated laws that prevent goods made with forced labor from entering the USA. CBP assessed $575,000 in fines on this enforcement action.

Who is responsible for global trade compliance?

The importer is ultimately responsible for ensuring compliance. A customs broker can provide guidance, but legal and financial liability rests on the importer’s shoulders.

Consider this scenario:

Distributor B buys goods from Manufacturer A and sells them to Retailer C. The retailer is responsible for ensuring the accuracy of the HS code, the correct quantity of goods, and compliance with labor and environmental regulations—even if they rely on information from Distributor B.

This means that importers must vet their suppliers, sometimes visiting factories to ensure compliance with U.S. trade laws and regulations.

———————————–

For a role that is so important and so complex, trade compliance is often an under-resourced function. Why? Because the function itself is mistakenly viewed as just a cost center.

———————————–

Whose job is it within an importer’s organization?

Responsibility varies by company size:

- Large enterprises may have a dedicated global trade compliance officer and supporting staff.

- Mid-sized firms might place this responsibility on the head of logistics or finance.

- Small businesses may rely on purchasing managers—or even the company owner—to manage trade compliance.

For a role that is so important, with requirements that are so complex, trade compliance is often an under-resourced function.

What is tariff engineering?

This question goes a little beyond the basics of trade compliance, but the practice of tariff engineering has gotten more attention recently. Tariff engineering has long been used by best-in-class importers to ensure the lowest possible, compliant duty for their products. More recently, when the Trump Administration added tariffs on certain commodities from certain parts of the world, companies began sourcing products from new regions, re-engineering their products and researching whether they could classify their products compliantly in a different, more appropriate section of the tariff. Changing an HS code for a previously imported product has repercussions, however, and must be considered very carefully.

There are 5300 HS codes, so you would think there would be one single code for your specific product. But there are grey areas. The same product could fall under multiple HS classifications depending on the product’s essential character. An experienced international customs broker will understand these nuances and can provide invaluable advice.

Of course, companies may choose to slightly reengineer the product to enable the change in classification, like adding a plastic coating or decoration to an item to alter its most appropriate HS code, potentially saving thousands of dollars in customs duties.

Why invest in a robust global trade compliance program?

Businesses hesitate to sink more money into a function they already consider a cost center. But investing time into a properly resourced trade compliance program – whether those resources are internal or external – makes bottom-line sense. Among the advantages:

- Minimized duty costs through strategic use of trade agreements and tariff classifications.

- Faster supply chain operations, reducing delays and keeping customers satisfied.

- Reduced legal risks, preventing costly fines and reputational damage.

- Stronger government and trade relationships, ensuring smoother business operations.

How can I learn more about global trade compliance to protect my organization?

If you’re looking to enhance your company’s global trade and compliance efforts, consider:

- Consulting your logistics partners: Freight forwarders, customs brokers, and third-party logistics providers (3PLs) can offer invaluable insights.

- Joining trade associations: Groups like the American Association of Importers and Exporters (AAEI) and International Compliance Professionals Association (ICPA) provide networking opportunities and training.

Leveraging professional advice: Companies like Dimerco specialize in global shipping and trade compliance, particularly for businesses trading between the U.S., China, and other Asian markets.

Get Help with Your Global Trade Compliance Needs

We live in a global economy where businesses depend on the ability to trade seamlessly and efficiently with other companies around the world.

There are ground rules that allow this to happen. Global trade compliance experts understand these ground rules and can give their companies a decided competitive edge.

If your company lacks the time or resources to develop this expertise internally, work with a company like Dimerco that combines global shipping and logistics capabilities with an expert knowledge of trade compliance – particularly between the US and China and other Asian countries. To discuss how Dimerco can assist with your global shipping and trade compliance needs, contact us today to start a discussion.