In the latest episode of The Freight Buyers’ Club, sponsored by Dimerco Express, industry experts discussed the changing landscape of freight procurement and supply chain management.

Key insights were shared by Alan McTaggart, VP of Global Logistics at Techtronic Industries (TTI), and Philip Damas, Managing Director at Drewry Shipping Consultants, shedding light on how businesses can navigate this complex environment.

Signs of Stability Emerging in the Freight Market

After experiencing unprecedented volatility in recent years, the freight market is showing promising signs of stabilization. The recent period was marked by significant disruptions – including soaring prices and lengthy contracts – largely driven by the pandemic’s impact. These challenges, particularly the transportation disruptions that emerged in March 2020 and persisted through 2022, have begun to subside.

While Alan McTaggart acknowledges the possibility of historical “false dawns” of stability, the discussion also emphasized a potential shift towards a more stable market environment. Factors such as easing port congestion and the increase in warehouse space, a result of panic purchasing ahead of geopolitical uncertainties, suggest a potential move towards a more stable market environment.

Key Factors Influencing the Market

Several key factors will continue to influence the freight market:

- Emerging geopolitical tensions, such as the ongoing trade war between the US and China, pose significant risks to global trade flows. This has led many companies to adopt “China + 1” strategies, diversifying their sourcing to reduce reliance on a single manufacturing hub.

- Companies are increasingly prioritizing strategies to build resilience into their supply chains, including diversification, technology adoption, and stronger relationships with logistics partners. This includes exploring alternative sourcing options beyond China and investing in technologies that enhance supply chain visibility and agility.

- Automation, robotics, and artificial intelligence are playing an increasingly important role in logistics, impacting production processes, transportation routes, and overall supply chain efficiency. It can also help mitigate the impact of labor shortages and reduce reliance on specific geographic locations for manufacturing.

- As depicted in the image from Drewry, 2025 is expected to see another 2 million TEU of ship capacity added to the market, exceeding predicted demand growth by 5%. This oversupply, coupled with the potential for a return to normal shipping routes through the Suez Canal, could lead to a further decline in rates.

- Higher wages for port workers and potential disruptions (if the tentative agreement with the ILA fails) will trigger either short-term or medium-term cost and capacity pressures.

- Ocean carriers have demonstrated discipline in capacity management and contract negotiations, which will play a crucial role in market stability.

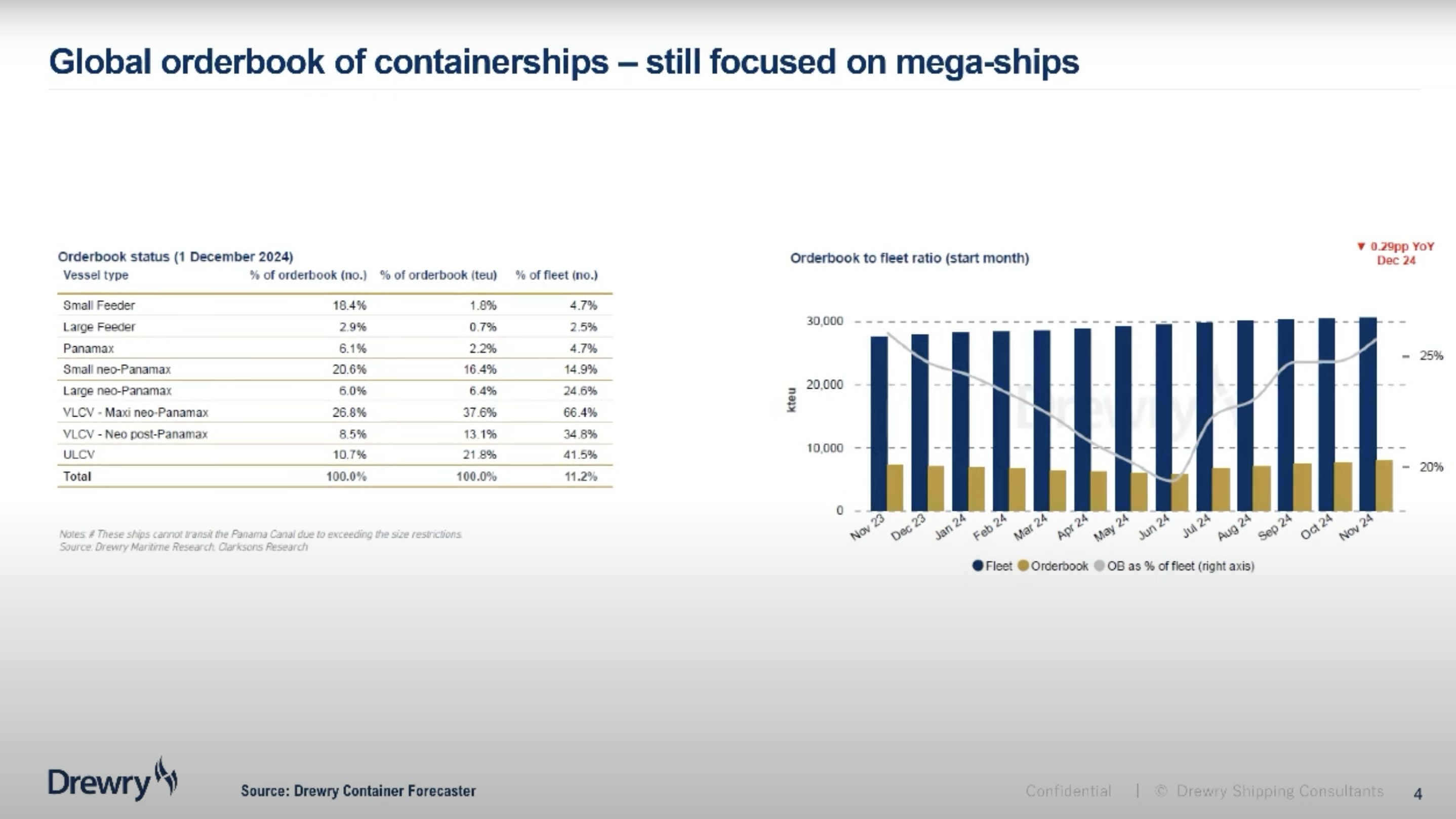

- The orderbook for containerships is heavily focused on mega-ships. While these vessels offer operational efficiencies, the continued investment in such large ships could exacerbate overcapacity issues in the market. This trend, coupled with the ongoing increase in overall supply, could put further downward pressure on freight rates.

Market Trends in Focus

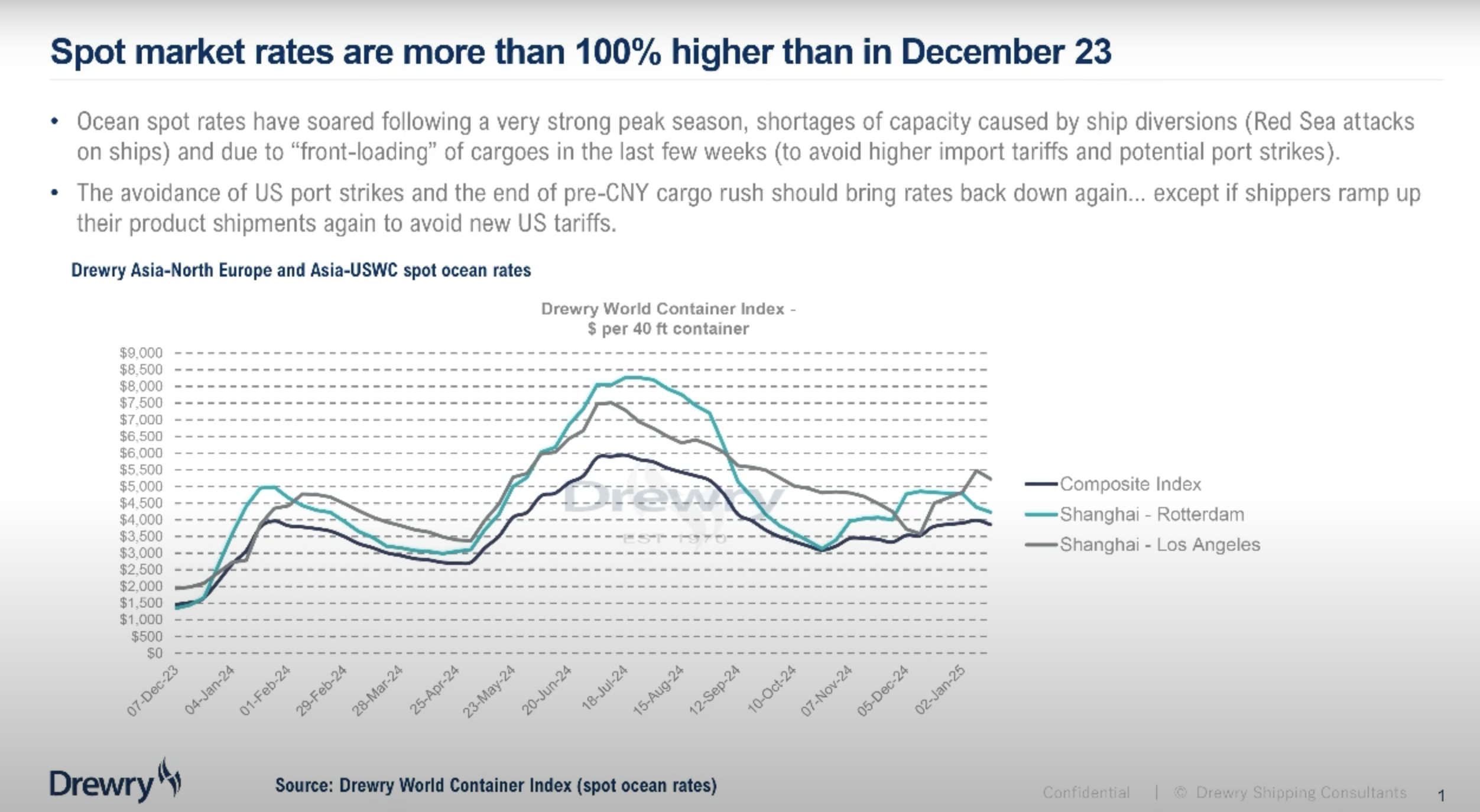

Spot Rates

As illustrated in the Drewry World Container Index, spot rates have fallen from their peak but remain significantly higher than levels observed in December 2023. This observation aligns with the discussion, which acknowledged that while some signs of stability are emerging, the market has not yet fully returned to pre-pandemic levels. The continued high spot rates indicate that the market is still not a buyer’s market, suggesting that shippers may still face challenges in securing favorable rates.

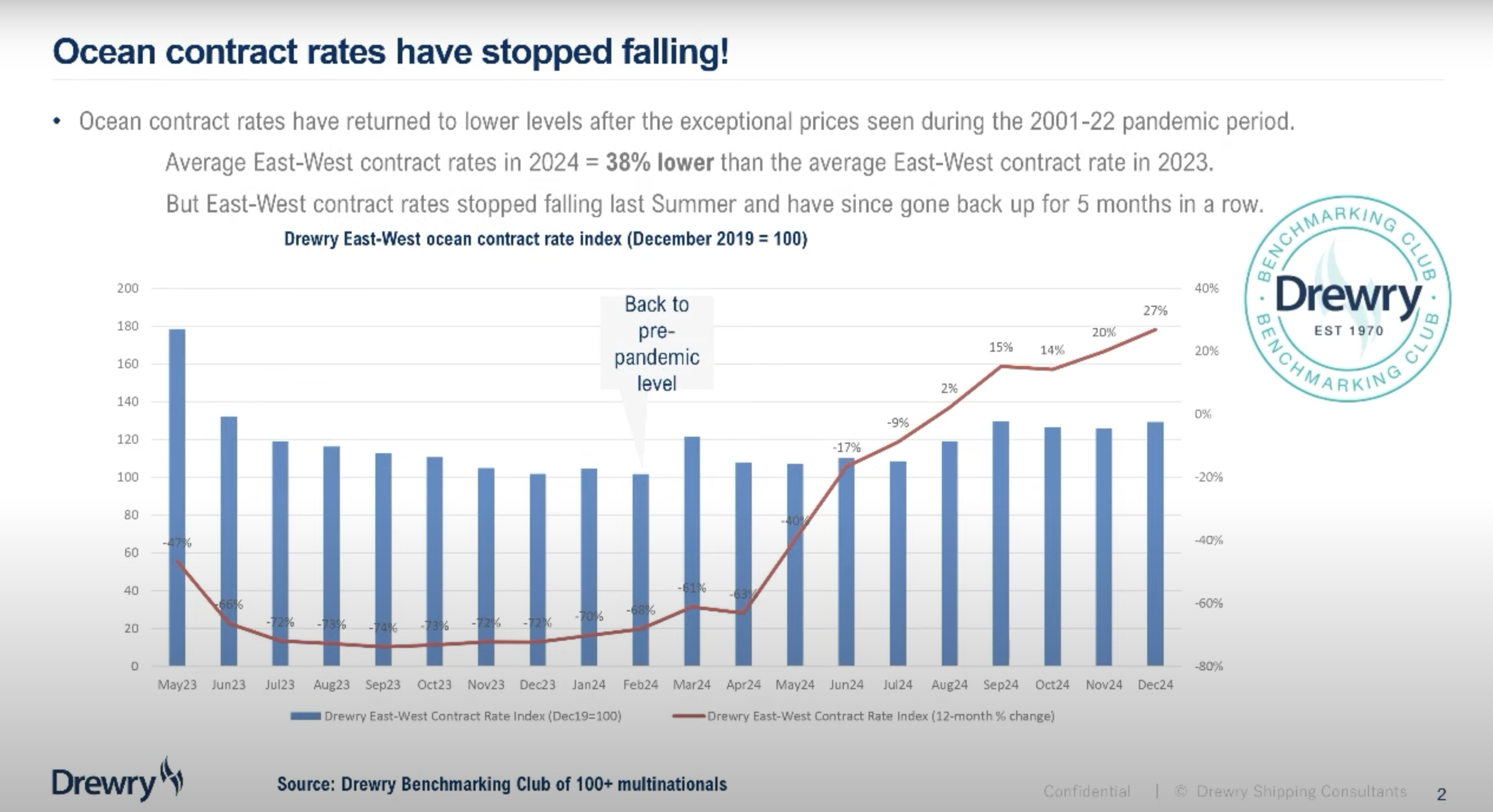

Contract Rates

Contract rates fell significantly in 2024 compared to the elevated levels of 2023. However, recent data from the Drewry Benchmarking Club of 100+ multinationals shows signs of stabilization and even a slight uptick in recent months. This suggests that despite the overall decline, contract rates may not continue to fall dramatically in the near future.

Strategies for Shippers

In this dynamic environment, shippers can navigate challenges by:

- Developing Robust Risk Management: Identifying potential disruptions, assessing their impact, and developing contingency plans is crucial for mitigating risks.

- Investing in Technology and Data Analytics: Utilizing advanced technologies can improve visibility, optimize routes, and enhance overall logistics efficiency.

- Building Strong Relationships with Carriers and Forwarders: Collaborative partnerships are essential for navigating challenges, ensuring reliable service, and securing favorable rates.

- Implementing “China + 1” strategies: Diversifying factory locations and exploring alternative sourcing options can help mitigate risks associated with geopolitical uncertainty and potential disruptions to supply chains.

Alan McTaggart emphasizes the importance of building strong relationships with carriers and forwarders to enhance resilience and ensure reliable service.

Alan McTaggart highlights TTI’s strategic use of long-term contracts, strong carrier relationships, and flexible forecasting to ensure stability and resilience during volatile freight market conditions.

Succeeding in the Evolving Freight Landscape

By understanding key trends, embracing technological advancements, and cultivating strong relationships within the supply chain, businesses can develop strategies for success in this ever-evolving landscape through 2025 and beyond.

Dimerco Express Group is committed to empowering shippers with knowledge, resources, and reliable freight solutions. We support businesses in today’s complex logistics landscape, with a strategic focus on freight movement to, from, and within the Asia-Pacific region. With over 130 offices across Asia, Dimerco offers tailored solutions to keep your supply chain running smoothly.

Does your business face challenges in navigating the complexities of the global freight market? Reach out to our team of experts for tailored support and guidance.

For in-depth insights into global logistics trends and strategies, listen to the full episode of The Freight Buyers’ Club podcast.