New port fees on Chinese built and operated vessels are set to take effect in the United States on October 14, 2025. The policy has already triggered significant responses by global carriers, through redeploying vessels and even reflagging fleets, and the ripple effects are only beginning. For shippers, the implications go far beyond higher charges.

To unpack what this means for the industry, Lars Jensen, global liner shipping expert and CEO of Vespucci Maritime, shared his perspective on the Freight Buyers’ Club podcast. Their discussion went beyond the headlines to examine the transpacific slowdown, emerging growth markets, and the outlook for Asia-Europe trade.

U.S. Port Fees Set to Reshape Carrier Strategy

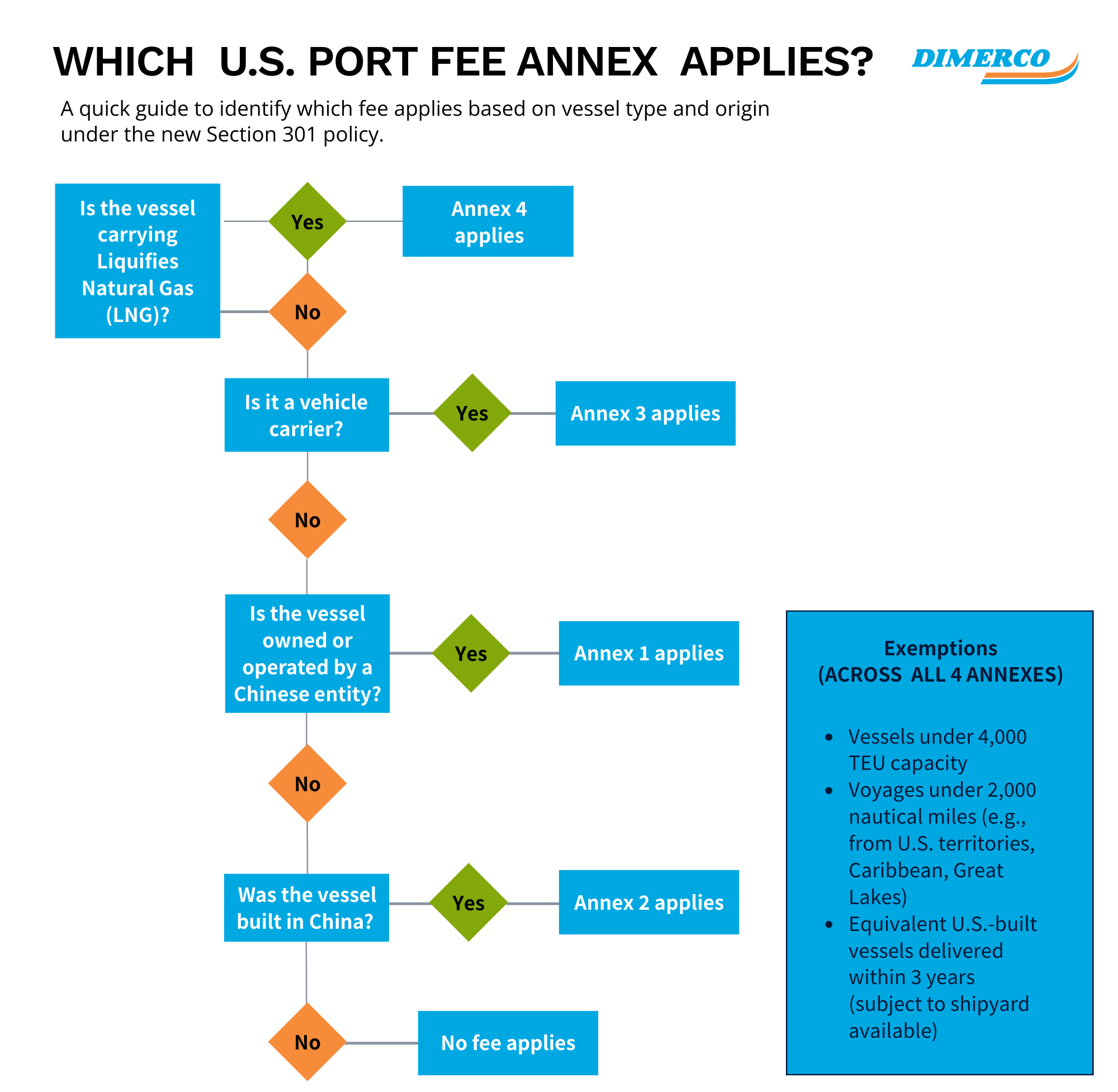

On October 14, new fees will be introduced for Chinese built, owned, or operated vessels calling at U.S. ports. Carriers have responded in predictable ways, redeploying Chinese ships to other routes and replacing them with non-Chinese flagged tonnage.

Some operators have taken bold steps, such as Seaspan, which is shifting around 100 vessels from Hong Kong to Singapore to avoid the new charges. While major players like Maersk and HMM have indicated that they will not introduce surcharges, smaller Chinese niche carriers have already exited certain services altogether.

The largest unknown remains how Chinese giants such as COSCO and OOCL will respond. Early signs suggest they will maintain operations, but market observers are watching closely.This uncertainty is heightened as China is indicating it may retaliate against the new US port fees.

For shippers, the key takeaway is that competitive pressure will prevent broad-based cost increases in the near term, but long-term implications could shift market share.

A Weak Peak Season Weighs on Transpacific Trade

The transpacific market has entered a soft patch. The expected peak season never materialized, despite rate spikes that briefly suggested otherwise. Actual cargo movements revealed weaker demand, with U.S. imports contracting even as global container growth continued.

This weakness cannot be blamed on tariffs alone. U.S. consumers have kept spending steadily, but inventories remain elevated, and the real impact of new tariffs will likely emerge in the months ahead. Carriers, meanwhile, have struggled to adjust capacity to policy swings that shift faster than fleet deployment can.

Growth Markets Beyond the U.S.

While the U.S. market falters, other regions are gaining momentum. Jensen pointed to growth in exports from Asia to Africa, South America, and Europe. Africa stands out, with growth rates reaching 15 to 20 percent in some West African trades.

Although smaller in scale, these markets highlight global adaptability. When U.S. demand slows, cargo finds new destinations. Carriers are now discovering growth opportunities they had previously overlooked, creating new avenues for long-term diversification.

Asia-Europe Trade Finds Its Equilibrium

Asia-Europe spot rates have slipped below 1,000 U.S. dollars per TEU, sparking talk of a market collapse. Jensen sees it differently, describing the development as normalization.

After a 2024 defined by capacity shortages and rerouting around Africa, fleet growth of10 percent in 2025 has brought balance back to the trade. Rates are lower than last year’s peaks but still above pre-pandemic levels.

Carriers are facing pressure on profitability, but this is not a rate war. Instead, the market is adjusting to a sustainable equilibrium shaped by capacity, seasonality, and shifting strategies ahead of Chinese New Year.

Preparing for 2026 Requires Flexibility

As 2026 approaches, Jensen cautioned that new U.S. port fees and shifting trade flows are already creating uncertainty, with IMO rules likely to add more pressure.

Winners in 2026 will be those who stay agile, adjusting strategies week by week rather than relying on forecasts that can be overturned overnight.

Guiding Supply Chains Through Uncertain Times

Success in 2026 will not come from fixed forecasts but from the ability to adjust quickly. Shippers that build flexibility into planning, monitor shifting trade flows closely, and stay alert to regulatory changes will be best placed to respond. Week-by-week adaptability is emerging as the strongest asset in global logistics.

For tailored strategies to help you navigate shifting market conditions, get in touch with a Dimerco specialist.

Subscribe to the Freight Buyers’ Club podcast for more expert insights and analysis on the forces shaping global trade.

Learn how to build greater resilience into your operations with our free eBook: Creating Supply Chain Agility.