Since its entry into force in early 2022, the Regional Comprehensive Economic Partnership (RCEP) has emerged as a central force in the Asia-Pacific region. As the world’s largest free trade agreement, RCEP has the potential to significantly shape the region’s economic and political landscape for years to come.

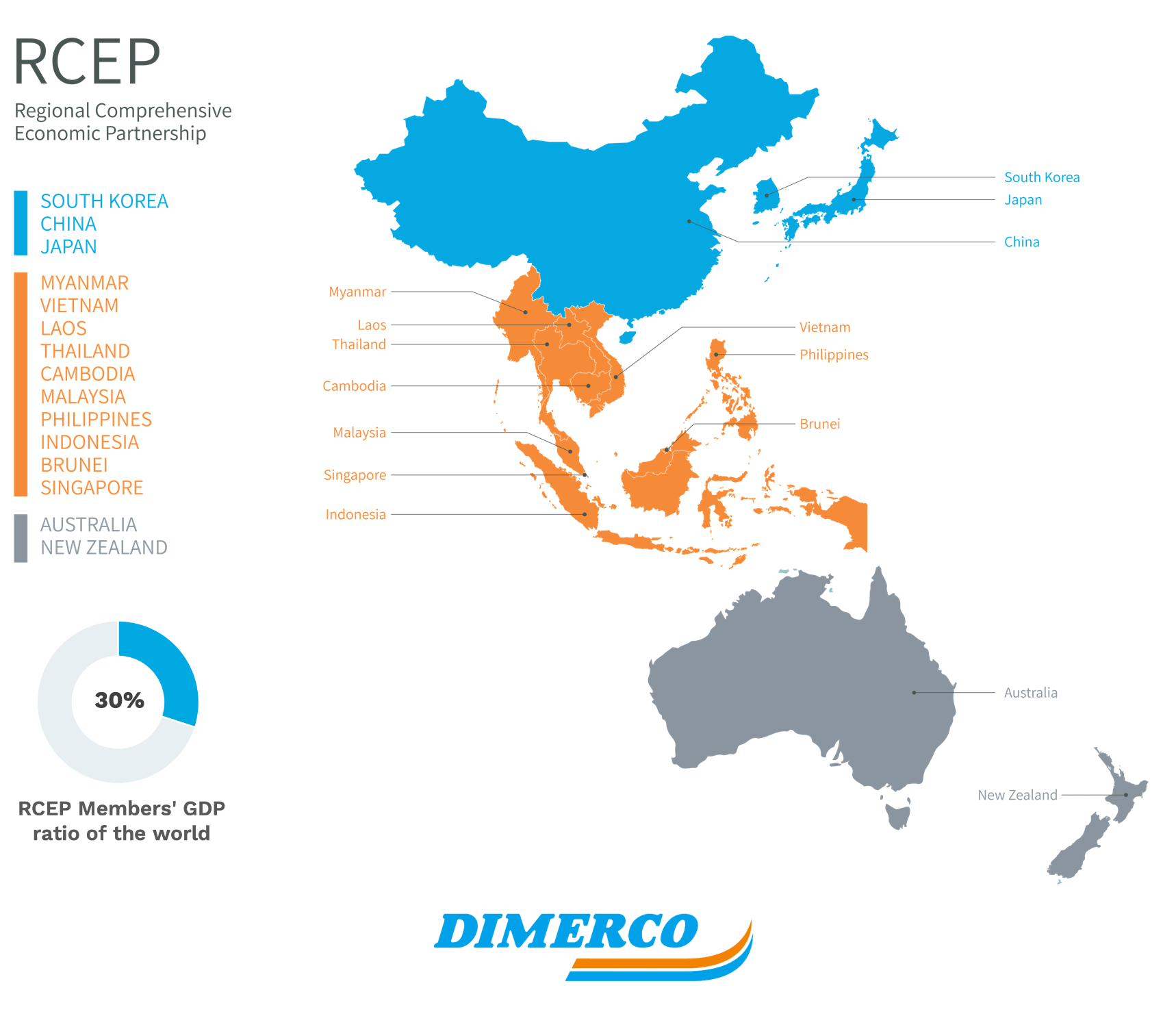

RCEP brings together 15 diverse economies across East Asia and the Pacific. These countries include all 10 members of the Association of Southeast Asian Nations (ASEAN), as well as China, Japan, South Korea, Australia, and New Zealand. Together, they represent over 30% of global GDP, highlighting the agreement’s significant economic weight.

RCEP’s largest expected impacts include:

- Relaxed market access for member countries

- Reduced import tariffs

- Simplified customs procedures

- Harmonization of rules of origin, inspection and quarantine, and technical standards, making trade fairer and more transparent

RCEP’s far-reaching impacts extend beyond its member countries. The agreement’s benefits include increased trade, investment, and economic growth within the region. While this may present new opportunities for some countries, it could also increase competition for non-RCEP countries seeking to export to the region.

Key Developments in 2024

As of 2024, RCEP remains fully in effect and is being actively implemented by its member countries. While there have been no major updates or significant changes to the agreement itself, ongoing discussions and negotiations among member countries continue to address specific issues and challenges related to its implementation.

Key areas of focus in 2024 have included:

Supply Chain Resilience: The agreement’s provisions on trade facilitation, customs procedures, and rules of origin have helped businesses navigate challenges and secure alternative sources of inputs.

Digital Trade and E-commerce: Recognizing the pivotal role of digital trade in the modern economy, RCEP has prioritized its promotion. Member countries have been working to create a conducive environment for online businesses, including through measures to reduce barriers to cross-border data flows and protect consumer rights.

Expanding Membership: While there have been no new members joining RCEP in 2024, discussions regarding potential future expansions have continued. India, which is not currently a member, has expressed interest in joining the agreement. However, outstanding issues need to be resolved before India can fully participate.

Major Tariff Reductions

At the top of the list of RCEP’s impacts is its effect on tariffs for participating countries. The 15 RCEP members have adopted a bilateral arrangement for the liberalization of trade. Under the RCEP framework, trade liberalization will be achieved through gradual tariff reductions. More than 90% of the trade in goods in the region will eventually achieve zero tariffs. Since import tariffs between many RCEP members were already low, the agreement will mostly reduce these tariffs on imports from China, Japan and South Korea, according to UNCTAD. For ASEAN members, along with Australia and New Zealand, the share of products with zero tariffs was already above 90%.

The largest reductions in tariffs will be on imports of machinery and appliances, plastic products, and electrical and electronic equipment, and on exports of textiles, bags and plastic products. The industries most affected are traditional high-tax industries such as food, agriculture, consumer goods and automobiles. In the future, consumers will be able to buy Japanese cars, Australian skin care products, New Zealand honey and Malaysian fruit at cheaper prices.

Intra-RCEP trade was already worth about $2.3 trillion (2019) overall and the UNCTAD analysis shows that RCEP’s tariff concessions will increase the intra-regional exports of alliance members by nearly 2%, representing approximately $42 billion. This results not just from trade creation due to lower tariffs between RCEP members, but also from trade diversion as the lower tariffs redirect trade away from non-members to members, accounting for approximately $25 billion. “As the process of integration of RCEP members goes further, these diversion effects could be magnified, a factor that should not be underestimated by non-RCEP members,” according to the UNCTAD report.

Harmonized Rules of Origin and a New Emphasis on E-commerce

One innovation driving the significance of RCEP is the development of harmonized rules of origin, which will make it easier for businesses to benefit from the deal. Under this part of RCEP, businesses enjoy the agreement’s duty-free treatment on a product as long as 40% of the product is produced in member countries. By comparison, the USMCA has a 60% requirement for most products.

The significance of RCEP extends into the world of e-commerce. The trade agreement includes the first comprehensive and high-level e-commerce rules established in the Asia-Pacific region. The agreement established a special e-commerce chapter to regulate e-commerce and create a more hospitable digital trade climate. The e-commerce components of RCEP encourage paperless trade, prevent customs duties on digital products, and lift restrictions on the location of computing facilities or movement of data across borders.

RCEP’s Significance Differs by Country

Japan may benefit the most from RCEP tariff concessions, largely because of trade diversion effects. Japan’s exports are expected to rise by about $20 billion, an increase equivalent to about 5.5% relative to Japan’s exports to RCEP members in 2019. Substantial positive effects are also found for the exports of most other economies, including Australia, China, South Korea, and New Zealand. On the other hand, RCEP tariff concessions may result in lower exports for Cambodia, Indonesia, Philippines, and Vietnam. This is due to the expectation that some exports of these economies will be diverted to other RCEP members because of differences in the tariff concessions between members. For example, some China imports from Vietnam could be replaced by imports from Japan because of the stronger tariff liberalization between China and Japan.

As RCEP continues to evolve and mature, its impact on member countries is likely to become more pronounced. It is essential for countries to monitor developments and adapt their strategies accordingly to maximize the benefits and mitigate the challenges associated with RCEP.

India and RCEP: A Missed Opportunity?

India’s decision to remain outside of RCEP has sparked debate among policymakers and analysts. While the reasons for India’s non-participation are complex, it’s clear that the country is missing out on potential benefits.

By staying out of RCEP, India may be limiting its access to:

- Larger markets within the Asia-Pacific region

- Preferential trade benefits

- Opportunities for supply chain diversification

- Increased foreign investment

For companies considering manufacturing in India, RCEP membership could have significant implications. By joining RCEP, India could become a more attractive destination for foreign investors seeking to leverage the agreement’s benefits.

If you’re interested in learning more about the challenges and opportunities of manufacturing in India, check out our eBook:

The Supply Chain Implications of RCEP

The significance of RCEP will be widespread and profound. The agreement brings a welcome measure of clarity to the supply chain landscape among ASEAN countries. Instead of navigating multiple trade agreements in the region, companies and supply chain providers will operate in a simplified regulatory environment with less bureaucratic confusion.

There will be one set of rules for trade and customs procedures compared to the confusing varieties that previously existed. The customs process should be accelerated in each country as part of the agreement. In addition, the steps to boost digital trade will reduce costs associated with managing the supply chain.

In essence, trade should be more straightforward, freeing providers to focus on identifying supply chain efficiencies throughout the region. The changes should make it easier for companies operating in Asia to integrate their supply chains across RCEP member countries. The RCEP covers many different sector-specific areas, so you should study the chapters of the RCEP business according to your products and industries. For companies that anticipate greater opportunities in the China market, you may be interested in our eBook: Mastering China Logistics.

How Will Your Supply Chain Evolve in the Wake of RCEP?

RECP creates opportunities for companies to reduce total supply chains costs by exploiting the expansion incentives and tariff reductions built into the trade agreement. One way or another, that will involve establishing a highly efficient intra-Asia logistics and shipping network.

Dimerco’s global logistics network includes more than 140 owned forwarding offices and distribution centers across Asia-Pac alone. Whether you need to design a supply chain strategy in a post-RCEP Asia, or provide the on-the-ground logistics to support that strategy, we’re ready to help. Let’s start a discussion.