A new update of the international product nomenclature that is used as a universal economic code for goods has affected a wide range of products, leaving behind an initial wake of confusion as importers adjust to the changes. For importers, make sure you are fully informed about these latest modifications – or risk noncompliance, delayed shipments and even fines or other penalties.

The World Customs Organization (WCO), which represents 183 customs administrations around the world, updates the Harmonized Commodity Description and Coding System (HS) every 5 years after a review process. The latest updates target tariff provisions, changes to product descriptions, and revised legal notes. The 351 modifications are designed to align customs administrations with advances in technology, environmental considerations, and health and safety. Over 98% of the merchandise in international trade is classified in terms of the HS, according to the WCO.

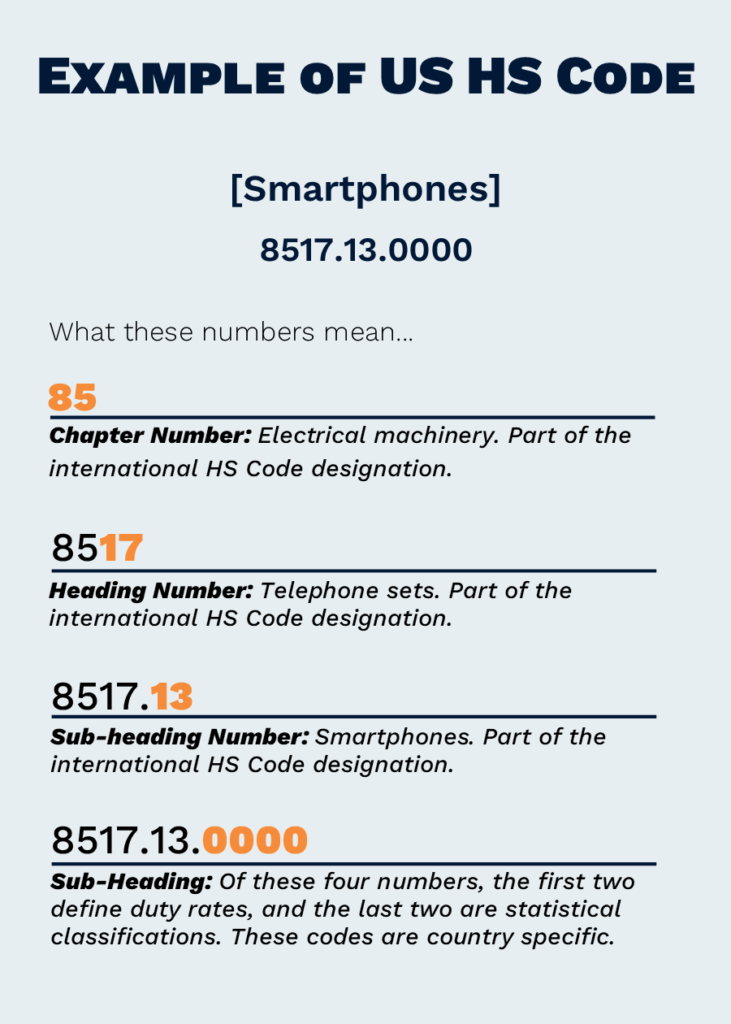

Participating countries, which include the United States, follow the HS code classification changes to update their own tariff schedules. The US adopted those updates into the Harmonized Tariff Schedule of the United States (HTSUS) on Jan. 27, 2022.

Want to know more? See the WCO’s HS Nomenclature 2022 Edition. Or check out the US HTS changes.

Wide-ranging HS code updates

New technology products are among the most prominent of the 2022 revisions, covering new flat panel displays, smartphones, 3D printers, unmanned aerial vehicles (i.e. drones) and electric vehicles, among other items.

New technology products are among the most prominent of the 2022 revisions, covering new flat panel displays, smartphones, 3D printers, unmanned aerial vehicles (i.e. drones) and electric vehicles, among other items.

For instance, smartphones will now receive their own tariff provision for the first time, under heading 8517. The classification changes not only affect the phones, but their accessories and component parts, too, making it important to map those updates. Another notable change is that flat panel display modules are now classified as products in their own right, simplifying classification by removing the requirement to identify the product’s final use.

Other changes, made to allow for better reporting and control over health and safety, cover items such as tobacco products intended for inhalation without combustion (vaping products), edible insect products, cell therapy, dual-use goods (such as detonators), and rapid diagnostic test kits. New subheadings are introduced for the monitoring and control of fentanyls and their derivatives, as well as two fentanyl precursors.

Environmental concerns drove changes to products like electronic waste (e-waste), other hazardous waste, chemicals, and materials specifically controlled under international conventions.

Importers are encouraged to review the HS code classification changes very carefully. More common commodities like extra virgin olive oil, certain types of furniture, light fittings, apparel and drinking containers are also covered under the changes.

Financial consequences of non-compliance with HS code reclassifications

While any changes are supposed to be duty neutral, many trade experts have found significant shifts in duty rates, so it’s important that you check. For instance, US Customs and Border Protection (USCBP) acted pre-emptively to reclassify stainless steel, double-walled beverage bottles (vacuum vessels) from HTSUS heading 7323 to heading 9617. This change will increase the duty rate on these bottles from 2% to 7.2%.

In general, there are more duty increases than decreases in the new HS code classifications – with an outsized impact on apparel and textiles. For example, while men’s shirts with pockets at the bottom were reclassified and now receive a lower duty rate, some blouses will move from a 6% duty rate to a 32% duty rate.

Dig into the HS code changes with the help of an expert

Importers should immediately review the HTS changes to determine the impact on their current product line and associated tariff codes. In the US, the update may affect duty rates, eligibility for trade preference programs, and application of Section 301 (Trump) tariffs and exclusions, along with other trade remedies.

In addition to a review of existing products, you can take a strategic look at the tariff changes, sharing any potential duty reductions with your product development teams. Tariff engineering, combined with a smart approach to product design, could result in duty savings for importers. Tariff engineering is the art of finding the lowest possible duty rate for an item, while remaining in full compliance with Customs regulations.

Remember that the changes apply to the customs administrations for all member WCO countries, so don’t forget to consider how the shifts might affect your company’s imports into countries outside of the US. Engaging an expert who can provide advice on the global impact to your products is always a great way to ensure compliance and to mitigate the financial impact to your organization.

Navigating these changes can be confusing, time-consuming and resource-intensive. If you need help, reach out to your supply chain service providers. Your customs broker and other trade compliance experts can work with you to ensure compliance. Many importers are deploying technology solutions that can streamline classification reviews and complement human expertise – even helping determine your eligibility for trade preference programs and whether your goods may be subject to trade remedies.

Integrate HS code changes into your systems and processes

Finally, be sure to update HS code classifications within your systems and share that data with relevant business partners. Failure to do so is one of the most common pitfalls for importers. Updating product or parts databases, bills of material and other sources that feed into purchase orders and commercial invoices at your company is an important step toward assuring compliance. It’s no use identifying a new code if your documents continue to reflect legacy data.

Next steps on HS code classification changes

Even though changes in the US are supposed to be duty-neutral by law, that has not proved to be the case. If you’re an importer impacted negatively by these changes, consider reaching out to an expert for help advocating with your local congressperson to seek a correction or other solution. Some companies have already stepped forward to argue their cases.

Looking for a global freight forwarder with strong trade compliance capabilities? Reach out to Dimerco to start a discussion.