Shipping alliances shape global trade by influencing freight rates, routes, and supply chain efficiency—learn how recent shifts impact logistics.

The Role of Shipping Alliances in Global Trade

Shipping alliances are strategic partnerships among ocean carriers that optimize operations through vessel sharing, expanded network coverage, and cost efficiencies. These collaborations influence freight rates, transit times, and service reliability, making them a crucial factor for businesses engaged in global trade.

Ocean carriers require substantial assets – ships, equipment, and infrastructure – to maintain global operations. Instead of investing in an entire fleet, alliances allow carriers to pool resources, improving efficiency and offering broader service coverage.

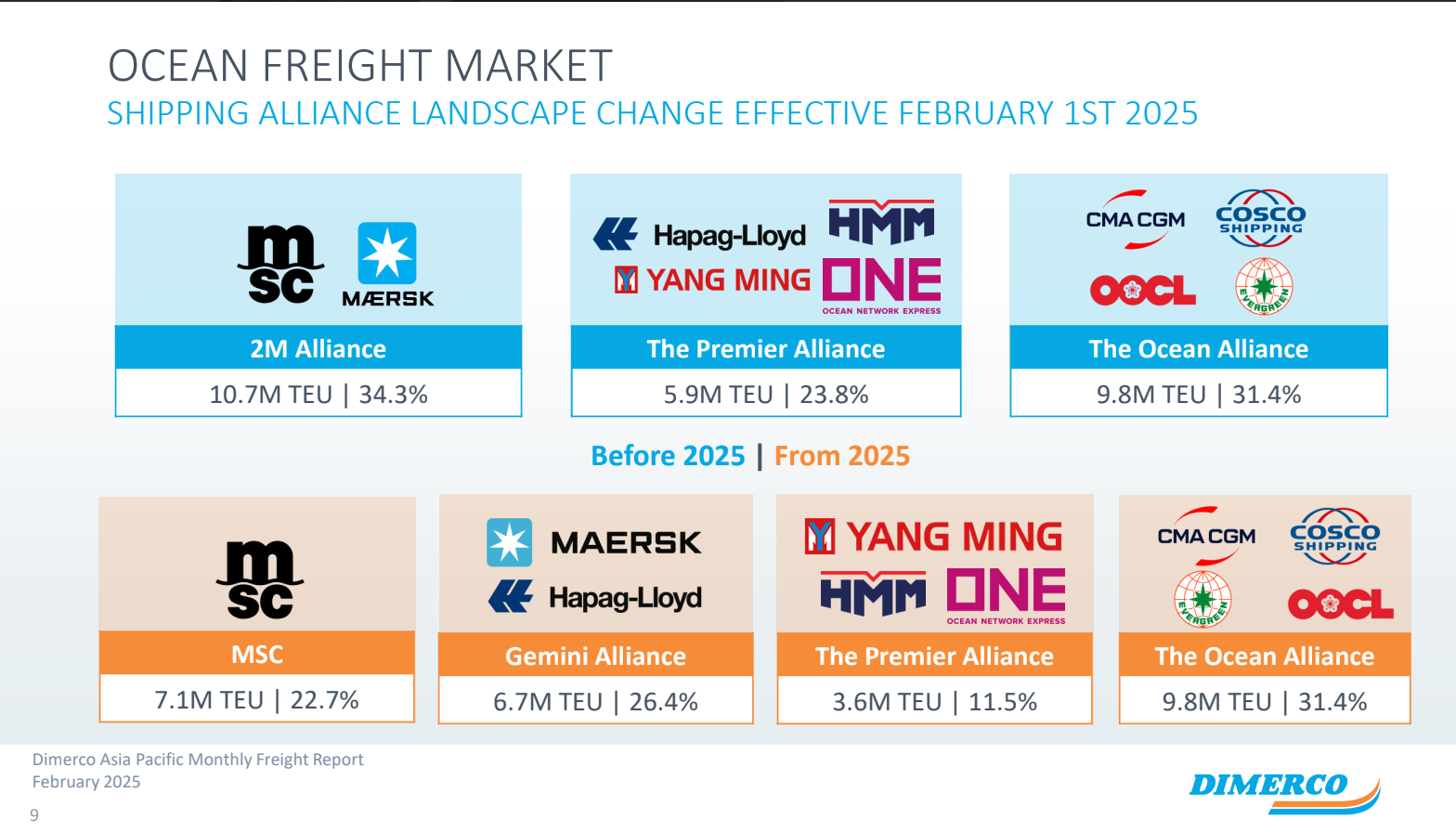

With major alliances evolving – such as the dissolution of the 2M Alliance and the formation of Gemini Cooperation and Premier Alliance – companies must reassess their logistics strategies. Understanding these shifts helps shippers anticipate market changes, mitigate risks, and secure stable transportation options.

The Evolution of Major Shipping Alliances

A History of Consolidation and Collaboration in Ocean Carrier Alliances

Carrier consolidation has significantly reshaped global shipping over the past two decades. A reduction in the number of independent carriers, coupled with increasing vessel sizes, has made collaboration through alliances the dominant operational model.

Since the late 1990s, alliances have formed, dissolved, and restructured in cycles – often coinciding with market fluctuations, regulatory changes, and shifts in trade volumes. Every time an alliance dissolves, carriers reconfigure their networks, forming new partnerships to balance service capacity and coverage.

Recent Alliance Shifts in Global Shipping Partnerships: What’s Changing?

The End of the 2M Alliance

After nearly a decade, Maersk and MSC are ending their 2M Alliance, effective January 2025. The split is primarily due to differing strategic objectives. MSC, now the world’s largest container carrier, has expanded aggressively with vessel acquisitions, while Maersk is shifting toward integrated logistics services beyond traditional container shipping.

The dissolution creates uncertainty regarding capacity and service routes. As the two largest global players reconfigure their networks, shippers may face temporary capacity constraints or rerouted services.

Gemini Cooperation: A New Strategic Partnership in Maritime Shipping Collaborations

Maersk and Hapag-Lloyd are launching Gemini Cooperation in 2025, introducing a hub-and-spoke model. Instead of operating vessels across numerous direct routes, the alliance will consolidate cargo at key hub ports and use feeder vessels for final delivery.

This model reduces port congestion and enhances schedule reliability, but it also requires terminals to coordinate efficiently. If feeder vessels experience delays, transit times could be impacted.

The Premier Alliance: Strengthening Market Coverage

HMM, ONE, and Yang Ming are forming the Premier Alliance, effective February 2025. This partnership aims to improve coverage between Asia, the U.S., and Europe, helping to balance vessel utilization across long-haul trade lanes.

Why are alliances shifting? The primary driver is vessel size. Over the past decade, ocean carriers have deployed larger vessels, some exceeding 20,000 TEU, to meet rising trade demands. However, consistently filling these massive ships has proven challenging, particularly on long-haul routes. Through alliances, carriers can share capacity, keeping vessels operating at profitable levels while maintaining weekly services.

For ongoing industry updates, visit our blog.

How Alliance Shifts Impact Global Supply Chains

Service Coverage and Route Efficiency

Alliance realignments alter service loops, transit times, and port accessibility. As carriers transition to new partnerships, shippers may experience:

- Temporary service gaps as vessels are reassigned.

- Modified port calls, affecting inland logistics planning.

- Adjustments in transit schedules, requiring businesses to reevaluate lead times.

Port congestion could temporarily increase as terminals adapt to new vessel-sharing arrangements. To mitigate delays, shippers should work closely with logistics providers to anticipate disruptions.

Capacity Management and Freight Rates

By sharing vessel space, alliances reduce the risk of underutilization, stabilizing rates. However, during alliance transitions, short-term capacity shortages can drive rate volatility.

For example, when a new alliance forms, vessels must be reassigned, and service loops must be restructured. This process can take one to three months, during which temporary service inconsistencies may arise.

Shippers should monitor freight rate trends and consider flexible routing options. Dimerco’s supply chain solutions help businesses adjust to these shifts by securing space across multiple carrier networks.

Operational Risks and Flexibility Challenges

While alliances create efficiency, they also introduce risks:

- Reduced Control Over Vessel Operations – When shipping cargo on a partner carrier’s vessel, the operating carrier makes key decisions, such as which terminals to use and which cargo/commodity to accept.

- Complicated Coordination – Differences in hardware, software, and operational procedures among carriers require extensive alignment.

- Service Disruptions – If an alliance partner faces delays, reroutes, or equipment shortages, shippers may have limited recourse when compared to working directly with the carrier through whom they booked. To optimize logistics strategies amid these risks, businesses should explore ocean freight services that offer flexibility across multiple alliances.

Strategies for Businesses to Navigate Shipping Alliances

1. Selecting the Right Carrier Partners

Shippers must assess carrier stability, network strength, and alliance membership when choosing partners. Some alliances focus on creating partnership with carriers that service different trade lanes, enabling market expansion; other alliances prioritize partnerships with carriers that service similar trade lanes in order to solidify that trade lane advantage.

2. Diversifying Carrier Options

Instead of relying on a single carrier or alliance, businesses should:

- Split cargo volume across multiple carriers to mitigate risk.

- Work with non-alliance carriers when needed for specific trade routes.

- Work with an NVOCC like Dimerco, which has partnerships with multiple carriers to provide the best option.

3. Building Flexibility into Contracts

Given alliance volatility, businesses should incorporate:

- Space guarantees across multiple carriers. However, businesses need to be aware that securing space guarantees often comes with additional costs.

- Flexible service terms to accommodate routing changes.

- Contingency plans in case of unexpected disruptions.

4. Staying Informed on Industry Changes

Alliance structures shift periodically. Shippers should maintain close relationships with logistics providers who can offer real-time updates and strategic guidance. Dimerco helps businesses navigate alliance complexities, ensuring uninterrupted supply chain performance.

Future Trends & Considerations for Global Shipping Partnerships

The Long-Term Stability of New Alliances

Although some newly formed ocean alliances may initially seem stable, external factors such as geopolitical tensions, regulatory scrutiny, and economic fluctuations could still drive potential restructuring in the future.

Sustainability and Regulatory Compliance

The International Maritime Organization (IMO) has introduced stricter emissions standards. While alternative fuels are emerging, full-scale adoption remains a challenge. Alliance members may adopt different sustainability strategies, impacting vessel availability and pricing.

Digitalization and AI-Driven Logistics

Blockchain, AI-powered demand forecasting, and automated booking platforms are reshaping how alliances operate. These technologies will improve transparency but may also require shippers to adapt to new digital logistics ecosystems.

Navigating Change with a Strong Logistics Strategy for Container Shipping Alliances

The evolving structure of container shipping alliances presents both opportunities and challenges. Businesses must stay agile, assess partner carriers carefully, and diversify logistics strategies.

Dimerco provides expert guidance in navigating alliance transitions, securing capacity, and optimizing global supply chains – particularly for businesses whose supply chains require strong freight capacity and expertise in Asia-Pac logistics. By working with a knowledgeable logistics provider, businesses can mitigate risks and maintain resilience in an evolving market. Contact us today to explore tailored strategies that keep your logistics operations agile and competitive.