Success in global trade involves finding quality suppliers, transporting goods in a volatile freight market, navigating trade wars and related tariffs, and a host of other factors. But one of your most critical day-to-day tasks is mastering the complexities of the customs clearance process which, if not managed well, can stop your cargo dead in its tracks. To gain more insight into this process, we gathered Dimerco’s customs brokerage experts for a discussion on Customs Clearance 101.

What is a Customs Clearance and Why Is It Required?

All goods crossing the border from one country (or region in the case of the European Union) into another require a customs clearance. In the US, the customs agency is US Customs and Border Protection (CBP). A primary goal of customs agencies: PROTECTION.

- Protect the revenue of the country and enhance the nation’s economic prosperity by ensuring proper duties and taxes are collected

- Protect consumers – make sure product standards are upheld so, for instance, food products are safe to eat and electrical products won’t malfunction

- Protect and safeguard the country’s borders from smugglers, terrorists and other bad actors who would use the global supply chain to harm others

What’s the Goal of the Importer in the Customs Clearance Process?

Pretty simple. Bring goods into the country without delay, in full compliance with laws and regulations, and at the lowest possible cost.

Speaking of Cost, How Much Does Customs Clearance Cost?

You’ll pay the following fees:

- Import Duties. The percent of the declared value you pay will depend on the product’s classification code and country of origin.

- Customs Clearance Fee. A broker oversees the customs clearance process, completes and files the necessary paperwork on your behalf, and acts as your expert partner to help assure your company remains compliant. An outside broker’s fee will vary depending on the complexity of your products and the services provided.

- Inspection Fees. If your cargo is among the small percentage of import cargo that gets physically inspected, and delayed several days in the process, you’ll pay for the privilege. These inspection fees vary widely depending on the type, location and scope of the exam

- Fees to Regulators. If your products are regulated by an agency other than Customs, you may have additional costs and paperwork to clear customs.

Depending on your product, you may also have to pay additional fees. Taking the US as an example, these may apply:

- Bond Payments. You’ll need to post a bond to guarantee duties and taxes that may be due on your imports. One option is to secure that bond through your customs broker (more on this role later). If you import regularly, you’ll probably buy a continuous bond that covers all imports into the US for a year. The bond amount is based on the estimated duties your company will owe during the year. If you import cargo sporadically, you can post a single-entry bond for each customs clearance instead.

- Merchandise Processing Fee (MPF). This fee is calculated and paid to CBP on all imported products at 0.3464% of the declared value of the cargo with a $27.75 minimum and $538.40 maximum charge (as of 10/1/21).

- Harbor Maintenance Fee (HMF). This fee is calculated and paid to CBP on ocean shipments only at 0.125% of the declared value.

What’s the Role of the Customs Broker?

Customs brokers help you navigate the complexities of global commerce, including entry procedures, admissibility requirements, HS code classification, product valuation, and the duties and taxes imposed on imports.

As the importer, your company is ultimately responsible for making proper declarations and complying with regulations from Customs and other agencies. If you are not a licensed customs broker, then you need an expert broker working on your behalf – either as part of an independent customs brokerage firm or as part of your freight forwarder’s team. A good customs broker service provider will:

- Vet your products for priority trade issue and other government agency reporting requirements

- Review and prepare required documents, making sure they are complete and compliant, then submit them

- Vet your products for correct classification and valuation so duty payments are accurate

- Advise on a range of issues that can save you time and money

You’ve Mentioned HS Classifications. What Are They and Why Do They Matter?

Every product you import must be assigned the proper Harmonized System code (HS code). These codes answer a very simple but important question for any customs agency: What product are you importing? There are approximately 19,000 HS codes that identify not just the broad category, like shirts, but every variety of shirt – each of which could have a different duty and different regulatory requirements assigned. The code selected must be accurate and not based on which code has the lowest duty.

Other Than the Global Transportation Team, What Corporate Departments Care About Customs Clearance?

The sales team may have committed to a large customer order and is awaiting replenishment of inventory. The purchasing team is negotiating with the foreign factory and wants to know how much duty must be paid on a new product. The logistics team manages freight movements and wants to arrange final-mile transport once goods clear Customs. And, of course, finance is anxious to get products into customers hands to turn these goods into cash.

Bottom line: lots of people have a stake in how quickly cargo moves through the Customs process and what it will cost to do so – and they’re relying on you to manage the process well.

What Paperwork is Required to Process Goods through Customs?

What Paperwork is Required to Process Goods through Customs?

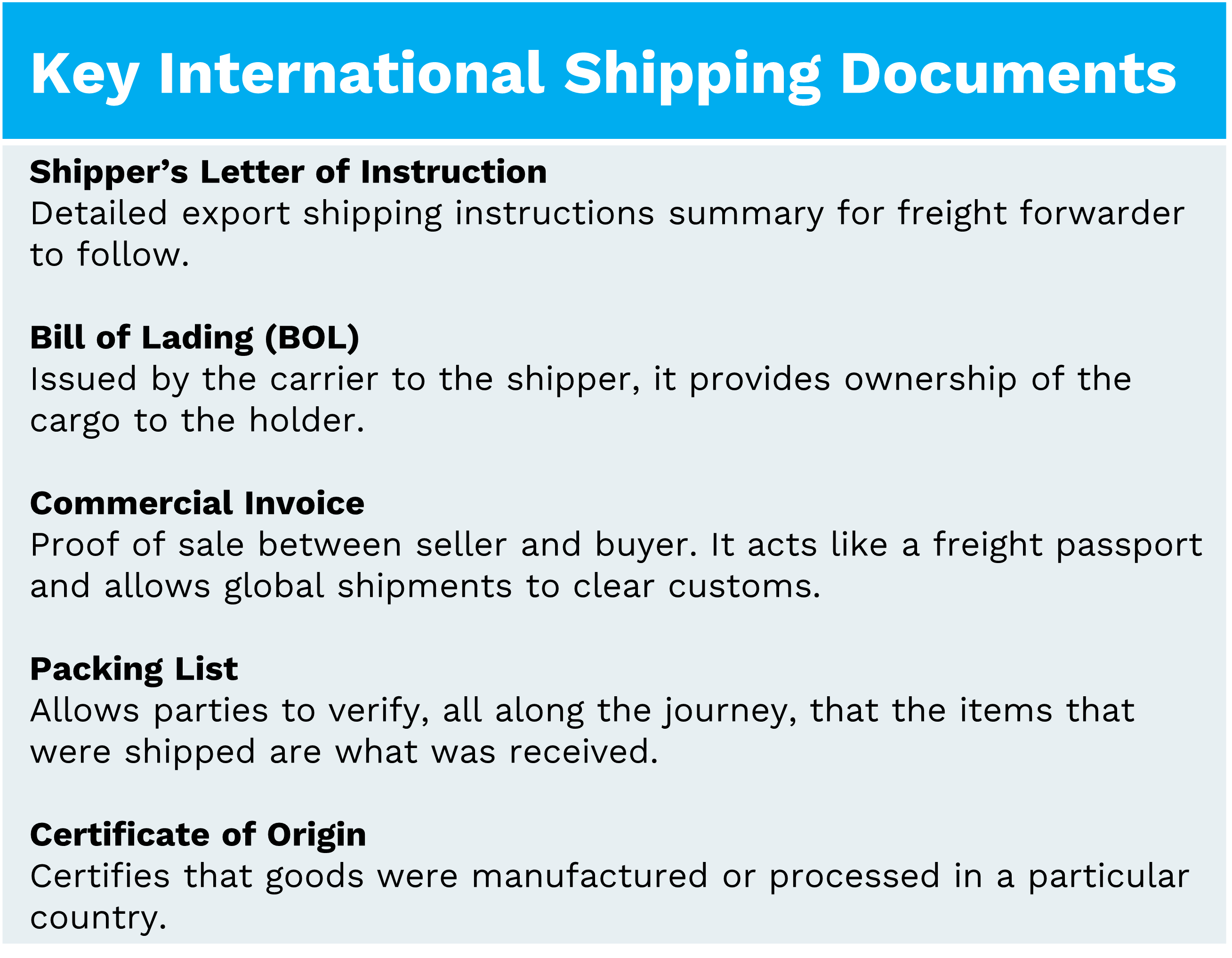

Incorrect or incomplete documents are a red flag to Customs agents and could delay your cargo substantially. For details, check out this Dimerco article on five key international shipping documents and why they are important.

How Long Does the Customs Clearance Process Take?

Customs entries are transmitted electronically and, if managed well, are transmitted before the goods even arrive. Typically, goods clear in less than 24 hours, unless there are problems with the entry, some other government agency process is required, or an inspection occurs.

When Can Customs Paperwork be Filed?

Your customs entry can be filed in advance of cargo arrival, so your goal should be to clear customs before the goods arrive. This way your cargo can be on its way shortly after it hits the port or airport. Technically, you can file with Customs as soon as the paperwork is ready. But, in the US for instance, CBP won’t process it for clearance until 5 days prior to arrival for ocean shipments and, for air shipments, not until the airplane is “wheels up” and directly en route to the US.

What are Common Mistakes in the Customs Clearance Process?

A lot of it boils down to improper paperwork and not taking the time to check and double-check details before filing the customs entry. Here are common mistakes we see:

- Not providing a compliant commercial invoice or missing paperwork. It’s your job to ensure proper paperwork is presented to your customs broker to assure a release by Customs. At minimum, that paperwork should include a commercial invoice, packing list and transport document. Supplier invoices must be complete and accurate. This invoice includes much of the essential detail Customs will need, so make sure these details are right. Other documents or certificates may be required, as well, depending on the nature of your commodity. The right international freight forwarder and customs broker can help.

- Not providing proper Incoterms. There are 11 Incoterms that outline the responsibilities of buyers and sellers – basically, who pays what and when, including customs clearance and duty payments. Obviously, a clearly defined Incoterm is required for proper clearance.

- Missing or unclear country of origin. Different tariffs may apply based on where the goods are manufactured. It gets a little complicated if the country from which you purchase the goods differs from the origin country. Make sure the country of origin listed on the commercial invoice is clearly stated and is accurate.

- Incorrect HS code. The right classification is arguably the most important step in the customs clearance process. The code tells Customs what is being imported, whether the goods are admissible, whether other government agencies have purview over the import, and what duties and taxes are due. If you misclassify products, you are breaking the law and subjecting your company to cargo delays and fines.

- Incorrect interpretation of free trade agreements. There’s clearly an advantage to shipping under such agreements, but you must have evidence to prove the product really qualifies.

What Should You Look for in a Customs Broker?

For small and mid-sized importers that don’t have their own import compliance or customs brokerage department, finding a reliable partner to represent you in your dealings with customs agencies is essential. Here are some thoughts on what to consider when evaluating brokers.

- Are they proven in the marketplace? Ask other importers for recommendations. Ask potential brokers for references. Ask your freight forwarder for a reference. Look for brokers with a track record of servicing clients over time with good results.

- Will they give you the attention you need? Look for a partner that is appropriately sized for your business. One that will take the time required to understand your business fully and be your trusted trade compliance guide.

- Are they integrated with a freight forwarder? If you can find a knowledgeable and dedicated resource within your forwarder’s team, this certainly reduces the number of handoffs per transaction – therefore saving time and eliminating opportunities for error and miscommunication.

- Do they have experience in your industry? This experience can be invaluable for goods like semiconductor products and any product that is regulated by a separate agency, like the FDA in the US for food products.

What Are the Benefits of a Good Customs Broker?

- Avoid delays and fines. If customs entries are incorrect, that could lead to inspections, fines, supply chain delays and lost sales. All told, that could mean a 6- or 7-figure profit loss to your business. One marketer of branded sweeteners was assessed a $575,000 (USD) fine for violating a law preventing goods made with forced labor from entering the US. So, yes, the stakes are high.

- Focus attention on your core business and keeping customers happy. Creating customs entries for regular imports can be time-consuming and deflect attention away from running your business. There’s a huge, albeit hard-to-quantify, benefit to entrusting this detail work to an expert who will keep your company compliant and free you up for more strategic work.

- Get expert guidance. Unless it’s your sole job, it’s not realistic to think you can keep up with all the changing laws and regulations that govern international trade. The right customs broker will serve as a seamless extension of your organization, guiding you through the importing process and even advising on strategic questions like “How will your sourcing strategy impact duty payments?”

Mastering the Customs Clearance Process

If customs clearance is just one of your many responsibilities as part of a global transportation team, it’s going to be difficult to master the complexities of trade compliance and the customs clearance process. In these cases, consider working with an outside expert who has customs brokerage as its one and only focus.

Dimerco has a dedicated international customers brokerage department that helps customers of our global freight forwarding services clear customs fast, at the lowest cost, and in full compliance with all requirements. To talk to a customs compliance specialist, contact Dimerco to start a conversation.