HS Codes in shipping are a globally accepted way of categorizing your product that is universally understood by Customs authorities and traders around the world. They create a common language for describing products.

Every product can be categorized under a 6-digit harmonized system (HS) code that is used as the basis for country-specific HTS (Harmonized Tarriff Schedule) codes, for example the US HTS in the United States. These product code encyclopedias contain a mind-numbing amount of detail that could make your head explode. This article examines some key questions to give you a basic understanding of what HS and HTS codes are in shipping and why you should care.

Let’s start piecing it together – hopefully in a way that keeps your head firmly attached to your body.

What’s a USHTS (HTS) code?

An HTS code is usually a 10-digit (sometimes 8) number that identifies the exact product type and duty rate for an item imported into the US. There are over 17,000 codes contained in 99 chapters. Each chapter contains Chapter Notes, Section Notes, Heading and Subheading Notes that help identify how items should be classified, along with the USHTS General Rules of Interpretation. US importers need to understand enough about HTS Codes to make sure you’re not paying the US government more than you should for duties and your company stays compliant.

Who are the players?

- The World Customs Organization (WCO) creates, develops, and maintains the HS coding system, which is used by more than 200 countries and in 98% of world trade. The WCO fine-tunes the codes once every five years.

- The US International Trade Commission (ITC) publishes the US Harmonized Tariff Schedule (HTS). This schedule tells you the real dollar implications of each code in terms of duty payments.

- US Customs and Border Protection (CBP) is solely authorized to interpret the HTS, to issue legally binding rules on tariff classification, and to police customs laws.

Why Do You Need an HTS Code?

The proper HTS code identifies the imported product accurately, assuring proper duty and tax rates are applied to your product. And it helps avoid delays that slow down your supply chain and anger customers.

The importer of record is ultimately responsible for assigning the right HTS code to imports. But most businesses can’t afford to hire someone to understand the INs and OUTs of this very complex harmonized tariff schedule. It helps to work with a licensed customs broker to make sure your documentation is correct and that you pay exactly what you owe, and no more.

What do the numbers in an HTS code mean?

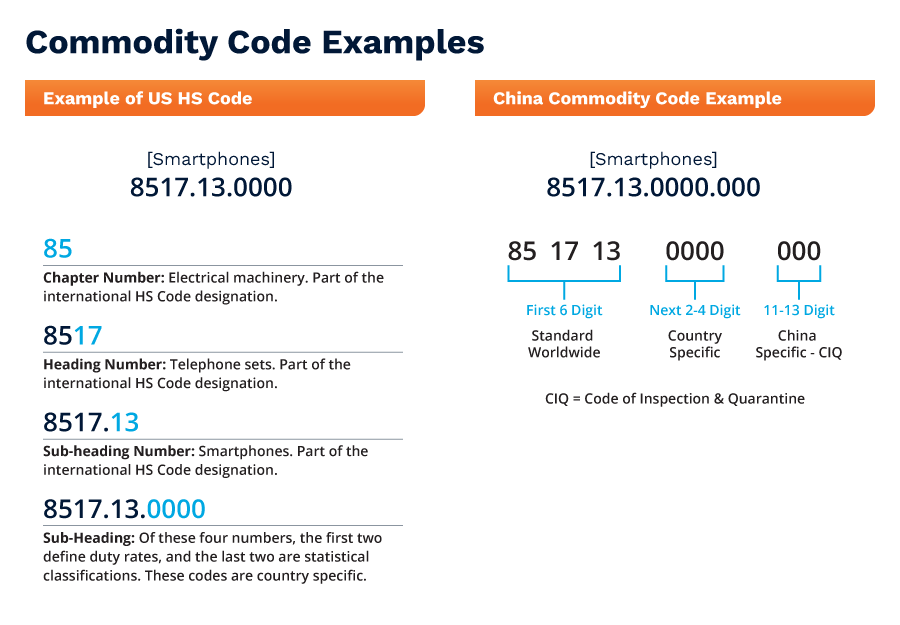

The US uses 8- or 10-digit HTS codes. The first six digits are defined by the WCO’s harmonized system. In the US, the 7th and 8th digits define the duty rate and the 9th and 10th digits are used for statistical reporting.

Most countries add 2 or 4 extra numbers to the HS code for further clarification of commodity type. In 2018, China increased the total number of digits in its commodity code to 13. This makes classification more specific, but creates greater potential for misclassification and questions from Customs officials. Like all countries, the first six digits of the China code adheres to the worldwide harmonized system standard, as noted in the graphic below. Find more detail in our eBook Mastering China Logistics.

What are the implications of using the correct HTS code?

It depends on your product type and the annual value of the goods you import. But, for example, if you determine that an alternate code is compliant and the duty is 2% less than what you currently pay, that could result in a six or seven figure boost to your profit line.

Since the HTS can also drive free trade agreement eligibility, a product’s country of origin is also key. For example, sourcing your product from a country with a free trade agreement with the US can have enormous financial benefits.

Where can I find the correct HTS code for my product?

Finding the correct HTS code in shipping is essential for international trade. Here are a few ways you can find it:

- For imports into the US, start with the HTS lookup tool provided by the US International Trade Commission (USITC).

- For exports, utilize the World Customs Organization (WCO) tool – the source of the codes.

- Consult a knowledgeable customs broker or freight forwarder. Some may handle HS or HTS code identification as part of their service at no extra cost.

Can my suppliers help with the right HTS code?

You can ask, and you should. They often know the code that their other customers use. But remember they are trying to sell you something and may believe you are more likely to buy if the duty rate is low. So ask, but remember you are ultimately responsible to CBP to verify the code they suggest is the right, compliant one.

How do HS codes determine duty payment?

Once you know your HS code, you can refer to the Harmonzied Tariff Schedule of the US International Trade Commission, which provides duty rates for every product. Enter your product description and you’ll be directed to HTS codes that might apply along with duty rates US importers pay for that product.

To get into the weeds a little bit, the HTS site pages show three columns after the product description. The “General” duty rate column denotes the duty rate for products from countries with normal trade relations with the US. This rate applies to most countries. The “Special” column notes rates for countries with which the US has special tariff agreements, like Free Trade Agreements. Column 2 is for countries without normal trade relations with the US.

A word of caution. While these tools seem easy to use on the surface, it takes knowledge and experience to know how to read and interpret the schedule. It’s wise to consult with a customs broker to ensure you’re working with the correct code and duty rate.

How do I know if my products fall under the additional US 301 tariffs on China-made products?

This page on the US Trade Representative website provides details. Dimerco also explored the recent expansion of 301 tariffs in this article.

What if my product is hard to classify?

One very helpful website is CBP’s Customs Rulings Online Search System, known as the CROSS database. Here you can type in your product, an HTS code, and even the name of your competitors and the system will give you every related ruling. For instance, you can type in “electric vehicle charging station” and see five different rulings for the same product.

The results shown are binding rulings and you may find that one applies to your exact product. For example, you may learn that one of your competitors is paying a lower duty rate than you.

Bottom line: HS codes are not always black and white. Very slight variations between seemingly identical products can result in very different duty rates.

So you can alter a product slightly to get a more favorable duty rate?

Yes, they call it tariff engineering. The same product could fall under multiple HS classifications depending on the product’s essential character. An experienced international customs broker will understand these nuances and can provide invaluable advice. We touch on tariff engineering in our article: Global Trade Compliance: Understanding the Basics.

Can I ask CBP for a binding ruling on my specific product?

As a matter of fact, you can. You can write a letter to CBP making your case – “I’m importing this pen and I think it falls under this code and here’s why I think that…”, asking CBP to formally confirm that your suggested tariff is correct. If you go this route, we recommend asking an expert to write the letter for you. Once the binding ruling is issued, it’s the final word on classification and duty for your product, even if CBP does not agree with your suggested code and duty rate.

What’s a common mistake companies make with HTS codes?

A surprising number of importers don’t have a bill of materials for their products and a system where they store the HTS code, duty rate, country of origin, sub-components used, and other key data.

When the data is not in a system and your company depends on spreadsheets and tribal knowledge to complete paperwork, you’re inviting problems. The solution is to purchase trade compliance software to house what’s currently in someone’s head. So, if that person leaves (the average person changes jobs 12 times in a career) there’s not widespread panic.

Another benefit of a trade compliance system is that the software vendor changes the system as HS codes and regulations change. That’s one less thing for you to worry about.

How diligent is CBP in identifying non-compliance?

The US government wants the money it’s due and invests to enforce its laws.

Some importers will try to play the odds and bet that CBP doesn’t have the resources to police every company and every shipment. But remember that CBP has a new friend in its corner, and it’s called BIG DATA. Combined with AI, it enables them to analyze thousands of documents in seconds and flag anomalies.

Here’s an example. One pen company went from importing finished pens from China to importing lower-duty rate pen parts and assembling them in the US to avoid the higher duty rate on the finished pen. But all the components came in the same shipment and CBP eventually flagged it as a violation. By not seeking proper advice from the start, the company ultimately had to pay the past duties it had “avoided” – plus interest.

Technology-aided enforcement by CBP will increase exponentially in the coming years, making it more and more difficult to game the system.

How can a reliable customs broker help me solve the HTS code puzzle?

In addition to helping you identify the correct HTS code in shipping, the right broker can:

- Free up your time to run your business by dealing with federal agencies on your behalf

- Clear goods through Customs quickly and in compliance

- Lower duties, tariffs, and other fees

- Ensure 100% trade compliance, thereby avoiding costly delays and penalties

- Monitor rule changes that could have a very positive impact on your business

If you’re an importer struggling with some aspect of HS or HTS code identification and trade compliance, consider that Dimerco Express Group offers a complete line of trade-related services, including importer security filing, import compliance, and customs brokerage services. Reach out today to start a discussion.