In the global supply chain for integrated circuits (ICs), Hong Kong has long been a key transit hub. Mainland Chinese companies frequently export IC products to overseas markets and import them from abroad, and in both cases many shipments pass through Hong Kong instead of moving directly to their destination.

This practice is based on long-standing trade habits, as well as policy advantages, efficient logistics, cost benefits, and compliance considerations. One of the most important incentives for Mainland China exporters is the China VAT rebate policy, which makes Hong Kong a strategic gateway for the IC trade.

Free Port Advantages that Benefit IC Shipments

Hong Kong’s status as a free port is central to its role in the movement of IC products.

Hong Kong provides tariff exemption for IC products that are transshipped through its ports. This means that no import or export duties are applied, regardless of the origin or destination. For high-value goods such as ICs, avoiding additional tax costs helps protect profit margins.

The customs process in Hong Kong is also more straightforward compared with direct cross-border shipments. Goods stored or re-exported from Hong Kong typically go through less complex customs declarations, often processed as express shipments. This is especially important for time-sensitive products such as semiconductors, as it helps avoid production delays during peak manufacturing seasons.

Hong Kong’s role as a free port also brings operational benefits that extend beyond customs treatment. The city is home to the world’s busiest international cargo airport, with more than 100 airlines operating flights to over 180 destinations. This strong air freight capacity allows IC products to move quickly to major global gateways, which is especially valuable for urgent shipments. Combined with well-established cross-border trucking services connecting Hong Kong with manufacturing hubs in South China, the city offers both speed and flexibility for IC supply chains.

Other Advantages of Routing IC Shipments Through Hong Kong

While the China VAT rebate is a major driver for using Hong Kong as a transit hub, other factors can also make it the most practical choice for certain IC shipments.

Lithium battery shipments: Goods containing lithium batteries or other dangerous goods cargo (DG) are often easier to export through Hong Kong than via airports such as Guangzhou Baiyun (CAN), which have stricter requirements for DG handling. Leveraging Hong Kong as a gateway helps avoid delays and ensures compliance with international DG regulations.

Cross-border trucking access: Direct loading of cargo from South China into Hong Kong International Airport via a terminal in Dongguan further reduces transit times, a service now offered by Cathay Cargo. The service builds on existing cross-border trucking options from South China to Hong Kong, providing faster and more flexible connections for exports.

Why the China VAT Rebate Matters for IC Shipments

For mainland exporters, the China VAT rebate, also referred to as the China VAT return, is a major reason to route IC shipments through Hong Kong.

When IC products leave a mainland port and enter Hong Kong, they are officially recognized as exported. For IC products, the VAT refund rate is typically 13 percent, as shown in China’s published VAT refund categories. This rebate can be claimed even if the goods are later shipped from Hong Kong to destinations such as the United States or Europe.

In some cases, goods may even be returned to the mainland after export. If this happens, the company can defer import VAT payment until the goods re-enter China. This provides cash flow flexibility and reduces financial pressure.

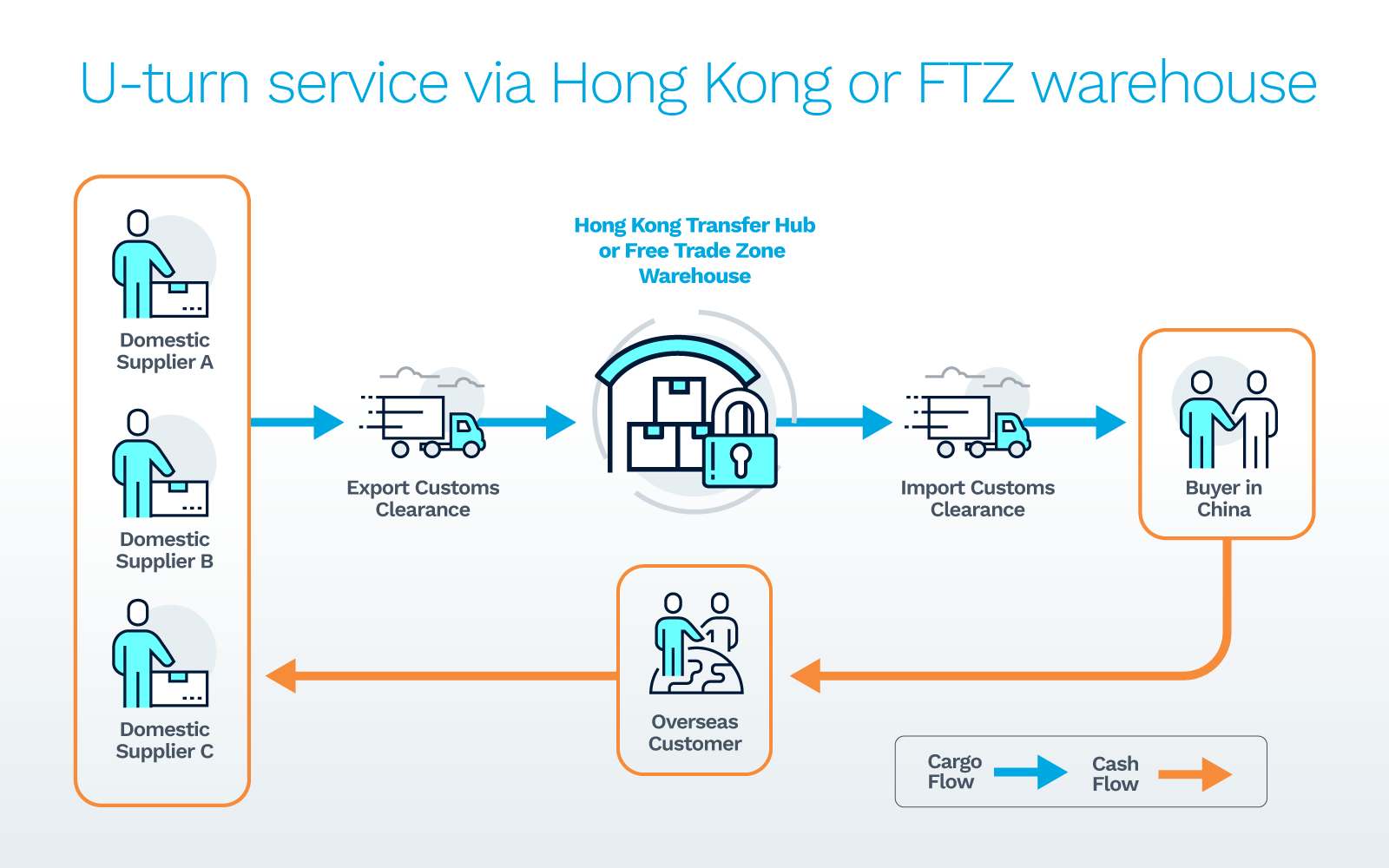

Bonded warehousing plays a key role in enabling these strategies. These warehouses allow goods to be stored temporarily without tax liability, avoiding double taxation. Many exporters adopt a “U-turn” approach, moving goods to Hong Kong, storing them in a bonded facility, and either shipping them out globally or reimporting them to China. This setup meets export requirements for the VAT rebate, even if the buyer is within China.

Companies may not always need to physically ship goods to Hong Kong to secure these benefits. Free trade zone (FTZ) warehousing within mainland China can also support VAT rebate eligibility. In these zones, goods are transferred to a bonded facility and declared as exports before being sold domestically or abroad. This option is especially useful for companies wanting VAT advantages without the added time and cost of physically shipping to Hong Kong.

It’s also important to confirm whether IC products fall under the category of strategic commodities as defined by the Hong Kong Import and Export Ordinance. If they do, the shipper or consignee must apply for an Import License through the Trade and Industry Department (TID) before import or export, supported by the required technical documentation.

To learn more about how this works, including a real-world case using a Dimerco-operated FTZ warehouse, see our article on the Hong Kong U-turn strategy and VAT savings.

The Impact of New U.S. Tariff Policies on IC Transshipment

The introduction of the 2025 U.S. reciprocal tariff policy means companies handling IC shipments must review their supply chain strategies carefully. While some categories of electronic products still enjoy tariff exemptions, restrictions on product origin and definitions of transshipment are becoming stricter.

Manufacturers must ensure their goods meet country of origin requirements to maintain the benefits of Hong Kong’s free port status. In some cases, this may mean reducing the proportion of Chinese raw materials used to qualify for certificates of origin issued in the transshipment location.

Shipping IC Products Through Hong Kong

Handling IC shipments through Hong Kong requires experience with customs compliance and supply chain operations. Partnering with the right 3PL can be a huge advantage.

Dimerco Express Group, for instance, operates its own warehouses in Hong Kong and Mainland China to provide flexible short-term or long-term storage solutions. The company’s air, sea, and cross-border trucking services are integrated through partnerships with major carriers and supported by the highest safety certifications, including AEO, IATA, and C-TPAT. Dimerco teams in both locations closely monitor customs policies and provide timely updates so that strategies can be adjusted quickly when regulations change.

The combination of bonded warehousing, direct air connections to major global markets, and efficient cross-border trucking gives Dimerco the ability to move high-value IC products quickly and securely. This multimodal flexibility is especially important when production schedules are tight or when market conditions require rapid redirection of goods.

How Hong Kong Strengthens IC Supply Chains

For IC manufacturers and traders, Hong Kong offers tax efficiency, faster customs processing, direct connections to global markets, and the flexibility to adjust quickly to changing trade policies.

By pairing Hong Kong’s advantages with integrated logistics solutions, companies can maximize their China VAT rebate, reduce transportation and compliance costs, and ensure timely delivery to global markets.

If you are ready to enhance your IC transshipment strategy, get in touch with a Dimerco specialist to create a customized plan that turns complex transit requirements into a competitive advantage.

To explore more ways to improve efficiency and resilience in electronics supply chains, read our eBook 8 Ways to Streamline Global Logistics for Electronics Products.