Home »

Strategic Warehousing in Asia-Pacific: How to Choose the Right Location

Contents

Importance of Choosing the Right Warehouse Location in Asia

Selecting a Distribution Hub in Asia

What Service Levels Do Your Customers Require?

What Will Taxes and Duties Cost You?

How Can Bonded Warehouses and FTZs Defer/Reduce Tax Payments?

Select Use Cases for Bonded Warehousing and FTZ Services

Is It Easy to Do Business in This Country?

How’s The Transportation Infrastructure?

Is It a Good Labor Market?

What Are the Combined Costs for Each Warehouse Location Option?

What Capabilities to Seek in A Warehouse Partner in Asia

- Scalability

- Integrated Services

- Omnichannel Capabilities

- Local Market Knowledge

- Technology-Driven

- Experience Running Bonded and FTZ Facilities

The Right Partner Can Reduce Your Location Selection Process By 4 – 5 Months

How to evaluate and choose the most efficient warehouse location

The Importance of Choosing the Right Warehouse Location in Asia

Asia’s growing role in global manufacturing and consumption makes strategic warehousing in Asia a critical component of any global supply chain.

Companies whose supply chains run through Asia need an efficient warehousing and distribution operation to get products to customers – within Asia and globally. But where should that warehouse be?

Millions of dollars ride on this decision, so it’s critical to choose the right location. But often companies lack the time and expertise to do anything more than a surface-level evaluation. When that happens, decisions can backfire.

Locating strategic distribution space in Asia-Pac—a common abbreviation for the Asia-Pacific region, which includes key manufacturing and logistics hubs like China, India, Vietnam, Thailand, Singapore, and others—has become increasingly critical in recent years. The so-called “China Plus One” strategy has led many manufacturers to consider a secondary warehouse in Asia for a couple of reasons:

- Today, companies want resilient supply chains that can withstand disruptions like pandemics, port bottlenecks, and natural disasters.

- Manufacturers are looking for alternate sources of supply outside China to avoid 301 tariffs.

The responsibility to locate an efficient distribution point often falls to procurement and logistics professionals who have little experience operating in Asia-Pac and lack a structured way to do an assessment.

This eBook will outline key factors to examine and why it could make sense to align with a third-party logistics (3PL) provider that has a comprehensive understanding of warehousing and distribution options across all of Asia.

Download Guide

If you prefer to download this article as a PDF, just complete the form. Otherwise, keep reading.

Factors to Consider When Selecting a Distribution Hub in Asia

If you’re buying a home in a new city, you’ll prioritize different factors based on your situation.

Retirees on a fixed income will want lower tax rates.

Parents of school age kids might be most interested in the quality of the school system.

For young, single people, nightlife and recreational opportunities might be their priority.

When selecting a distribution hub in Asia, many factors should be examined, but some will be more important than others based on your business.

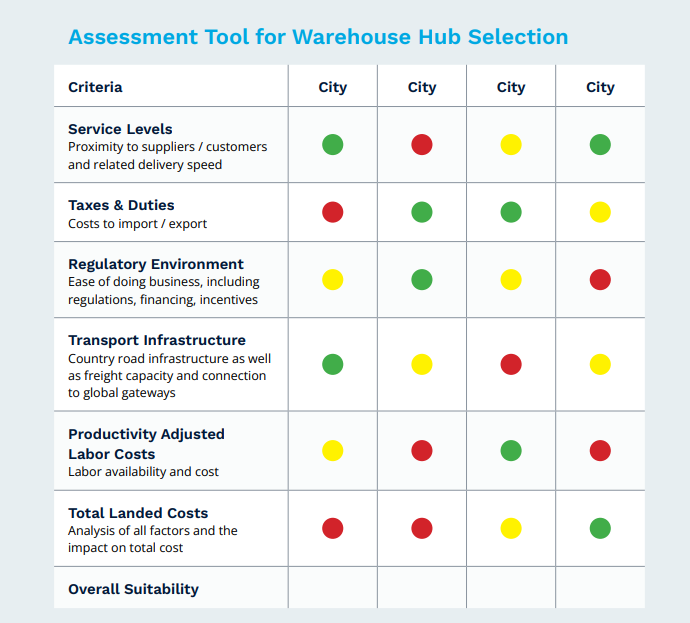

The accompanying chart offers up a hypothetical rating system that compares cities across six critical factors. Exactly which cities you decide to assess will depend on your goals. Popular Asia distribution hubs include Taipei, Hong Kong, Shanghai, Shenzhen, Singapore, as well as port cities in Malaysia, Thailand, Vietnam, Indonesia, and India.

The balance of this eBook will look at each of these factors.

What Service Levels Do Your Customers Require?

Most companies searching for a warehouse in the Asia-Pacific region seek an outbound distribution solution, so they tend to focus most on the proximity of the warehouse to either their suppliers or their end customers. The key factor: what is the Service Level Agreement (SLA) with the customer?

If you are a semiconductor industry manufacturer, you may want to be closer to suppliers to facilitate cost-saving consolidation. Since most foundries (semiconductor factories) are in Taiwan, choosing a warehouse near these factories might make sense.

Laptop manufacturer Framework moved most of its manufacturing from China to Taiwan to be closer to their suppliers. Now the company distributes from Dimerco Express Group’s bonded warehouse within the Taoyuan International Airport’s Free Trade Zone. The location allows Framework to hold less inventory, reduce the number of touch points between factory and consumer, and ship products as early as two days after they are made.

If your supplier base is scattered and you need fast, efficient distribution from Asia to the U.S., Europe and other parts of the world, a gateway like Singapore would be a great option. Singapore has more direct links to other global gateways than any other ports in Asia, enabling a rapid order-to-delivery cycle.

Bottom line: You can search for the most cost-effective warehouse location in Asia, but if it doesn’t meet the order-to-delivery timeframe you promised your customer, it won’t work.

What Will Taxes and Duties Cost You?

Your warehouse location will certainly impact your costs for storage and transportation. But logistics costs can actually account for a relatively small percentage of product value for commodities like pharmaceuticals or semiconductor equipment. For that reason, companies researching possible distribution hubs often place most emphasis on the taxes and duties they will pay in different countries, since these are based on a percentage of product value.

Like most nations around the world, Asian countries impose duties, tariffs, and a value-added tax (VAT) on exports and imports, along with documentation requirements and product restrictions. In general terms, customs duties are based on product characteristics, while tariffs are fees applied to specific products from specific countries. VAT rates are fixed and calculated on the total value of the product imported into the country. Tariffs and duties are mainly designed to help local companies compete with lower-priced imports.

Not only do these duties, tariffs, and VATs vary by country, they vary by commodity and whether they are being exported or imported. China, for instance, imposes an import consumption tax, but only on specific commodities, including cigarettes, alcohol, cosmetics, cars and other items. There are also duties on exports, but the rate is relatively low and applies to about 20 different commodity types.

At the opposite end for trade is Singapore, which is generally a free port and an open economy. It applies a Most-Favored-Nation (MFN) zero-duty to nearly 100 percent of its tariff lines. Singapore does levy a 9% Goods and Services Tax on imports (starting January 1, 2024). For tax purposes, companies with high cargo value often look at Singapore as a potential distribution hub.

Duty and tax payments could be the significant factors when it comes to choosing a distribution location. But the wise use of bonded warehousing and Free Trade Zones in Asia can defer, and even avoid, payment of those duties and taxes.

How Can Bonded Warehouses and FTZs Defer/Reduce Tax Payments?

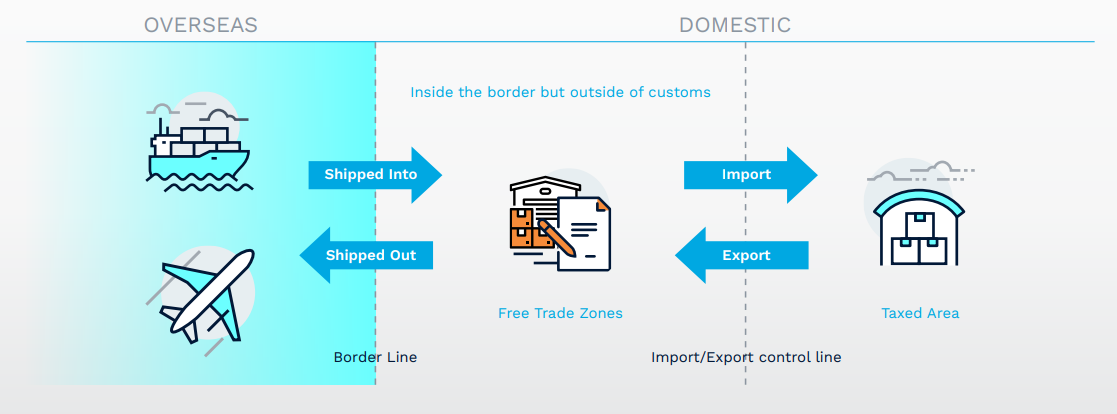

Most warehouses around the world are general purpose warehouses, but just about every country, including those in Asia, have established bonded warehouse and Free Trade Zone (FTZ) programs to promote global trade.

A bonded warehouse allows companies to store imported goods close to customers but to defer payment of duties on these imports until the goods are sold – a huge cash flow advantage. If your duty rate is 15% and you’re sitting on $100 million worth of high-value inventory, that’s USD 15 million in cash that’s yours to spend or invest until the product is sold.

An FTZ affords similar benefits as bonded warehouses. Additionally, with an FTZ, there are no duties payable on imports that are later re-exported. Also, manufacturing activities are allowed within an FTZ with no immediate duties or taxes payable.

All space within an FTZ is bonded. But a bonded warehouse can sit inside or outside an FTZ.

The storage options are a bit complicated, so its wise to align with a local logistics company that can guide you.

Check out the following page for real examples of how companies are benefiting from bonded warehousing and FTZs in Asia.

FTZs allow you to hold on to your cash.

Select Use Cases for Bonded Warehousing and FTZ Services

Import Hub

Defer duty payments until final sale

A global manufacturer of high-tech components imports products into the Shanghai Pudong International Airport (PVG). Shipments move in bond from PVG to a Shanghai-area FTZ. Only orders that ship out to final customers are declared to Customs authorities, with taxes due.

Export Hub

Avoid duty payments on imported components that will be re-exported

A leading cyber security company uses Dimerco’s FTZ warehouse in Taiwan to consolidate supplier inventory from Taiwan and other Asian countries and prepare products for export. The company avoids duty payments on the inbound supplier shipments since they are re-exported. Also, shipments from its Taiwan manufacturing plants into the FTZ are regarded as exports, so they can request a duty refund from the government.

Buyer Consolidation Hub

Create more efficient shipping of multi-vendor shipments

A U.S.-based manufacturer has lots of suppliers in the Shenzhen area of South China. With each vendor shipping separately, 10 house bills would need to be created and each would be charged separately. Instead, this company uses Dimerco to consolidate all shipments under one house bill from the 3PL’s Integrated Free Trade Zone in Shenzhen. This results in one single clearance and clearance charge, as well as cost-efficient, carbon-efficient shipping.

E-commerce Distribution

Defer duties on items that are sold online

Lazada, one of the top eCommerce marketplaces in Southeast Asia, ships goods from China to Dimerco’s bonded warehouse in Indonesia to serve consumers in the Jakarta market. These goods are imported and stored tax and duty-free until items are sold online and leave the facility.

VMI Hub

Reduce safety stock of supplier inventory used to feed the assembly line

As a manufacturer of integrated circuit products, Dimerco operates a vendor-managed inventory (VMI) hub within the Beijing Airport Free Trade Zone. The facility stores inventory and provides real-time replenishment to two company factories nearby. The solution has reduced factory safety stock and sharply reduced the company’s cash cycle since they don’t take ownership of the product until it ships out.

Transshipments

Avoid tax and duty payments when shipping products globally from a foreign gateway

A consumer product manufacturer in Vietnam struggled to reliably ship FCL loads from its home port in Vietnam to major customers in the U.S. The company began to ship this cargo via cross-border road freight from Vietnam to Dimerco’s FTZ bonded warehouse in Shenzhen. There the cargo was prepared and shipped via FCL to U.S. buyers. Since the product remained in bond during this transshipment process, the company avoided tax and duty payments in China. Additionally, the company was able to ship more reliably at a much lower ocean freight cost.

Is it Easy to Do Business in This Country?

Some countries — and even cities in countries — are easier places to establish and operate a business than others. Since regulations can directly impact how quickly and easily you can establish distribution in a new country or city, it’s crucial to understand specific government requirements for your products.

The World Bank rates Singapore as the easiest country in Asia for conducting business. The accompanying chart shows the complete World Bank Rating and the criteria used.

Among Asian countries, Singapore may have the easiest application process for setting up a warehouse. While the process is quick, getting such approval will be three to four times more expensive than in other Asian countries.

In Singapore, as with many of Asia’s key distribution hubs, available warehouse space can be hard to find. The fastest path to establishing a new distribution point is to partner with a 3PL that already has a warehouse in your chosen market.

The other advantage to a 3PL partnership is that this provider can help you navigate the local bureaucracy based on its understanding of local regulations and licensing requirements. So even in countries where there is more regulatory oversight, like India and China, the 3PL-aided process remains simple for you and your team.

World Bank ranking of Asia countries based on ease of doing business

# displayed is the world ranking out of 190 countries rated

NOTE: Factors weighed in this World Bank calculation include cross-border trade, construction permits, property registration, energy availability, credit access, and tax payments.

| #2 Singapore | #63 India | #99 Sri Lanka |

| #3 China (Hong Kong SAR) | #66 Brunei | #108 Pakistan |

| #5 South Korea | #70 Vietnam | #144 Cambodia |

| #12 Malaysia | #73 Indonesia | #147 Maldives |

| #15 Taiwan | #81 Mongolia | #154 Laos |

| #21 Thailand | #89 Bhutan | #165 Myanmar |

| #29 Japan | #94 Nepal | #168 Bangladesh |

| #31 China | #95 Philippines |

How’s the Transportation Infrastructure?

The reason you’re locating a warehouse in a new country is to quickly and efficiently fulfill customer orders. But if a market lacks available freight capacity for global transportation, or if the local road and rail infrastructure is not developed, your order-to-ship times will suffer.

Ideally, you want a warehouse near major roadways so truckers have easy in and out access and you enjoy rapid transport to ports and major markets. But such warehouses likely come with a higher price tag. A warehouse further from the port may be less expensive, but if roadways are not developed, you need to decide whether the inefficiency and delays caused by these challenges outweigh the other advantages of the market.

Some companies simply must be near a major gateway to meet customer demands for fast delivery. For example, tech firms shipping high-demand products via air from Southeast Asia to Europe or the United States need their Asia warehouse to be near an airport with frequent direct connections to key global markets. Your research should confirm that your new distribution hub has sufficient global transportation capabilities.

When an industrial manufacturer moved its factory from South China near Hong Kong to Penang, Malaysia, it learned that the outbound air freight capacity from Penang was about 3% of that of its previous gateway in Hong Kong.

With careful planning, you can overcome such barriers. For instance, a semiconductor company that also struggled with air freight capacity out of Penang now leans on its freight forwarder to coordinate a road + air solution using Kuala Lumpur and Singapore Airports as gateways to the U.S., Europe, and other countries.

Bottom line: You can pay more for the advantages of being close to a major port or you can set up warehousing operations away from the port to save on storage and labor costs and then use a nearby gateway as a transshipment point.

2023 World Bank Logistics Performance Index (LPI)

Rank of Asian countries out of 139 total countries rated

| Country | LPI Rank | LPI Score |

| Singapore | 1 | 4.3 |

| Hong Kong SAR, China | 7 | 4 |

| Japan | 13 | 3.9 |

| Taiwan | 13 | 3.9 |

| Korea, Rep. | 17 | 3.8 |

| China | 19 | 3.7 |

| Malaysia | 26 | 3.6 |

| Thailand | 34 | 3.5 |

| India | 38 | 3.4 |

| Philippines | 43 | 3.3 |

| Vietnam | 43 | 3.3 |

| Indonesia | 61 | 3 |

| Cambodia | 115 | 2.4 |

Is it a Good Labor Market?

The issue of labor availability and cost can’t be ignored when looking to establish an Asia distribution center.

If your familiarity with warehouses is mostly based on European and U.S. facilities, don’t be surprised at the relative lack of automation in Asia warehouses. Even with worker costs rising in some countries like China, salaries are still quite low compared to Western industrial nations (See the accompanying chart on Asia labor rates by country). Receiving, putaway, picking and packing are largely manual activities that require lots of bodies. Make sure the markets you are evaluating have sufficient labor to support your needs.

In Asia, as in the U.S. and Europe, warehouse work is considered a 3D job: dirty, dangerous, and difficult. Fewer people are choosing this type of work. For those who do, there is fierce competition, particularly since warehouses are often clustered in the same area and it’s easy for workers to switch employers.

Labor rates will differ from country to country, and so will productivity rates. A semiconductor supplier recently moved its facility from China to Malaysia and budgeted the same number of workers for the same estimated throughput. However due to lower skill levels, more vacation days and national holidays, and fewer daily work hours, the company needed almost double the staff to handle the same volumes.

If you plan to outsource warehousing services to a 3PL, recruiting and managing labor becomes the provider’s challenge, not yours. However, you’ll want assurances from the provider that sufficient labor will be available, especially during critical peak volume periods.

Minimum Monthly Wages for 2023 (USD) in select Asia-Pacific countries (WageCentre.com)

| Country | Minimum Monthly Wage (USD) |

| Singapore | $1020* |

| Taiwan | $849 |

| Hong Kong | $768 |

| China | $205-$375 |

| Malaysia | $340 |

| Indonesia | $135-$330 |

| Philippines | $200 |

| Thailand | $200 |

| Vietnam | $140-$200 |

| Cambodia | $200 |

| India | $65-$275 |

The source is wagecentre.com, *except for Singapore which does not set a minimum wage but recommends low-wage workers be paid at least $1,020 a month USD. Minimum wages in China, India, Indonesia, and Vietnam vary by region.

What Are the Combined Costs for Each Warehouse Location Option?

At the end of your analysis, you need a framework to compare warehouse locations across all the different variables. Ideally, this is a total landed cost analysis that accounts for expenses related to duties, taxes, shipping, labor, storage, customs brokerage, and insurance.

A cost-based analysis is ideal but, frankly, that can be difficult as part of a hypothetical scenario. Most companies develop their own rating system that, while not numbers-based, can provide good direction.

One large, multi-national company recently completed a six-month analysis that led to a 3PL-operated Singapore FTZ being chosen as a secondary distribution point in Asia, along with Beijing.

The accompanying inset shows the criteria the company used for its assessment. As you can see, they were most interested in air freight capacity, the cost of taxes and duties, and the efficiency/speed of the customs clearance process.

Your key criteria may differ based on your commodity type, shipping mode, and delivery service-level requirements.

One mistake companies make during the warehouse selection process is that they do their analysis and only then engage 3PLs in their chosen market. But 3PLs with locations across China and the Asia-Pac region can bring tremendous value during the assessment process. When it comes to things like country tax structures, government regulations, labor rates, and freight capacity, they already have these answers and can help you arrive at the right decision much faster.

The key is working with a logistics provider that operates across the entire Asia-Pac region. A 3PL located only in one or two countries will be biased toward these locations and will not give you an objective read.

Key criteria used by one global tech company for its Asia warehouse search

- Number of direct connections to major global gateways

- Number of flights per day

- Airport’s total flight capacity

- Customs regulations

- Import duties and taxes

- Customs clearance time

- Is the location a freeport?

- Transaction processing speed

What Capabilities to Seek In A Warehouse Partner in Asia

Whether establishing a first Asia warehouse or expanding a warehouse footprint to a new country in Asia, most companies will choose to partner with a 3PL rather than operate the facility themselves. 3PL capabilities vary widely in Asia, so take your time and choose wisely. Here are some key competencies you should look for.

Scalability

Scalability

It’s difficult and costly to change warehouse providers, so choose a partner that can grow with you as the volume and complexity of your operation increase. Does the 3PL have locations across the Asia-Pac region and even around the world, if needed?

Integrated Services

Integrated Services

Supply chains run smoother and faster when a logistics partner can combine air, ocean, warehousing, and trucking services in one solution – all managed on a single operating system. Integrated services also add flexibility. When a port disruption in Phnom Penh, Cambodia threatened a fast-fashion company’s peak season sales, its freight forwarder arranged to truck over 100 containers to the port of Ho Chi Minh City in Vietnam and secured vessel capacity to keep promised delivery dates to the U.S. retailers. That doesn’t happen if the 3PL lacks this integrated service model.

Omnichannel Capabilities

Omnichannel Capabilities

If you sell through multiple sales channels, both B2B and direct-to-consumer, these channels call for very different warehouse operating models. You don’t want to work with different providers for each channel since that will lead to inflated space, labor and inventory costs. Choose a 3PL that allows you to distribute to all your sales channels through a single partner.

Local Market Knowledge

Local Market Knowledge

An experienced operator can advise you on local regulatory requirements and paperwork, make a call to troubleshoot a customs delay, and find immediate truck capacity for urgent cargo. In India, Dimerco’s primary services are freight forwarding and warehousing. But our fastest growing service is providing legal consulting to companies that want to establish production and distribution operations in India and need help navigating the local bureaucracy.

Technology-Driven

Technology-Driven

Asia is a hotbed for high-tech manufacturing but, ironically, warehouse processes across the region are largely manual, resulting in inaccurate inventories and picking and shipping errors. Look for a 3PL partner that scans inbound cargo upon receipt and does not just match it against a packing slip. Also, demand a clear demonstration of the 3PL’s visibility and reporting tools. For many, the reality does not match the claims on their websites.

Experience Running Bonded and FTZ Facilities

Whether you’re an importer or exporter, Bonded/FTZ space can bring huge cash flow advantages.

The Right Partner Can Reduce Your Location Selection Process By 4 – 5 Months

The choice of where to locate a new distribution warehouse in Asia is serious business. Millions of dollars in profit could be added or lost based on this decision.

Leverage the tips in this eBook to create your own assessment process, and then do your homework.

Alternatively, you can identify a 3PL that operates warehouses across the entire Asia-Pacific region and can help with an objective analysis. Such a partner may even do the analysis work for you, working collaboratively with your team each step of the way.

Relying on a regional warehousing and logistics expert in Asia would result in a smart, informed decision and would likely cut 4 – 5 months off your assessment process.