The Government of India has established many incentive programs to encourage foreign electronics companies to set up manufacturing plants in India. And many such companies are making the move. But, in the process, they’re finding unexpected logistics and trade compliance challenges. The right logistics partner can help make expansion to India faster and more profitable.

Why are electronics companies setting up manufacturing plants in India?

Electronics companies, like semiconductor manufacturers, are drawn to India as a production hub for a number of reasons:

- Relatively low labor costs. India’s labor rates are 3x less than those in China.

- Educated workforce. India has lots of engineers, and most are bilingual.

- Large consumer market. In fact, India will be the world’s largest consumer market by 2030.

- Large workforce. India has a very young population. By 2030 it will have the world’s largest working-age population.

As an added push, the Government of India offers a number of incentive schemes aimed at electronics companies.

- The Production Linked Incentive Scheme (P.L.I. ) seeks to attract large-scale mobile manufacturers.

- The Scheme for Promotion of Manufacturing of Electronics Components and Semiconductors (S.P.E.C.S.) seeks to attract electronics component manufacturers.

- The Modified Electronics Clusters scheme (E.M.C.) aims to build factory infrastructure to attract firms to India.

Foxconn, Samsung, Pegatron, Apple, Delta Electronics, and Wistron are just some of the companies that are taking advantage of these incentives.

Check out the Dimerco eBook, Manufacturing in India: Opportunities and Challenges

Be sure to catch our latest infographic for a visual overview!

Logistics and Regulatory Challenges

While the incentives are available, it’s a challenge to establish efficient import/export operations and to master all the tax, regulatory and paperwork requirements necessary to take advantage of the programs. Documents must be completed. Licenses and certifications must be secured. It can be a tedious and detailed process.

If you are trying to do it on your own from a foreign country, there are also language and cultural barriers to overcome.

The right logistics partner can make the process of setting up a manufacturing plant in India much easier.

Let’s take trade compliance as an example.

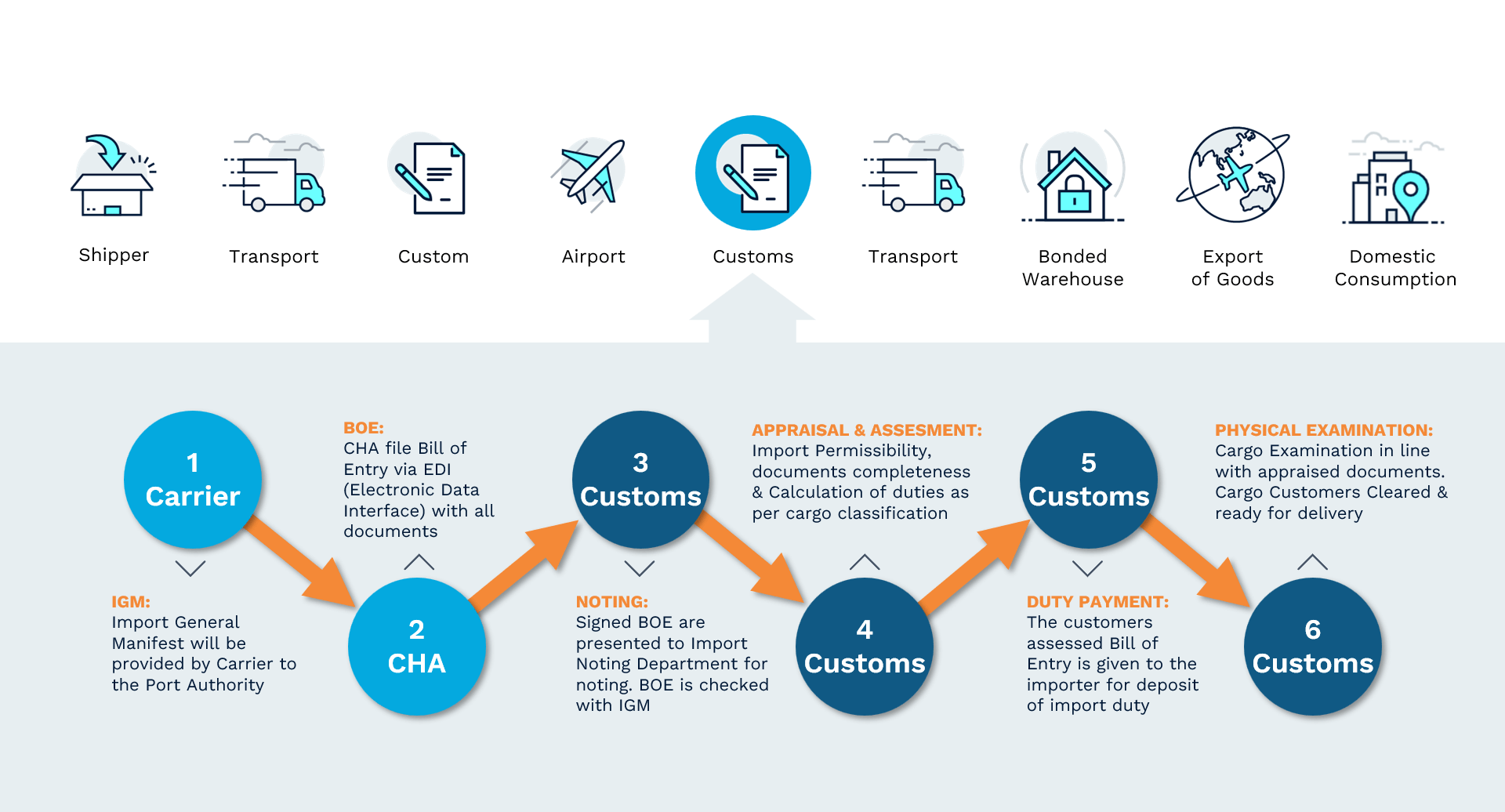

India’s trade compliance rules are lengthy and complex, involving different government agencies. It helps to have logistics and customs clearance experts in India to ensure full regulatory compliance.

Dimerco, for example, not only manages needed global transportation and local warehousing, it has multilingual trade compliance experts who act as a bridge between customs representatives in India and foreign-based manufacturers. Dimerco people help to:

- Verify that all documents are accurate to prevent delays and compliance errors

- Coordinate with government representatives to secure the necessary licenses and certificates

- Execute the clearance process, coordinating with India customs, as needed.

Here’s what the customs clearance process looks like in India.

India Customs Clearance Process

The right partner can advise electronics manufacturers that are setting up operations in India for the first time and, frankly, don’t have the time to become instant experts on India’s detailed customs processes. You can try to handle it on your own, but why risk fines and legal troubles if expert guides are available?

Bonded facilities in India provide a huge cash flow advantage

Companies entering India for the first time may not know the critical role a bonded warehouse can play in their supply chains. Bonded warehouses in India serve much the same purpose as bonded warehouses in China and other countries. Manufacturers can import products and components and defer or even avoid duties and the goods and services tax (GST). Products eventually sold to customers in India pay tax only when items ship out of the Customs-controlled bonded warehouse. Imported components that are used in manufacturing and then re-exported can avoid duty and GST fees altogether.

Either way, it’s a significant cash flow advantage. It helps to work with a logistics partner that understands the rules, regulations and paperwork associated with bonded warehousing and transportation services.

3PLs Help Companies Expand to India

For companies expanding to India but not setting up manufacturing plants there, the right 3PL can be also a valuable resource.

Taiwan-based drone manufacturer Holy Stone wanted to sell its products in India, importing from its factories in Hong Kong, Mainland China, and Taiwan.

Dimerco set up a customs bonded warehouse in India for Holy Stone so duty payments are deferred until final customs clearance. Also, Dimerco helped the company deal with India’s Special Valuation Branch (SVB). This unit makes sure that, when companies doing business in India import from their own locations outside India, goods are not undervalued to improperly lower duty and tax payments.

In the end, Dimerco helped Holy Stone expedite its expansion to India, stay compliant with all local and national regulations, and improve cash flow.

.

The logistics of setting up manufacturing in India

India is becoming a go-to location for electronics manufacturing. And to enhance that trend, the government has just announced a national logistics policy to make India one of the world’s top 25 countries in logistics performance.

But there are many obstacles to overcome when setting up a manufacturing plant in India. Those obstacles include local regulations, licensing requirements, unique customs processes, language barriers, and establishing efficient warehousing and transportation.

Electronics companies that can overcome these obstacles can realize huge advantages. It helps to have an expert local advisor to set up a smooth, compliant supply chain for imports and exports.

Dimerco’s India logistics offices are located in Ahmedabad, Bangalore, Chennai, Hyderabad, Mumbai, and New Delhi. Each office has legal and Customs consultants to ease your entry to the India market. Contact Dimerco to speak with one of our India logistics solutions experts.