Home »

Mastering China Logistics

Tips on managing the international shipping, customs, warehousing and delivery challenges of distributing goods to and within China

Why China?

China remains one of the biggest growth markets for businesses worldwide.

Its 1.4 billion people represent a huge, largely untapped, consumer market for multi-national brands. On the B2B side, the opportunity is no less compelling. China is the #2 import market in the world after the US, and much of that import volume is component parts to support China’s huge manufacturing sector.

The opportunity is significant. And the Chinese government’s “opening-up” policy is making the market more accessible, particularly for businesses that support high-end manufacturing and other sectors of the economy that China wants to develop.

One sign of China’s commitment to attracting outside investment is the government-sponsored China International Import Expo – a huge annual event for foreign investors designed to highlight China’s support for trade liberalization and economic globalization.

But the silk road to this huge market is strewn with logistical potholes – particularly for companies with little experience distributing products to and within China.

The customs declaration process can be confusing, with different regulations applying to different commodities. Also, opportunities to leverage foreign trade zones to defer duty and tax payments are compelling, but not widely known or utilized.

Basically, it’s a huge, complex logistics landscape that can be tricky to navigate for businesses with little experience here. This eBook will help you understand the logistics-and customs-related barriers to market expansion to China, providing tips to create the fastest, smoothest shipping and distribution process.

Download Guide

If you prefer to download this article as a PDF, just complete the form. Otherwise, keep reading.

China is the world’s #2 import market

Exporters |

Value Imported in 2020 ($US) |

|---|---|

| Chinese Taipei | $200.6 billion |

| Japan | $174.8 billion |

| Republic of Korea | $172.7 billion |

| United States | $135.9 billion |

| Australia | $114.8 billion |

| Germany | $105.2 billion |

| Brazil | $84 billion |

| Vietnam | $78.4 billion |

| Malaysia | $74.7 billion |

| Russian Federation | $57.1 billion |

Shipping Goods into China

COVID-19 has caused massive disruptions across global supply chains. Lack of freight capacity and labor shortages are liable to cause delays at any point in the distribution chain. That’s why it’s so important to have an agile global shipping capability that can quickly shift modes to get cargo moved on time, at the right price.

For this, you’ll need logistics partners with the know-how and freight capacity to move your cargo in planes, ships, railcars or trucks.

Following is a brief rundown of each mode and what you need to know.

Air Freight

China has invested trillions of dollars to develop its transportation infrastructure. In fact, some of its busiest airports are practically brand new. Jiaodong International Airport (TAO) in Qingdao (between Beijing and Shanghai) and Chengdu Tianfu International Airport (TFU) in Western China both opened in 2021. Beijing Daxing Airport (PKX), launched in 2019. Reliable air freight is critical for aerospace, medical equipment, and high-fashion companies, as well as China’s many tech manufacturers and the thousands of component manufacturers that supply them.

The accompanying chart shows the busiest ports in China by cargo volume (air and sea).

Shipping to China via air is not cheap, but it’s fast. You can get 24- to 48-hour transit times from other countries within Asia and 72-hour transit times from most other origins. To achieve this level of time-critical service, look for freight forwarding partners with strong relationships and block space agreement with all top Asia-based, global airlines.

Not all airports in China have international flights. Often, it depends on the origin city. A freight forwarder that understands the China market can help determine airport options and which offer the best costs – port-to-port and door-to-door.

Busiest Airports in Mainland China

Airport |

Annual Metric Tonnes (millions) |

Cargo Volume Ranking (global) |

| Shanghai Pudong | 3.7 | #3 |

| Guangzhou | 1.8 | #15 |

| Shenzhen Baoan | 1.4 | #19 |

| Beijing | 1.2 | #22 |

| Hangzhou Xiaoshan | 0.8 | #33 |

Ocean Freight

For smaller shipments that are not urgently needed in China, less-than-container (LCL) ocean shipping, where your goods travel in the same container as other shippers, will probably be cheaper than reserving a full container. If your shipment is around 18 to 20 cubic meters or above, you can consider shipping a 20’ container as FCL. FCL has natural advantages over LCL: faster transit time, better cargo security, and potentially a lower shipping cost. For instance, from Los Angeles to Shanghai FCL service is normally 9 days faster than LCL.

Ocean freight shipments into China will be cheaper than volume out of China since steamship lines want to get scarce containers back to cover the large volume of China exports.

Don’t ignore the multi-modal option when shipping ocean freight. In the current freight environment, an agile shipping operation is a must. A Sea-Air or Air-Sea solution can achieve fast delivery, lower costs and a smaller carbon footprint. Using multiple modes does add complexity, so it’s important to work with a forwarder with experience coordinating the en route handoffs.

Busiest Seaports in Mainland China

Port |

Annual TEUs (millions) |

Cargo Volume Ranking (global) |

| Shanghai | 43.5 | #1 |

| Ningbo-Zhoushan | 28.7 | #3 |

| Shenzhen | 26.6 | #4 |

| Guangzhou Harbor | 23.3 | #5 |

| Qingdao | 22 | #7 |

Sources: Air Cargo World (2020) and World Shipping Council (2020)

Cross-Border Rail Freight

Rail has emerged as a viable option for cargo moving from Europe to China. The main reason: transit time is 20 days faster than ocean and as much as 30% cheaper than air freight. The Chinese government has invested heavily to improve service and ship times along the Silk Road. For example, you can ship from Germany to Xi’an, China via rail in about 15 days, with final door-to-door delivery within 22 days (28-30 days during the pandemic).

When a valve manufacturer had to ship 33 tons of cargo from Milan to support construction of the Beijing Daxing Airport, it opted for rail. Dimerco handled complex customs clearance requirements at the borders, as well the road/ rail transitions at origin and destination. The shift from ocean to cross-border rail cut the customer’s transit time by nearly 3 weeks.

If you’re based in Europe, don’t ignore rail as an option when shipping to China.

Over-the-Road Freight

For China-bound shipments from Southeast Asia, your company may be losing time (with ocean freight) or losing money (with air freight). A cross-border road freight solution can move freight between Shanghai and Singapore (and key markets in between) within 8 days, and at 56% savings over air freight and up to 14 days faster than ocean freight.

A road freight option can be part of a multi-modal solution that can keep your products flowing in a constrained freight market. A global semiconductor product distributor found this out when pandemic-related lockdowns and flight cancellations limited air freight capacity from Malaysia to Hong Kong, threatening its ability to support mobile phone production in China. Leveraging the cross-border trucking capabilities of its freight forwarder, Dimerco, the company trucked products from Penang, Malaysia to Singapore, and then shipped them via air to Hong Kong. The 4-month project involved 83 truckloads and helped the distributor meet its delivery promise to a VIP customer.

Clearing Goods through China Customs

No company wants its goods held up at Customs. It subjects you to fines, puts delivery promises in jeopardy and lengthens your cash cycle. Like other Customs authorities around the world, China has its own rules and regulations that must be followed to quickly process and release imported goods. The advantage, always, goes to shippers who follow the rules. If you’re unfamiliar with the strict procedures of China Customs, it’s best to partner with a customs clearance agent that understands the China market and works with Customs on a daily basis.

Understanding China Customs

The good news for companies shipping to China is that the clearance process has gotten a whole lot easier over the past few years. Since 2017, China has been integrating and modernizing its import customs clearance process through its National Customs Clearance Integration Regime. Ports had been operating independently, often with their own set of unique procedures. Today, rules and requirements are enforced more centrally. As a result:

- Shippers can choose a suitable port for Customs declarations. It does not have to happen at the arrival port. For shipments where all paperwork is in order, an automated system allows for fast clearance at the port, with inspections and audits impacting a smaller percentage of goods, post-clearance.

- Enforcement will be consistent across local Customs offices. Before, ad hoc approaches at different ports could result in different duties being assessed for the exact same goods.

- Time to clear Customs is shorter. The Customs data of each port is connected – air, sea, truck and railway ports, plus free trade zones. All share the same database, improving clearance efficiency.

Remote clearance is an option under the new regime. Most importers prefer a Customs declaration port closest to the final delivery point, even if the arrival port is far away. That can be a real advantage. Recently, lack of space on the Chicago-to-Xi’an shipping lane forced a shipment of Xi’an-bound freight to Beijing. Dimerco worked with the consignee’s local customs broker to handle remote declaration at Xi’an Airport, post clearance, while Dimerco arranged truck transport of goods from Beijing to Xi’an.

This approach is enabled by the customs clearance integration policy implemented by China Customs. Under this policy, enterprises can choose the customs clearance or customs declaration place and port at will and can go through relevant formalities anywhere in the country. The integration of national customs clearance can make the import customs clearance process less expensive and more convenient.

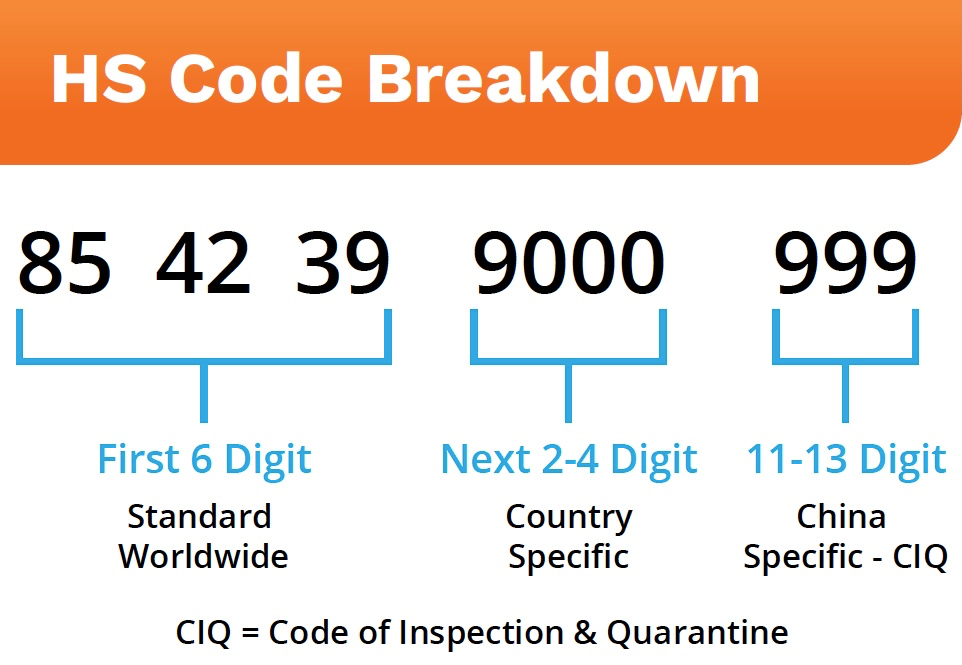

One critical aspect of clearing China Customs quickly and without hassle is selecting the correct HS code, which classifies the type of product it is and helps to determine the duty, tax rate and other potential government charges or fees. All countries follow a worldwide standard that classifies goods with a 6-digit code. Most countries add 2 or 4 extra numbers to the HS code for further clarification of commodity type. The US, for instance, uses 10 digits. In 2018, China increased the total number of digits in its commodity code to 13. This makes classification more specific, but creates greater potential for mis-classification and questions from Customs officials. Invest time to assign the correct HS code to your shipping paperwork; it can save you a lot of time and headaches.

Questions about HS codes is just one of the things that might trigger a customs inspection. When inspections occur, your local customs broker makes it easier on you by going on site with the China Customs officer to address questions and concerns.

Tips for a Fast, Smooth Clearance Process in China

It’s difficult to stay on top of shifting regulations, document requirements and tariff changes – particularly if you are dealing with Customs agencies in multiple countries. In the case of China, consider working with a freight forwarder and customs broker that know the market and can advise you on the steps necessary to avoid penalties and delays.

Here are tips that can help:

- Work with an AEO-certified forwarder. The Authorized Economic Operator (AEO) program was developed by the World Customs Organization to promote and secure global trade. It allows Customs authorities to quickly identify operators who meet rigorous standards for supply chain integrity. In China, forwarders with the highest level of AEO status can cut clearance time as much as one full workday compared with a non-AEO logistics provider.

- Work with an air freight forwarder approved to process ULDs near the port of entry. Manpower shortages at airport terminals in China can add many days to the clearance process for air freight. You can avoid such delays by working with a forwarder that is approved by China Customs to receive and sanitize air freight containers or pallets. The process works like this. The forwarder builds ready-to-ship ULDs at origin and then receives and deconsolidates ULDs at its bonded warehouse, which is located in a Customs-supervised restricted zone near the destination airport. These ready-to-ship units, called BUPs (Bulk Unitization Program), greatly reduce handling time at the cargo terminal by combining lots of separate items into a single unit. At destination, they avoid airport terminal processing and are given directly to the forwarder for unloading. These BUPs can be available up to 3-4 days faster than airline-loaded ULDs.

- Go paperless. A simple data entry mistake can hold up your shipment for days. Using optical character recognition, the right forwarder can help you eliminate manual transfer of Customs-related data to save time and avoid errors.

- Leverage bonded warehousing within Free Trade Zones. These services allow you to defer or avoid import duties and taxes until products are shipped to the final customer, improving your cash flow.

- Declare goods while in transit. For air freight, your forwarder’s destination office team can receive the airline manifest upon the departure of the incoming flight. Once they receive this information, they can do a pre-declaration to China Customs. Authorities can then conduct a risk assessment and prepare the release decision while cargo is in transit, thus enabling release of goods immediately upon arrival.

Bonded Warehouses in China

Bonded warehouses offer a powerful economic advantage since you can defer duty/tax payments until after products ship to your buyers. Any importer can leverage a bonded warehouse to keep cash longer, but businesses may not be aware of this opportunity, or how to take advantage of it.

Here’s how it works. When you transfer goods to a bonded warehouse within a Free Trade Zone in China, duties and taxes are not immediately due. As far as China Customs is concerned, these goods have not yet arrived. You can import, store, process and/or manufacture goods within this space without Customs intervention.

Following are practical uses for bonded space in China

- Import Distribution Center (DC). A company needs to maintain higher levels of safety stock in China to quickly supply its local distributors. This has become a more common objective as COVID-related supply chain disruptions have made it difficult to fulfill orders quickly and reliably from another country. An import DC strategy lets you move your goods close to your customers in China, without having to pay import-related duties and taxes in advance.

- Vendor Managed Inventory (VMI) Hub. A manufacturer needs to ensure the uninterrupted supply of raw materials at any time when producing goods like semiconductor chips. But buying materials in advance drains your working capital, and storing components in the factory eats up valuable production space. By establishing a VMI operation in a nearby bonded warehouse, the company can free up factory space and defer Customs duties and value-added taxes (VAT) until parts are needed for production.

- Spare Parts Hub. Mission-critical equipment like airplanes and semiconductor manufacturing machines require 24/7 spare parts support. With a bonded warehouse for spare parts (Technical Service Station, or TSS), you can bring parts into China but delay payment of duties and VAT until 14 days after parts are used. If 5 parts are ordered, but only 2 are used, the 3 unused parts can be returned to the warehouse with no duties and tax due.

- Export Hub. An overseas retailer ordering goods from several suppliers in China may want to ship the goods to different distribution centers in the destination market. Instead of each supplier shipping separately, they can ship to a bonded warehouse within a Free Trade Zone in China, where their goods are consolidated and prepared to ship together as part of one export shipment. At destination, goods are deconsolidated and shipped to each destination warehouse based on purchase order instructions. When goods leave the bonded warehouse in China, suppliers may receive an immediate tax refund.

Warehousing

Commercial warehouse space is plentiful across China. The solution will really depend on your company’s specific needs.

If you need bonded space, for instance, there are many different types of bonded facilities. It can be confusing to determine which is best for your product and usage. If your freight forwarder is well-versed in China logistics operations, they can advise you. And some forwarders, like Dimerco, actually operate bonded facilities in China.

If you plan to hold a significant amount of inventory in China, you can partner with a third-party logistics company (3PL) to manage a warehouse exclusively dedicated to your products. Otherwise, you can share the warehouse and overhead costs with other shippers in a multi-client facility.

Most 3PLs in China offer a wide range of value-added services, like repackaging. For instance, many Dimerco customers import goods into China and then change labels from their local language into Chinese.

While China does not lack for warehouse space, a relatively small percentage of that space could be classified as modern, Grade-A space according to the China office of industrial real estate firm, JLL. That’s changing fast as companies invest heavily in modern, automated warehouses in China – particularly to support high-volume eCommerce distribution. In the meantime, you should vet potential providers carefully. Tour their warehouses and observe if and how they are using technology to minimize slow, error-prone manual processes.

In China, it can be beneficial to work with a partner that integrates multiple services into a single logistics solution. For businesses new to the China market, having one logistics partner for international transportation, customs clearance and local warehousing and distribution reduces your time to coordinate multiple suppliers. The right partner will also give you visibility to your cargo throughout the entire distribution cycle.

Using Hong Kong as a Distribution Hub

Many companies bringing goods into China ship to Hong Kong, store products there, and then arrange trucking services to deliver goods to final destinations in Mainland China. While storage costs are much higher in Hong Kong, the customs process is easier. There are many other advantages that make Hong Kong an attractive distribution hub for China.

- It’s is one of the largest Asia-Pac hubs for both air and ocean cargo. With a high frequency of inbound flights and sailings, Hong Kong ports give you flexible shipping options.

- Hong Kong is a freeport, so goods are exempt from normal Customs inspection and duties.

- Hong Kong does not have sales tax or value-added tax. It does however collect duty on alcohol, tobacco, methyl alcohol, and hydrocarbon oil.

When goods move from Hong Kong into Mainland China, they must be declared at the border, when duties and taxes are due to China Customs. For these over-the-road shipments, Customs inspection works similar to air and ocean ports – a percentage of shipments will be randomly selected at border crossings for closer examination.

Last-Mile Distribution

If you’re concerned about poor roadways slowing final distribution of goods from the warehouse to the final customer in China, don’t be.

As part of its Belt and Road Initiative, China has spent many trillions of dollars (USD) to develop a modern road and rail infrastructure to ship goods not only within China, but into neighboring countries and regions.

Over-the-Road (OTR) freight options are similar in China as in other countries. Full truckload and less-than-truckload services are available, along with various levels of expedited service.

The driving factor in trucking sector growth today in China is last-mile delivery of eCommerce orders. The eCommerce market in China will reach US$3 trillion by 2024, according to GlobalData – a 12.4% growth rate. Strong competition between China’s two internet giants, Alibaba and JD.com, has resulted in faster delivery times and innovation in last-mile delivery. Alibaba is a major investor in multiple courier companies, while JD.com has developed its own in-house logistics company, JD.com logistics.

Companies choosing to leverage Hong Kong’s freeport status and distribute to Mainland China from here will find a robust market for trucking services, with fast, reliable service. The accompany chart shows estimated transit times from Hong Kong to various cities in China.

Truck Transit Times for General Cargo from Hong Kong into Mainland China

Routing |

Transit Time |

|

|---|---|---|

| Short-Haul | Hong Kong ↔ Shenzhen/Dongguan/Guangzhou/Zhuhai | 1 day |

| Hong Kong ↔ Shenzhen ↔ Xiamen / Fuzhou | 2 days | |

| Hong Kong ↔ Shenzhen ↔ Changsha | 2 days | |

| Long-haul | Hong Kong ↔ Shenzhen ↔ Shanghai / Suzhou / Nanjing | 3 days |

| Hong Kong ↔ Shenzhen ↔ Tianjim / Beijing | 4 days | |

| Hong Kong ↔ Shenzhen ↔ Chongqing | 4 days | |

Choosing the Right Logistics Partner for China

If you plan to begin or expand business in China, perhaps the most important decision you will make is your choice of a logistics partner for international shipping and local support. Here are a few of the most important criteria you should look for in a 3PL.

Strong freight capacity.

Freight forwarders tend to be strong in certain lanes and weak in others. You need a forwarder with strong relationships and block space agreements with carriers that service China, giving you access to capacity with good negotiated rates.

Digitized processes.

Highest level of Authorized Economic Operator (AEO) status across China.

Owned local office network.

Integrated services.

Right size.

Most important of all, make sure you choose a growth partner, not just a shipping partner. The right 3PL will handle all the day-to-day details, but can also work with you to design a comprehensive solution for China distribution that helps you outshine your competitors and win favor with your Chinese customers. That translates into greater market share.

China remains an untapped market for many. The opportunity is there. You just need a superior logistics solution to unlock it!

Dimerco connects Asia with the world like no other global 3PL.

We integrate air and ocean freight, trade compliance and contract logistics services to make global supply chains more effective and efficient. The majority of our global shipping projects connect Asia’s logistics and manufacturing hubs with each other and with North America and Europe. We serve customers from 160+ Dimerco offices, 80+ contract logistics operations, and 200+ strategic partner agents throughout China, India, Asia Pacific, North America, and Europe. Contact us here.