Navigating international trade logistics can be complex, especially when it comes to managing storage and import costs. To optimize your operations and bottom line, two key options are worth considering: Foreign Trade Zone (FTZ) warehouses and bonded warehouses.

Both solutions offer financial and logistical advantages, such as deferring duties and improving cash flow. However, they serve different purposes and come with unique regulations. Understanding these distinctions will help you make the best choice for your business.

What Is the Difference Between a Bonded Warehouse and an FTZ Warehouse?

Both bonded warehouses and FTZ warehouses provide secure storage for imported goods while offering duty deferment benefits. However, their operations and advantages vary:

| Feature | FTZ Warehouse | Bonded Warehouse |

|---|---|---|

| Duty Deferral | Duties and taxes are deferred until goods enter the domestic market. | Duties are deferred until goods leave the warehouse for domestic distribution. |

| Manufacturing & Manipulation | Allows repacking, relabeling, light assembly, and sometimes full manufacturing. | Limited to basic storage and repacking. |

| Export Benefits | Ideal for goods that will be re-exported, potentially avoiding duties altogether. | Allows duty drawback if goods are re-exported. |

| Domestic Distribution | Requires customs clearance before goods enter the local market. | More suitable for domestic distribution as goods are already within the customs territory. |

| Setup Costs & Complexity | Higher setup costs and regulatory requirements. | Easier and less expensive to set up. |

| Storage Duration | Varies by country; often unlimited in the U.S. | Typically has a time limit (e.g., 5 years in the U.S. and EU, shorter in some Asian countries). |

What Is a Foreign Trade Zone (FTZ) Warehouse?

A Foreign Trade Zone (FTZ) warehouse—also known as a free trade zone (FTZ) warehouse—is a designated area within a country that operates outside its normal customs territory. This means businesses can store, process, and even manufacture goods without immediately incurring duties or taxes.

Key Benefits of an FTZ Warehouse

- Duty Deferral & Reduction: Duties are only paid when goods leave the FTZ for domestic distribution. In some cases, businesses can reduce costs by paying duties on the finished product rather than raw materials.

- Tax Advantages: Some FTZ locations offer exemptions or reductions on state and local taxes.

- Inverted Duty Strategy: Companies may qualify for lower duty rates based on whether they import raw materials or finished products.

- Merchandise Processing Fee (MPF) Savings: In the U.S., weekly imports can be consolidated into one entry, significantly reducing MPF costs.

Considerations Before Using an FTZ Warehouse

- Higher Setup Costs: Establishing an FTZ can be more expensive than using a bonded warehouse.

- Regulatory Oversight: Customs authorities monitor FTZ activities to ensure compliance.

- Focus on Exporting: FTZ warehouses are ideal for companies focused on international trade rather than domestic distribution.

What Is a Bonded Warehouse?

A bonded warehouse is a secure storage facility where imported goods can be held without paying duties until they are sold or re-exported. This allows businesses to defer duty payments and, in some cases, claim a duty drawback when goods are re-exported.

Key Benefits of a Bonded Warehouse

- Duty Deferral: Pay duties only when goods leave the warehouse for local sale.

- Duty Drawback: If goods are re-exported, previously paid duties can be refunded.

- Simpler Setup: Bonded warehouses have fewer regulatory requirements than FTZs, making them easier and cheaper to establish.

Considerations Before Using a Bonded Warehouse

- Limited Activities: Only basic storage and repacking are allowed—no manufacturing or significant modifications.

- Fixed Duty Rates: Duties are calculated based on the condition of goods at the time of entry, unlike FTZs, which allow for inverted duty strategies.

- Storage Limits: Many countries impose time restrictions on bonded storage (e.g., 5 years in the U.S. and EU, varying limits in Asia).

How to Choose Between an FTZ Warehouse and a Bonded Warehouse

To determine whether an FTZ warehouse or a bonded warehouse is right for your business, consider these key questions:

1. What Are Your Goods?

- High-duty items: FTZs can help reduce overall duty costs.

- Goods for re-export: A bonded warehouse allows for duty drawback on re-exported products.

2. What Operations Do You Need?

- Need to manipulate or manufacture goods? FTZs allow value-added activities.

- Just need storage? A bonded warehouse is a simpler, cost-effective option.

3. How Long Do You Need to Store Inventory?

- Long-term storage? FTZ warehouses typically offer unlimited storage in some regions.

- Short-term storage? Bonded warehouses may have restrictions (e.g., 5-year limits in the U.S. and EU).

4. Where Are Your Customers?

- Export-focused? FTZs are ideal for businesses shipping internationally.

- Selling domestically? Bonded warehouses allow for a smoother transition into the local market.

5. How Much Control Do You Need Over Inventory?

- Greater flexibility? FTZs allow manipulation and repackaging.

- Simpler compliance? Bonded warehouses have fewer regulatory requirements.

6. What Is Your Import Volume?

- High volume & frequent re-export? FTZs can be more cost-effective.

- Lower volume & local distribution? Bonded warehouses offer a faster, less expensive setup.

7. Are You Comfortable Managing Regulations?

- Okay with complex regulations? FTZs require more compliance oversight.

- Prefer straightforward operations? Bonded warehouses are easier to manage.

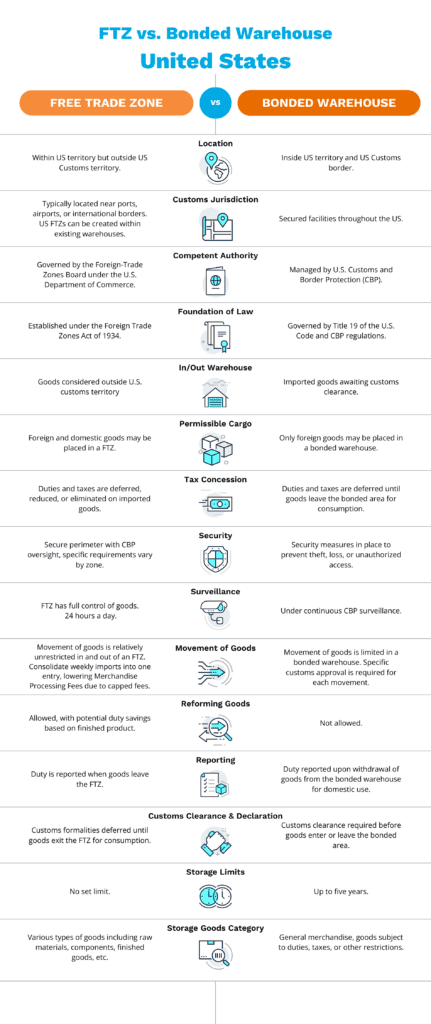

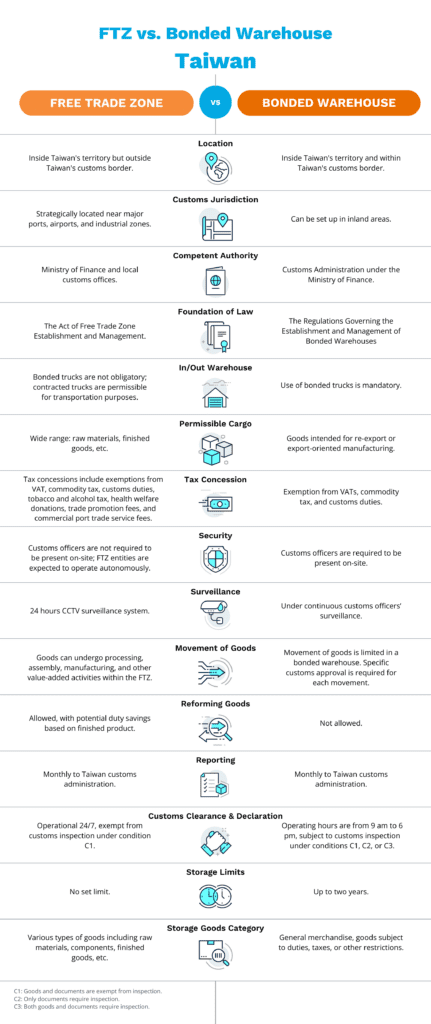

U.S. vs. Taiwan: Comparing FTZ and Bonded Warehouse Regulations

When choosing between a FTZ warehouse and a bonded warehouse, location plays a crucial role. The U.S. and Taiwan both offer FTZ and bonded warehouse options, but their regulations, storage limits, and cost structures differ significantly. Understanding these differences can help you determine which solution best aligns with your supply chain strategy, whether you’re importing goods for domestic distribution or re-exporting to global markets. Let’s break down how U.S. vs. Taiwan FTZ and bonded warehouse regulations compare.

Consult an Expert for Your FTZ or Bonded Warehouse Needs

Deciding between an FTZ warehouse vs. a bonded warehouse requires a strategic approach. Partnering with an experienced logistics provider can help you navigate the regulations, minimize costs, and optimize your supply chain.

Why Work with Dimerco?

Dimerco offers extensive expertise in FTZ and bonded warehouse solutions across major global markets, including:

- Strategic Locations: FTZ and bonded warehouse facilities in the U.S., Shanghai, Taiwan, Shenzhen, and Singapore.

- Regulatory Compliance: Expert guidance to help you navigate customs and trade laws.

- Cost Savings: Optimized duty and tax strategies to reduce expenses.

- Efficient Supply Chain Solutions: Integrated logistics services to streamline your operations.

Ready to optimize your storage and distribution strategy? Contact Dimerco today to discuss how an FTZ warehouse or bonded warehouse can benefit your business.

Explore further insights into strategic warehousing in the Asia-Pacific region with our eBook “Strategic Warehousing in Asia-Pac.” This comprehensive guide delves into how to evaluate and choose the most efficient warehouse location, covering topics such as how bonded warehouses vs. FTZs defer/reduce tax payments. In a world where global trade dynamics are ever-evolving, equip yourself with the knowledge to make informed decisions and stay ahead of the curve.