In the ever-evolving landscape of global trade and commerce, the container shipping industry has always been a barometer of economic health and geopolitical stability. As we set our sights on the next three years in the ocean shipping industry, it becomes evident that shippers must not only grasp the subtleties of the industry’s trajectory but also refine their strategies to nimbly navigate the waves of change.

Challenges Shape the 2023 Landscape

This year has seen the ocean shipping landscape shaped by economic challenges, many stemming from the complex relationship between the United States and China. These geopolitical dynamics have left their imprint on trade patterns, shipping volumes, and supply chains. Notably, China and the United States have revised their GDP forecasts for 2023, with the U.S. experiencing a drop from 2.8% to 1.7%, and China adjusting its growth from 5% to 3.2%. These changes hold significance beyond mere numbers, acting as indicators of wider uncertainties fueled by ongoing tariff disputes and intricate trade negotiations. As these economic swings reverberate throughout the industry, they cast a shadow of uncertainty over decision-making and strategic planning for shippers globally.

Alongside economic complexities, the Russia-Ukraine conflict adds another obstacle to an already complex maritime domain. The year began with escalating energy costs, a tightening labor market, and inflation concerns, all deterring shippers’ momentum. These disruptions triggered a chain reaction, slowing down factory operations and rippling through supply chains, ultimately affecting shipping efficiency. This atmosphere of uncertainty has cast shadows over freight volumes, testing the adaptability of shipping strategies. Moreover, rising inflation reaches into consumer spending, potentially reshaping demand dynamics and impacting shipping rates.

Net-Income Levels Down for Ocean Carriers, But Positive Signs are Emerging

In contrast to previous years, 2023 has witnessed a more cautious pace in the ocean shipping sector. The figures tell the story: the first quarter yielded a net income of only $13 billion, a steep 78% drop from the impressive $58.7 billion recorded during the same period the prior year. This profit decline marks the third consecutive quarterly dip, interrupting a streak of seven record-breaking income quarters during the Covid-19 pandemic. In 2021, ocean carriers raked in an astonishing $190 billion in profits, bolstered by an additional $130 billion in cash. These figures underscore how 2023 has been relatively subdued compared to recent industry financial peaks.

As the year progresses, two positive factors have emerged: resilient manufacturing plants and a stabilized U.S Purchasing Managers’ Index. These developments indicate more balanced and stable manufacturing operations, directly impacting the flow of goods. Resilient manufacturing brings predictable production schedules, reduced supply chain disruptions, and clearer operational planning for shippers.

Geo-Political Tensions and Slow Growth are Among the Headwinds Ocean Carriers Face

Despite positive signs in the manufacturing sector, challenges persist. Rising inflation rates and ongoing geopolitical tensions inflate operational expenses, increasing costs for fuel, labor, and supplies, and pressuring shipping companies financially. The Russia-Ukraine continues to adds another layer of uncertainty, potentially disrupting established shipping routes and causing delays in cargo delivery.

The third quarter traditionally sees peak shipping activity due to holiday demand and restocking. But in 2023 only a modest rise is happening. In the U.S., the National Retail Federation’s (NRF) Global Port Tracker reported that U.S. import levels in the first half of 2023 were 22% below the same period in 2022. Monthly volumes have risen slowly since February 2023 and the NRF expects this slow increase to continue for the remainder of the year while still trailing significantly behind 2022 levels – despite increased consumer spending.

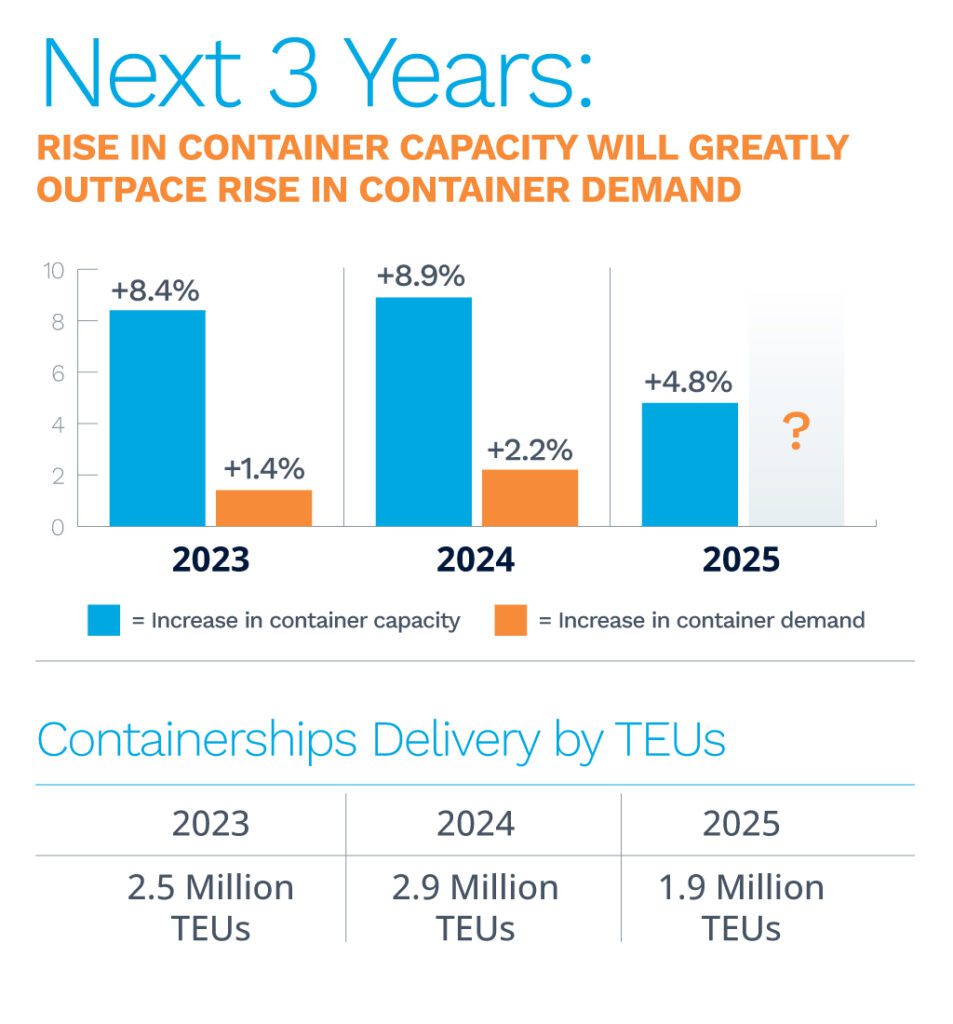

During the next few years, carriers will add a significant number of new vessels, increasing container capacity sharply. The surplus of container vessels poses a critical challenge for the ocean shipping industry since it comes at a time of slow economic growth and container demand. Ocean shipping companies must adopt effective strategies to manage excess slot capacity and maintain market stability. The graph below shows what Alphaliner projects will happen with the imbalance between new container capacity entering the market and expected demand growth.

A Crossroads and an Ever-Evolving Future

Approaching the year’s end, the shipping industry stands at a crossroads marked by challenges and opportunities. Negative volume growth patterns persist, but the latter half of the year hints at potential recovery and growth rate acceleration. Economic expansion remains pivotal for container market demand. The IMF’s forecast of 2.8% global economic growth in 2023 and 3.0% in 2024 offers promise, but economic uncertainties linger.

The next few years in ocean shipping demand skillful navigation of economic shifts, adaptability to evolving landscapes, and an understanding of emerging opportunities. Successful navigation requires strategic flexibility, financial acumen, and a watchful eye on global trends. As the industry charts its course, effective navigation will steer it toward growth and adaptability.

Outlook for 2024 and 2025: Sailing Through Uncharted Waters

As we peer into the future of the ocean shipping industry for 2024 and 2025, obstacles and opportunities abound. Here are the key trends we see.

Resilience in the Face of Economic Headwinds

While some of the challenges from the previous years might persist, such as rising inflation rates and geopolitical tensions, there is a growing sense of resilience. Governments and businesses have adapted to these challenges, finding ways to mitigate their impact on supply chains. Strategies such as near-shoring, diversified sourcing––exemplified by the China Plus One strategy––and enhanced risk management will continue to play a crucial role in navigating these economic headwinds.

To Win, Shippers Should Embrace Technological Advances

The next two years are likely to witness an accelerated adoption of technological innovations. Notably, the adoption of digital solutions like online bookings and rates is set to redefine industry norms, streamlining interactions between shippers and the ecosystem. Beyond this, technologies like Artificial Intelligence (AI), Robotic Process Automation (RPA), and the Internet of Things IoT will play bigger parts in shipping processes. AI will introduce predictive analytics for accurate demand forecasting; RPA will automate repetitive tasks, minimize errors, and boost efficiency in shipment processing; the IoT will enhance transparency through real-time tracking of certain high-value goods.

As the ocean shipping sector ushers in a new era, shippers who embrace these innovations will position their organizations for success. These technologies have the potential to unify data and standardize industry practices, signifying a substantial leap forward. A good example is the Digital Container Shipping Association’s advocacy for a fully standardized electronic bill of lading by 2030. These and similar initiatives promote fast, easy data sharing, and collaboration across shippers, freight forwarders, and carriers. The ultimate result of this collaboration: better control over vessel schedules, improved container tracking, and more informed decision-making to reduce costs.

Green Ocean Shipping Initiatives Cannot Be Ignored

Environmental sustainability will continue to gain greater prominence in the years ahead. Stricter regulations and increased customer demand for eco-friendly practices will drive the shipping industry toward greener solutions. The International Maritime Organization (IMO) has set some aggressive sustainability goals, aiming for a reduction in sea freight-related carbon emission of 40% by 2030 and 70% by 2050, compared to 2008 levels. There’s some real momentum toward going green and it’s likely that alternative fuels for ocean shipping and similar green initiatives will gain traction, allowing companies to meet sustainability goals and contribute to a cleaner planet. Shippers that embrace these initiatives not only stand to gain environmentally but also have the potential to attract environmentally-conscious customers.

Trade Agreements Impact Trade Lanes

Global trade dynamics will continue to shift, influenced by various factors, including trade agreements, political alliances, and evolving consumer preferences. Notably, strategies like near-shoring and regional trade agreements are already redefining traditional trade paradigms. One striking trend is the rise of near-shoring, exemplified by Mexico’s growing prominence as a manufacturing hub due to its geographical proximity to the U.S. and advantageous trade agreements like the United States-Mexico-Canada Agreement (USMCA). Meanwhile, freight shipments within the Asia-Pacific region will rise as trade pacts like the Regional Comprehensive Economic Partnership (RCEP) promote more trade between member nations. As traditional trade lanes change with the emergence of new strategies, shippers must stay adaptable to these changes, ensuring they have the freight capacity they need in the right lanes.

Future Success Requires Resilience and Flexibility

The lessons learned from previous disruptions will inspire a deeper commitment to resilience and flexibility. Case in point: In a Dimerco survey of over 100 supply chain executives in early 2023, respondents named “market uncertainty” as their top post-Covid supply chain points. One respondent’s comment typified the feelings of the surveyed group: “Balancing inventory post-Covid has been hard. With market uncertainty, we have been left second guessing more.”

This uncertainty clearly extends to the ocean shipping market. Shippers will have to actively invest in building agile supply chains that can quickly pivot in response to changes they cannot predict.

Final Thoughts: Sailing Toward Prosperity

In the midst of uncertainty and change, the ocean shipping industry remains on a promising course. For shippers reliant on a stable, well-performing ocean sector, success will be achieved by using logistics strategies that embrace technology, sustainability, and flexibility.

Part of this success formula is having global 3PL partners, like Dimerco Express Group, who offer that rare blend of affordable freight capacity, technological prowess, and an ability to quickly adapt to unexpected changes. If you’re looking for an agile logistics partner with a focus on moving freight to, from and within Asia-Pac, let’s talk.